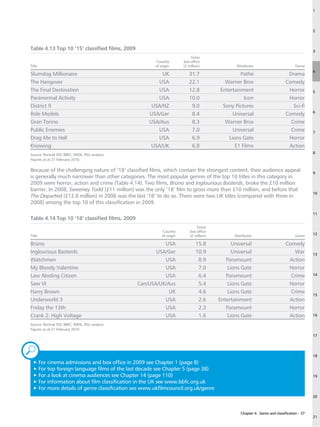

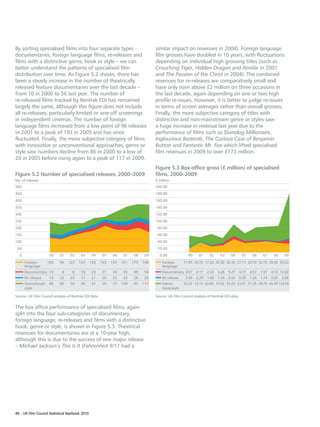

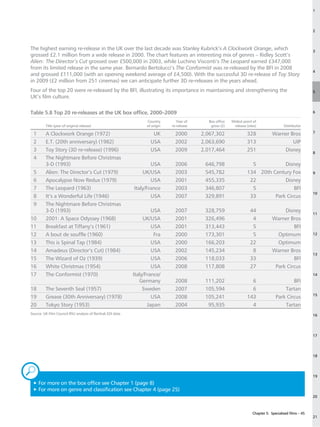

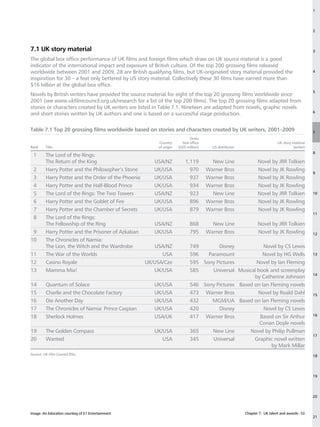

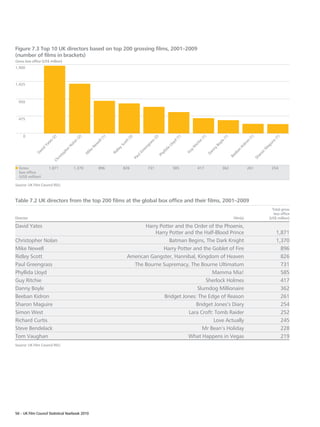

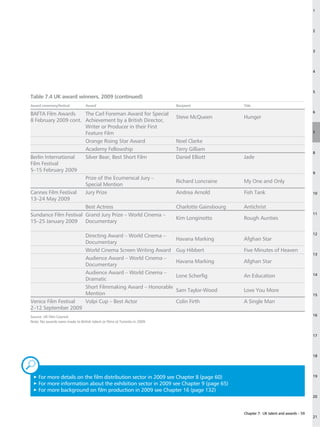

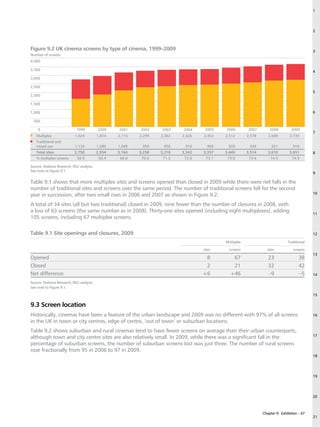

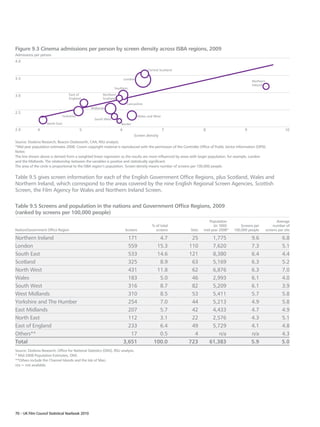

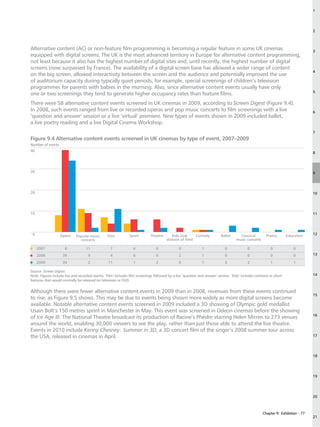

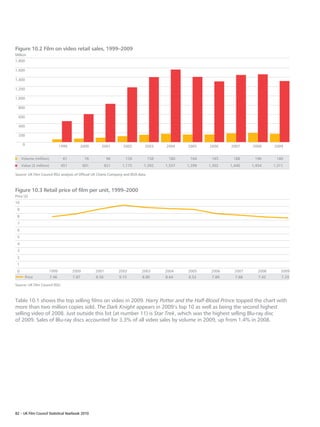

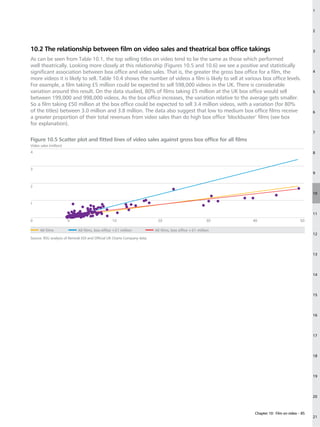

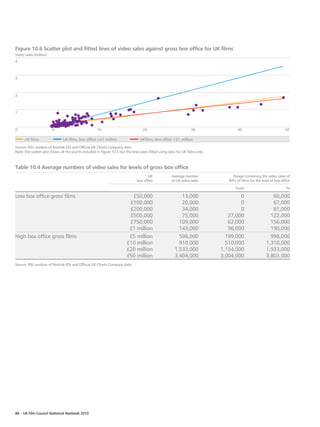

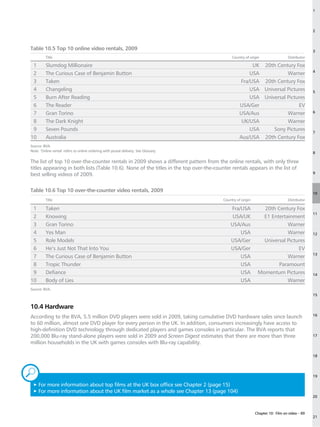

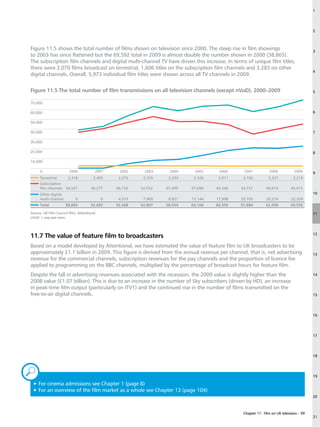

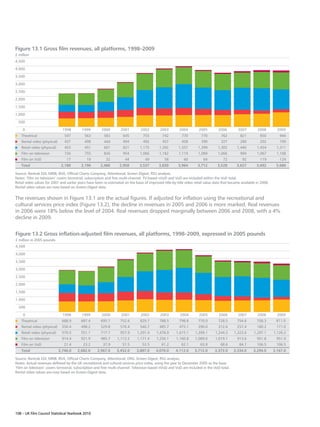

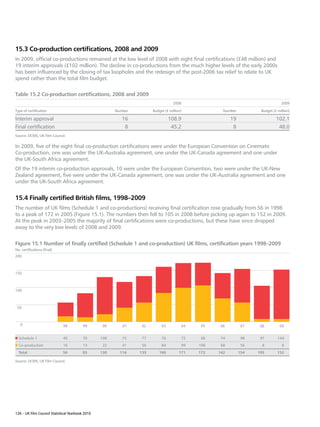

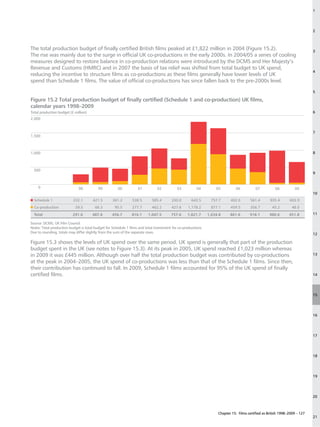

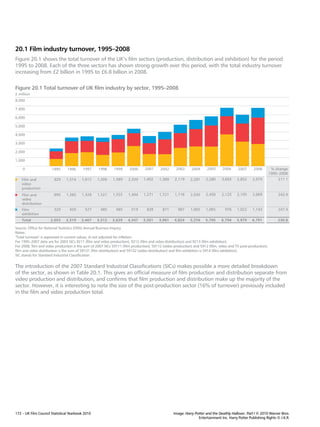

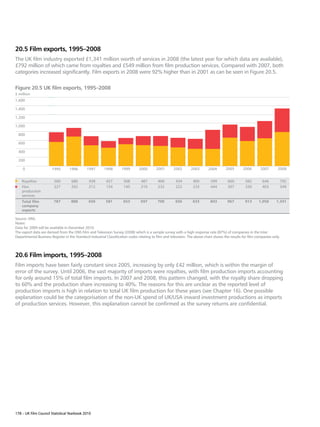

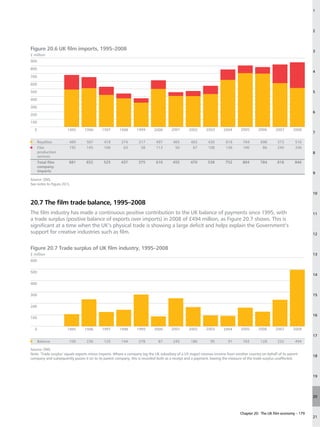

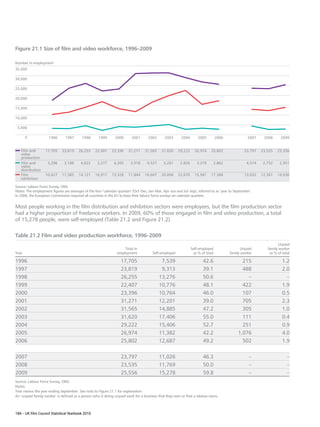

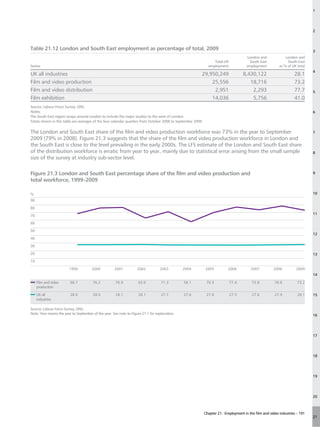

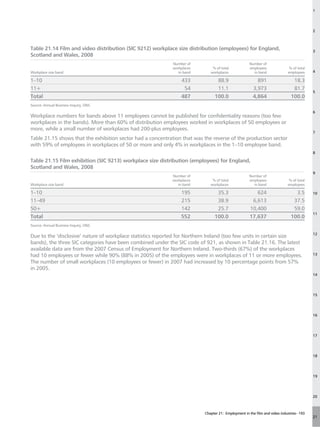

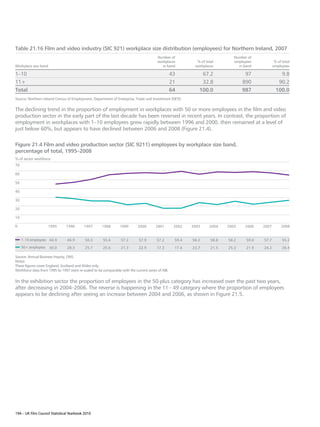

This document is the 2010 UK Film Council Statistical Yearbook, which provides industry data and analysis on film in the UK. It includes information on box office admissions and revenues, the top performing films, genre trends, the distribution and exhibition sectors, film on video and television, and the international performance of UK films. The yearbook aims to further the UK Film Council's commitment to evidence-based film policymaking.