The key points from the document are:

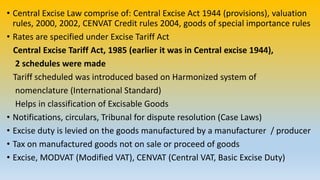

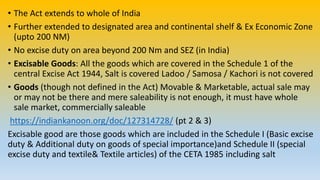

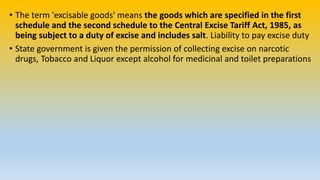

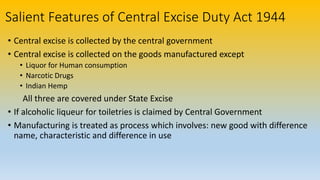

1. Central Excise Duty is an indirect tax levied on goods manufactured in India by the Central Government. It is collected on excisable goods which are included in the schedules of the Central Excise Tariff Act (CETA).

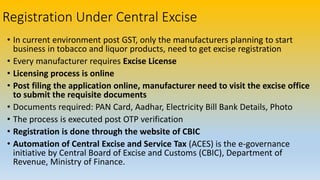

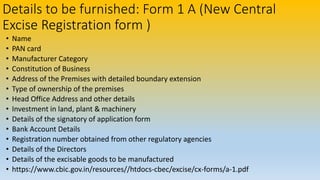

2. Manufacturers are required to register for an Excise Control Code (ECC) number by filing Form 1A and providing documents like PAN, address proof, bank details.

3. The tax credit system of CENVAT allows manufacturers to claim credit for excise duty paid on raw materials, avoiding double taxation. Small Scale Industries with turnover less than Rs. 1.5 crore are