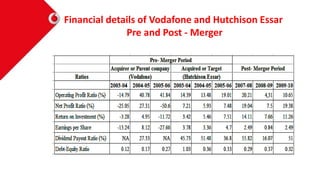

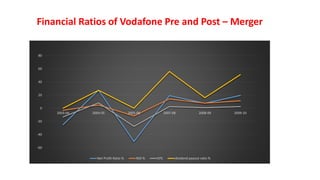

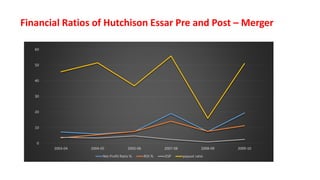

The document analyzes the merger between Vodafone and Hutchison, which occurred on February 11, 2007, with Vodafone acquiring Hutchison Essar for $11.1 billion, subsequently gaining a 67% stake. Vodafone Group, a major telecommunications entity, sought to expand its presence in the Indian market due to lower telecom density and saturation in western markets, leading to potential growth opportunities. The merger enabled Vodafone to access a large customer base in India and strengthen its position in emerging markets.