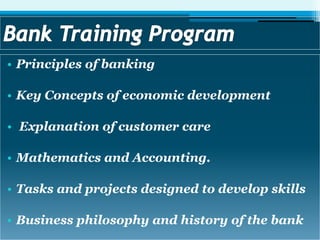

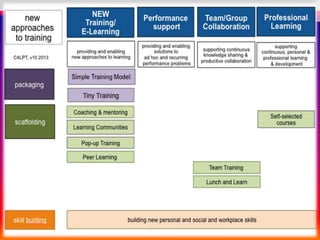

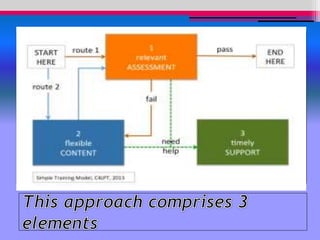

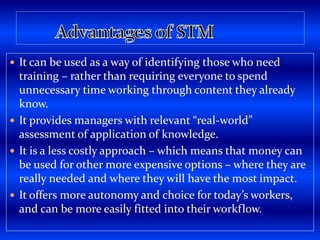

This document discusses new approaches to training employees at banks. It describes several training models including tiny training, coaching and mentoring, pop-up training, and self-selected online courses. The key elements of an effective training program are relevant assessments, flexible content delivery, and timely support. Regular "bursts" of information and knowledge sharing between employees are also encouraged. On-the-job training, rotation between departments, and weekly branch training programs are highlighted as effective training methods used by some world banks.