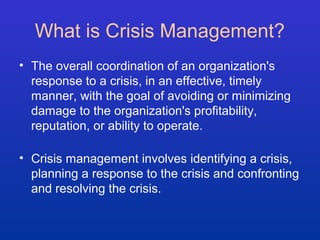

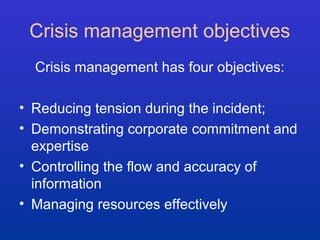

This document discusses crisis and risk management for companies. It defines a crisis as anything that could significantly impact an organization. Crisis management involves identifying potential crises, planning responses, and resolving crises to minimize damage. The goal is to reduce tension, demonstrate expertise, control information flow, and manage resources effectively. A crisis typically follows a three stage life cycle of the crisis breaking, intensifying, and passing. Good crisis management requires daily risk management processes to identify and address potential issues before they escalate into crises.