Sales tax numerical 2013 solution B.com part 2 Punjab University.

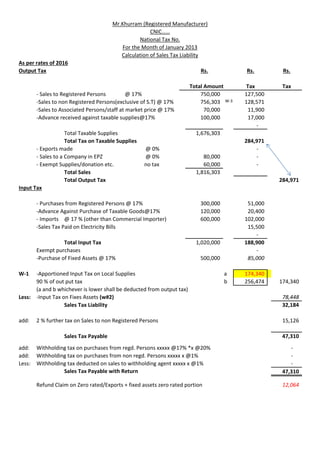

- 1. As per rates of 2016 Output Tax Rs. Rs. Rs. Tax Tax - Sales to Registered Persons @ 17% 750,000 127,500 -Sales to non Registered Persons(exclusive of S.T) @ 17% 756,303 W-3 128,571 -Sales to Associated Persons/staff at market price @ 17% 70,000 11,900 -Advance received against taxable supplies@17% 100,000 17,000 - Total Taxable Supplies 1,676,303 Total Tax on Taxable Supplies 284,971 - Exports made @ 0% - - Sales to a Company in EPZ @ 0% 80,000 - - Exempt Supplies/donation etc. no tax 60,000 - Total Sales 1,816,303 Total Output Tax 284,971 Input Tax - Purchases from Registered Persons @ 17% 300,000 51,000 -Advance Against Purchase of Taxable Goods@17% 120,000 20,400 - Imports @ 17 % (other than Commercial Importer) 600,000 102,000 -Sales Tax Paid on Electricity Bills 15,500 - Total Input Tax 1,020,000 188,900 Exempt purchases - -Purchase of Fixed Assets @ 17% 500,000 85,000 W-1 -Apportioned Input Tax on Local Supplies a 174,340 90 % of out put tax b 256,474 174,340 (a and b whichever is lower shall be deducted from output tax) Less: -Input Tax on Fixes Assets (w#2) 78,448 Sales Tax Liability 32,184 add: 2 % further tax on Sales to non Registered Persons 15,126 Sales Tax Payable 47,310 add: Withholding tax on purchases from regd. Persons xxxxx @17% *x @20% - add: Withholding tax on purchases from non regd. Persons xxxxx x @1% - Less: Withholding tax deducted on sales to withholding agent xxxxx x @1% - Sales Tax Payable with Return 47,310 Refund Claim on Zero rated/Exports + fixed assets zero rated portion 12,064 Mr.Khurram (Registered Manufacturer) CNIC…… National Tax No. For the Month of January 2013 Calculation of Sales Tax Liability Total Amount

- 2. Working#1 Apportionment of Input Tax Total Local Supplies 1,676,303 1,676,303 x 174,340 1,816,303 Exempt Supplies 60,000 60,000 x 6,240 1,816,303 Zero Rated Supplies 80,000 80,000 x 8,320 (including Exports) 1,816,303 Total Sales 1,816,303 Working#2 Fixed Assets Apportionment Total Local Supplies 1,676,303 1,676,303 x 78,448 1,816,303 Exempt Supplies 60,000 60,000 x 2,807.90 1,816,303 Zero Rated Supplies 80,000 80,000 x 3,743.87 (including Exports) 1,816,303 Total Sales 1,816,303 Working#3 Purchase exclusive of sales tax x 100 756,303 119 Notes - - - Sales in Export Processing Zone is zero rated supply. 85,000 Less this from output Tax 85,000 Cannot be Claimed(including samples & donation) 85,000 Refund Claim 900,000 = No input tax adjustment is allowed on water charges paid. Sales Tax Paid on Electricity Bills of residential colonies is not allowed. 188,900 Refund Claim 188,900 Less this from output Tax 188,900 Cannot be Claimed(including samples & donation)