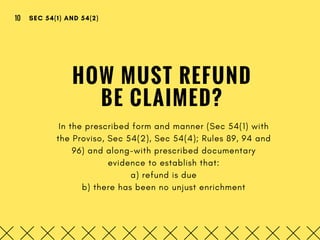

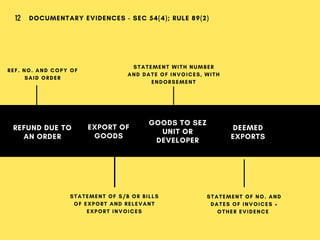

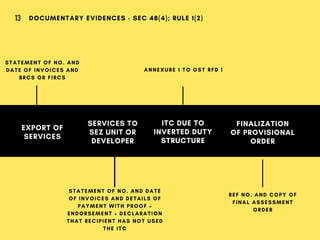

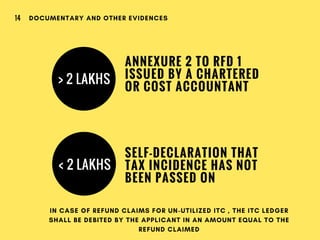

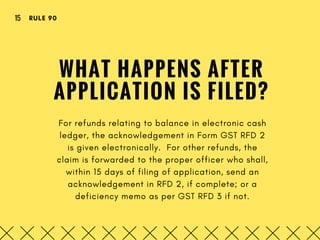

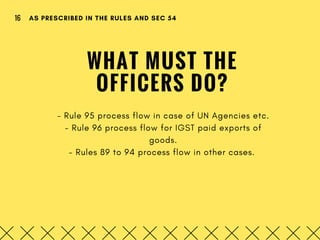

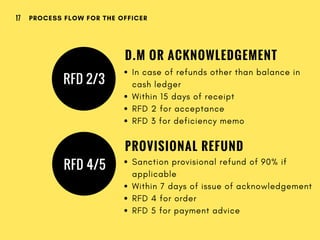

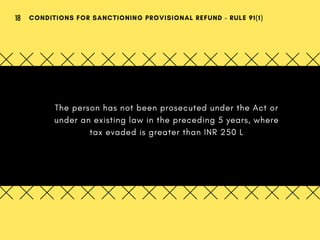

The document outlines the procedures and provisions related to GST refunds, including eligibility, timelines for claiming refunds, and necessary documentation. It specifies that refunds can be claimed for zero-rated supplies, deemed exports, and unutilized ITC, among others, with detailed guidelines for applicants and tax officers. Additionally, it discusses conditions under which refunds may be withheld and the establishment of a consumer welfare fund for certain refund situations.

![WHO CAN CLAIM

REFUND?

- Any person - [Person is defined in Sec 2(84)]

- Any UN Agencies, consulates, embassies etc. as

notified under Sec 55 (on taxes paid for inward

supplies received by them)

SEC 54(1), SEC 54(2)05](https://image.slidesharecdn.com/understandingrefunds-170907124302/85/Understanding-Refunds-in-GST-5-320.jpg)

![CONSUMER WELFARE FUND

57

This Fund is to be established by the Govt.,

and in certain situations the refund amount

will be credited to the Fund, and not the

applicant. [Sec. 57, 54(5)]

UTILIZATION OF FUND

58 The money credited to the Fund shall be

utilized by the Govt. for the welfare of

consumers. Govts. shall maintain or specify

the authority which shall maintain, proper

and separate accounts and other relevant

records in relation to the Fund.

OTHER PROVISIONS26](https://image.slidesharecdn.com/understandingrefunds-170907124302/85/Understanding-Refunds-in-GST-26-320.jpg)