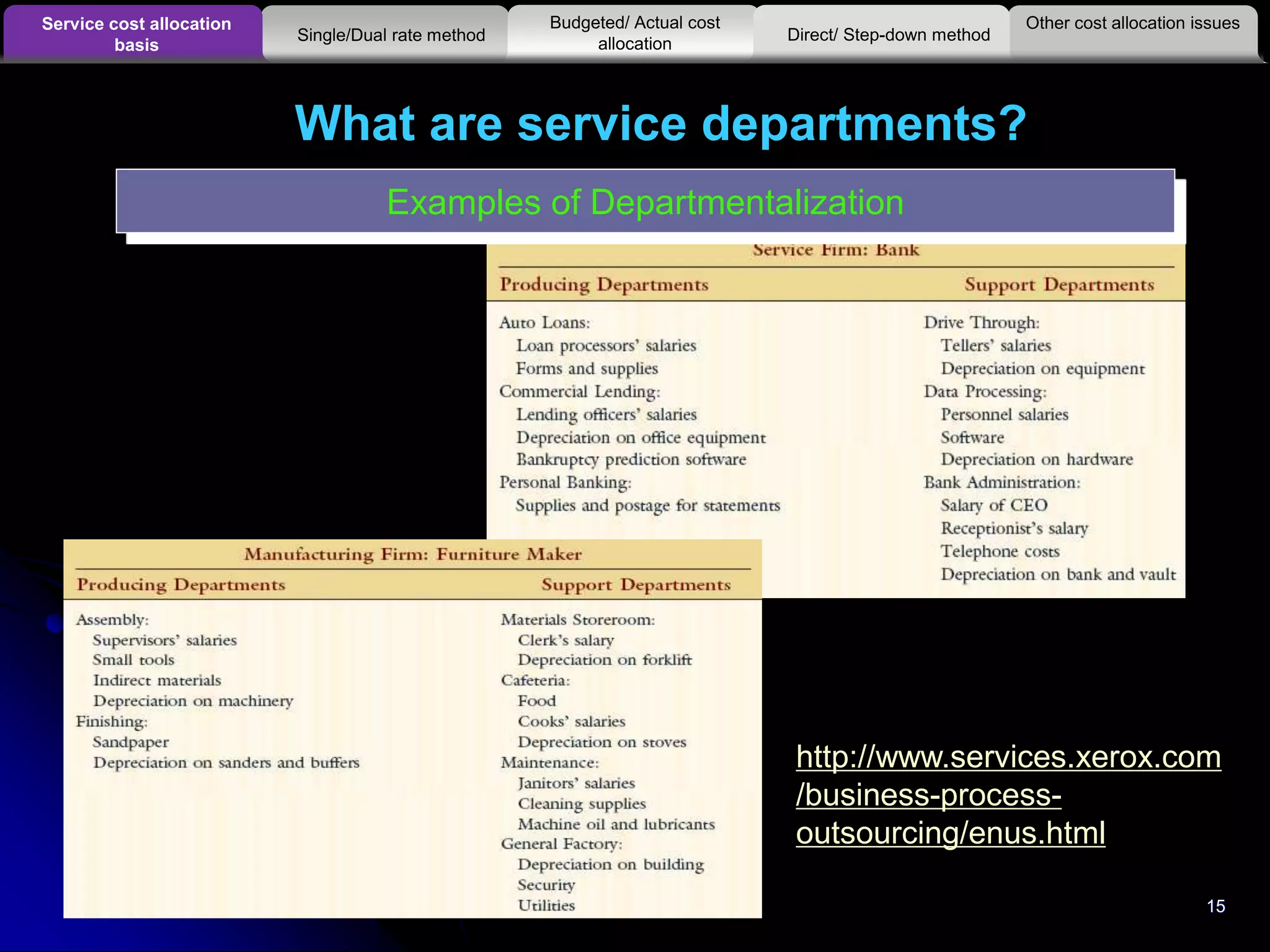

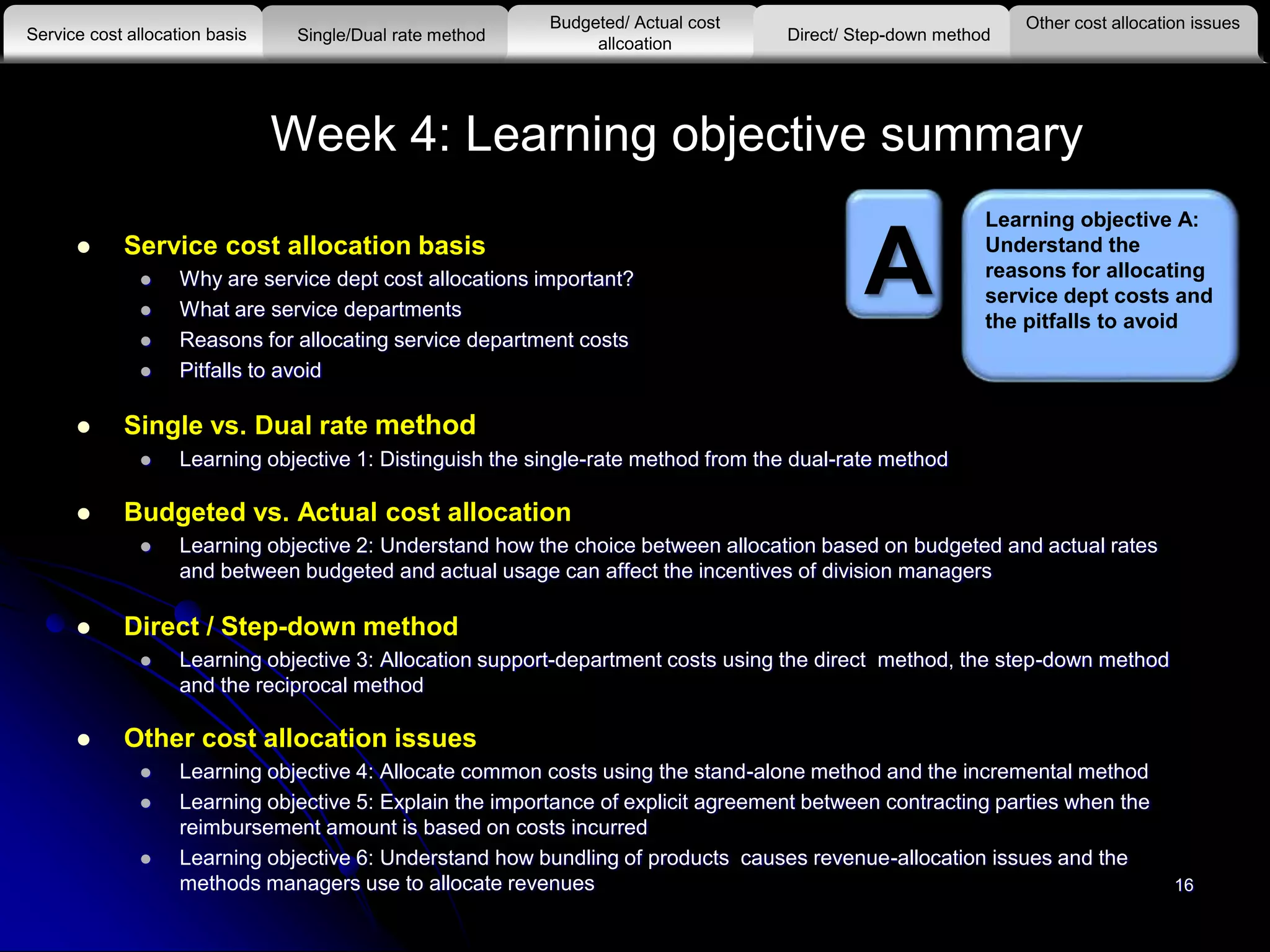

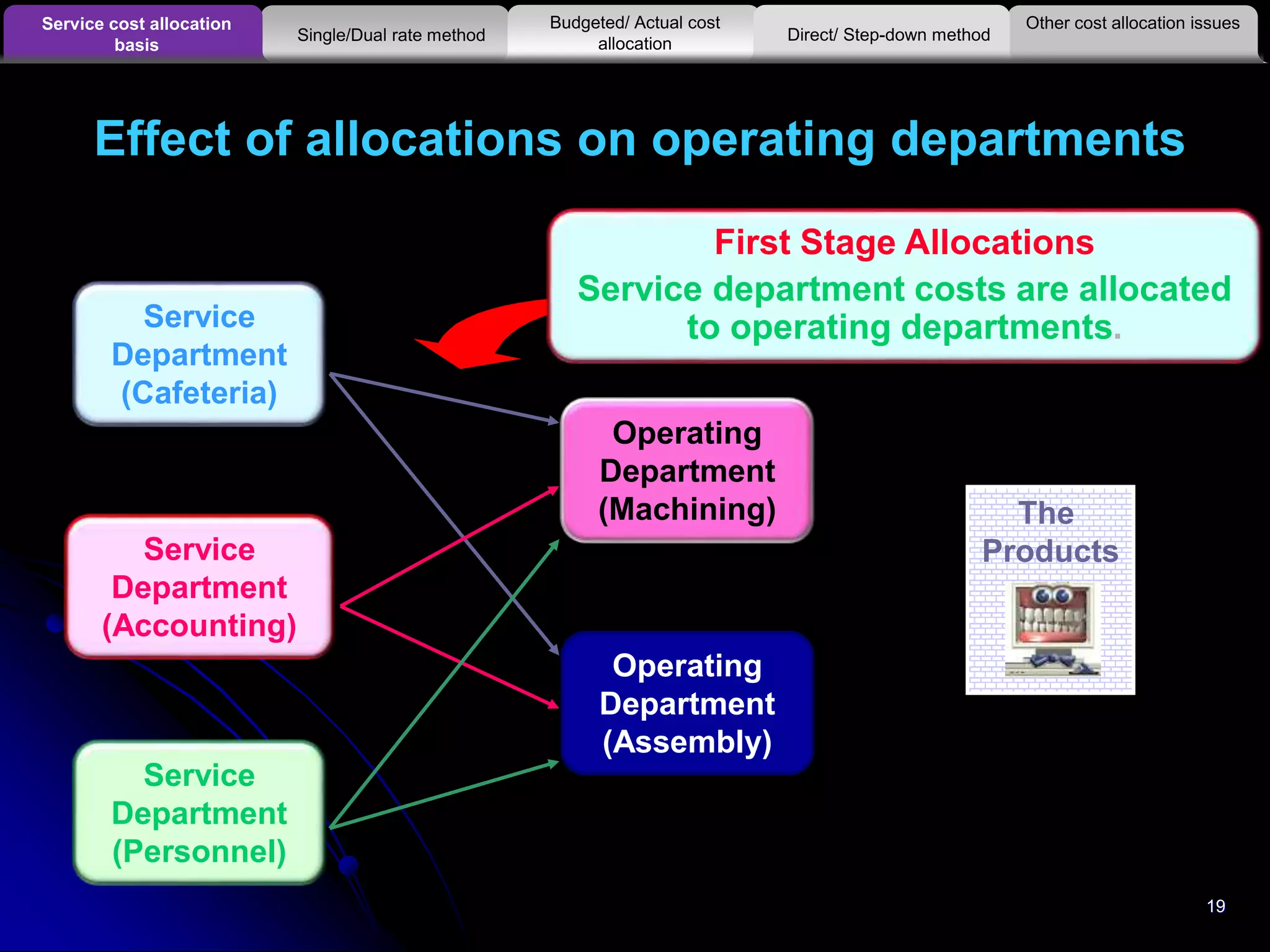

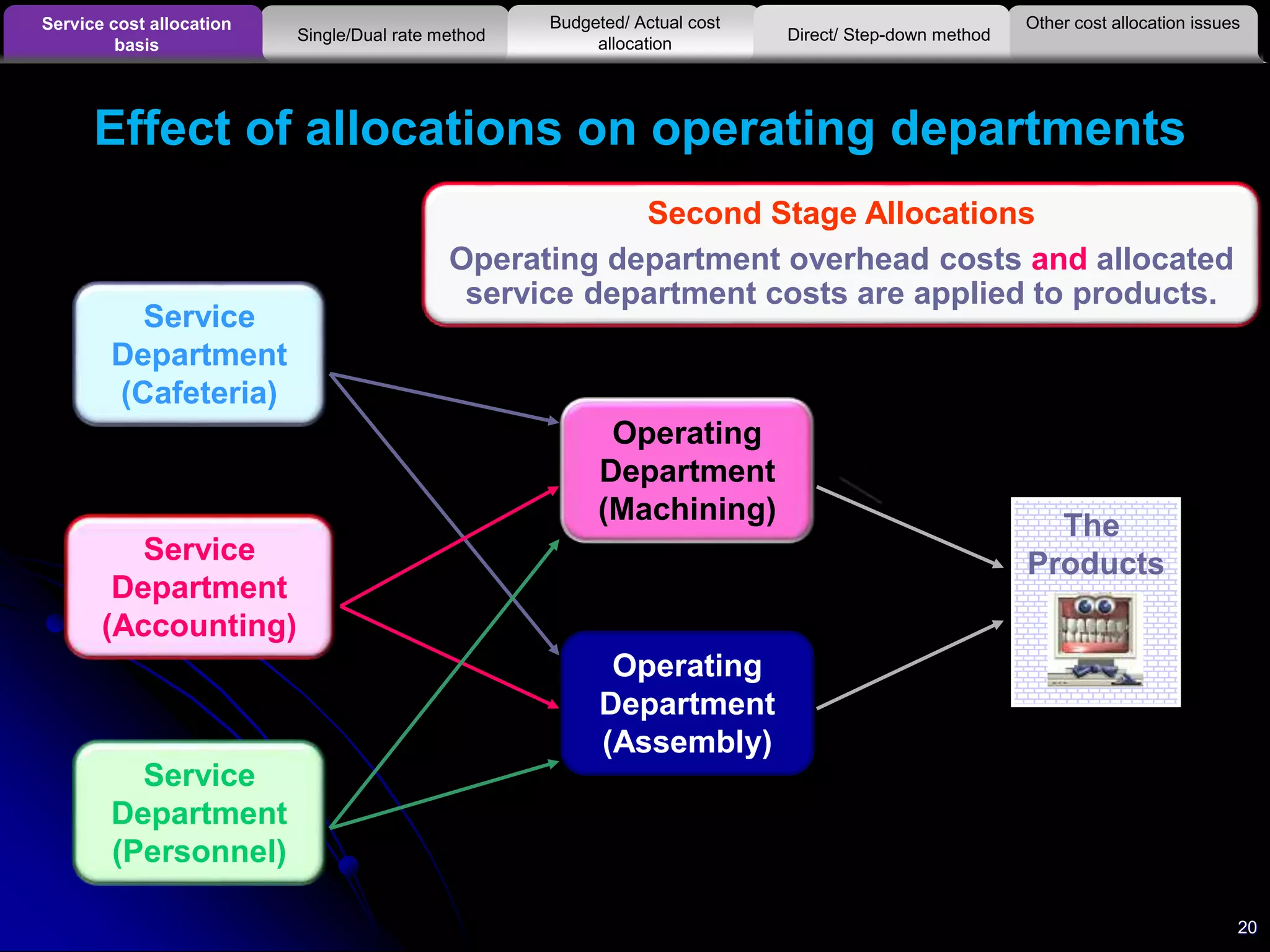

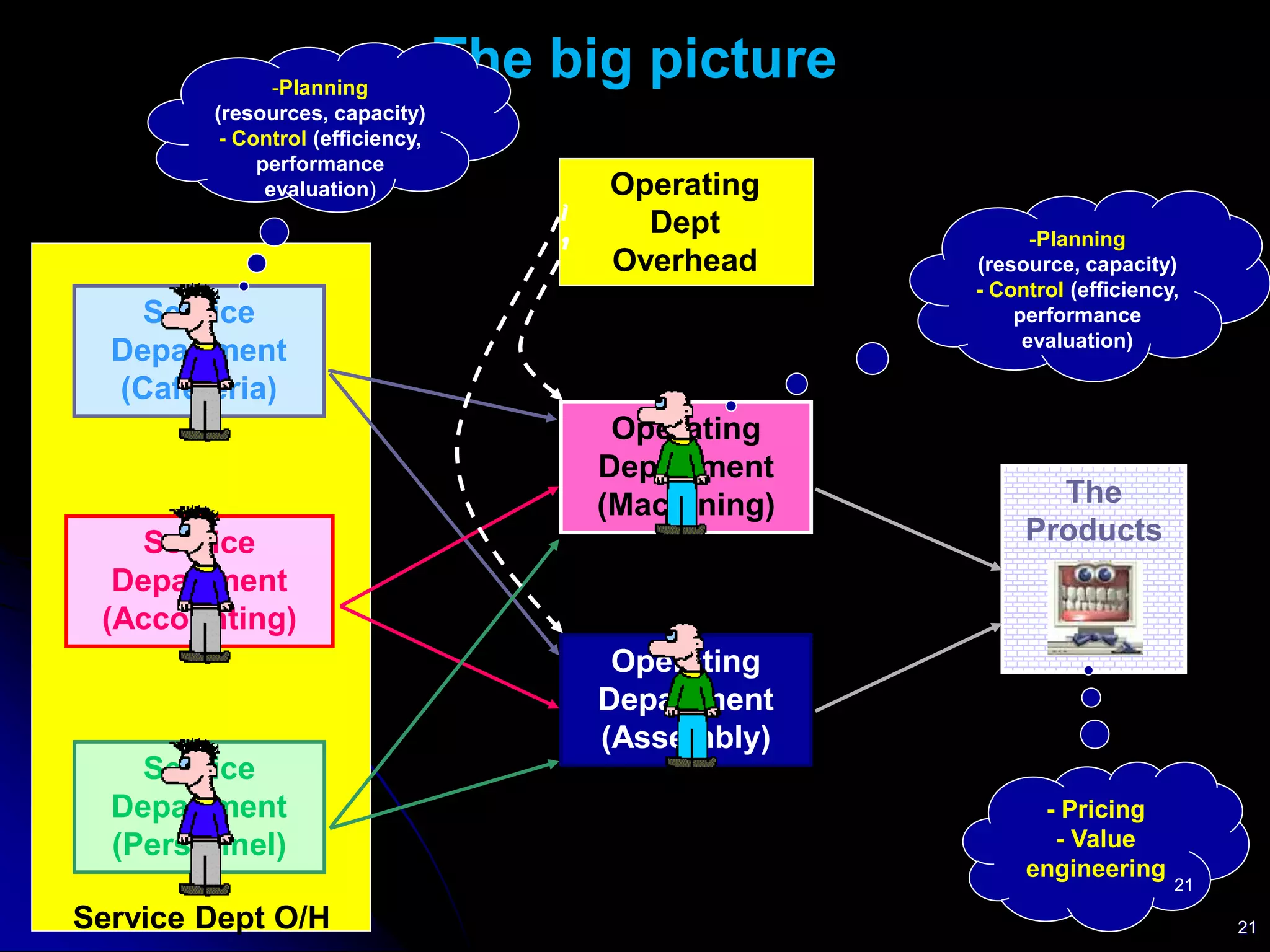

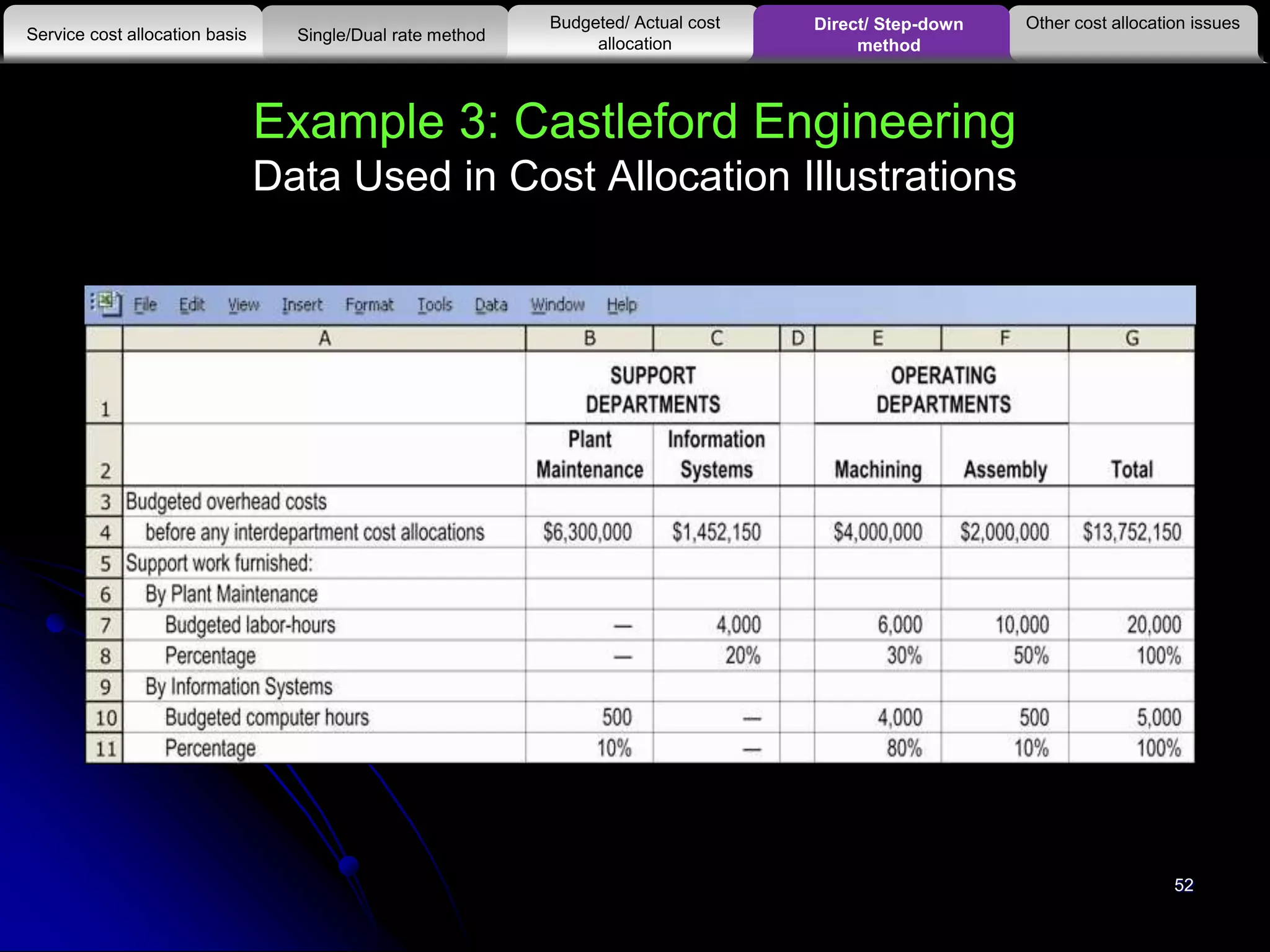

The document discusses cost allocation methods for service departments. It covers:

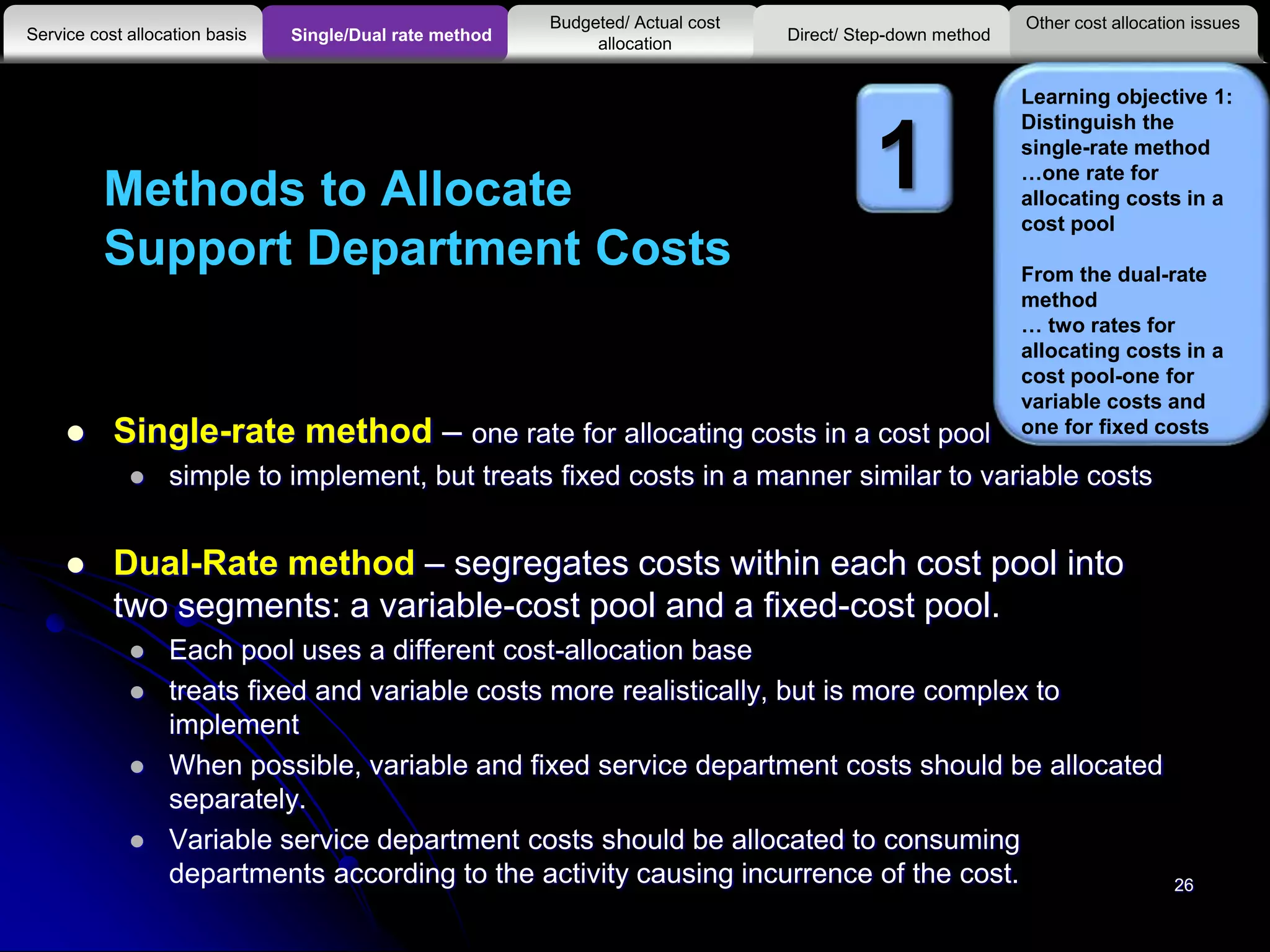

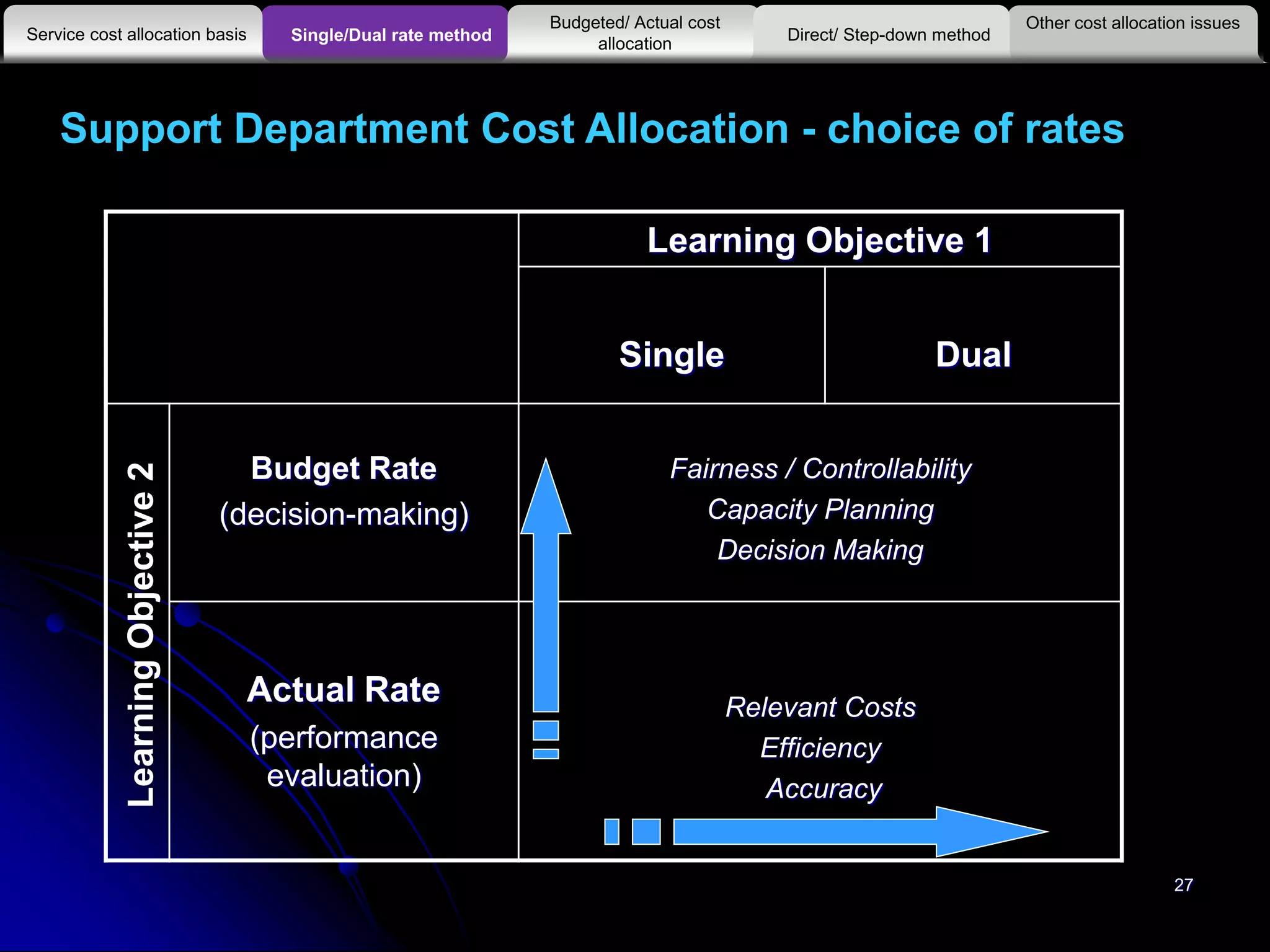

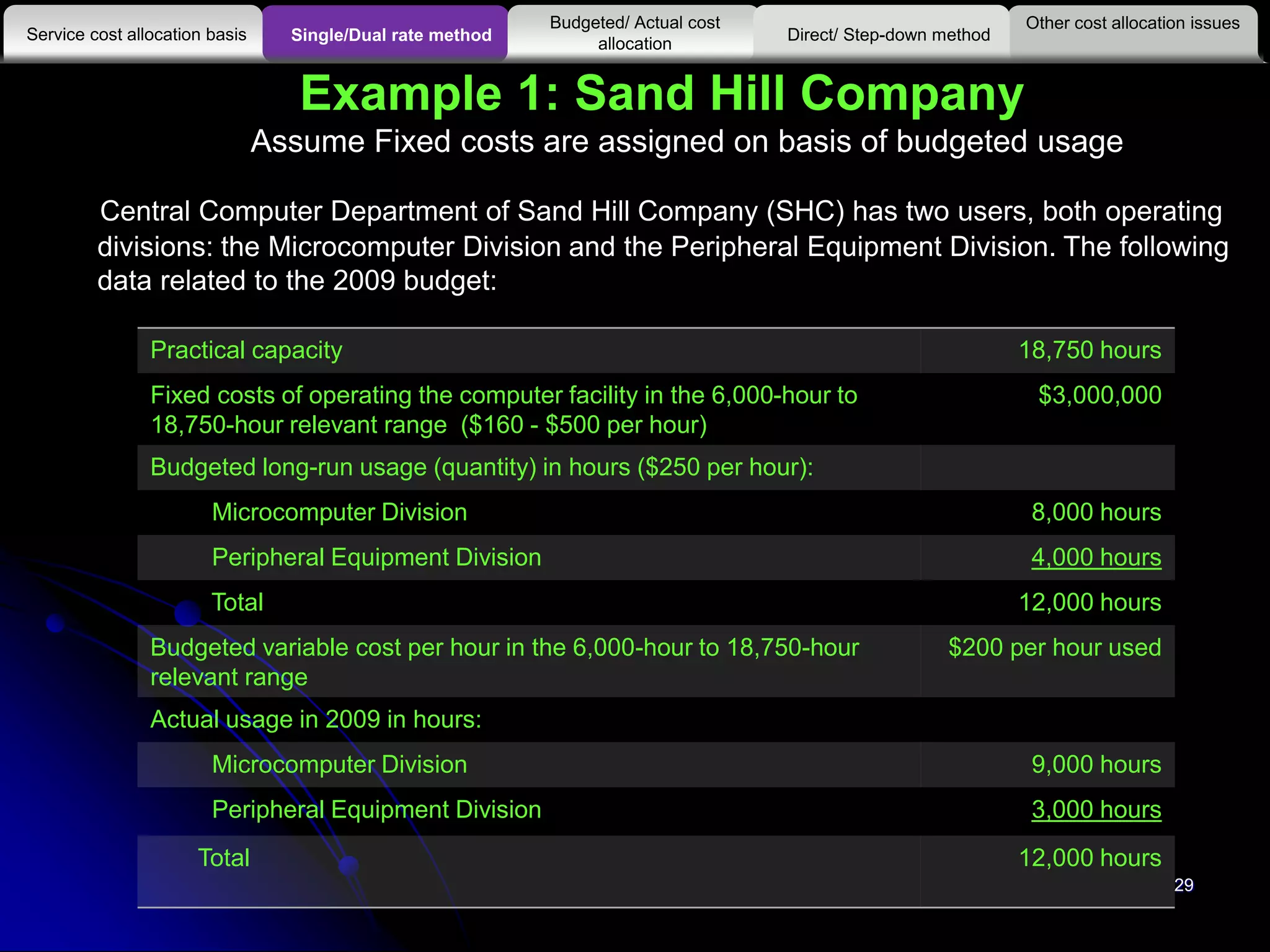

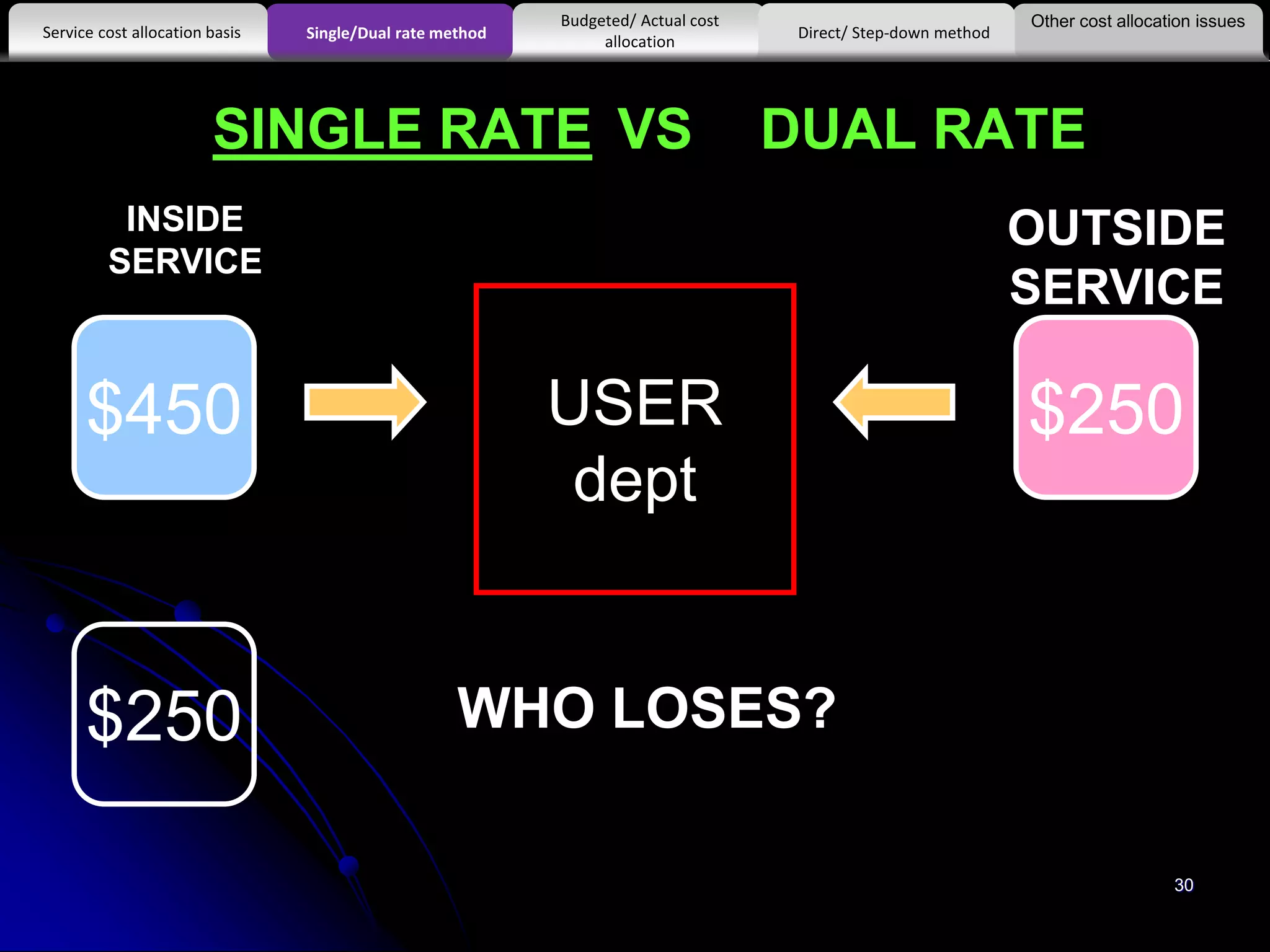

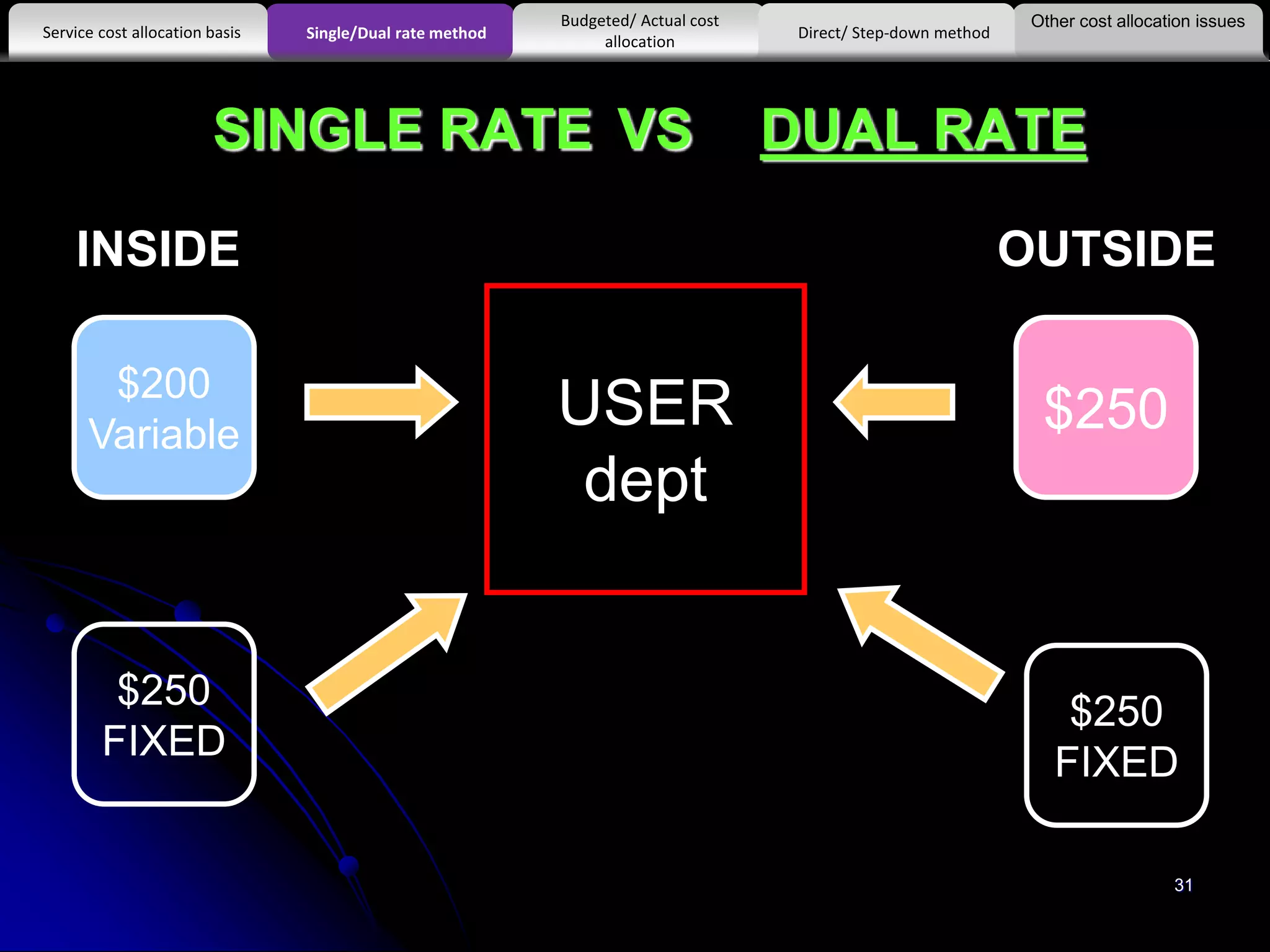

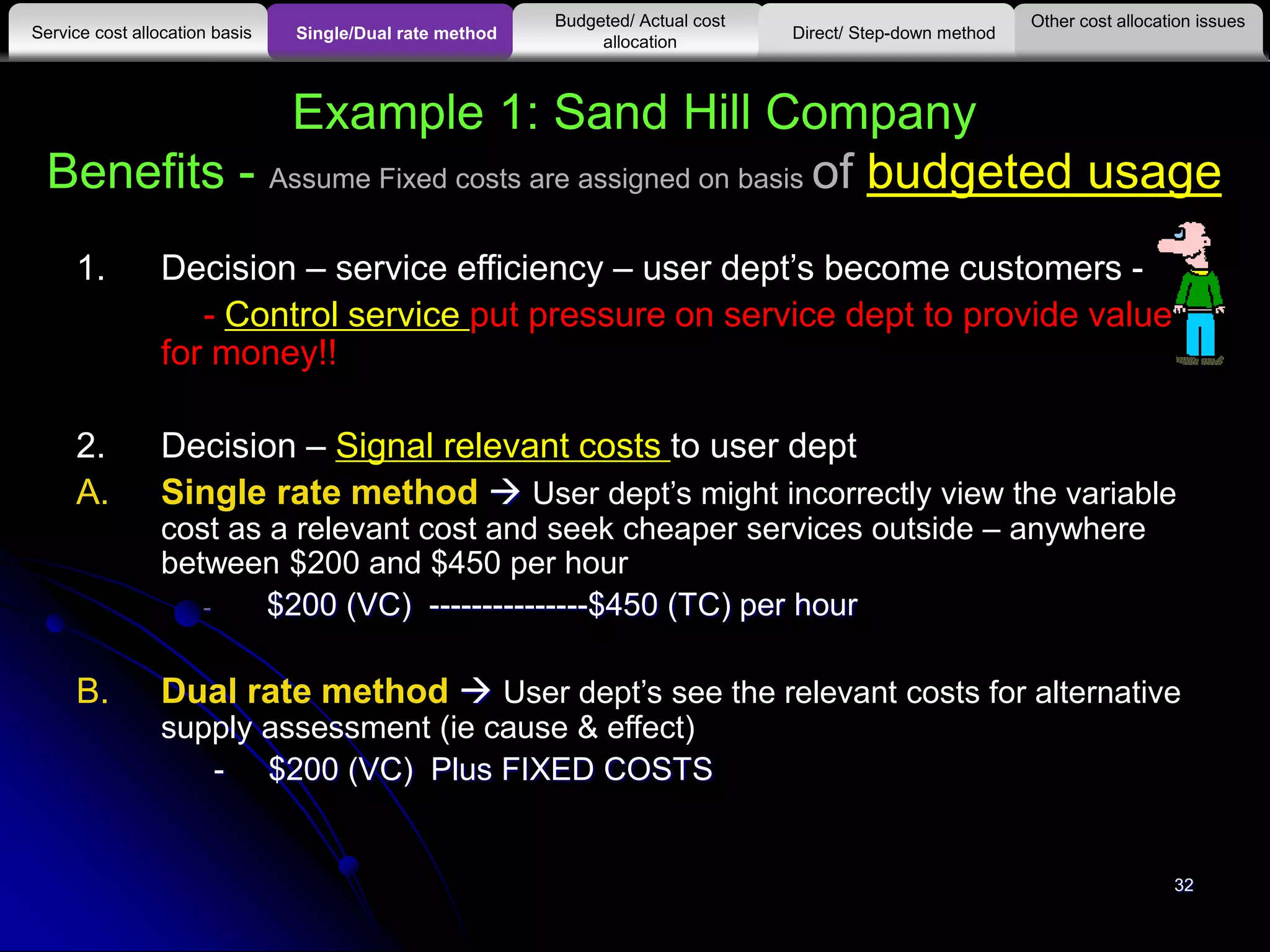

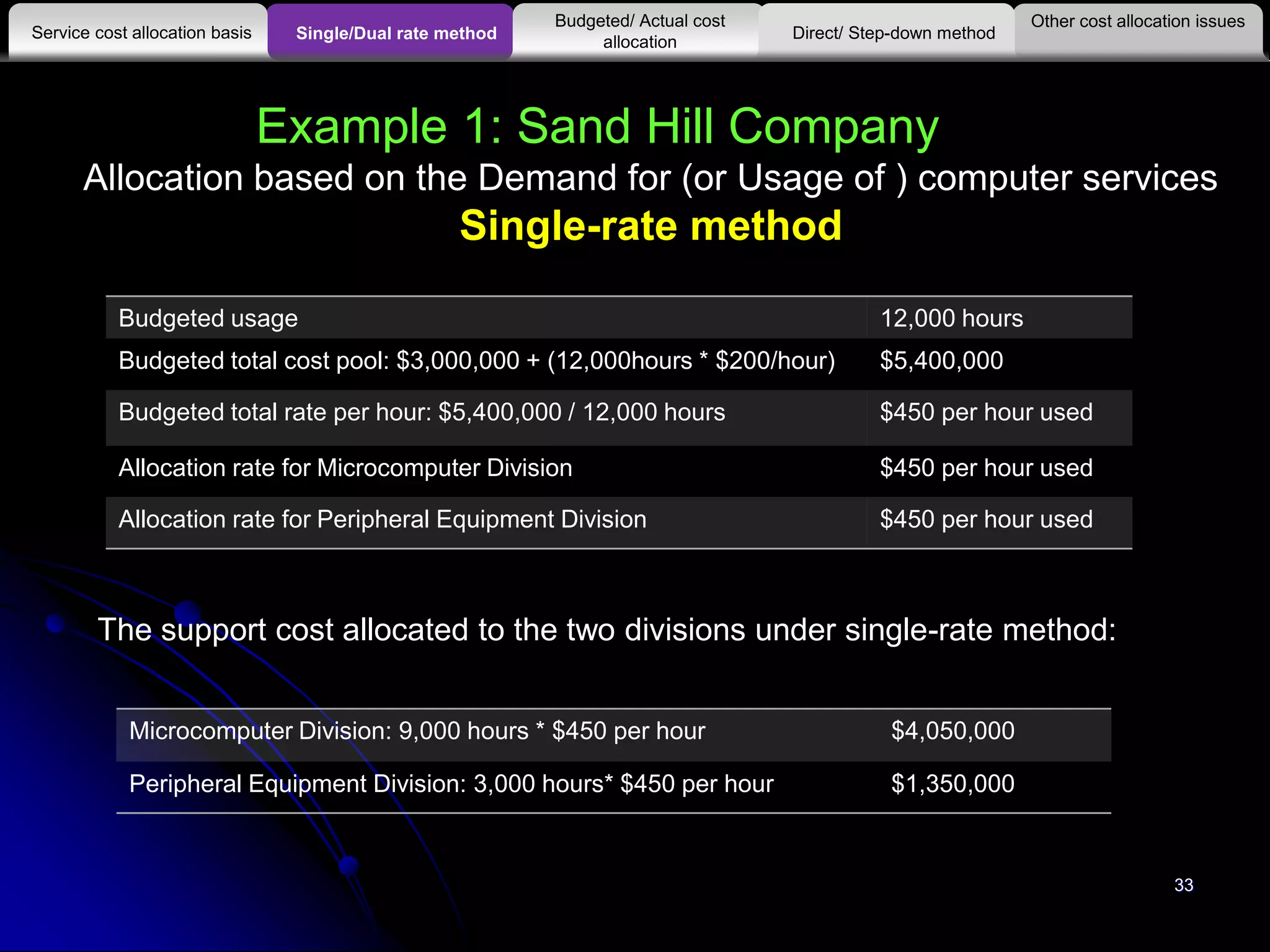

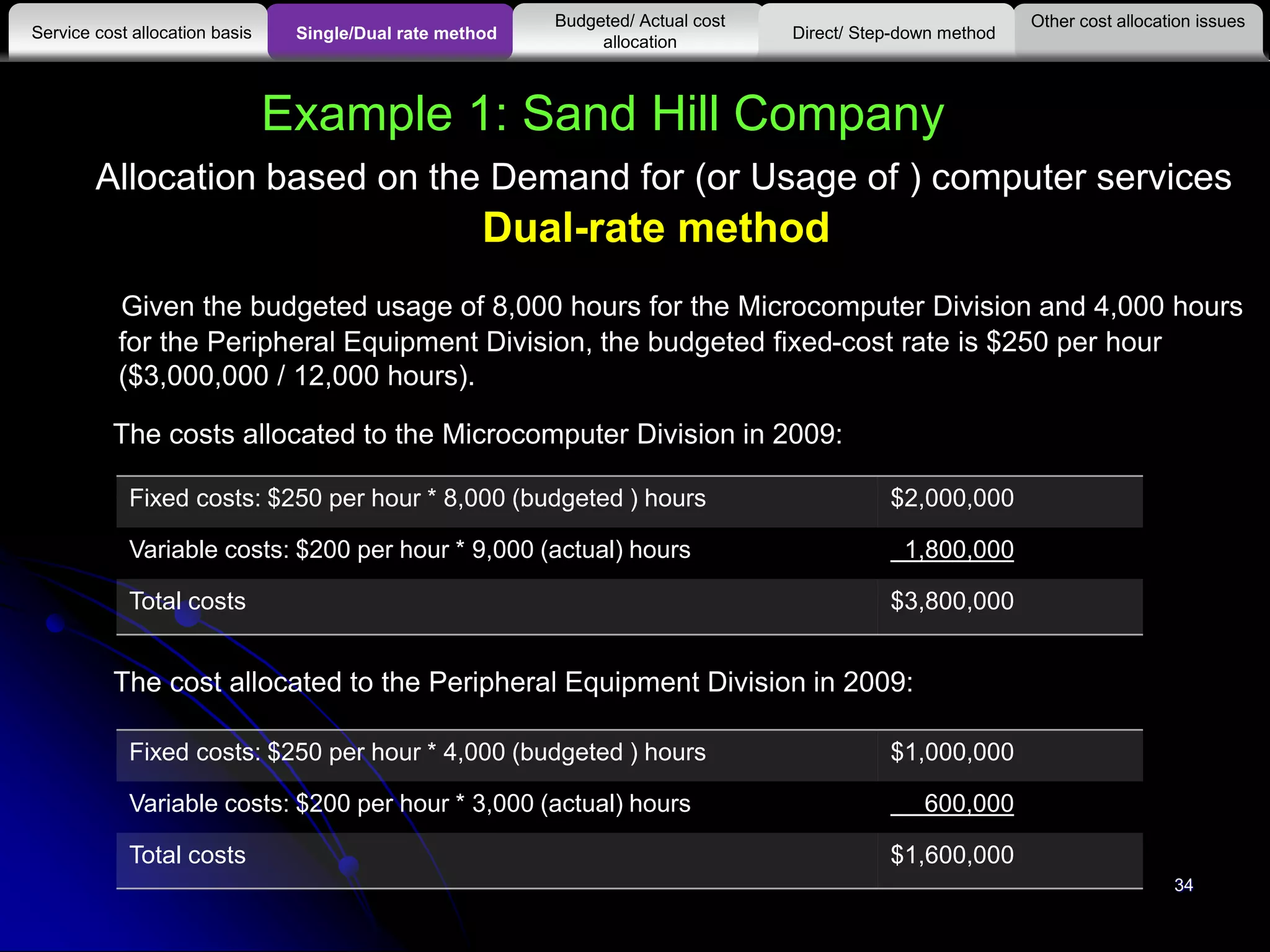

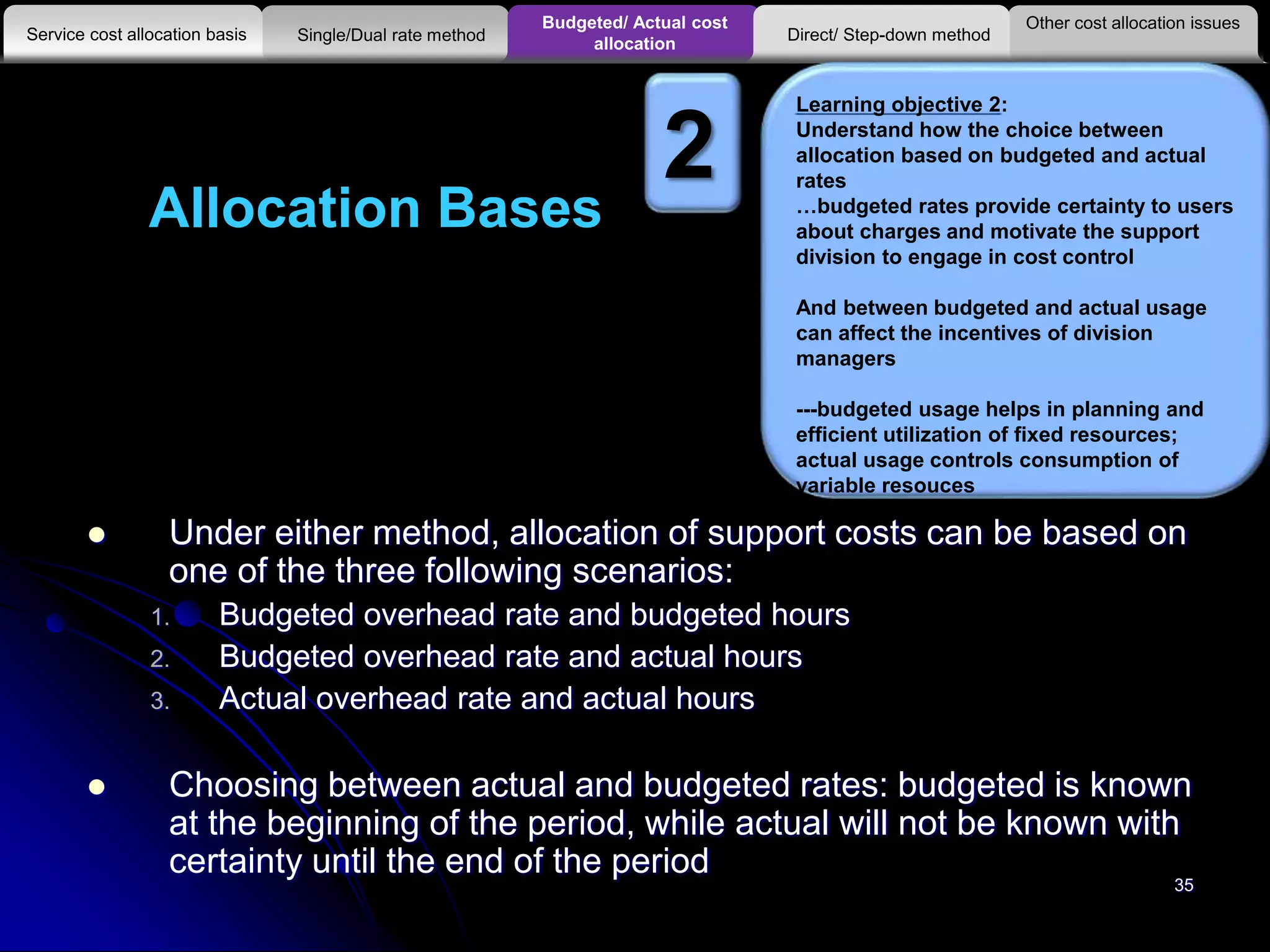

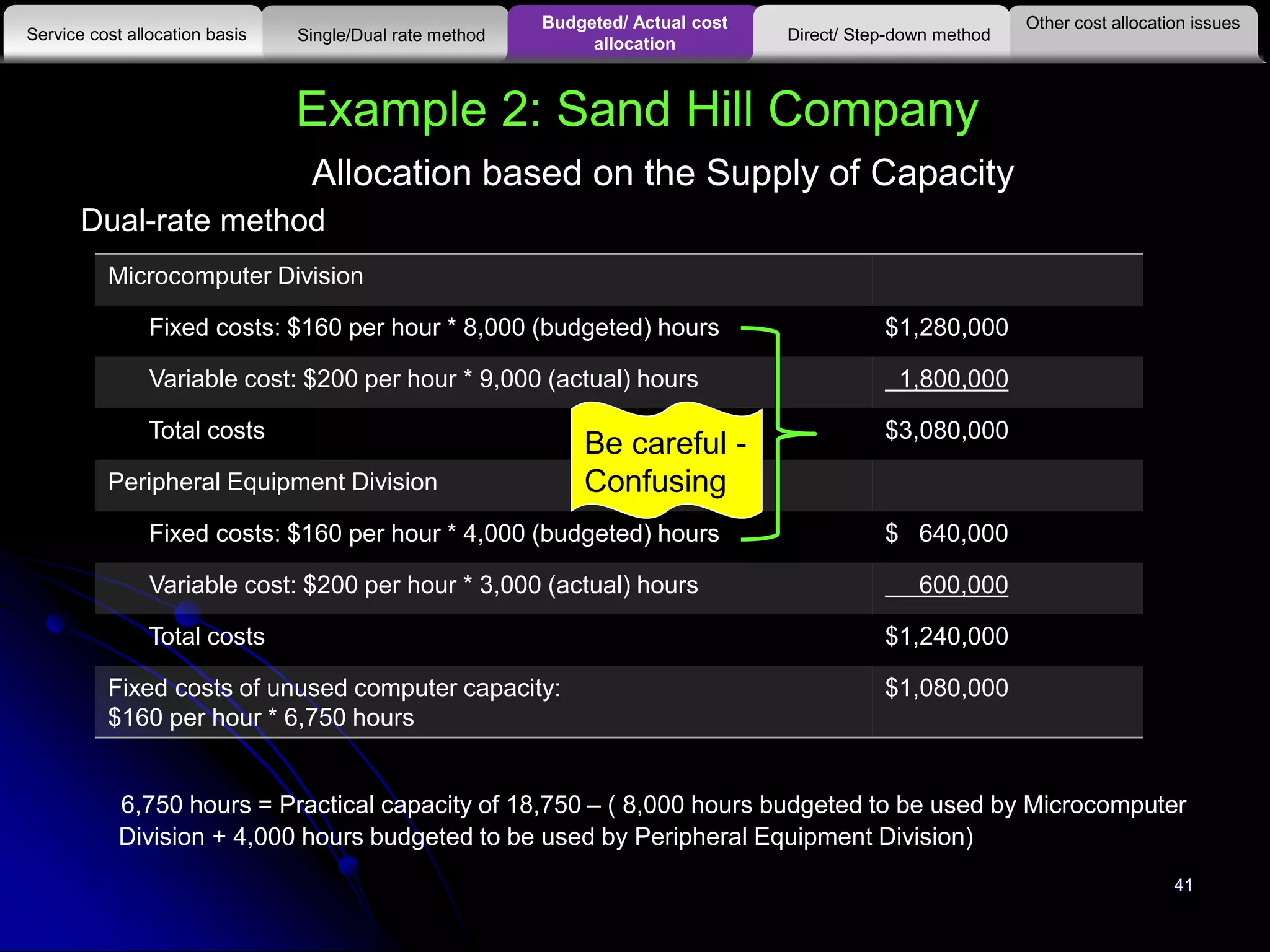

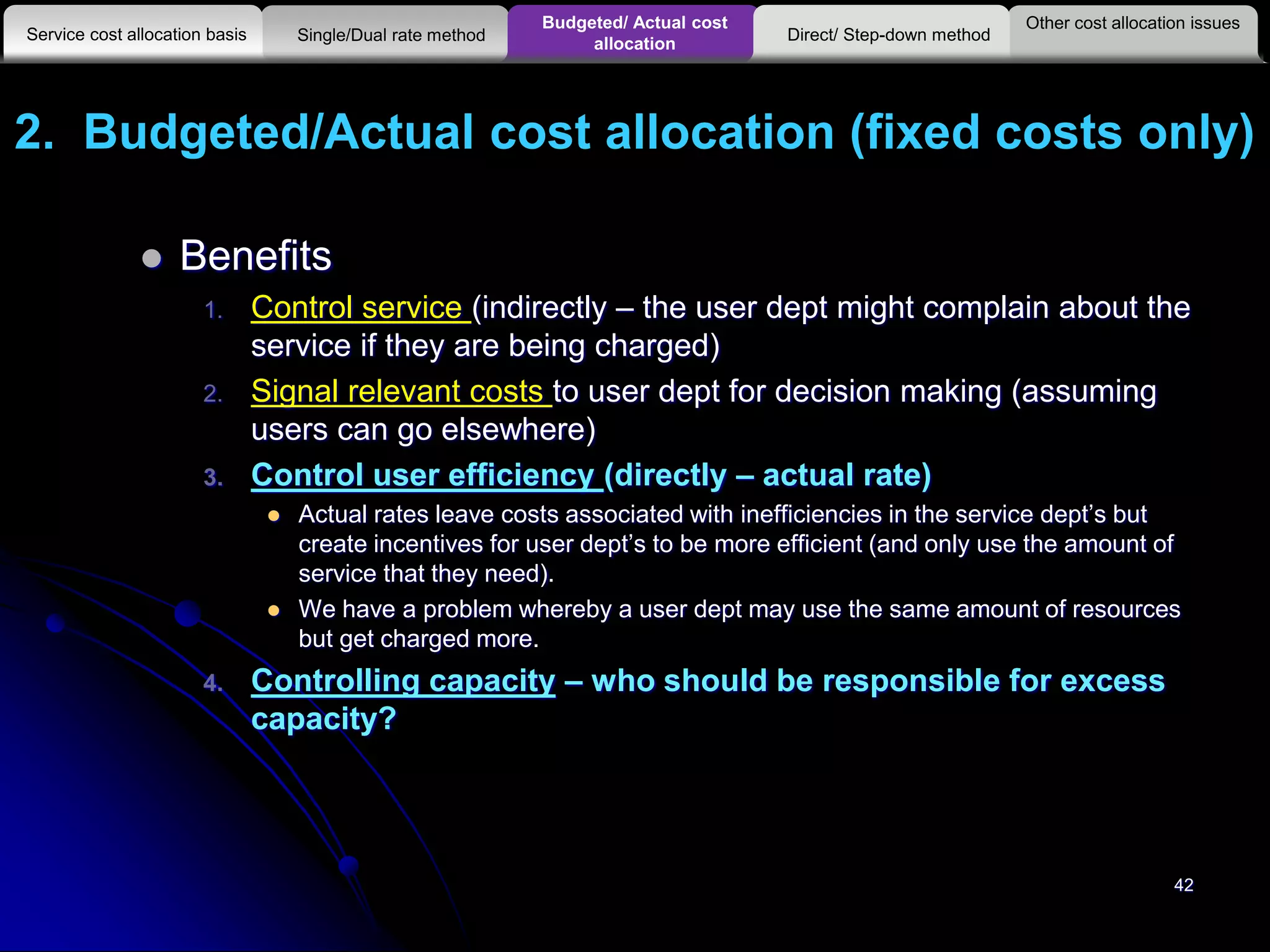

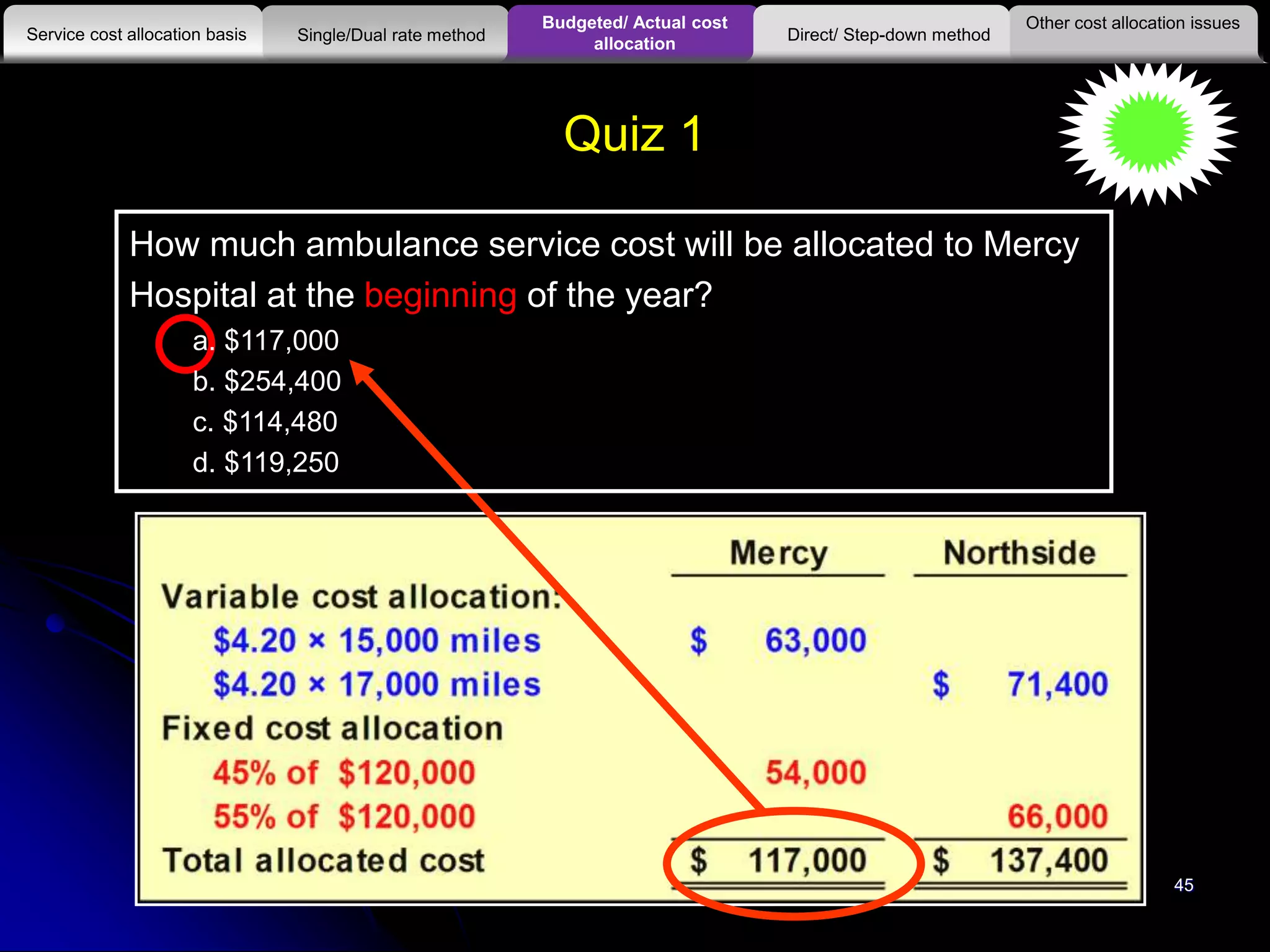

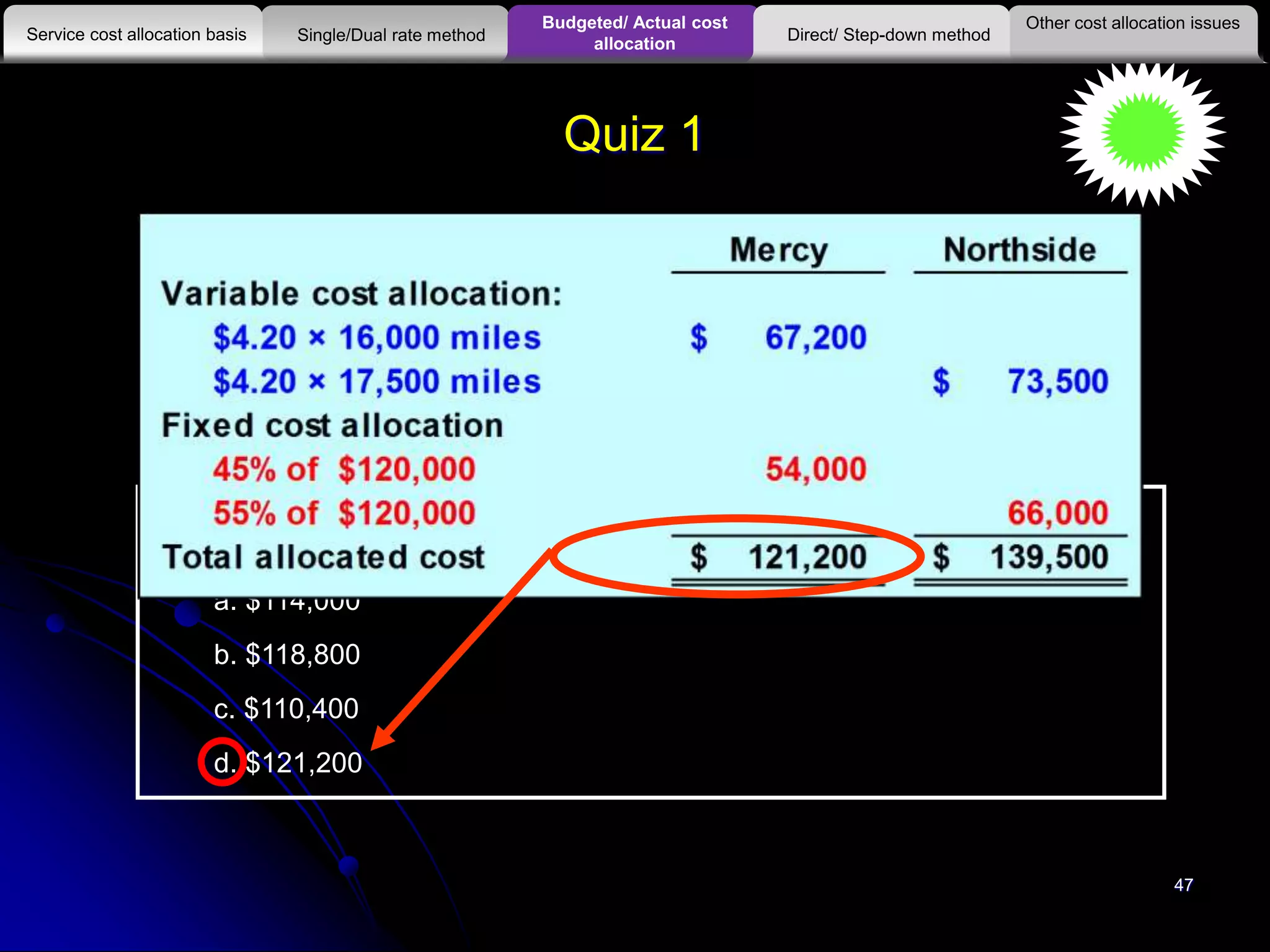

1. The single-rate and dual-rate methods for allocating service department costs, with the dual-rate method treating fixed and variable costs separately.

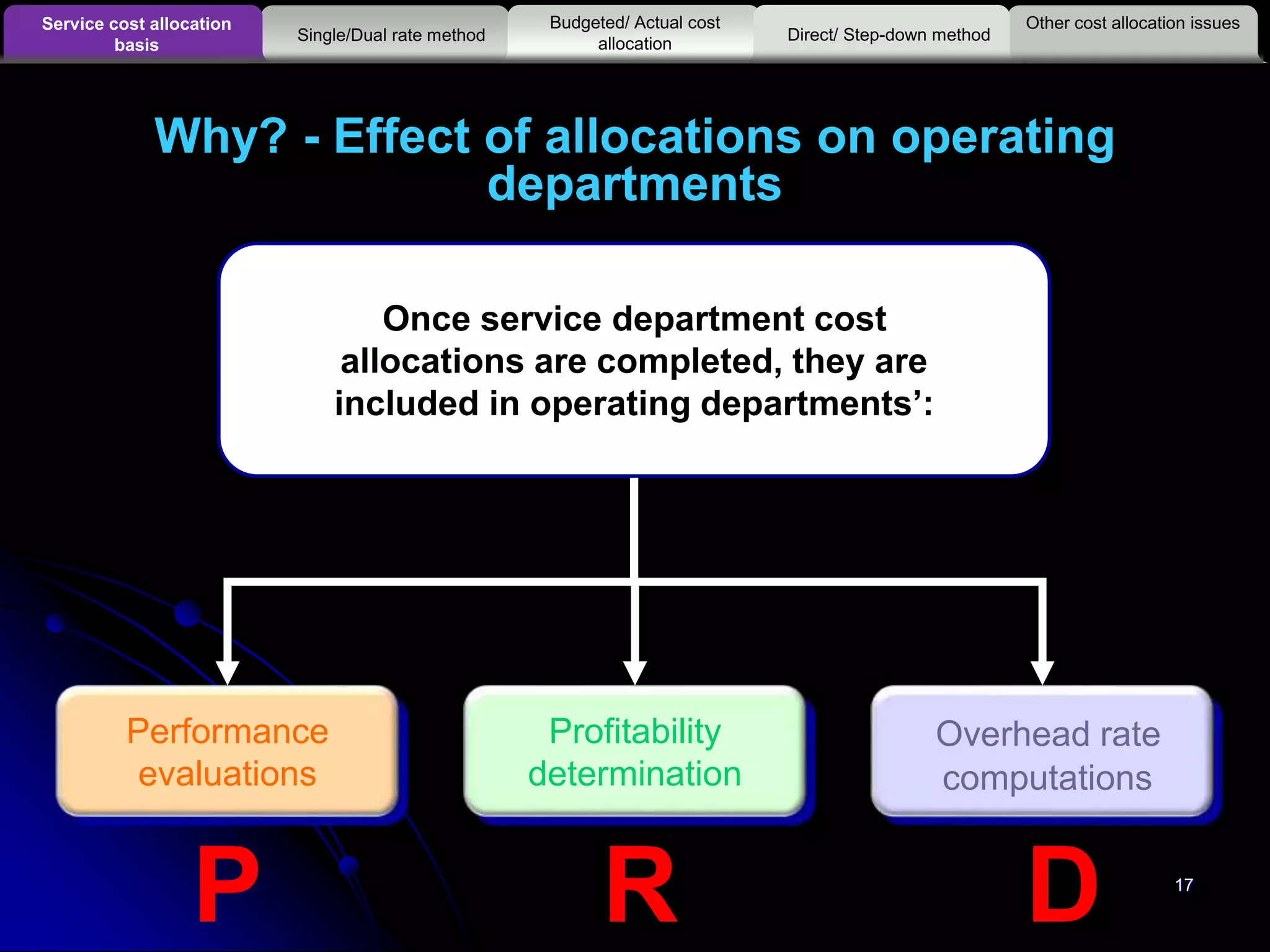

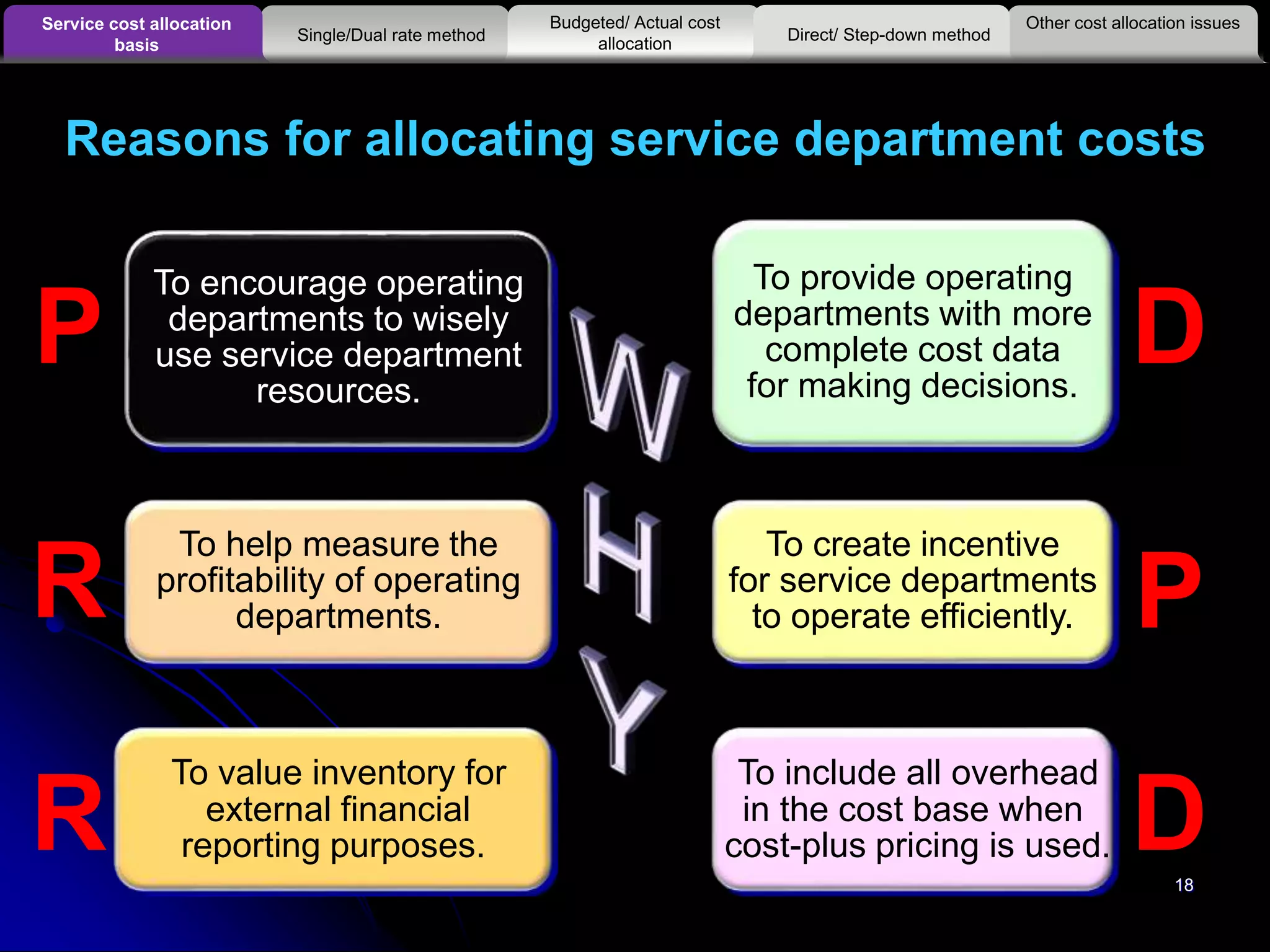

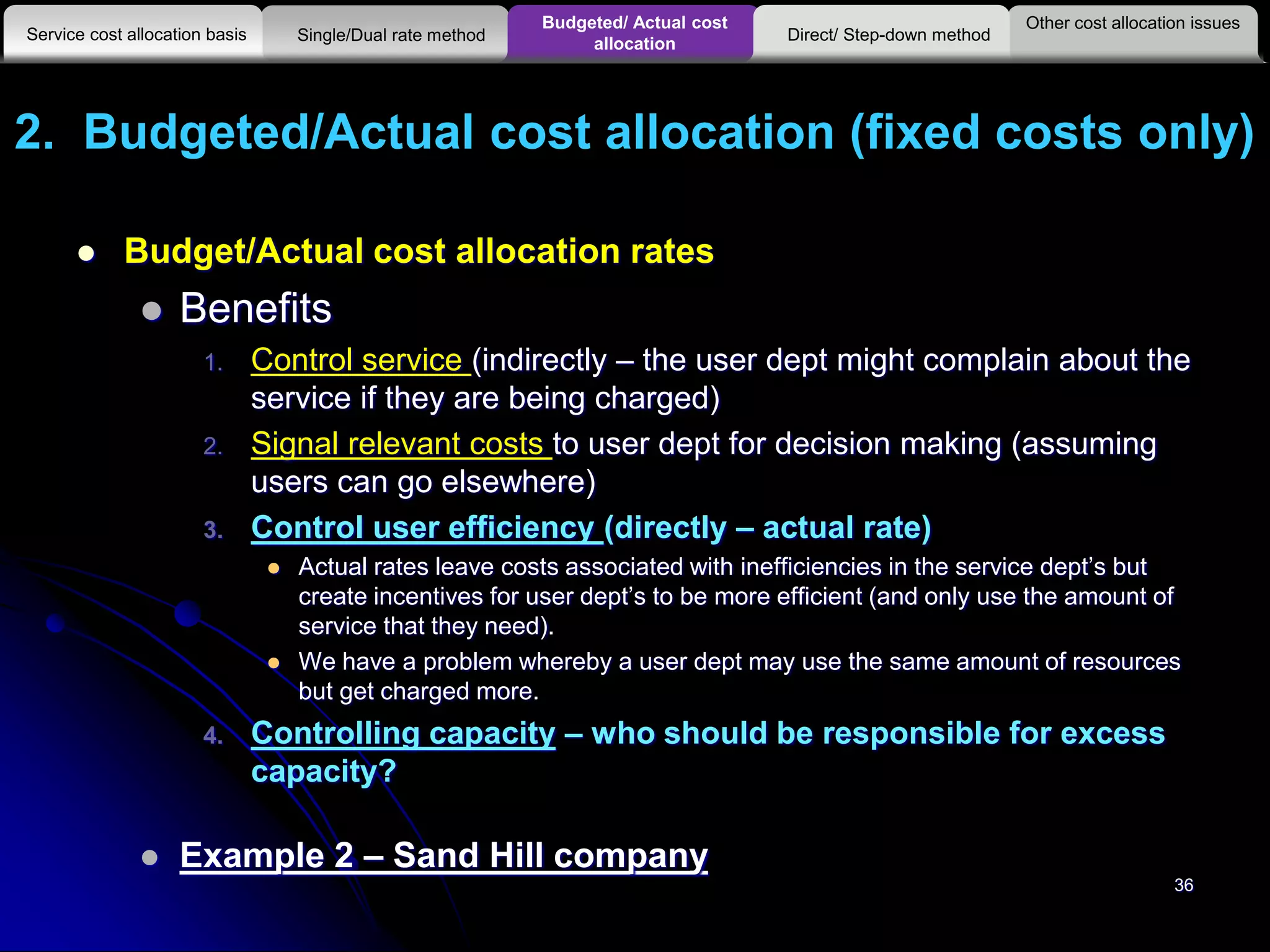

2. The benefits of allocating costs, including encouraging efficient use of resources and providing accurate cost data for decision making.

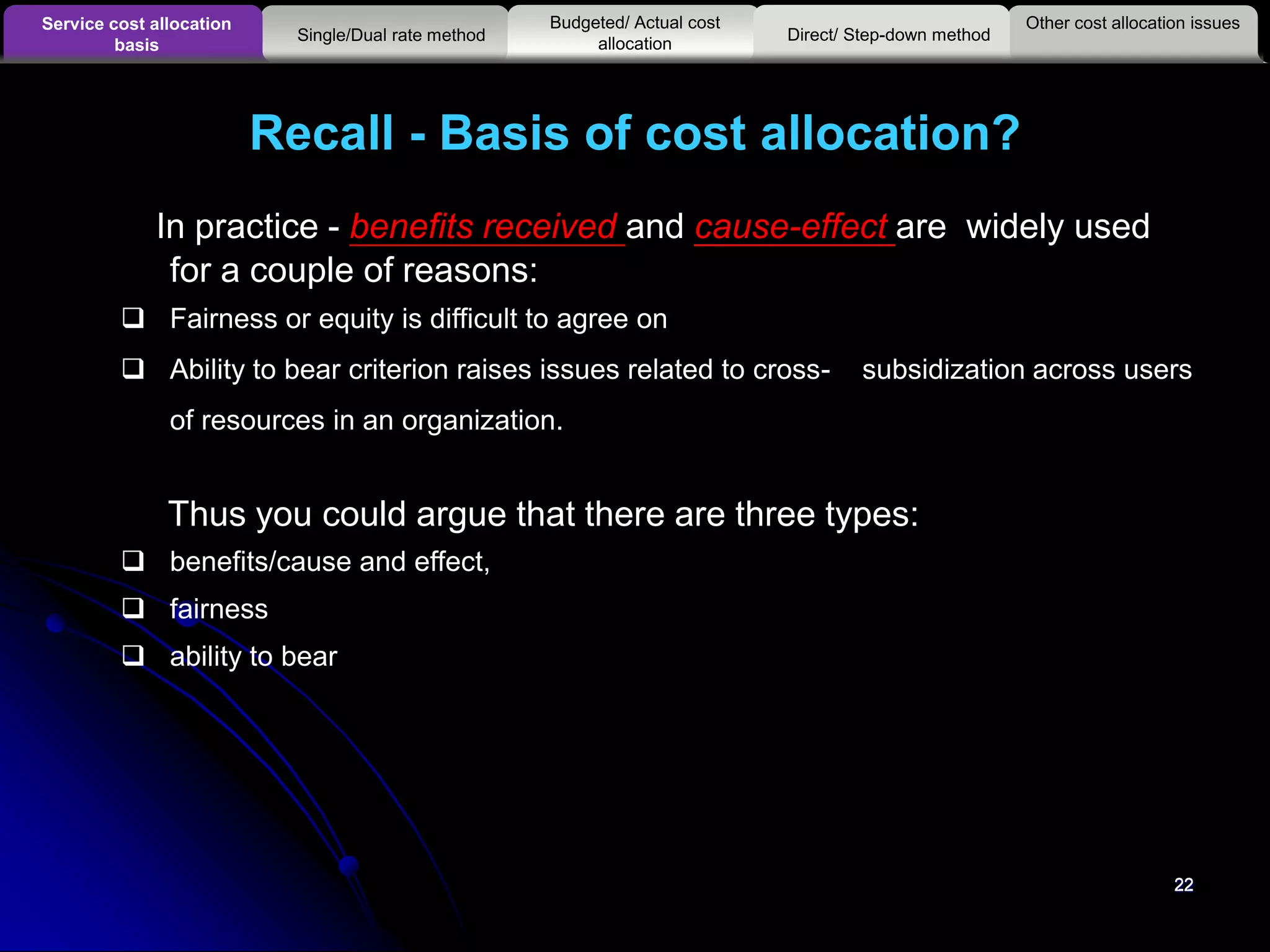

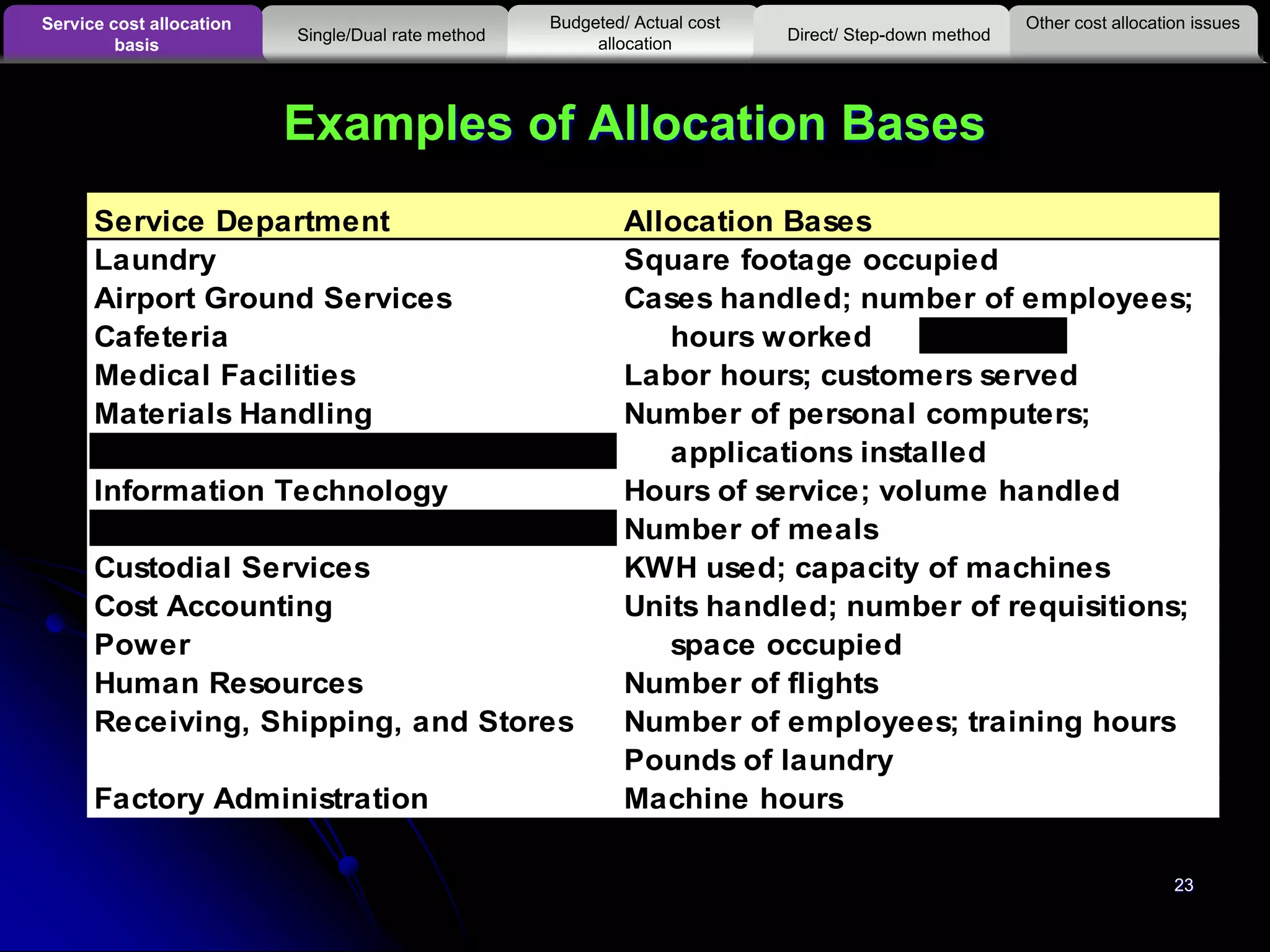

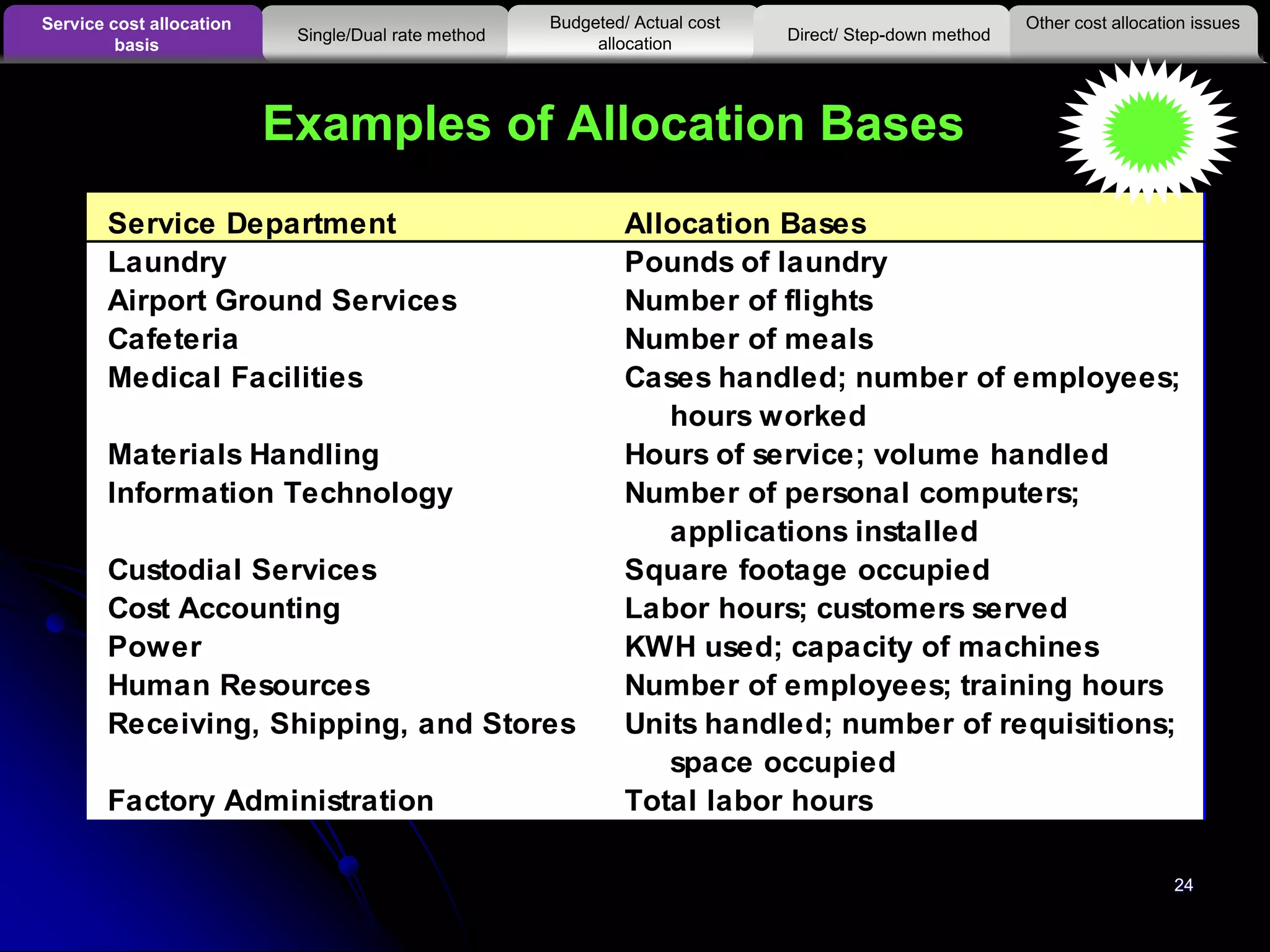

3. Examples of allocation bases for different service departments, and the pitfalls to avoid like allocating fixed costs using a variable base.

![12

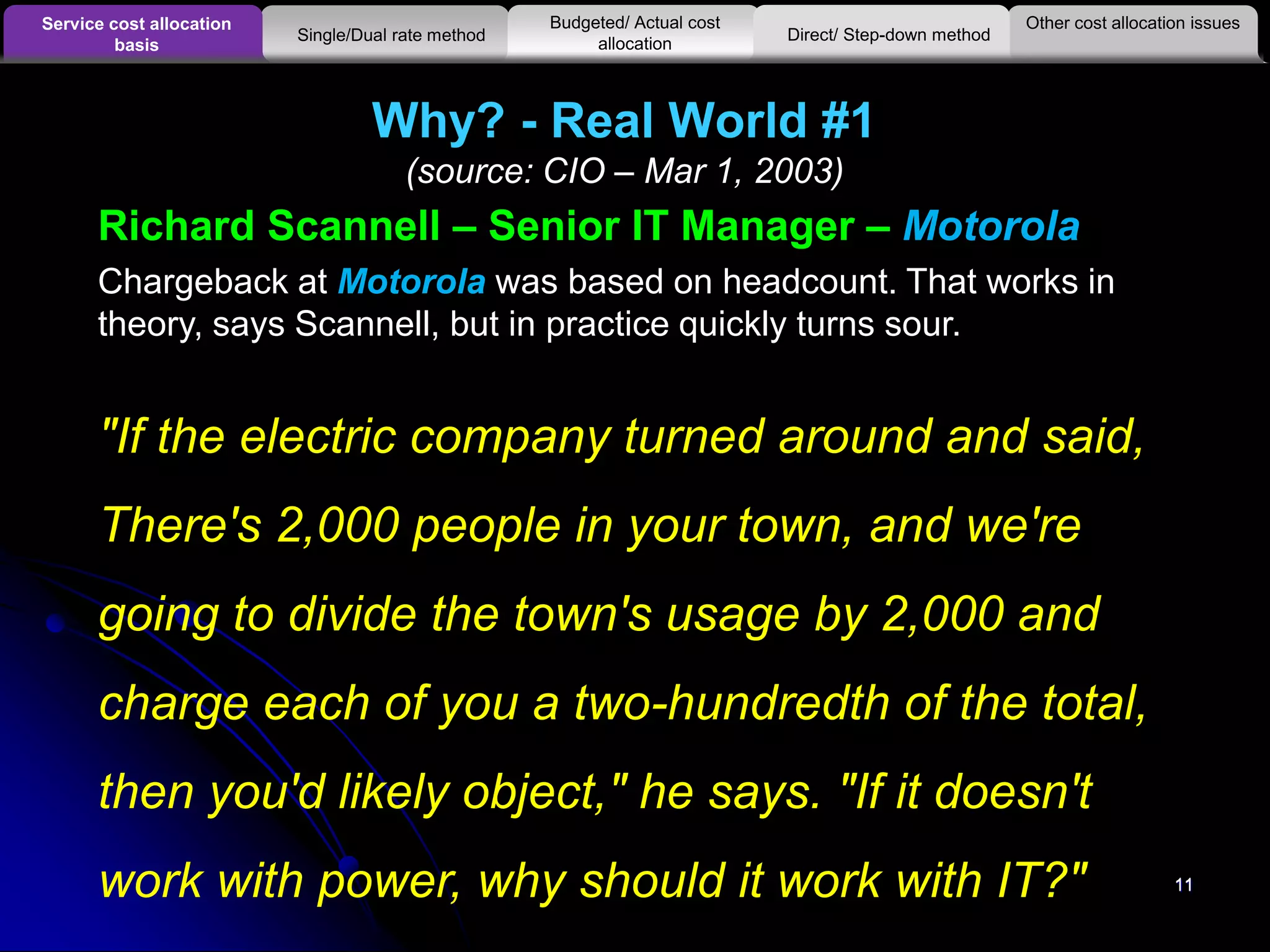

Why? - Real World #2

(source: CIO – Mar 1, 2003)

12

Nordin, vice president and CIO of specialty metals manufacturer

A.M. Castle

“…it's way too much work..[to allocate every $IT

to producing depts.]. It's a never-ending debate

over what constitutes a fair share. In the end, it

comes down to this: What am I being paid to do?

And I think I'm being paid to do more that just

debate MIPS and CPU cycles."

Other cost allocation issuesService cost allocation

basis

Budgeted/ Actual cost

allocationSingle/Dual rate method Direct/ Step-down method](https://image.slidesharecdn.com/week-4-160321102923/75/Week-4-9-2048.jpg)