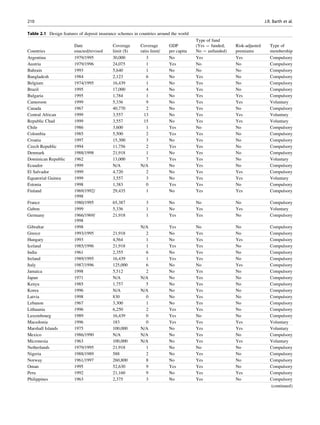

The document discusses deposit insurance schemes that have been established in many countries around the world. It notes that over 50% of countries have established such schemes to increase depositor confidence and stability in the banking system by guaranteeing deposits. However, deposit insurance also creates moral hazard by removing depositor discipline over bank risk-taking. The document analyzes differences in features of deposit insurance schemes, such as coverage limits, funding structures, use of risk-adjusted premiums, and membership types. Effective bank regulation and supervision are needed to mitigate the moral hazard created by deposit insurance.