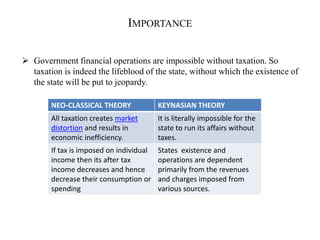

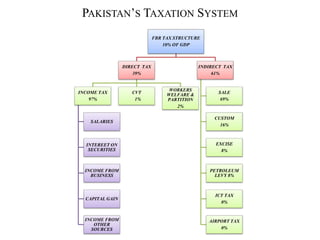

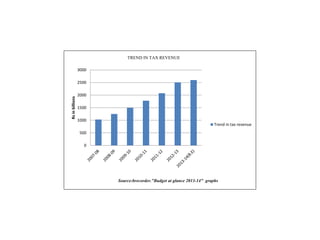

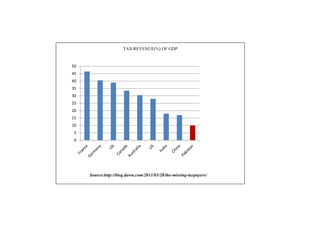

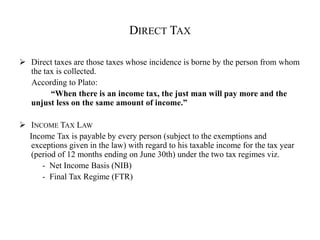

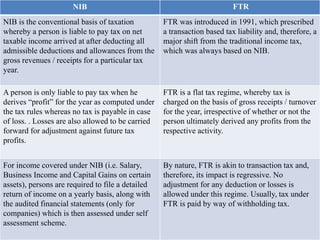

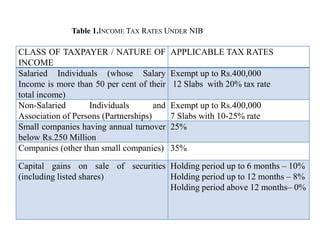

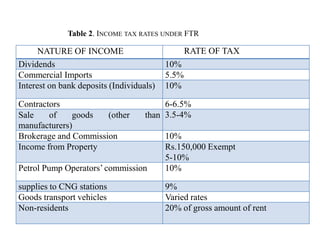

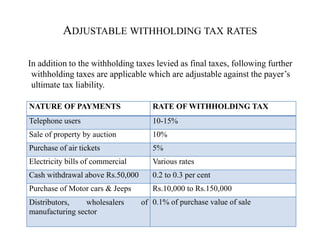

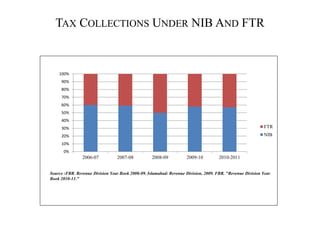

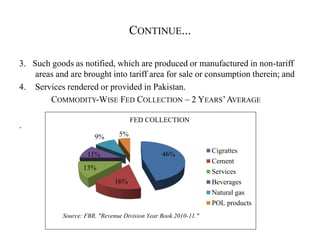

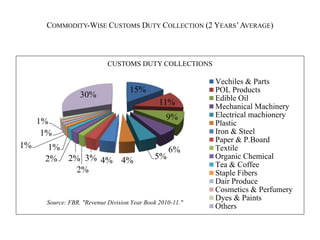

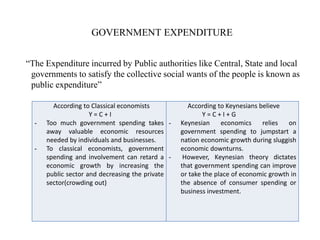

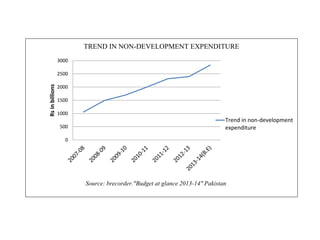

This document discusses public finance, taxation, and government expenditure in Pakistan. It provides an overview of Pakistan's taxation system, including direct taxes like income tax and indirect taxes like sales tax, federal excise duty, and customs duty. It notes that taxation is crucial for generating government revenue but that Pakistan has a low tax-to-GDP ratio. The document also examines problems with Pakistan's taxation system such as widespread exemptions, an large undocumented economy, and recommends solutions like bringing more sectors into the tax net, reforming agricultural income tax, and improving tax administration.