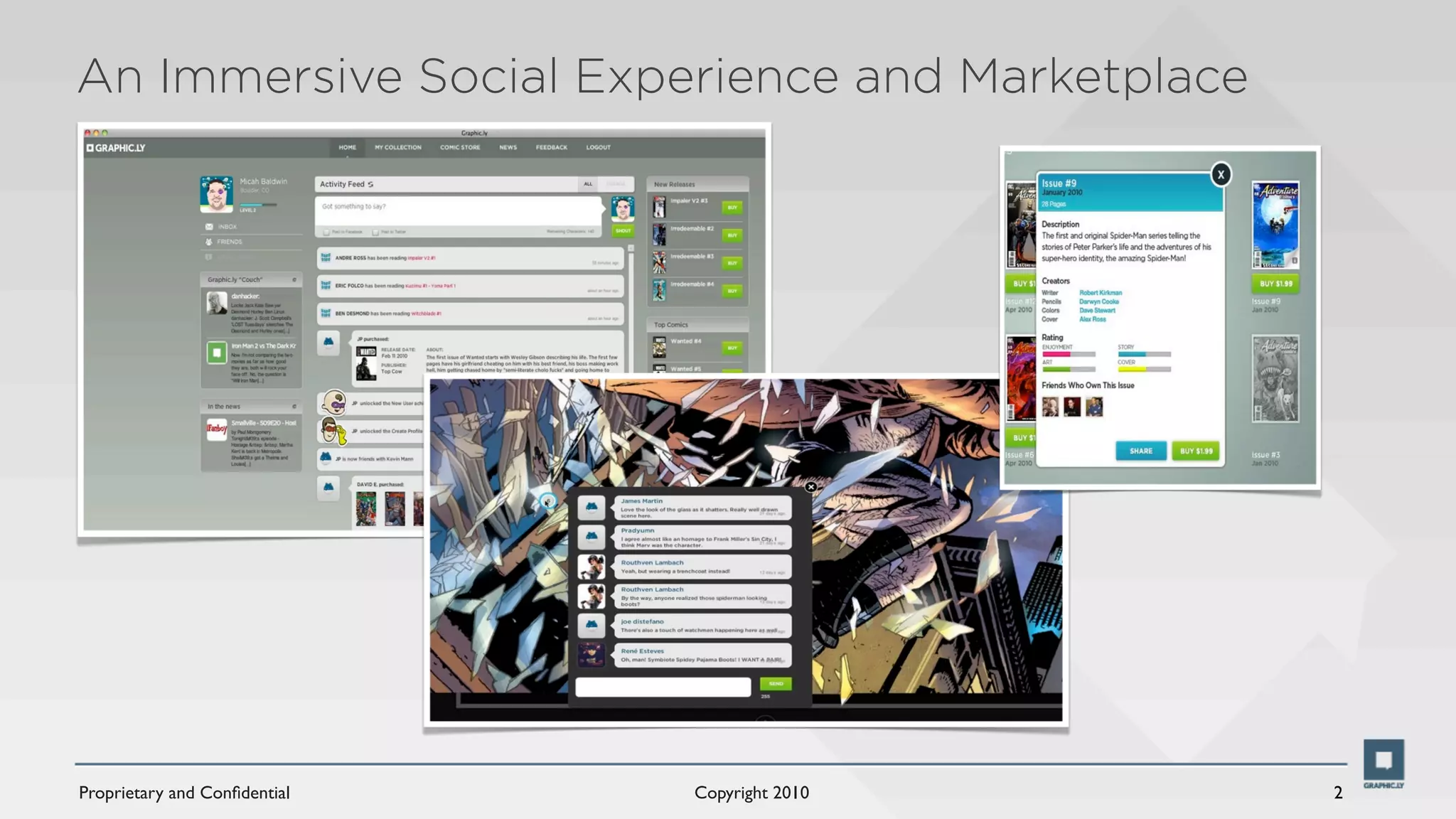

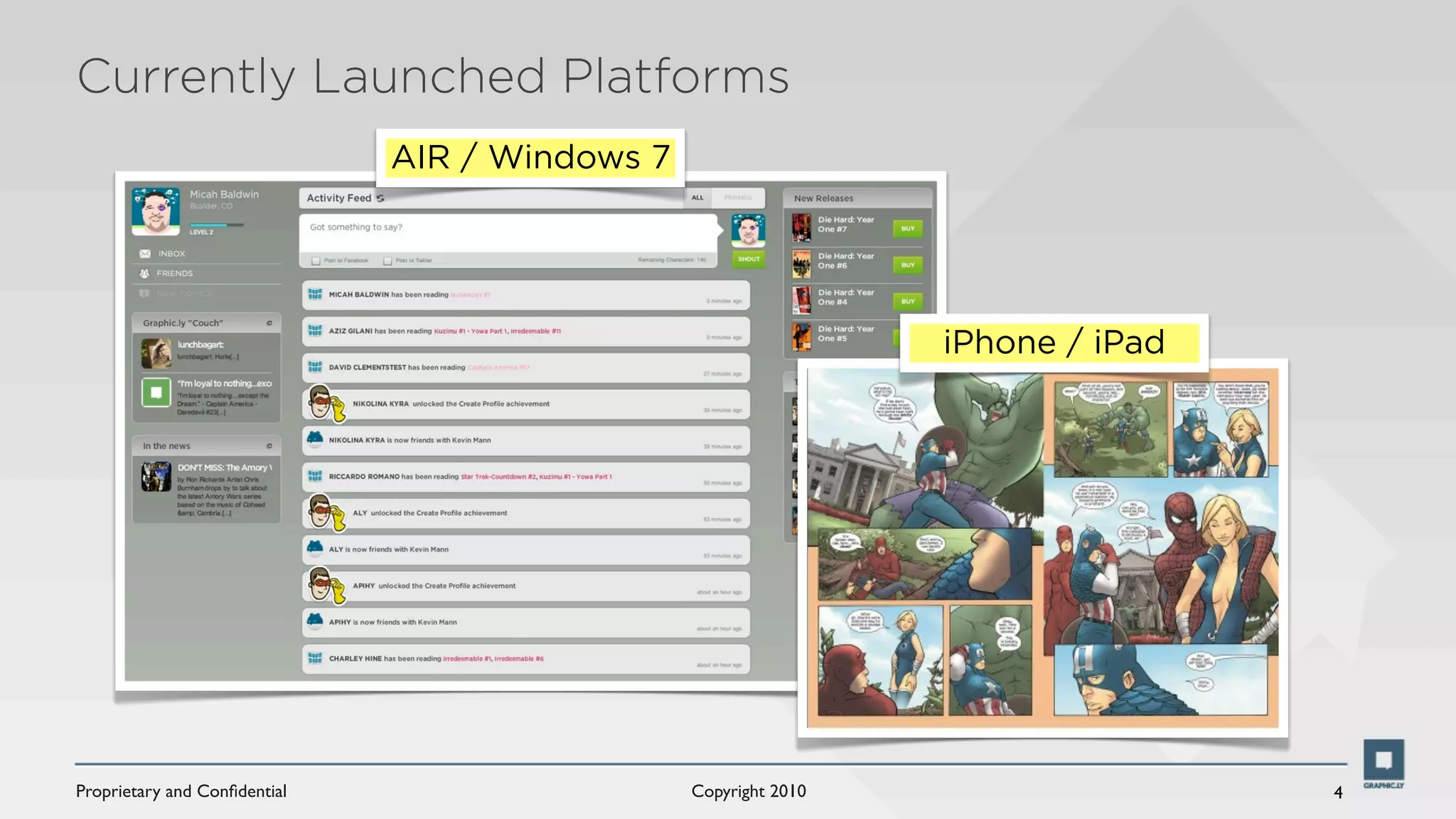

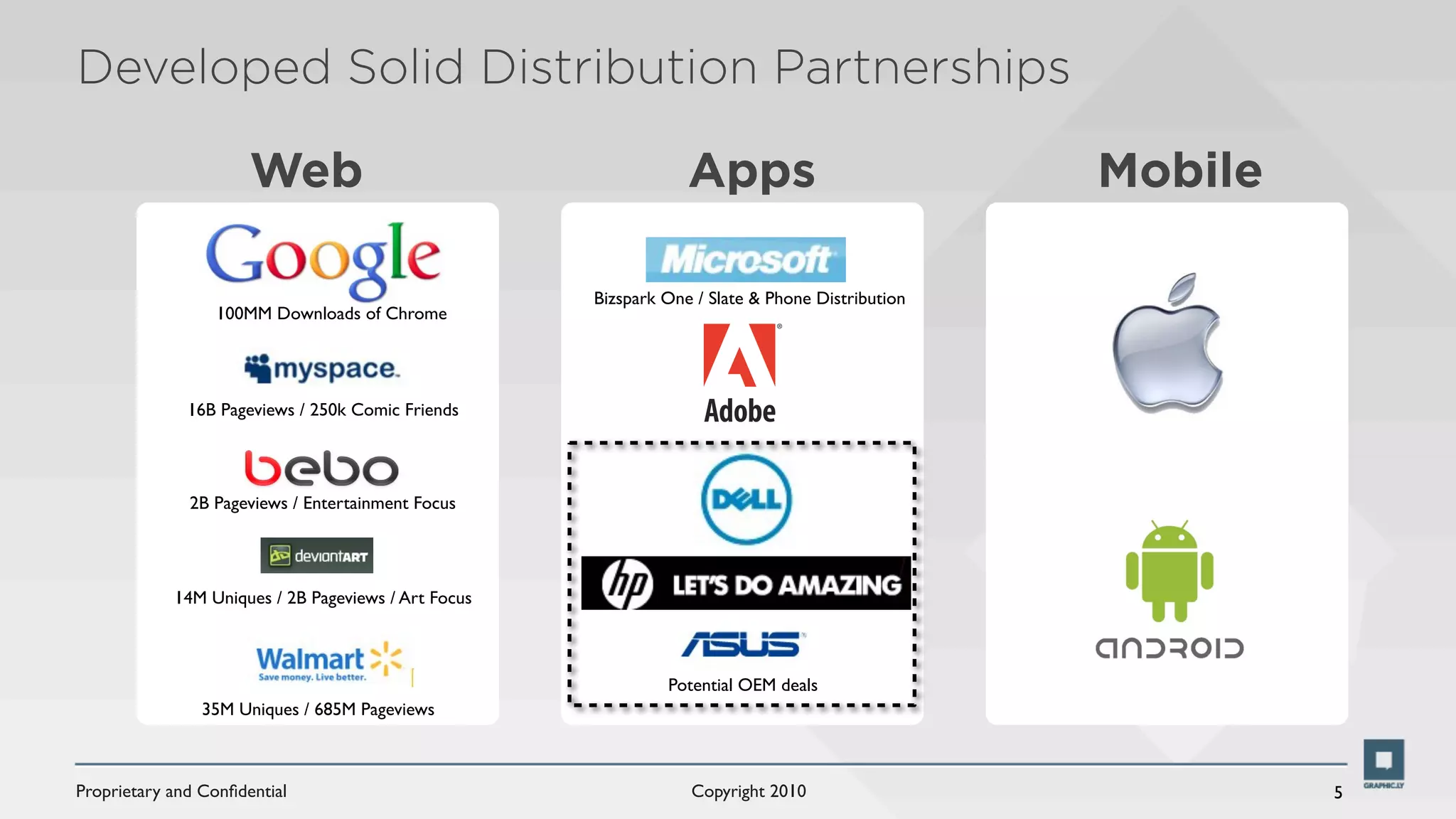

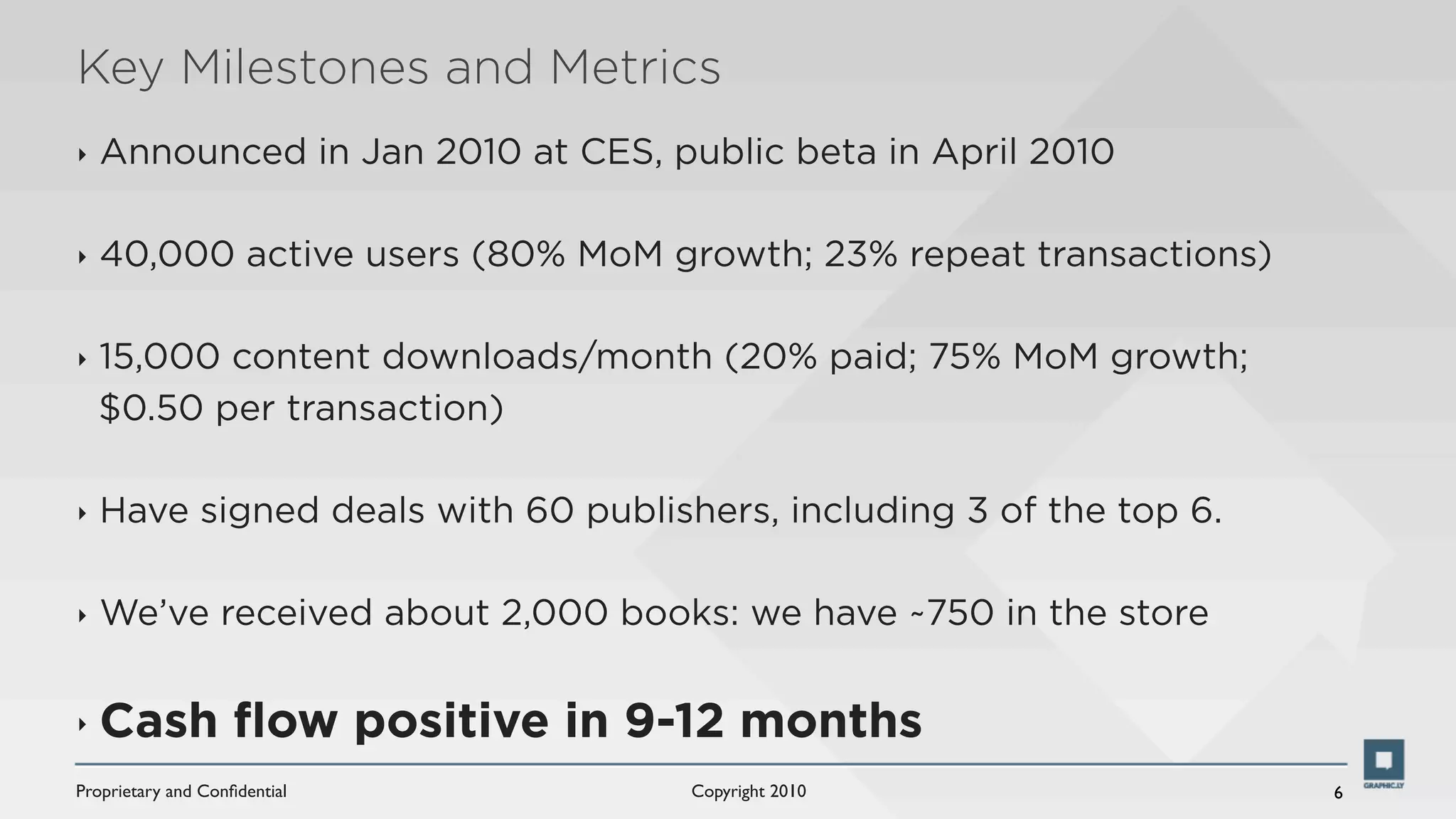

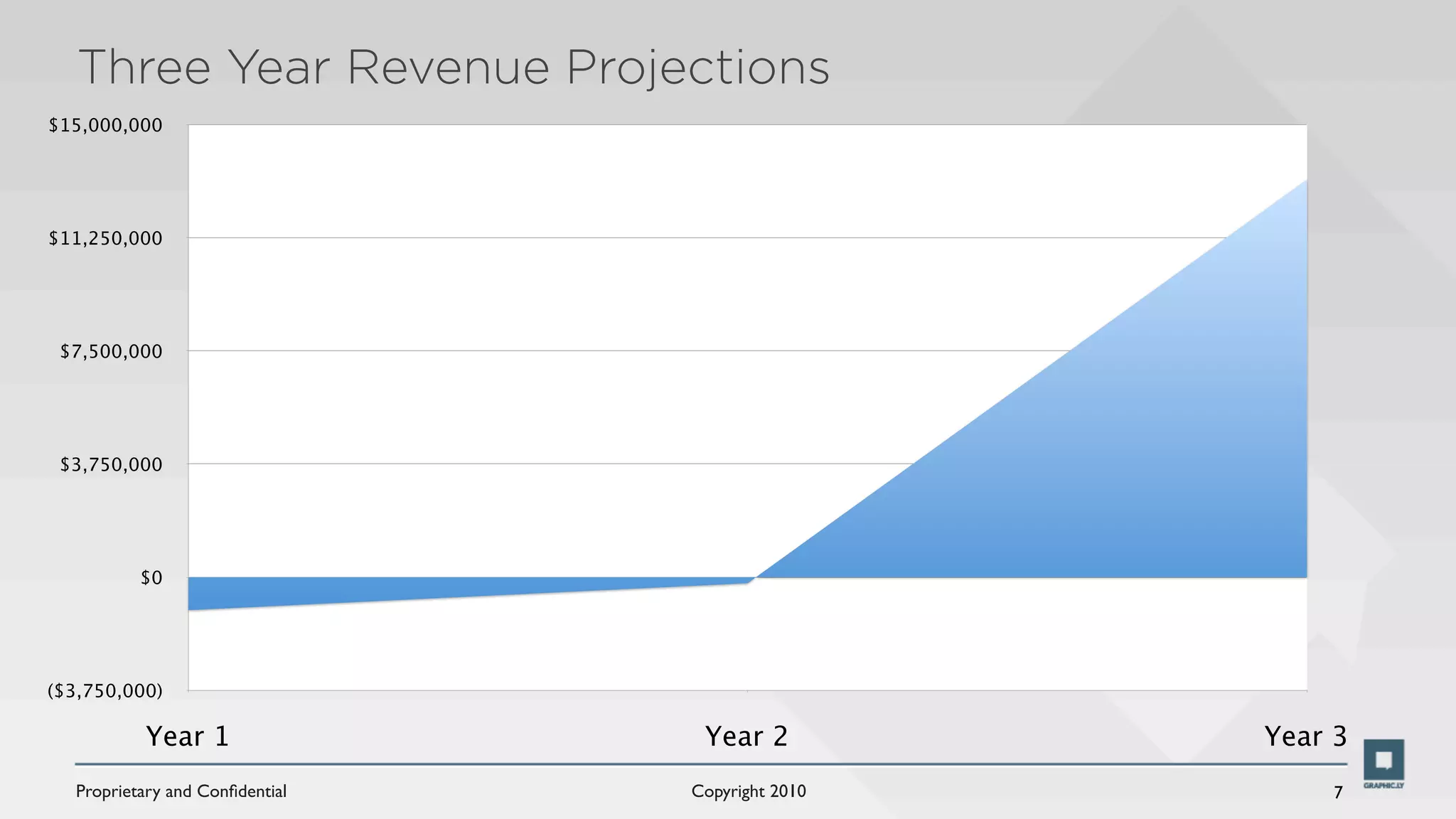

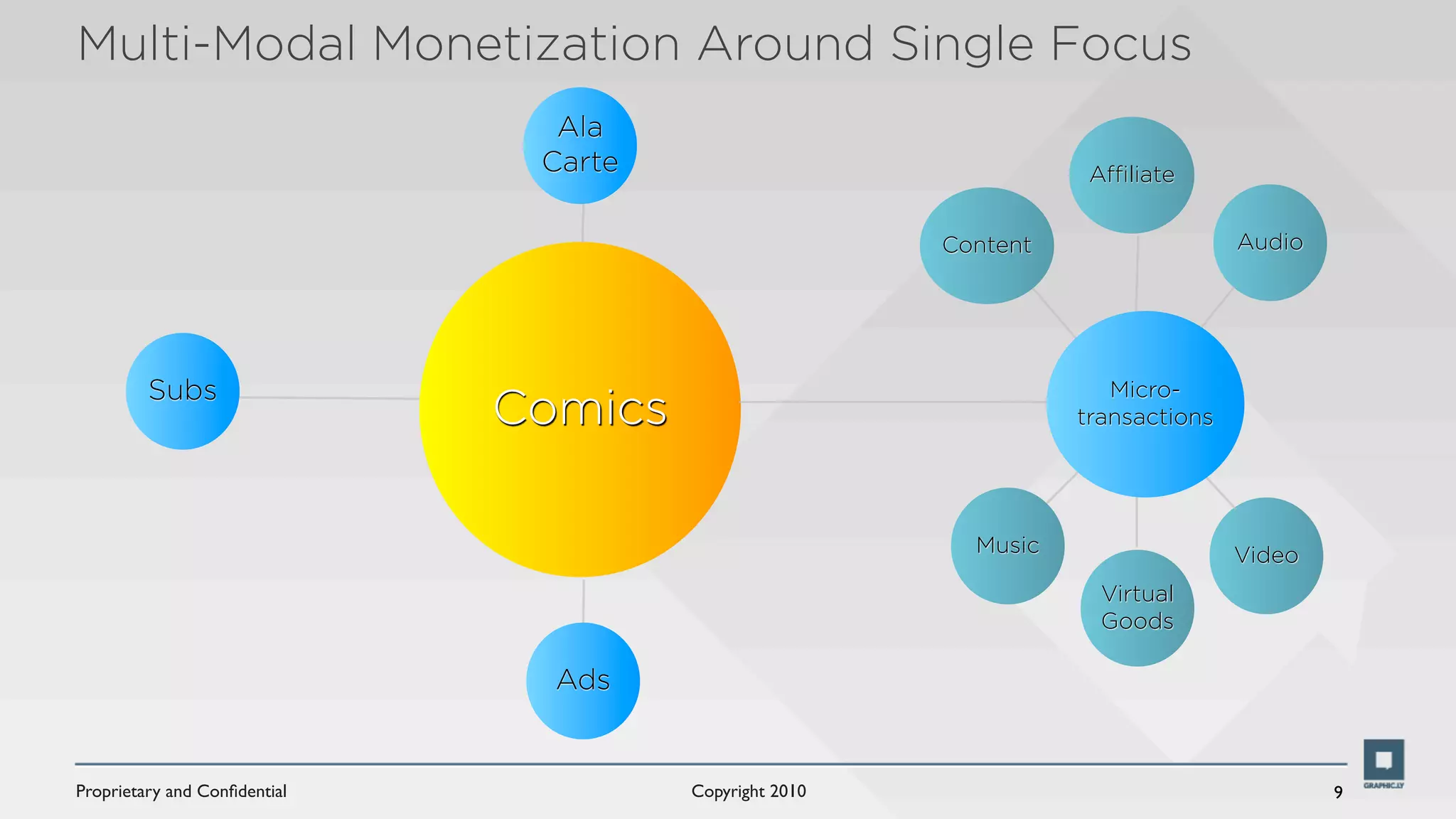

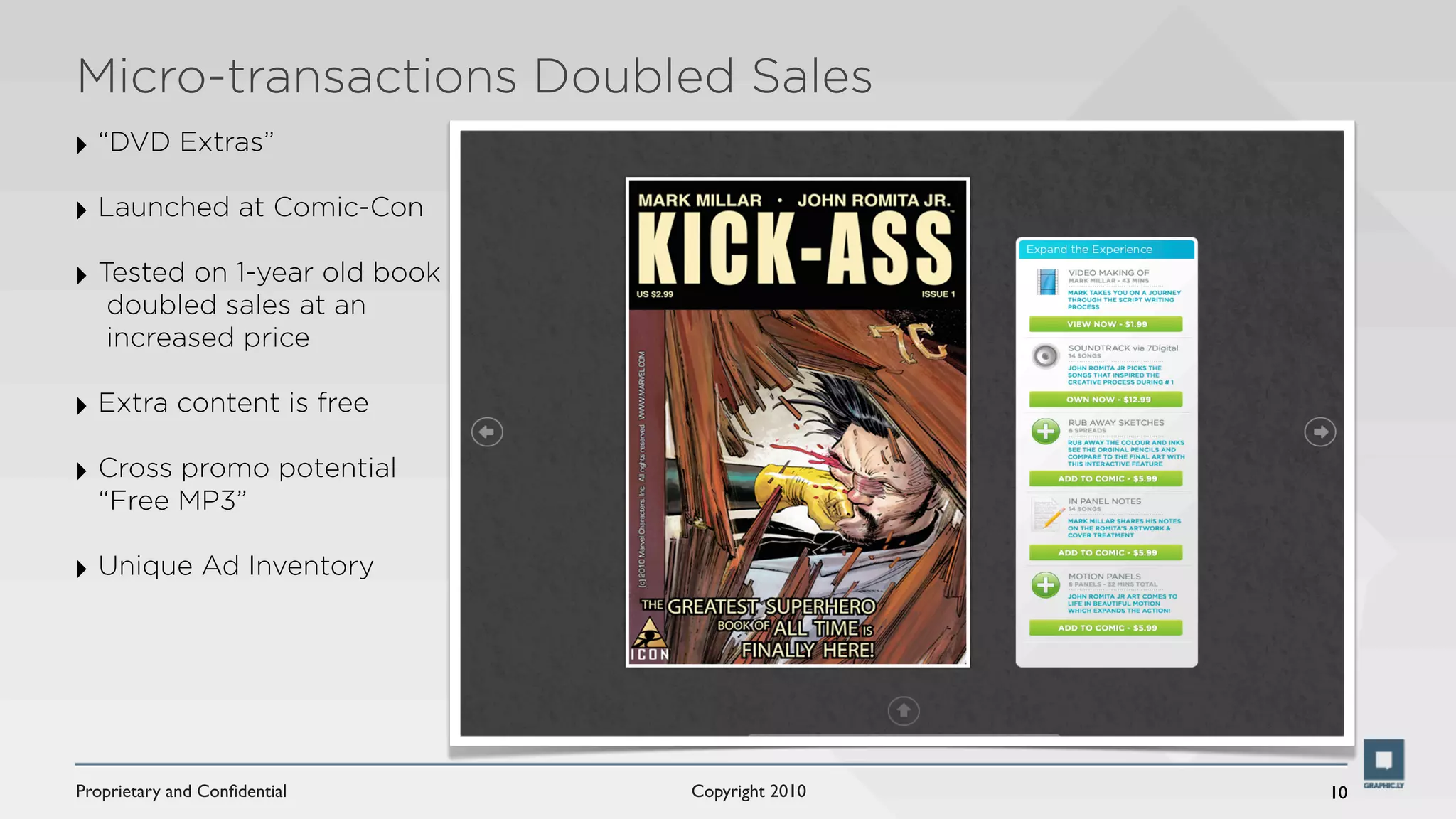

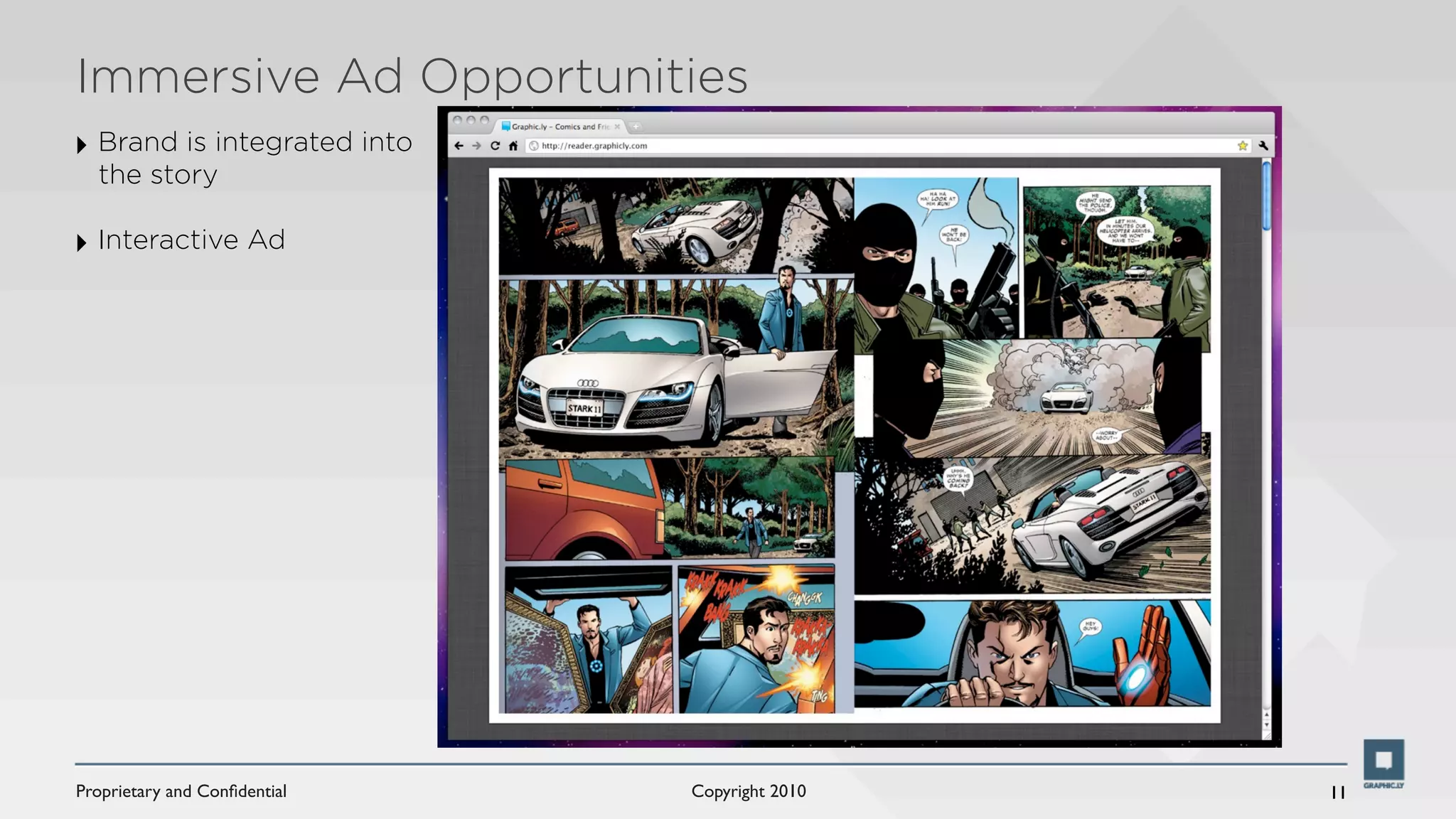

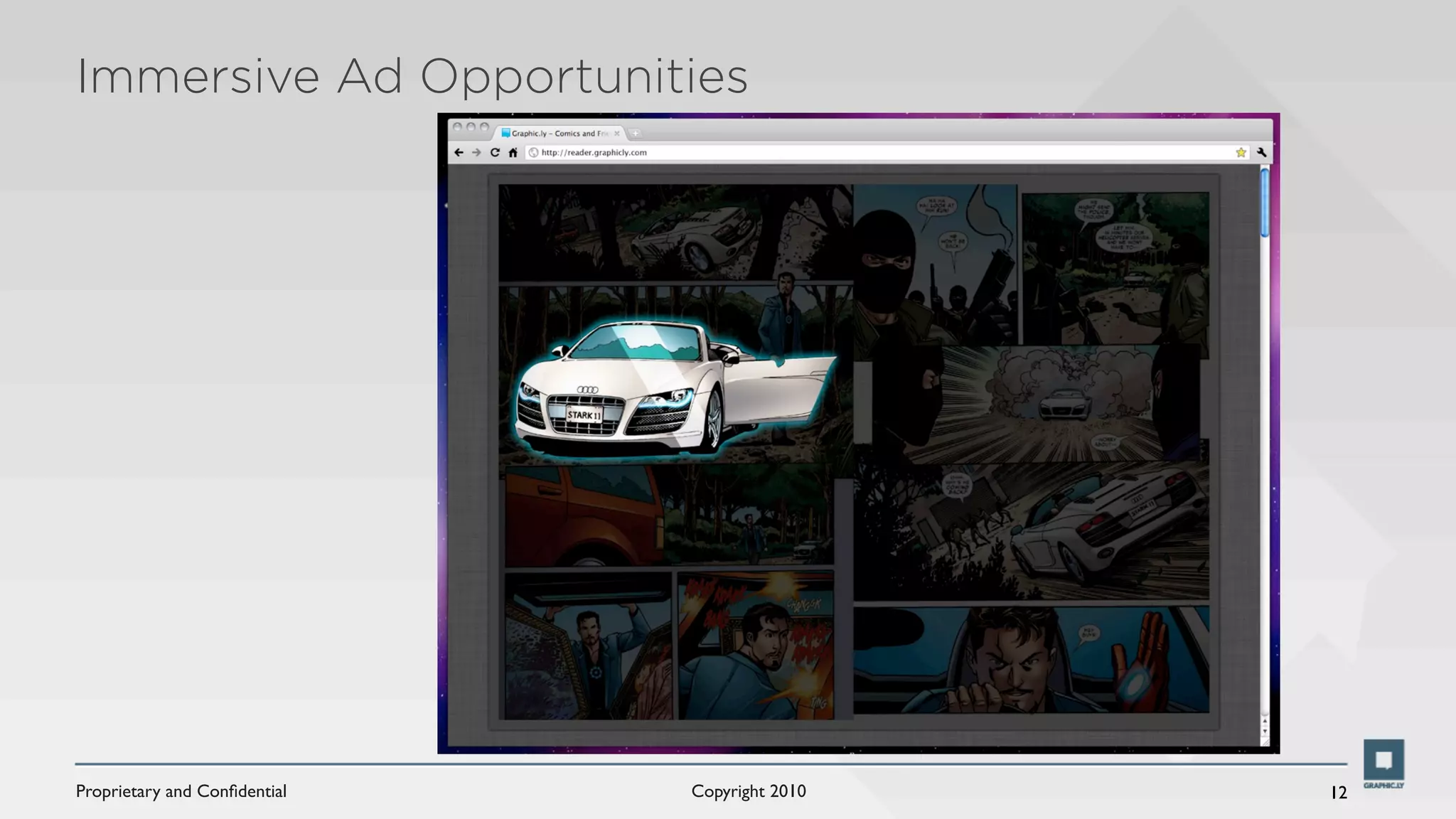

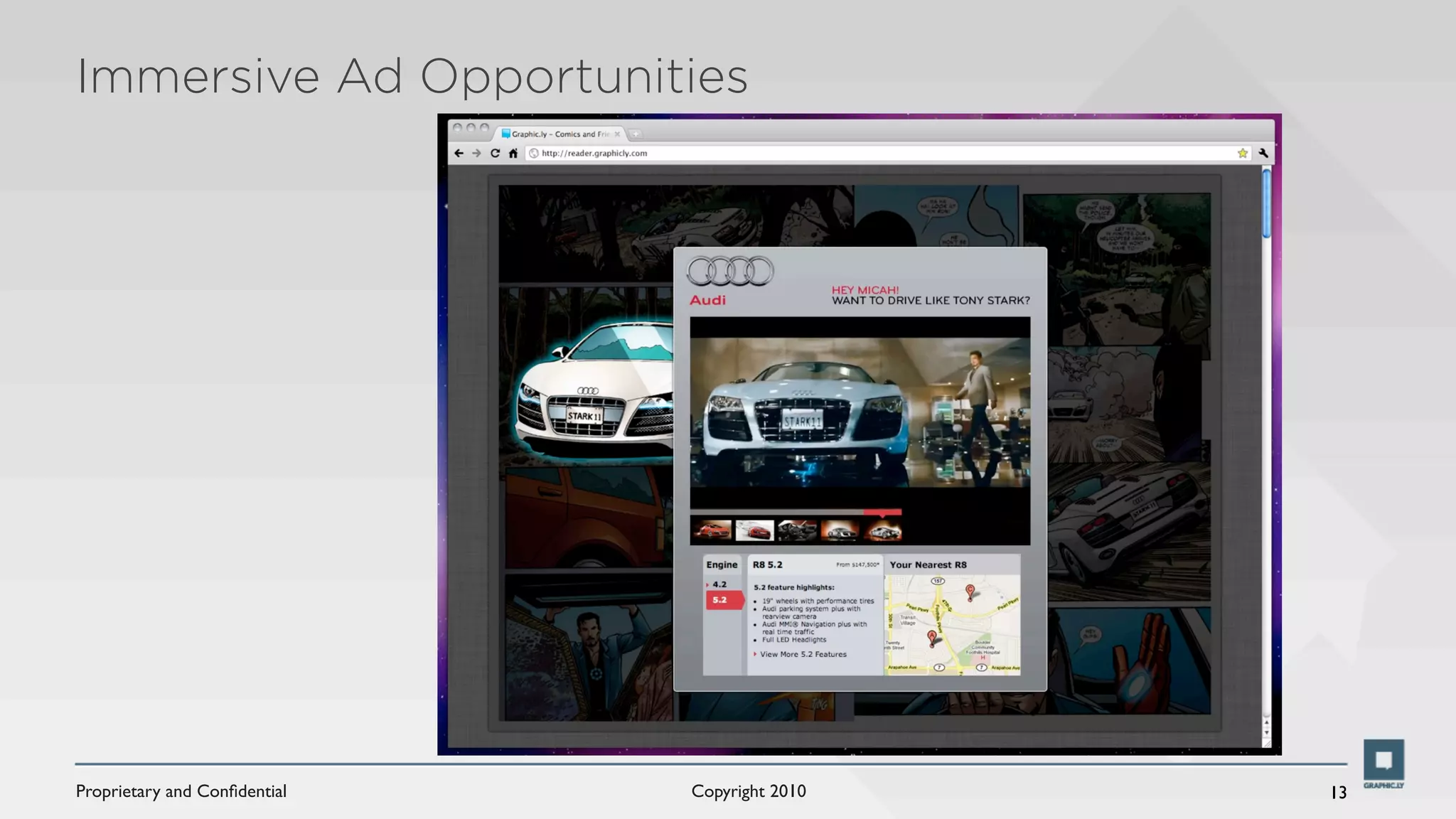

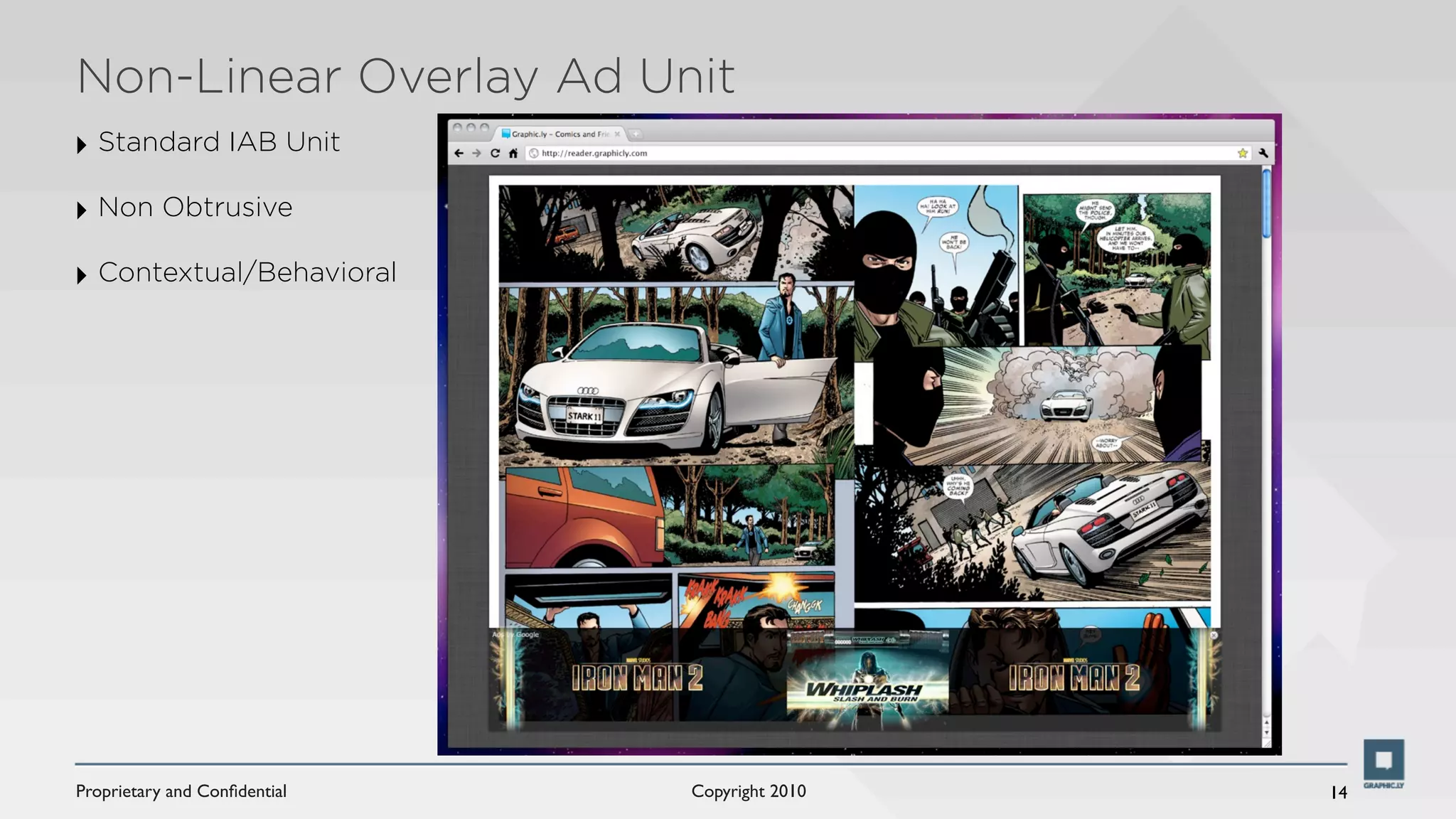

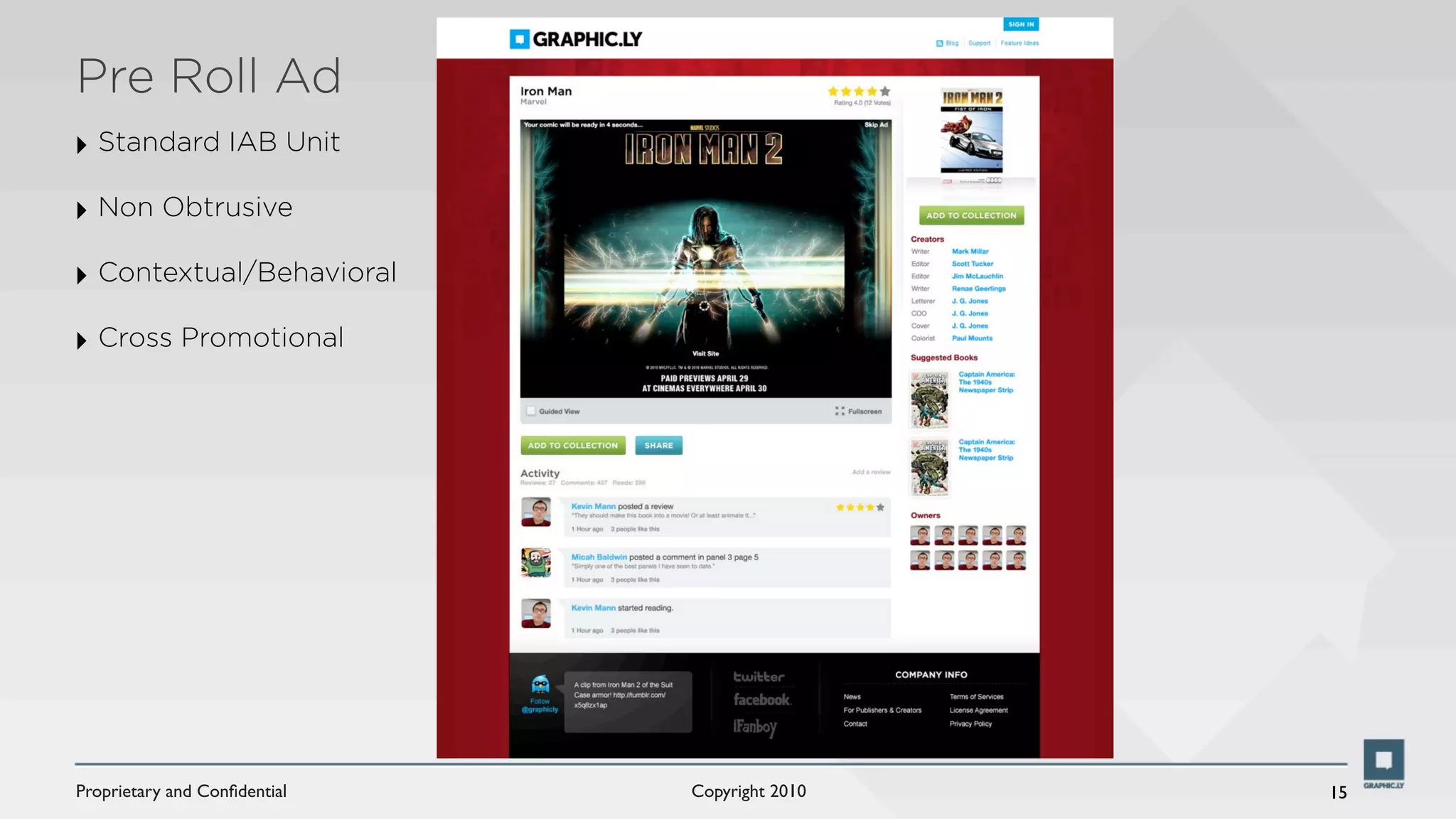

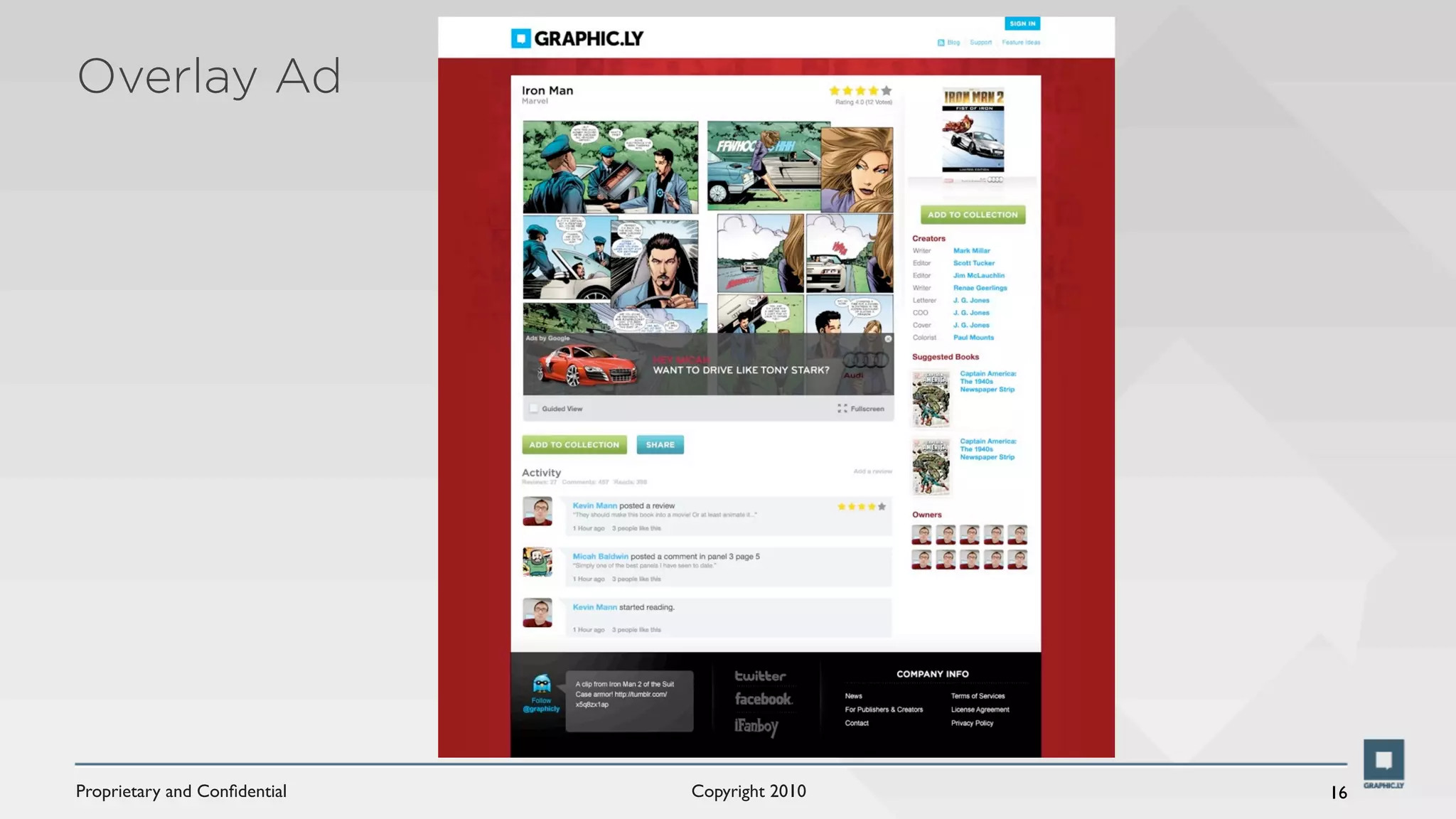

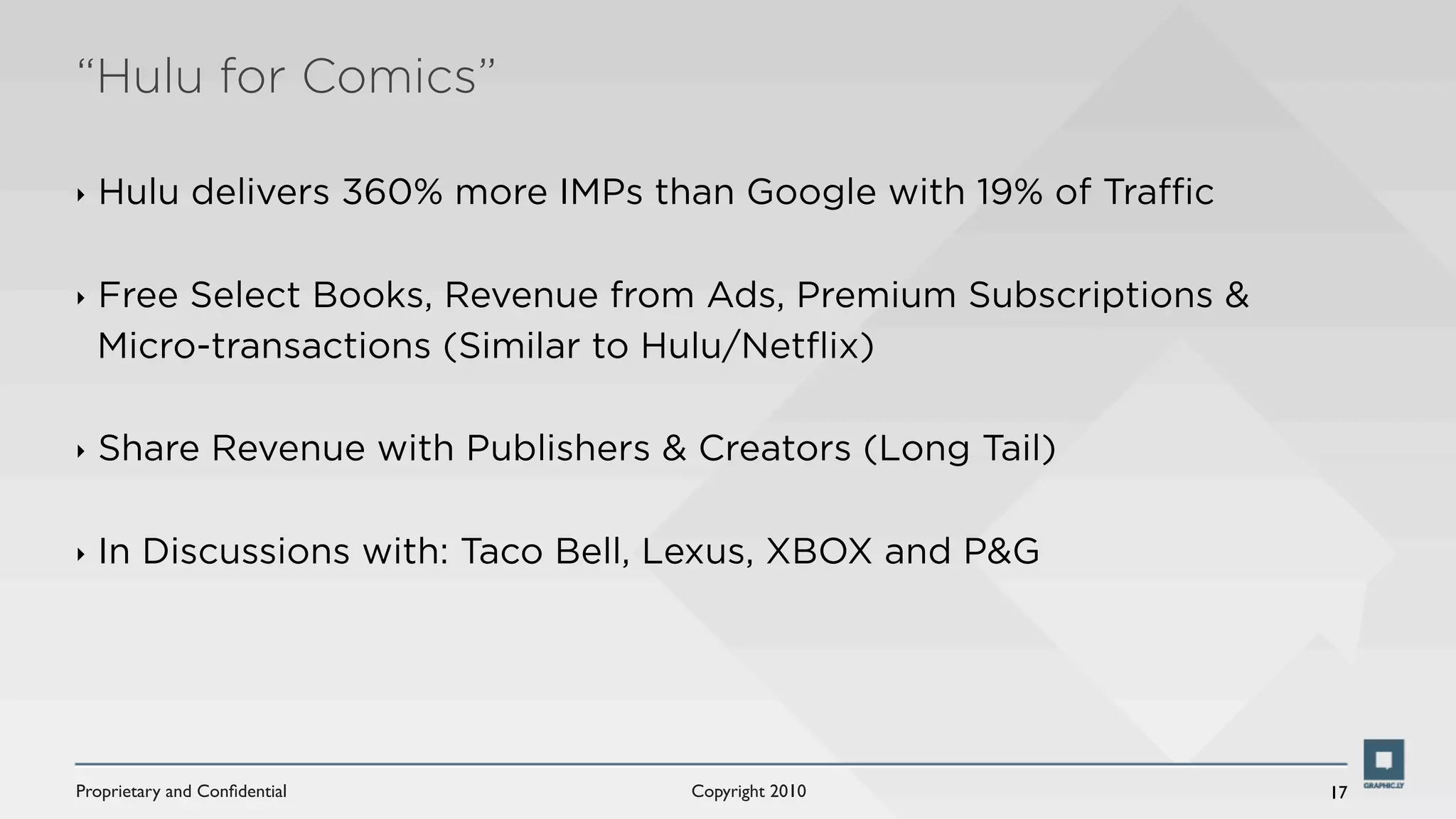

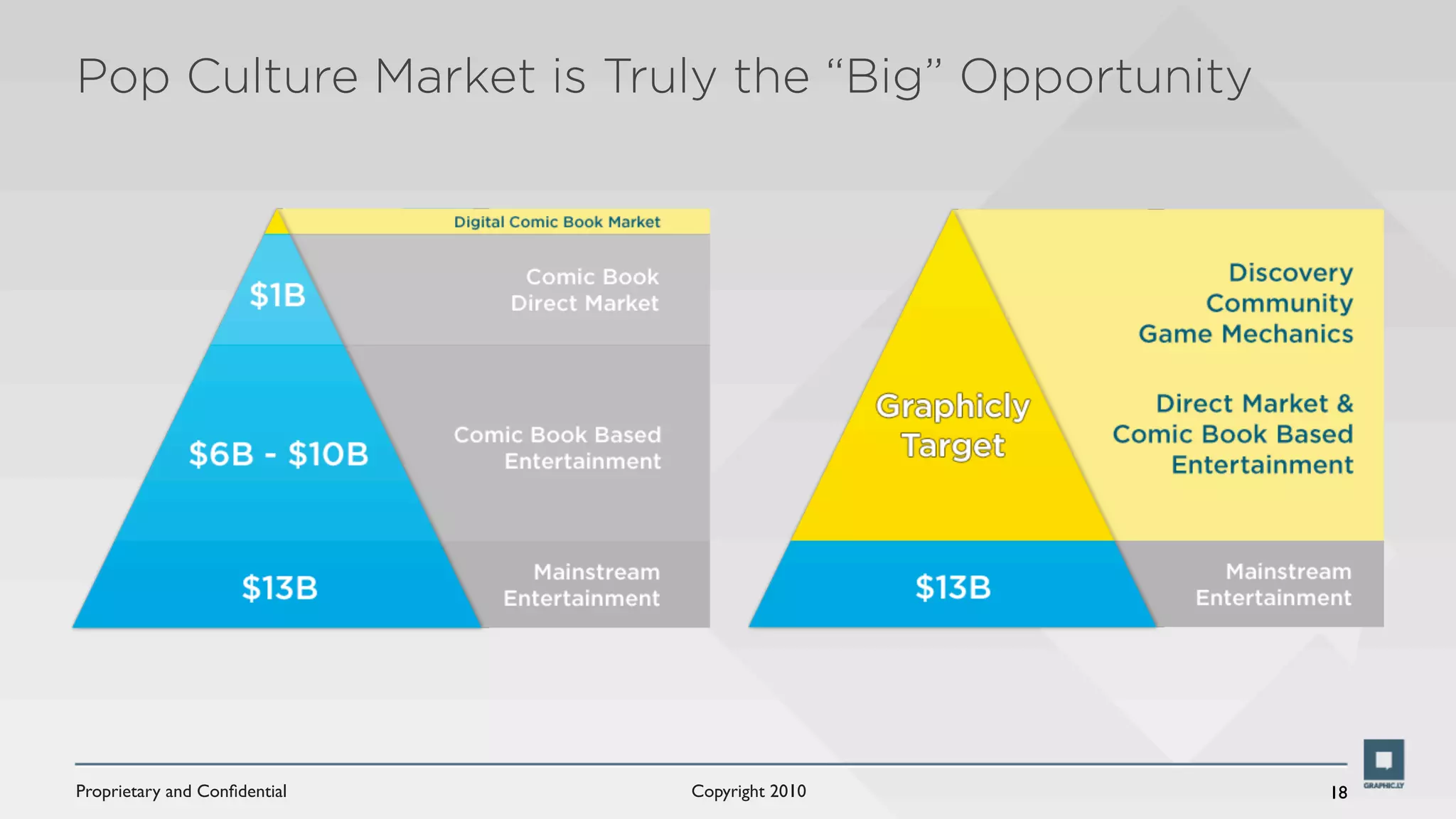

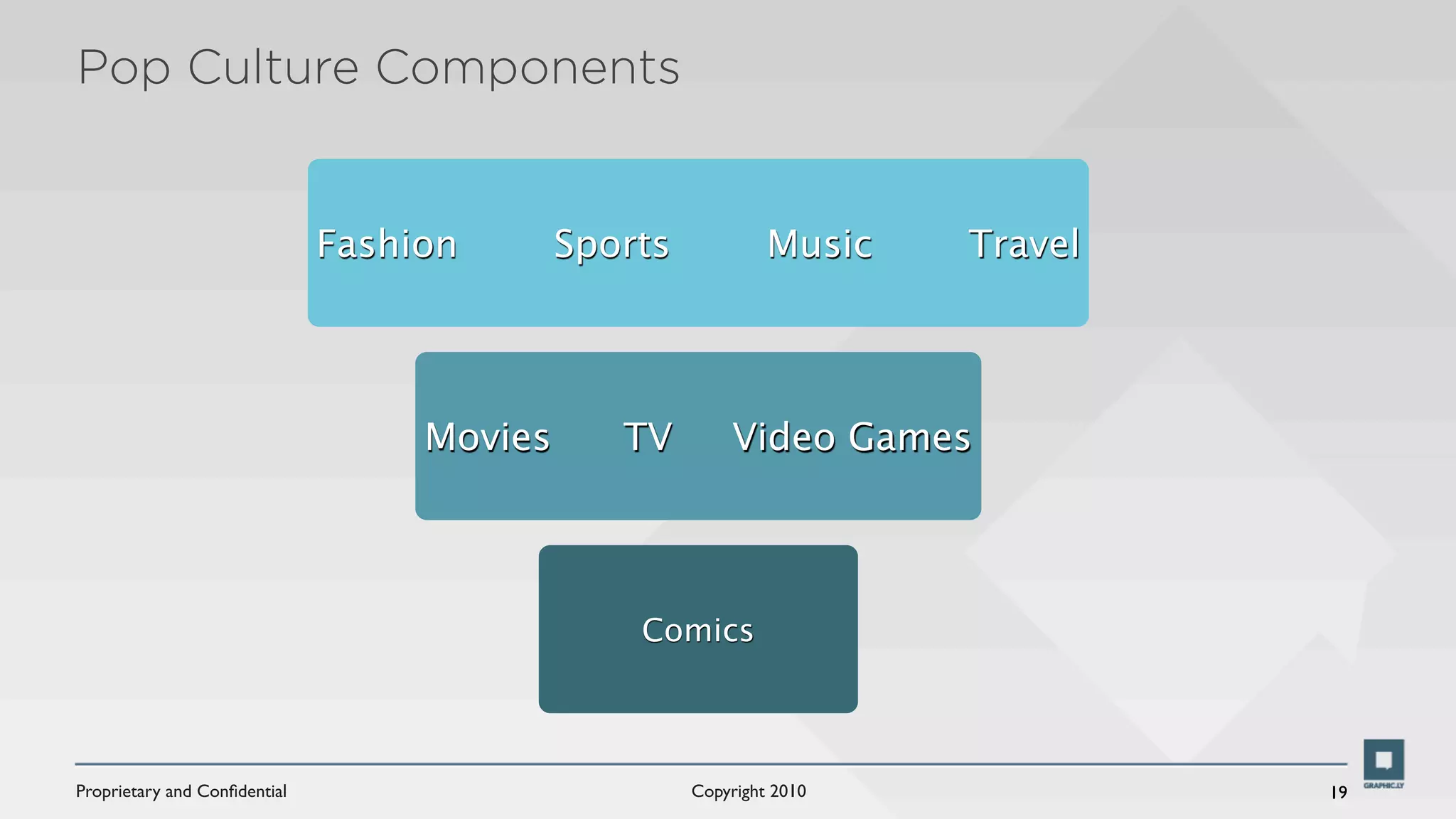

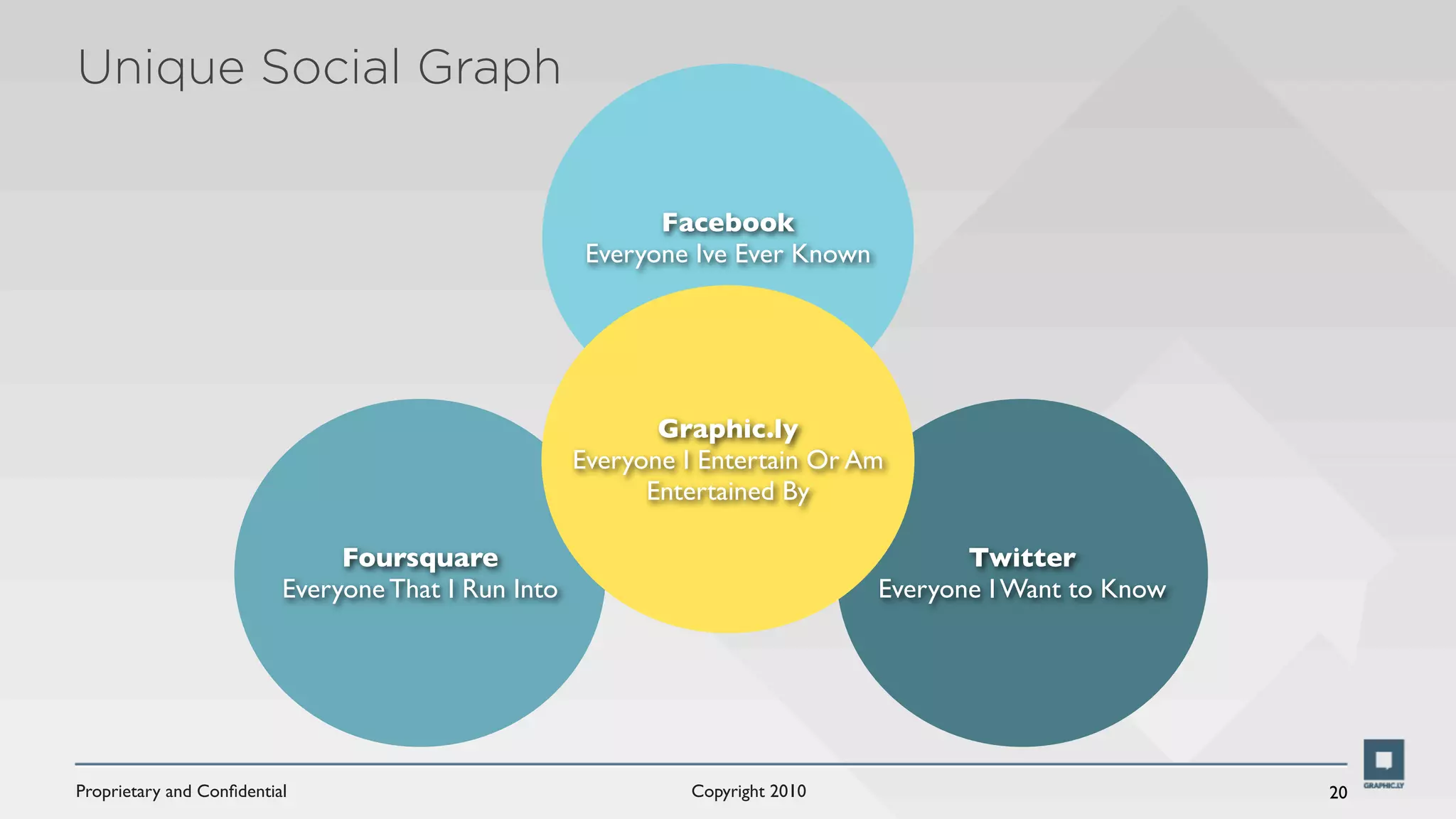

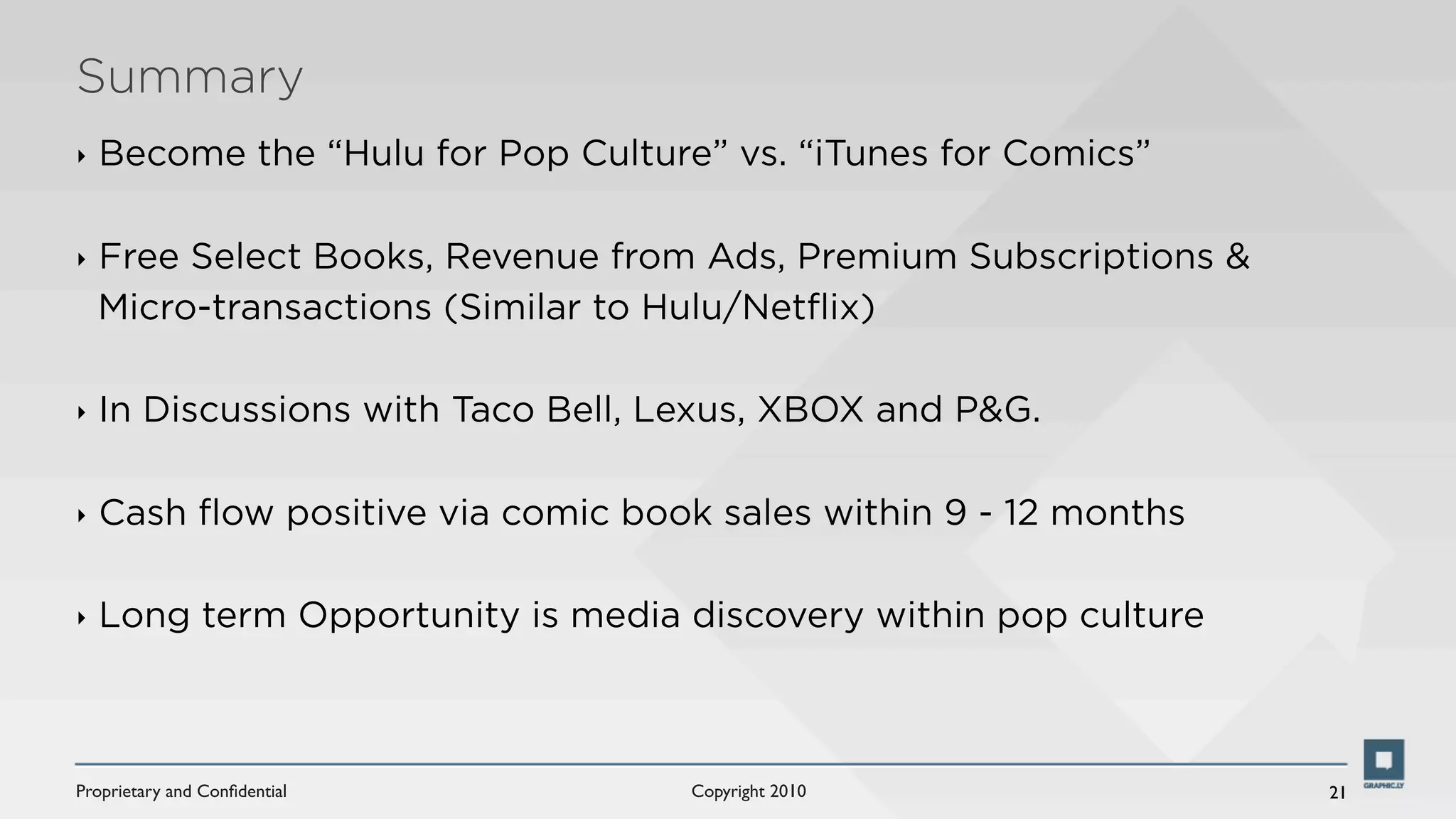

Graphic.ly aims to become the "Hulu for pop culture" by offering a platform for comic book sales and discovery within the broader pop culture space. It has experienced rapid growth in its first year, with 40,000 active users and $0.50 per content download on average. While competition exists from Comixology and publishers themselves, Graphic.ly sees an opportunity to leverage relationships with 60 publishers, including 3 of the top 6, as well as partnerships with major brands and platforms. It is raising $2.5 million in additional funding to expand its team and development of new features and advertising opportunities on the platform.