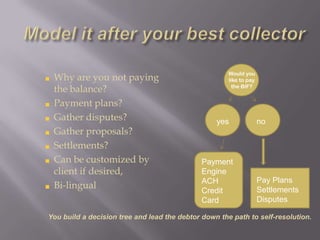

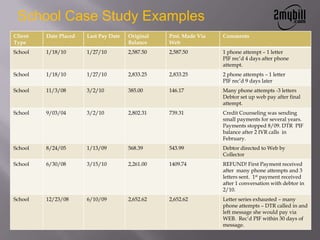

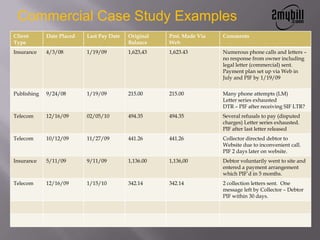

This document summarizes a presentation given at the 2010 ACA International Convention about changing communication habits and the evolution of technologies that demand faster response times. It discusses how payment habits have changed with more electronic payments and less check usage. It also describes a case study of a company that implemented a virtual collections agent on a website to provide debtors a self-service option to make payments online at any time. The virtual agent was modeled after the company's best live collectors and has increased online payments and recoveries while lowering operating costs.