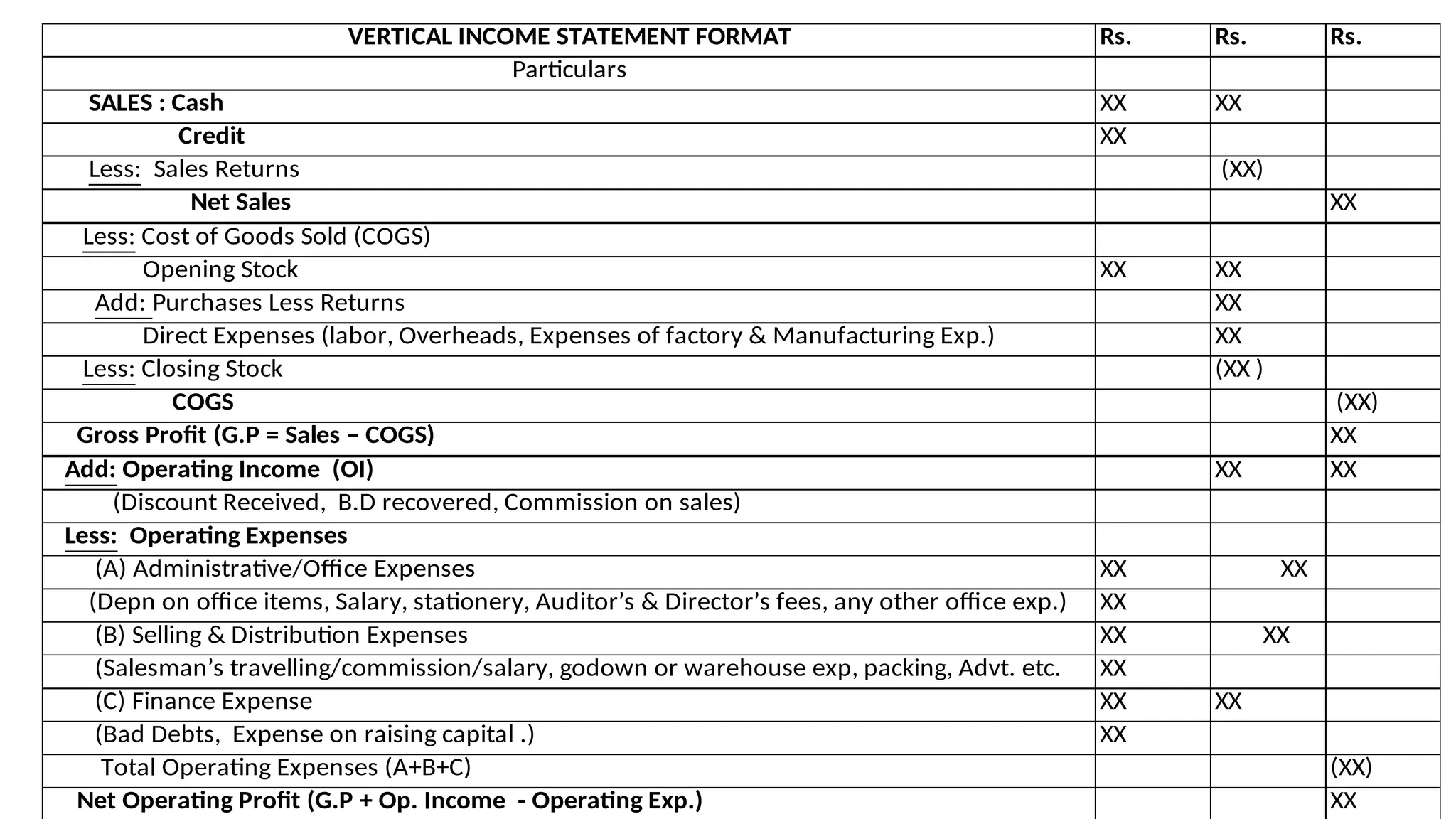

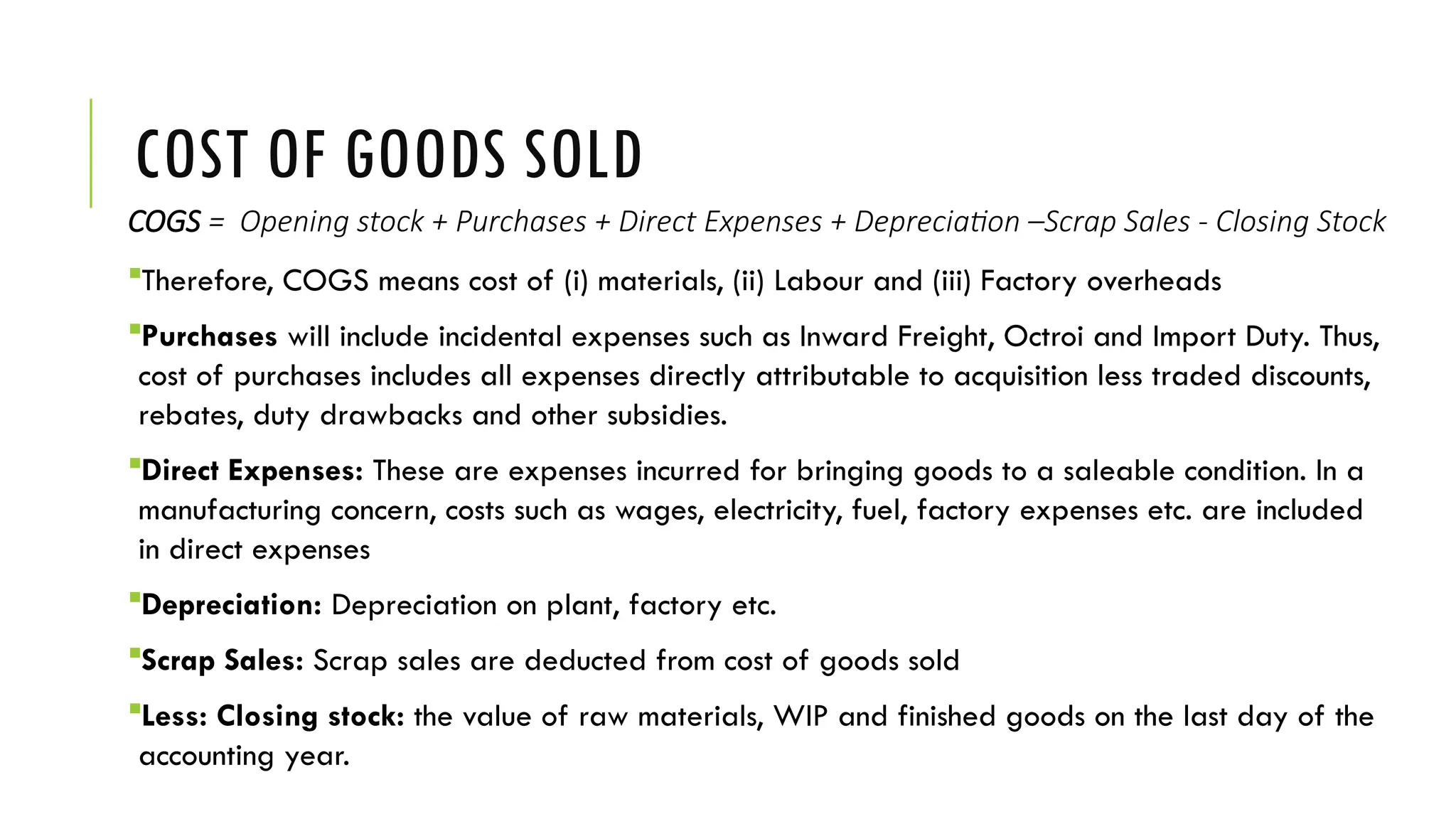

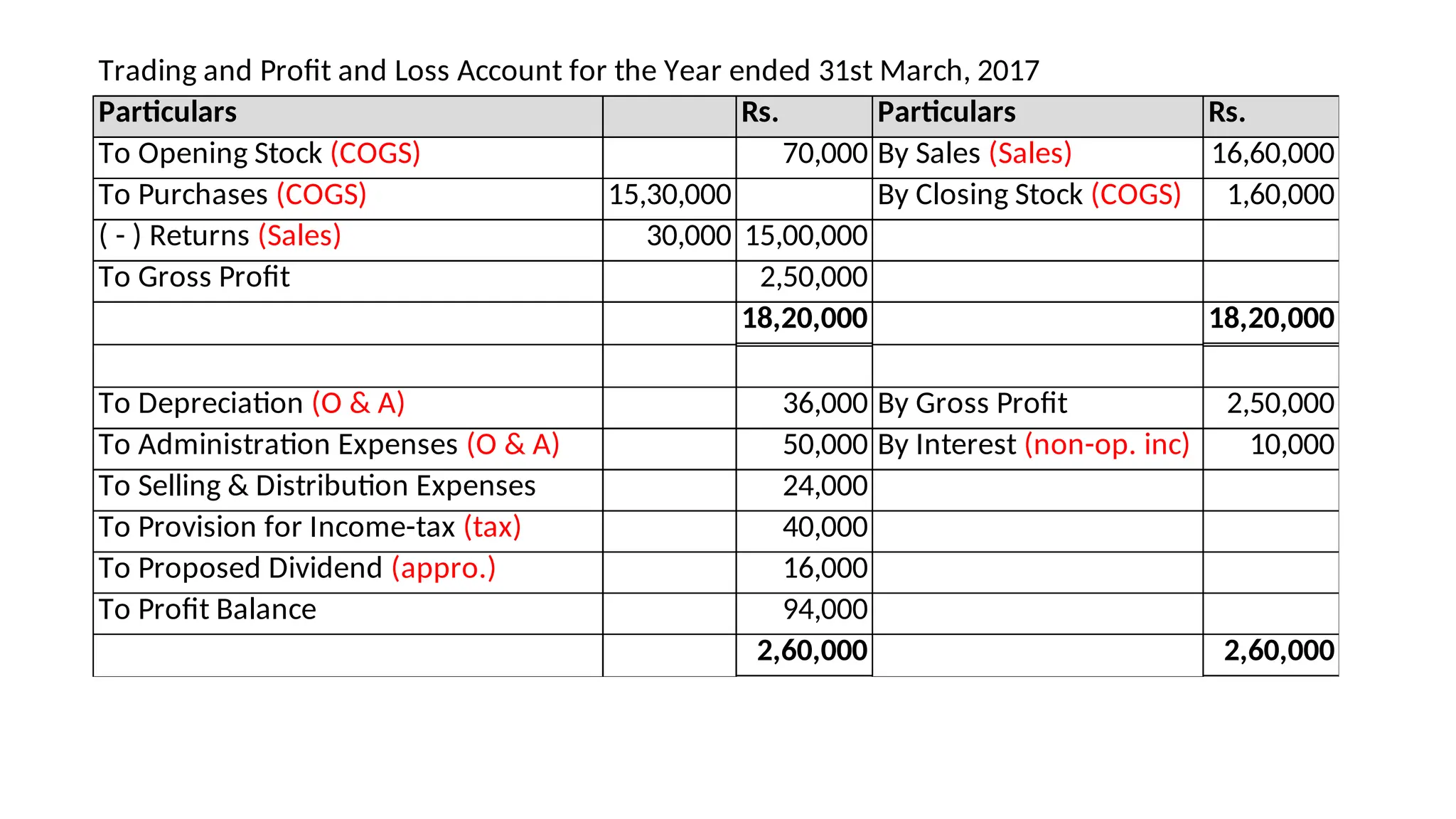

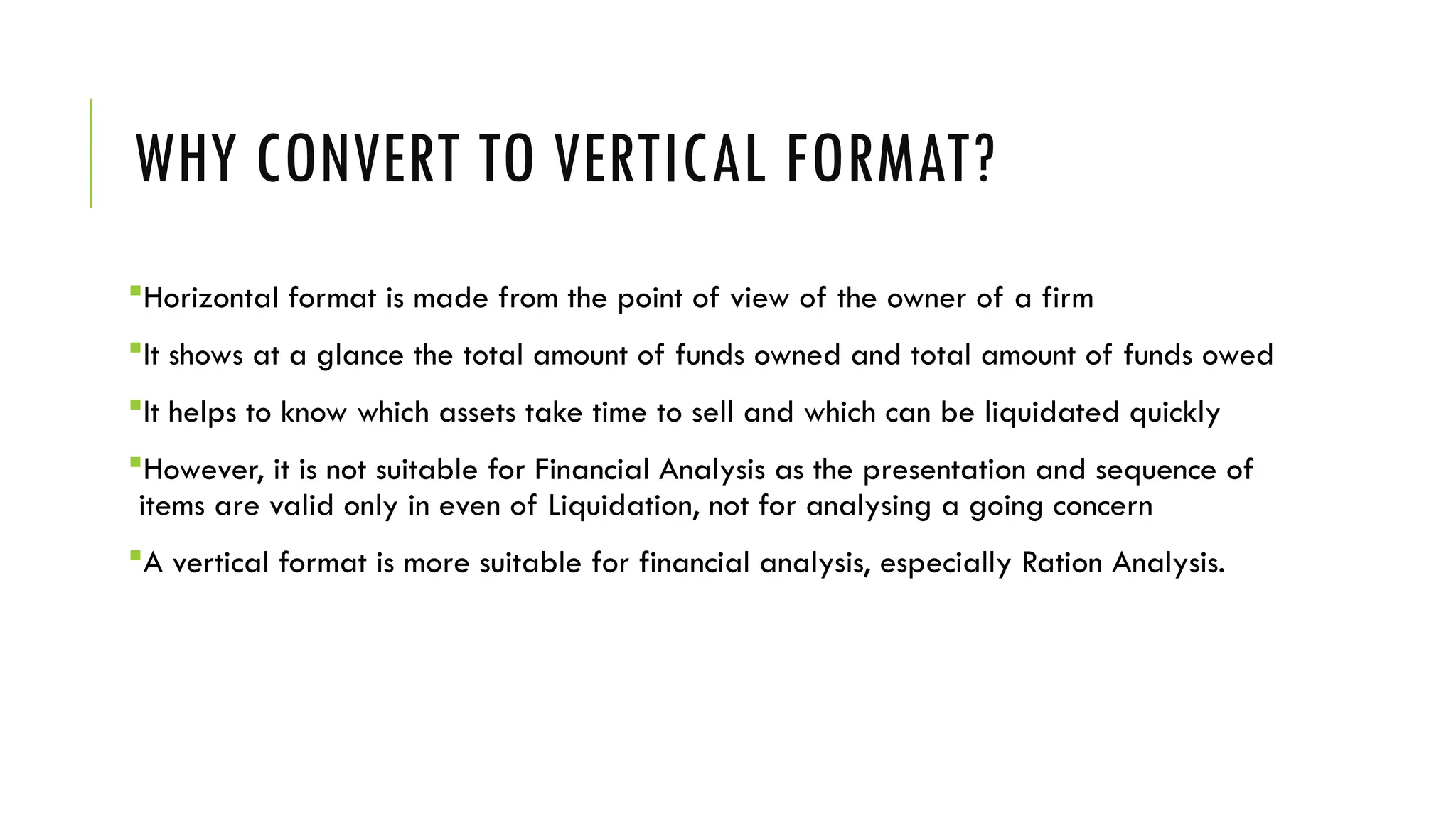

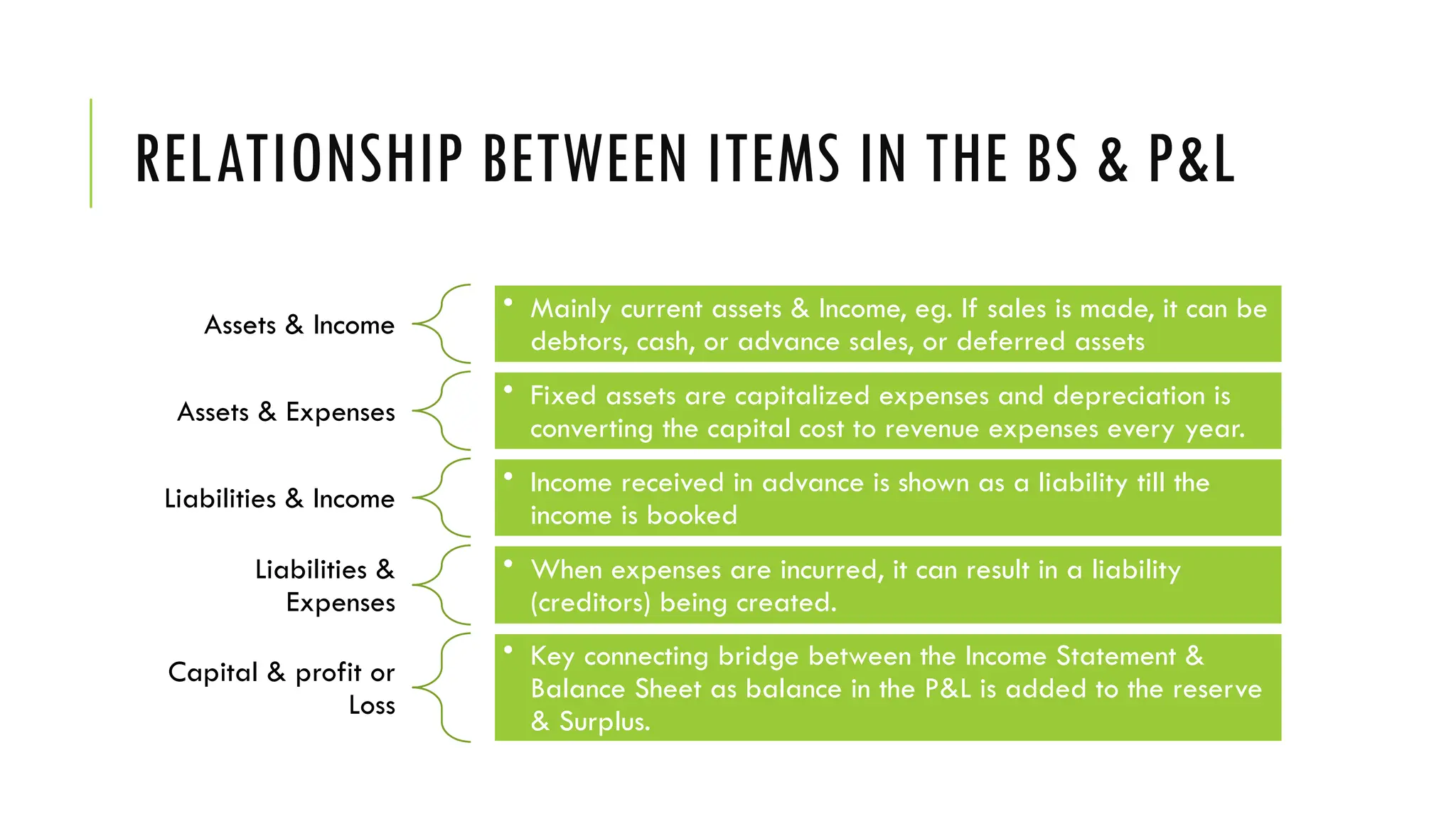

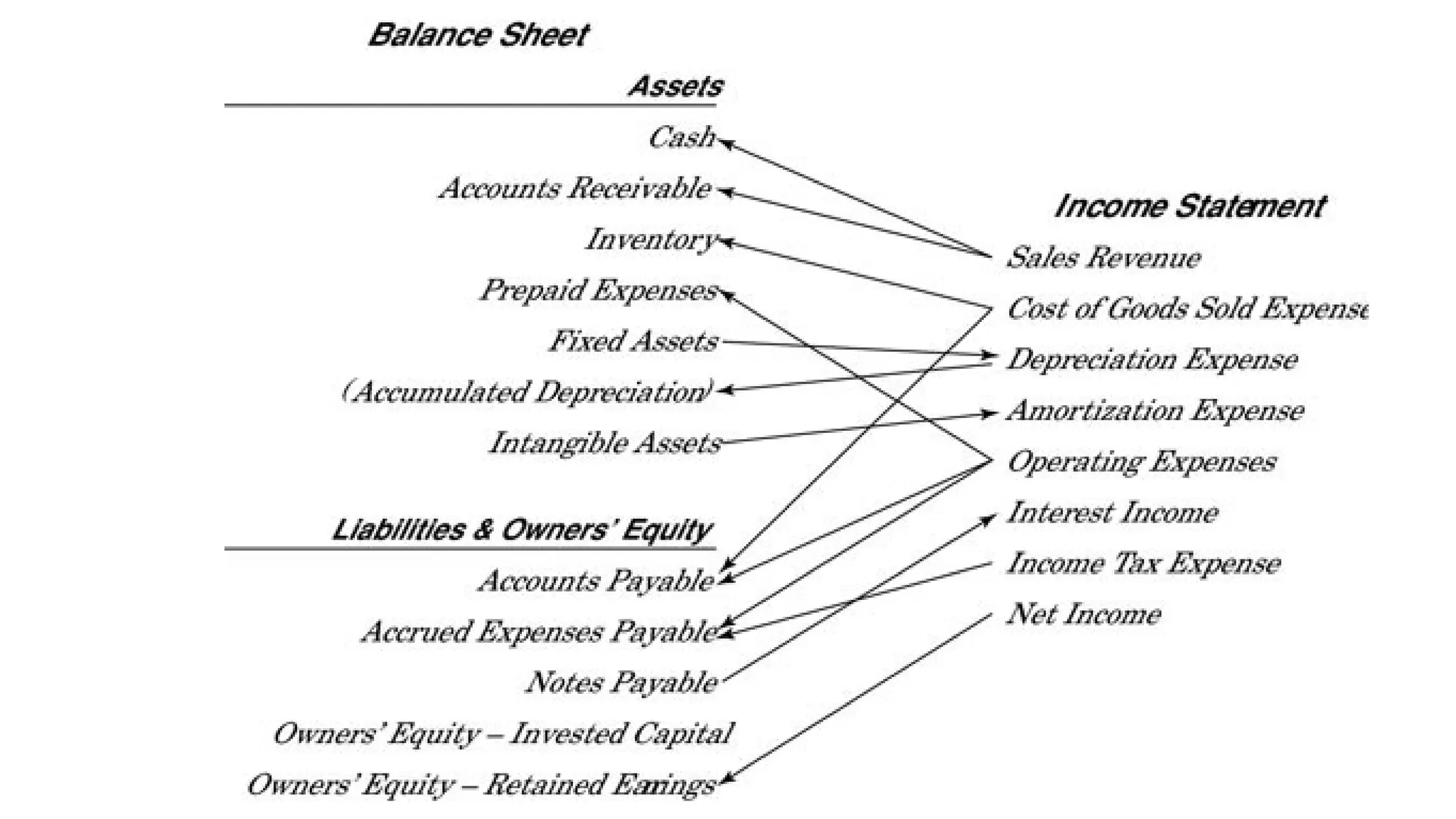

The document compares vertical and conventional formats for income statements and balance sheets, highlighting the benefits of vertical formats for financial analysis. It details the structure of income statements, including classifications of income and expenses, and outlines how the presentation aids in evaluating profitability and managing expenses. Additionally, it explains the significance of using vertical formats for understanding relationships between assets, liabilities, and income in financial statements.