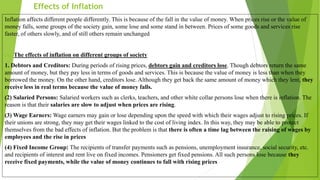

Inflation in early 20th century Germany caused prices to rise so rapidly that savings were quickly erased. Inflation is generally defined as a sustained rise in the general price level caused by an increase in the money supply. It can have varying effects on different groups in society such as harming fixed-income earners but potentially benefiting debtors. Countries use monetary, fiscal and other measures to control inflation and stabilize prices.