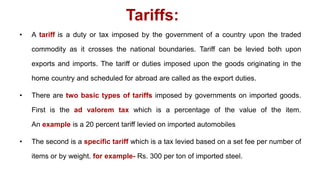

Forms of protection against imports include tariffs, subsidies, import quotas, voluntary export restraints, administrative policies, and anti-dumping policies. Tariffs are taxes imposed on imported goods, either as an ad valorem percentage of the good's value or as a specific fee. Subsidies provide domestic producers cash payments or tax breaks to lower production costs. Import quotas set physical limits on the quantity of goods that can be imported in a given time period. Voluntary export restraints are agreements between countries to limit exports. Administrative policies use bureaucratic rules to restrict imports. Anti-dumping policies punish foreign firms that sell goods in foreign markets below production costs or fair market value.