The Korean telecom industry is entering the late phase of the LTE era. Consumption trends are changing as consumption diverges between high-priced LTE plans and low-priced MVNO plans. Consumers are also becoming more rational, opting for discounted handset rates over subsidies. Telcos face risks from potential regulations lowering rates, while opportunities exist in growing data usage and expanding new businesses like media and IoT. Telcos maintain strong cash flows and dividends despite slowing revenue growth.

![Telecom Service

Solid downside support and decent growth

potential

In late phase of LTE era: Consumption diverging and becoming rational

LTE technology came to Korea in end-2011. Nearly five years later, the domestic

telecom service industry is now entering the late phase of the LTE era. During the

initial high-growth phase, early adopters purchased expensive handsets and

subscribed to high-priced rate plans. Now, telecom service consumption trends are

changing. 1) First, consumption is diverging, with the gap between telcos’ average

rates and MVNO rates widening further this year, compared to 2012. 2) Second,

consumers are becoming more rational. Low- to mid-end handset purchases out of

all purchases are estimated to be near 30%, from less than 10% in 2012. In addition,

the cumulative number of subscribers who have chosen a rate discount in lieu of

subsidies has surpassed 10% of overall mobile subscribers.

Risks from telecom plan restrictions; Opportunities from growing data

usage and business expansion

The most serious threat to telcos in 2H should be downward pressure on plan

prices. Once the new National Assembly takes office in June, a revision to the

handset distribution act and a bill related to telecom plan restrictions will likely be

proposed. With ARPU growth slowing and service rate discounts being booked as

sales discounts, telcos must find ways to deal with the growing pressure to lower

telecom bills. In our view, they could point to the following facts to justify current

rates: 1) Telecom expenses as a percentage of household spending have steadily

decreased over the past decade. 2) Handset purchase expenses are a bigger driver

of household spending growth than service plans. 3) Data plans are cheaper in

Korea than in other countries.

On the bright side, we believe telcos will find opportunities from high-priced rate

plans amid growing data usage. In addition, telcos are expanding aggressively into

new business areas, with a particular growing influence in the media business.

Furthermore, capitalizing on nationwide IoT networks, telcos are planning full-

swing launch of low-power wide-area network (LPWAN) services.

2H: Attractive dividend payout; Aggressive expansion; Retain Overweight

Free cash flow at domestic telcos is improving markedly. Capex has been on the

downswing in the era of advanced telecom technology, while variable costs have

also decreased due to stable marketing competition. Given stable earnings and

ample cash flow, we expect telcos to show attractive dividend payout. If shares

correct due to regulatory risks, high dividend yields should provide downside

support. Telcos’ growth prospects also appear decent in light of their aggressive

business expansion.

We retain our Overweight rating on the telecom sector. In the short term, we

recommend KT in light of its high earnings visibility and dividend growth. And from

a longer-term perspective (through the end of the year), we recommend SK

Telecom (SKT) given its high dividend payout and aggressive business expansion.

Overweight (Maintain)

2H16 Outlook Report

June 3, 2016

Mirae Asset Daewoo Co., Ltd.

[Telecom Service / Media]

Jee-hyun Moon

+822-768-3615

jeehyun.moon@dwsec.com

Nu-ri Ha

+822-768-4130

nuri.ha@dwsec.com

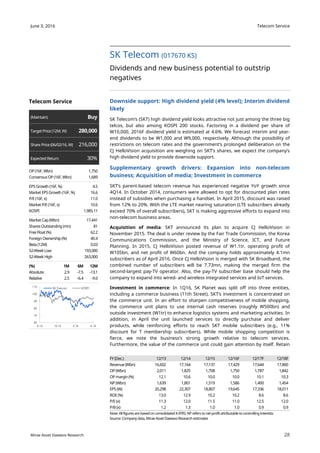

Korean telecom service industry index long-term trend: Key variables are ARPU,

dividends, and new businesses

Note: KOSPI dividedby 50 to show on same axis as telecom index; Telecom index is FTSE KoreaTelecom Index;

Source: Thomson Reuters, respective companies’ data, Mirae Asset Daewoo Research

25

30

35

40

45

50

28,000

30,500

33,000

35,500

38,000

04 05 06 07 08 09 10 11 12 13 14 15 16F 17F 18F

(p)(W)

AverageARPUof threebigtelcos(L)

Telecomserviceindustryindex(R)

KOSPI/50(R)

LTE

introduction

[Increaseddividends; Newbusinesses]

Downsidesupport, growthpotential

Telecomsector

tradingrange

mayrise](https://image.slidesharecdn.com/telco2016061408423129-161109042638/75/2H16-Telecom-Industry-Outlook-1-2048.jpg)