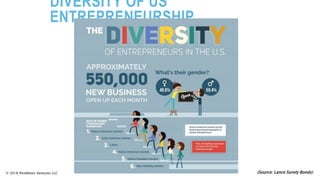

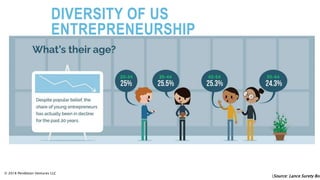

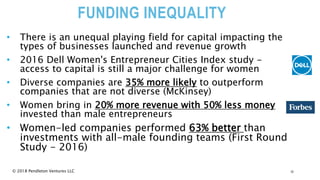

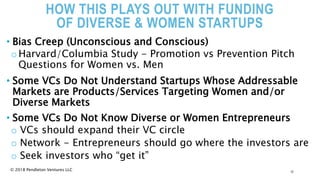

The document discusses the challenges and trends in diverse entrepreneurship and the funding landscape, highlighting significant inequalities in access to capital for diverse and women-led startups. It emphasizes that diverse companies tend to outperform non-diverse ones, yet most funding decision-makers lack diversity, leading to biases in investment opportunities. Solutions include expanding networks to find investors who understand diverse markets and focusing on creating diverse entrepreneurial ecosystems.