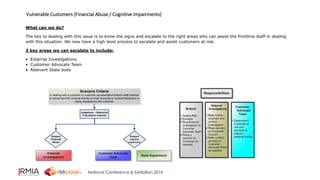

This document summarizes a presentation given by Paul Bonello from ANZ Banking Group on vulnerable customers and elder abuse. The presentation covers ANZ's work to implement processes to help frontline staff identify and escalate potential cases of financial abuse or customers with cognitive impairments. It discusses signs of abuse like suspicious withdrawals and what staff should do if they suspect issues like deceiving powers of attorney. The presentation also provides two case studies and resources on cognitive impairment from Alzheimer's Australia to help staff identify and assist vulnerable customers.