Embed presentation

Download to read offline

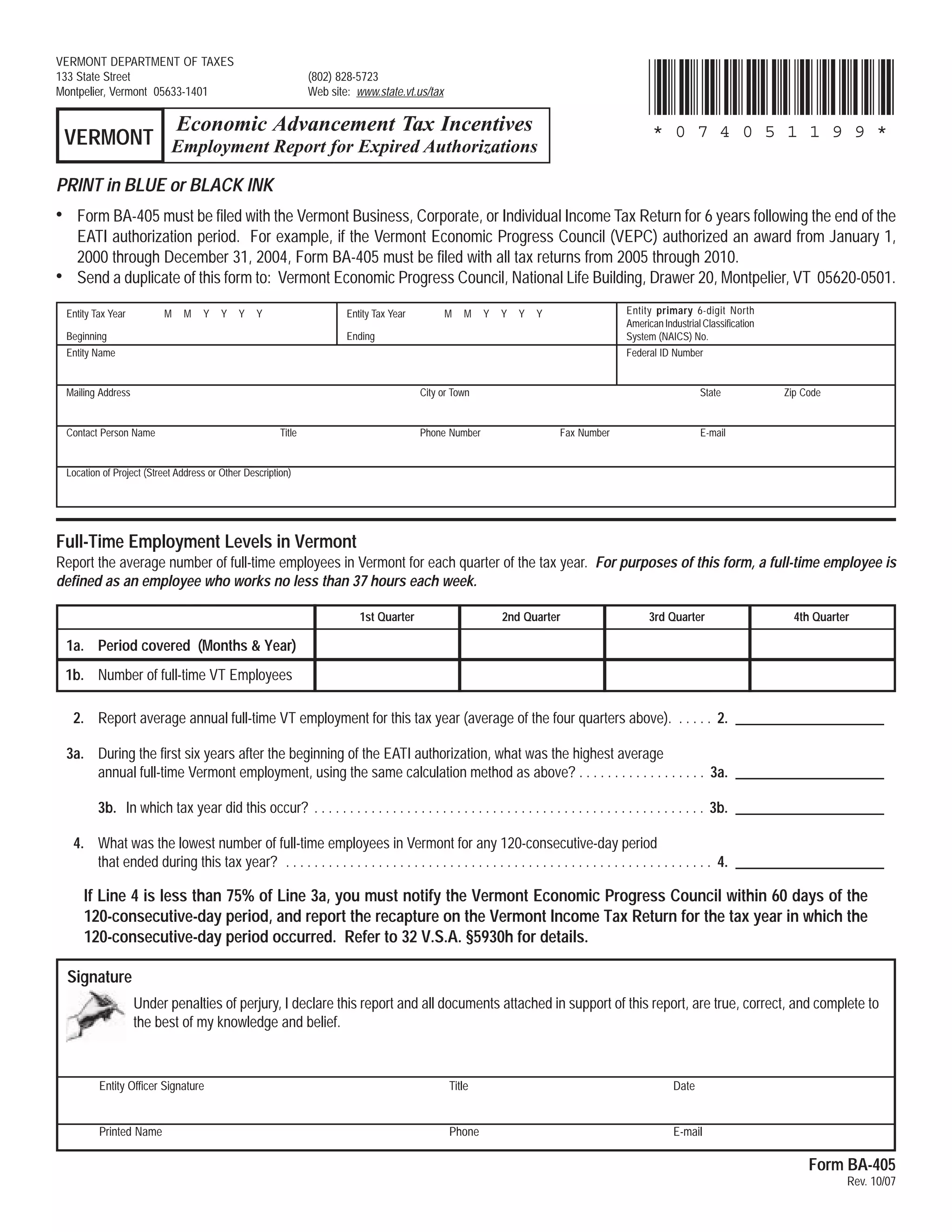

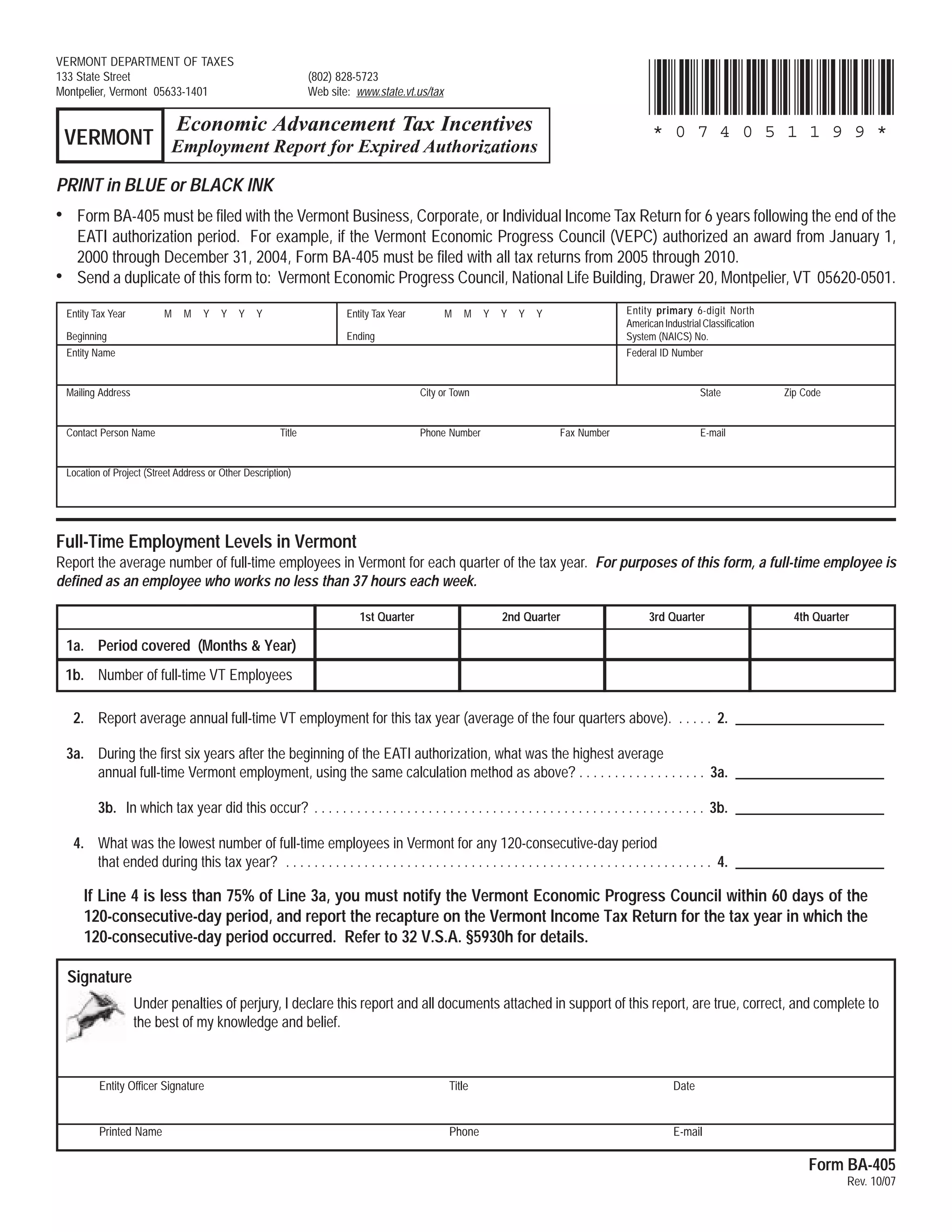

This document is from the Vermont Department of Taxes regarding economic advancement tax incentives. It provides instructions for filing Form BA-405 for 6 years following the end of an authorization period from the Vermont Economic Progress Council. It requires reporting average quarterly and annual full-time employment levels in Vermont, along with the highest employment level and lowest 120-day employment level during or after the authorization period. Failure to meet certain employment requirements could result in recapture of incentives.