Embed presentation

Download to read offline

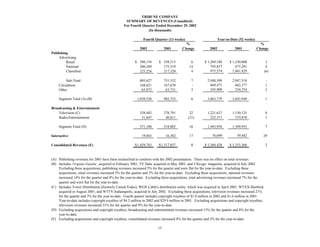

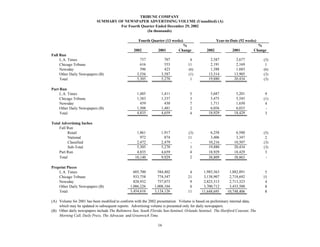

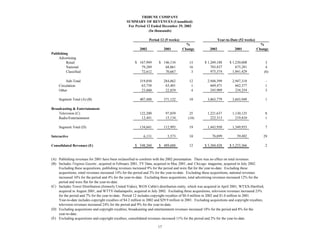

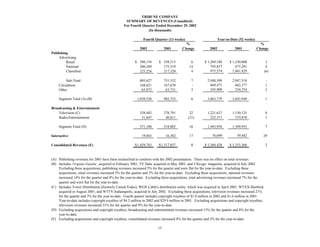

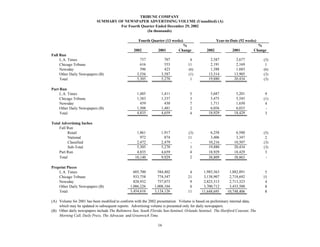

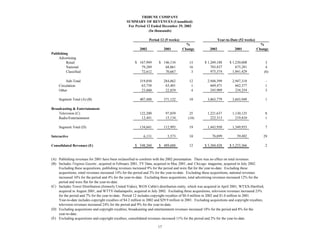

Tribune Company reported its fourth quarter and full year 2002 results. For the fourth quarter, revenues increased 8% year-over-year and net income increased 24%. Operating profit before restructuring charges increased 33% due to cost reductions. For the full year, revenues increased 2% and net income increased 43% due to restructuring initiatives and asset sales. Earnings per share increased 22% in the fourth quarter and 45% for the full year, reflecting continued improvement.