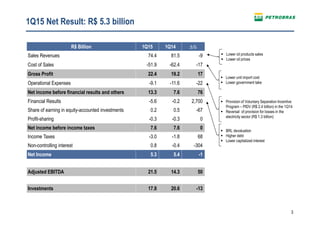

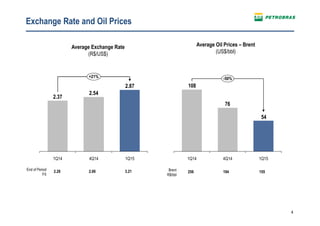

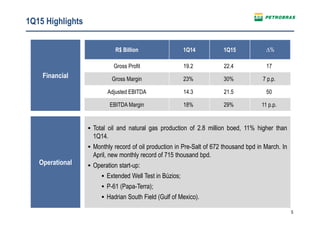

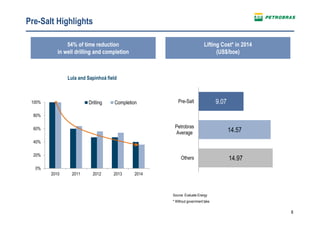

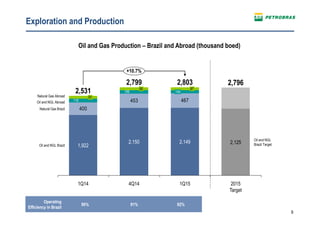

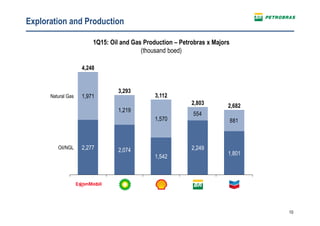

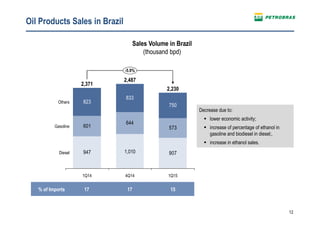

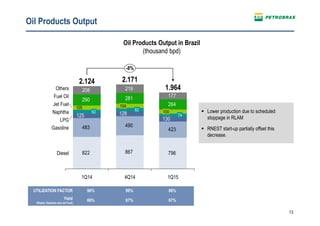

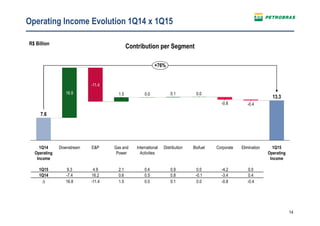

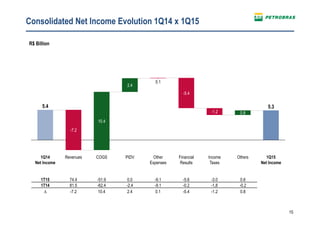

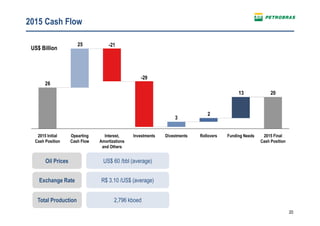

Petrobras reported its financial results for the 1st quarter of 2015. Net income was R$5.3 billion, a 1% decrease from the same period last year. Higher oil production from the pre-salt fields and lower costs partially offset factors such as lower oil prices, a stronger dollar, and lower oil product sales in Brazil. Operational highlights included setting new monthly oil production records from the pre-salt and starting up new production systems. For 2015, Petrobras expects total oil and gas production of 2.8 million boe/day and plans investments of US$25-26 billion to be funded through cash flow and debt rollovers.