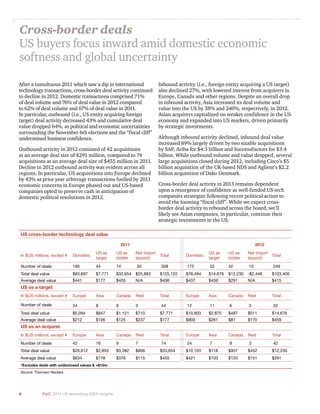

In 2012, the US technology M&A market faced significant declines, with deal volumes and values dropping by approximately 20% due to political and economic uncertainties, culminating in a total deal value of $103.4 billion. Despite these setbacks, a shift towards software and internet transactions was evident, making up over half of the deal volume, while larger acquisitions, like Google’s purchase of Motorola, marked notable exceptions. The outlook for 2013 predicts continued subdued activity but potential growth driven by cloud, mobile, analytics, and security sectors as companies reassess their strategies.