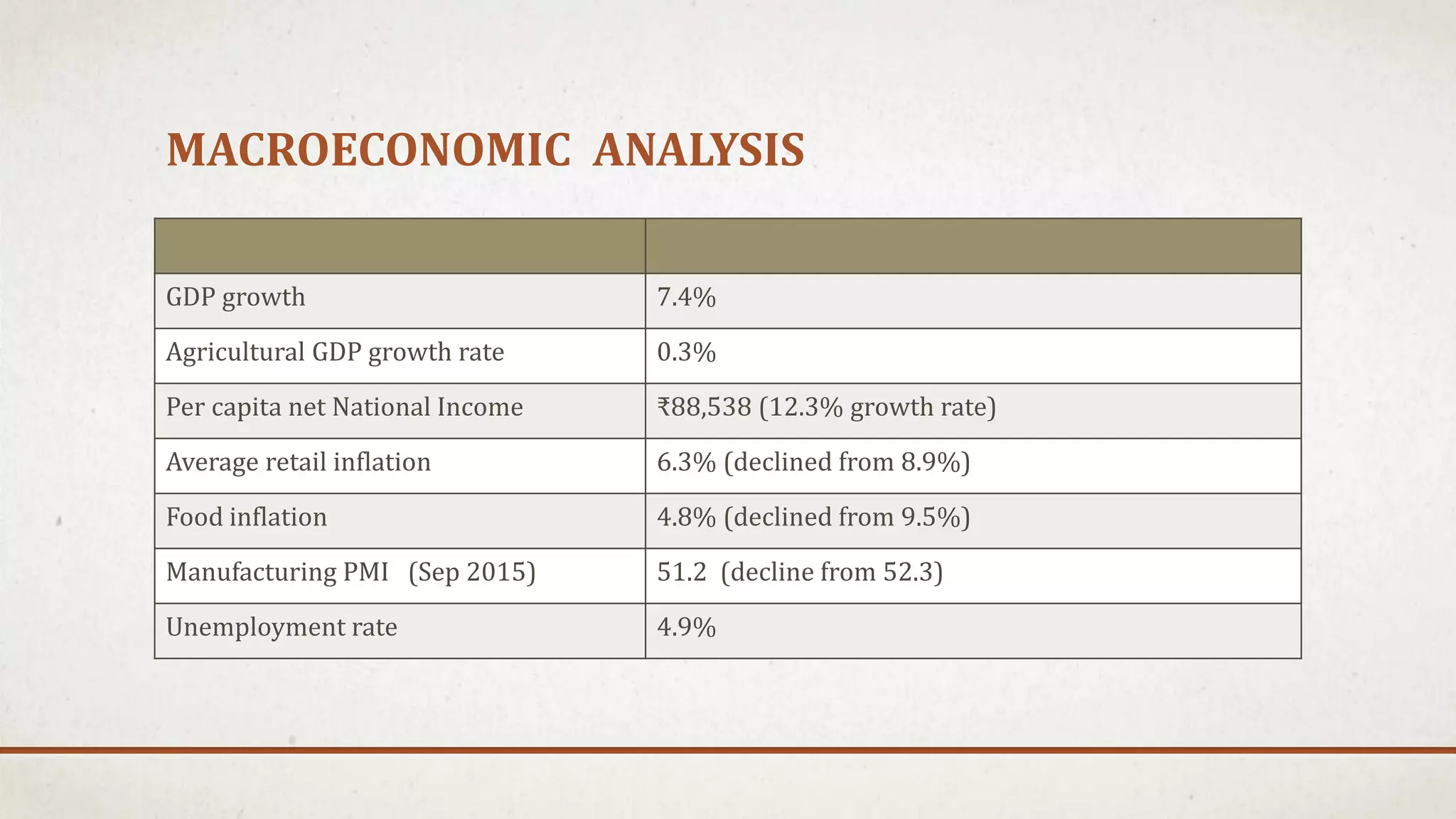

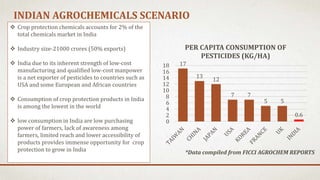

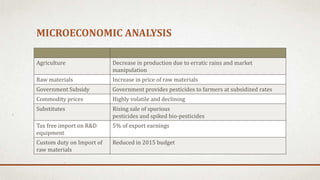

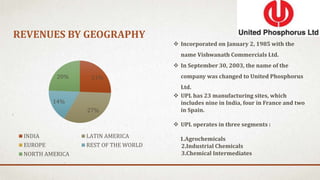

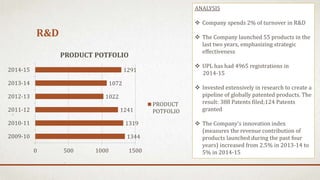

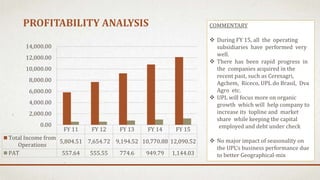

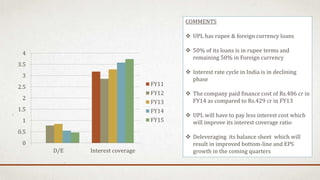

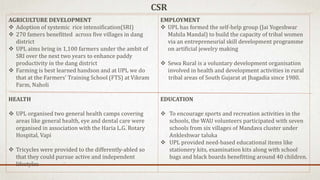

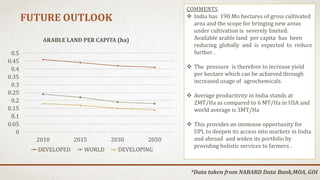

This document provides an analysis of macroeconomic indicators in India and an overview of the agrochemicals industry and key company United Phosphorus Limited (UPL). It summarizes UPL's financial performance, business segments, R&D investments, international presence, and competitive position. The outlook suggests increasing global demand for agrochemicals to boost food production will drive continued revenue growth for UPL.