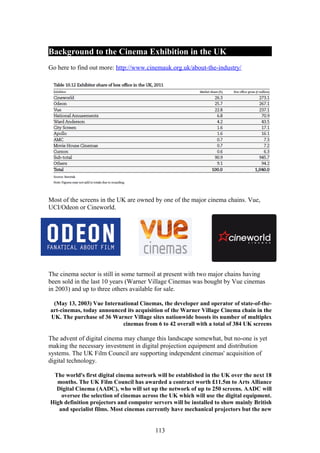

The document discusses film exhibition in the UK cinema industry. It provides statistics on the number of screens and cinemas in the UK in 2012, as well as box office figures showing growth that year. It also examines the roles and activities of film exhibitors, who work with distributors to book, market, and screen films. Exhibitors manage cinema buildings, undertake local marketing like newspaper ads and promotions, and rely on concession sales to earn profits beyond box office revenues. Their goal is to attract audiences, especially 16-24 year olds who make up the bulk of cinema goers.

![cinema will remain prohibitively expensive. The CEA therefore strongly believes that

it is the studios and distributors, rather than the exhibitors, who should meet the bulk

of the costs for this transition.

In the US and Europe, various third party organizations have proposed financing and

installation plans to exhibitors, backed by agreements with the studios. Under these

plans, the third parties raise the necessary finance to buy and install digital equipment

in cinemas, with the studios over time paying "virtual print fees" (VPFs) to the third

parties for the use of the equipment.

From the outset of the transition, the CEA (Cinema Exhibitors Association) was keen

to ensure that as many of its members as possible were able to make the transition to

digital, should they so wish, without experiencing financial hardship. As a result the

Association The Association therefore supported the establishment of the Digital

Funding Partnership (UK) [DFP(UK)] a grouping of small and medium-sized

operators brought together to negotiate the best possible funding deal to support

digital conversion.

c. DVD release window

The ‘theatrical window’ is the number of days between a film’s official theatrical

release and its release on DVD/video rental. Over the last 10 years, the size of the

window in the UK has fallen significantly, from around from 27 weeks in May 1999

to an average of 17 weeks at the current time. Changes to the release window are a

matter for negotiation between the studio and exhibitor concerned. But in general the

CEA would be concerned about any changes which might have a negative impact on

the UK cinema industry

Cinema is not the music industry, where existing business models are widely seen as

broken. UK cinema admissions have been steadily rising for the last 25 years. Many

cinemas have invested huge amounts of their own money in improving the cinema-

going experience, most recently through digital 3D. Without a clear window between

a film's theatrical release and its release on other platforms, such as DVD, that

investment is at risk.

Significant changes to the release window could cause a marked reduction in cinema

admissions, particularly for those smaller operators who can only play a film several

weeks after it is released. Hundreds of cinemas up and down the country would be put

at risk by any significant reduction in admissions. The impact of this would be lost

jobs and businesses. But more importantly still, it would result in less film choice and

less opportunities for the public to see movies where they were intended to be seen –

the cinema."

118](https://image.slidesharecdn.com/07g322sectionb-exhibition2012-130319113745-phpapp02/85/07-g322-section-b-exhibition-2012-13-320.jpg)