Embed presentation

Download to read offline

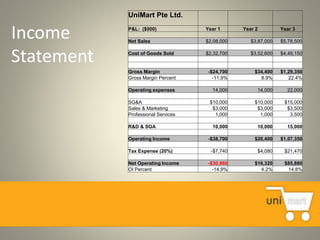

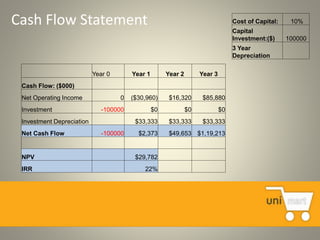

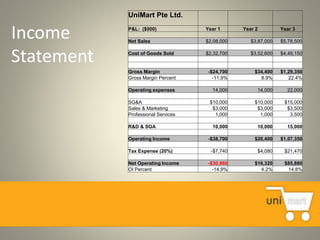

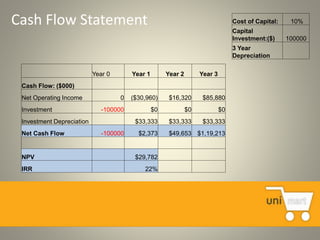

UniMart Pte Ltd. experienced losses in its first year of operations but saw steady growth and profitability in subsequent years. Net sales increased from $2.08 million in Year 1 to $5.78 million in Year 3. While the company had a gross loss in Year 1, it achieved gross margins of 8.9% in Year 2 and 22.4% in Year 3. The net present value of the investment was $29.78 million with an internal rate of return of 22%, above the cost of capital of 10%.