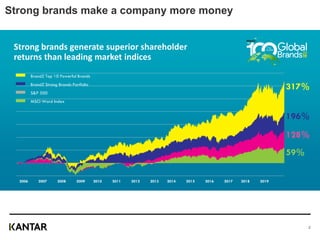

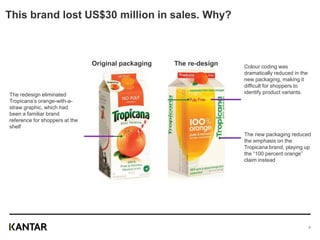

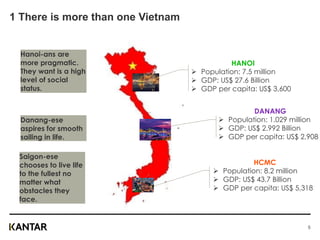

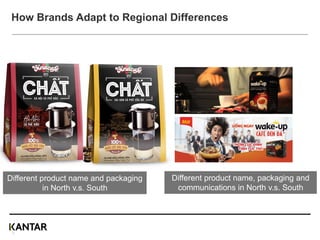

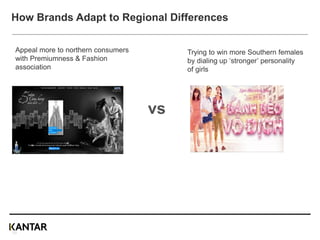

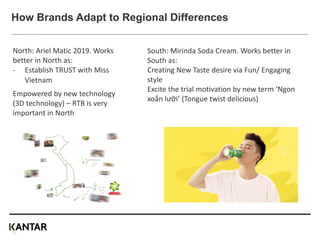

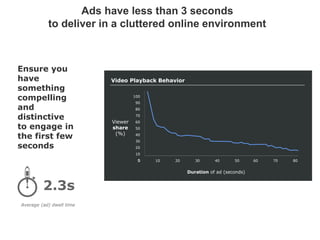

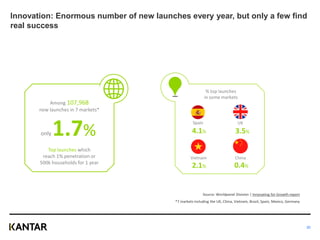

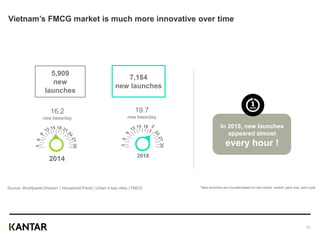

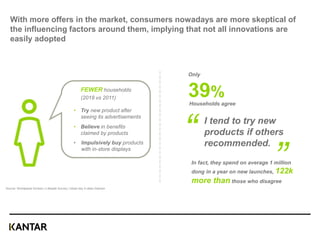

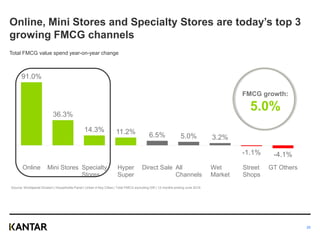

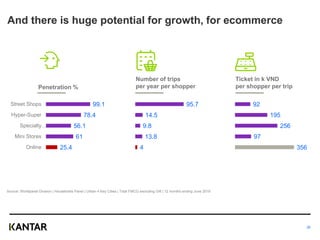

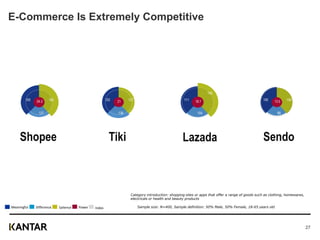

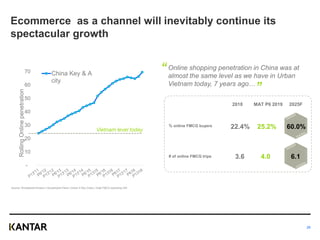

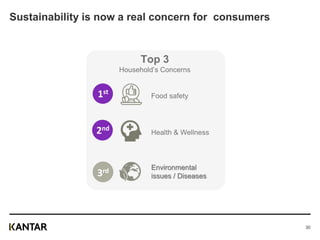

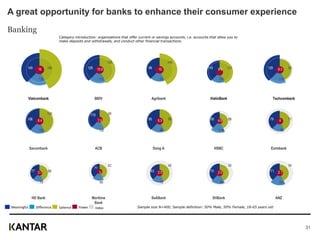

The document outlines consumer trends in Vietnam for 2020, indicating that strong brands outperform market indices and that regional differences significantly affect consumer behavior. Key trends include a booming e-commerce market, increased consumer skepticism towards advertising, and a growing emphasis on sustainability. It also discusses the varying attributes that appeal to consumers in different Vietnamese cities, such as practicality in Hanoi and a desire for risk-taking and innovation in Ho Chi Minh City.