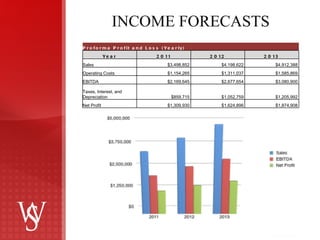

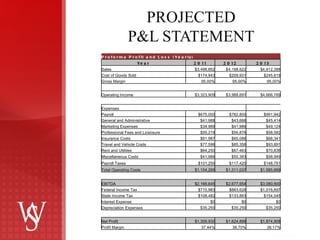

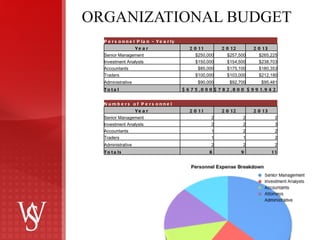

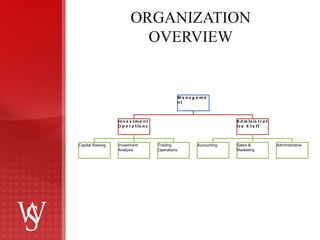

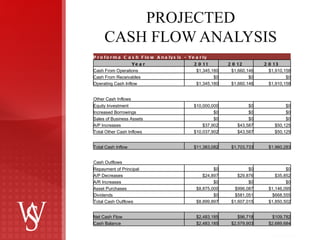

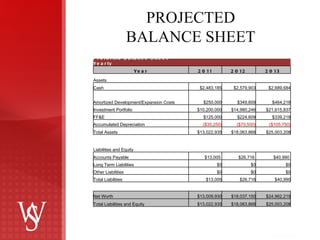

Wall Street Equities Co. Ltd. is seeking $10 million in financing to develop its facilities and launch business operations. The company plans to generate 30% annual returns through a diverse investment portfolio. It will be led by Mark Sutter, who has over 20 years of experience in investment banking. Projections estimate sales growth and net profits increasing each year, with profit margins around 38% by year three. The funding will be used to expand the investment portfolio, facilities, and personnel.

![ADDITIONAL SUPPORTING MATERIAL Thank you for your review and consideration in Wall Street Equities Co. Ltd. Please see our “Business Plan” and “Offering Memorandum” for further explanation to the material and details herein. Canadian Administrative office: 2 Temperance St, Suite 209, Toronto, ONT M5H 1Y51/3/11 Tel +1-416-623 -9615 Mark Sutter CEO & President Tel:+1 (480) 628 5910 Efax:+1 (206) 299 7269 Office of Dubai Office 23, CNN Building, Media City, Dubai, United Arab Emirates Email: [email_address]](https://image.slidesharecdn.com/wallstreetequitiesco-1-ltd-presentation-110730184313-phpapp02/85/Wall-street-equities-co-1-ltd-presentation-10-320.jpg)