Embed presentation

Download to read offline

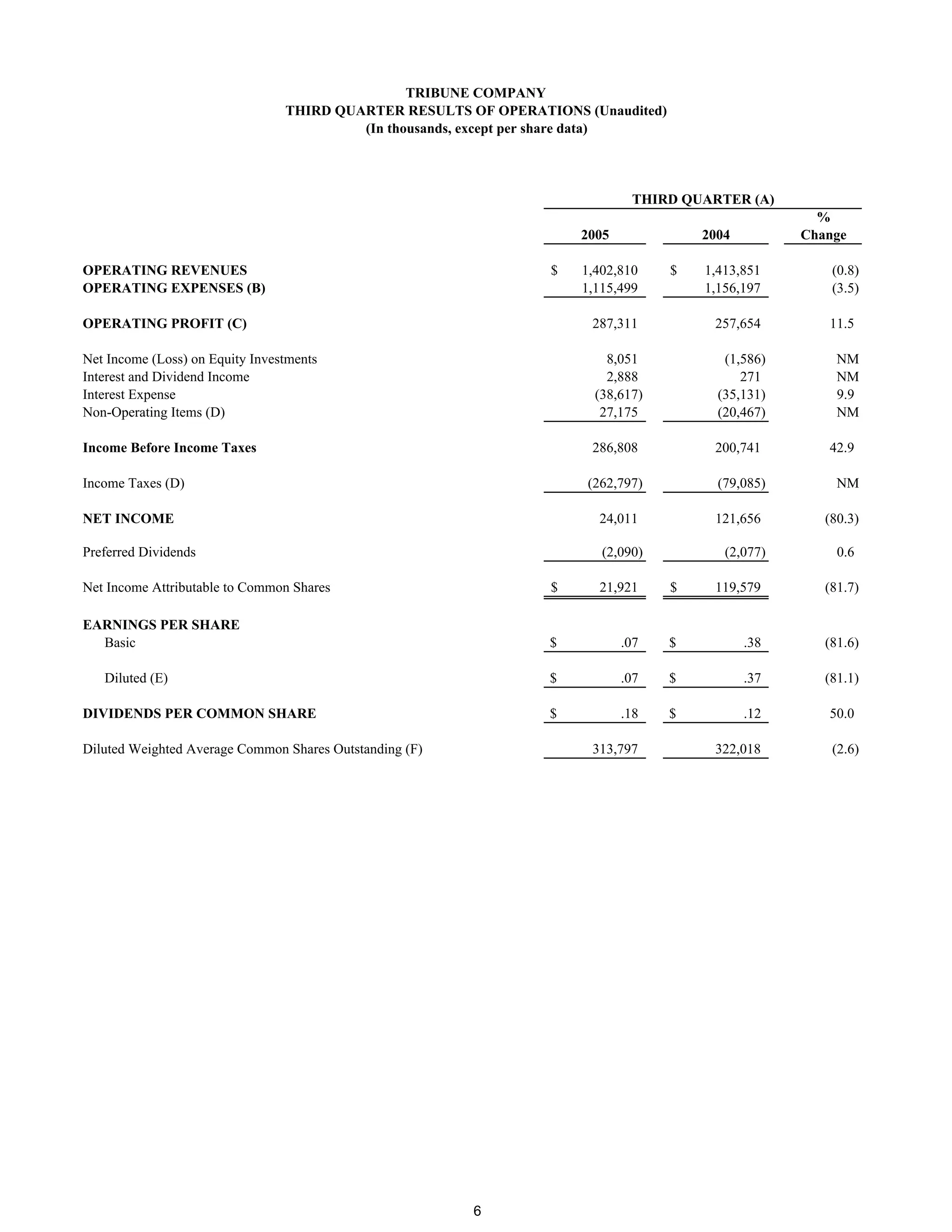

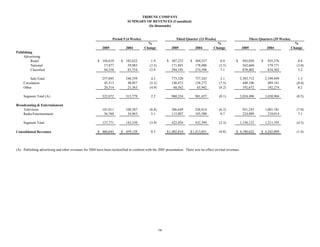

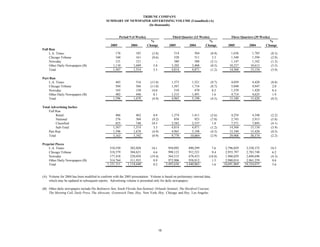

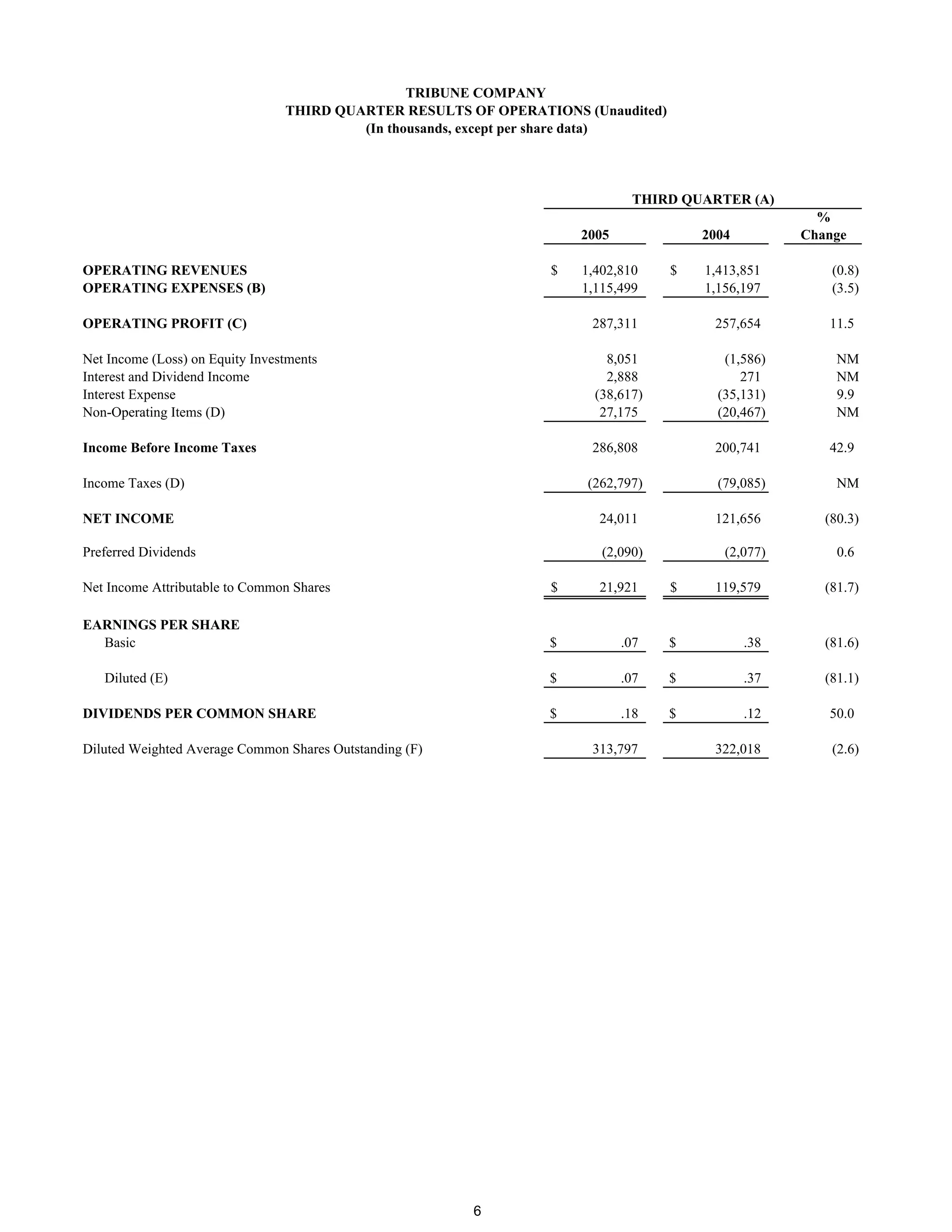

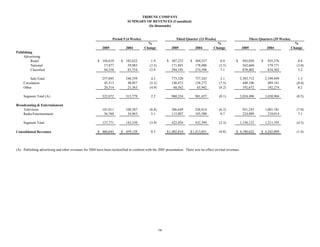

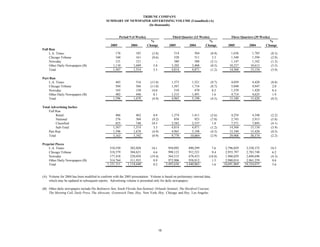

The document summarizes Tribune Company's financial results for the third quarter and first three quarters of 2005 compared to the same periods in 2004. Key points: - Operating revenues and operating profit increased in the third quarter of 2005 but decreased for the first three quarters compared to the prior year. - Net income decreased significantly for the third quarter but increased for the first three quarters of 2005 versus 2004. - Earnings per share decreased substantially for the third quarter but increased for the first three quarters compared to the previous year.