Embed presentation

Download to read offline

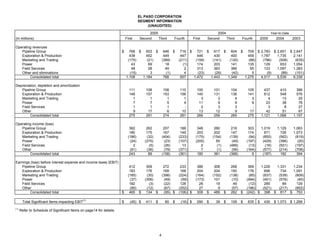

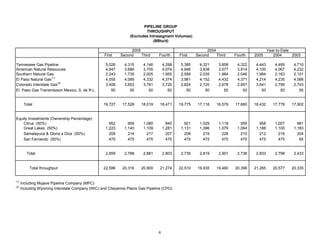

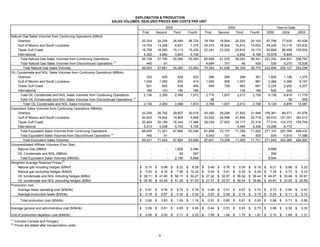

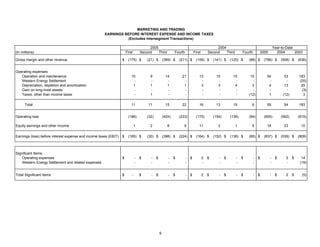

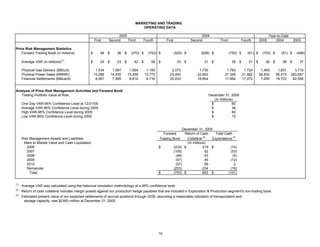

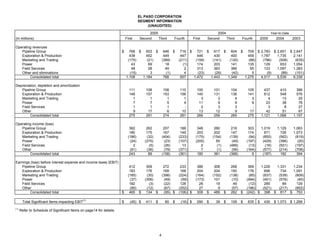

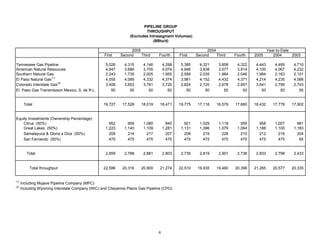

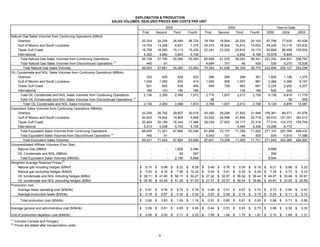

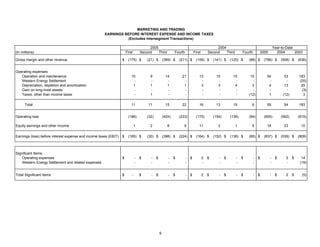

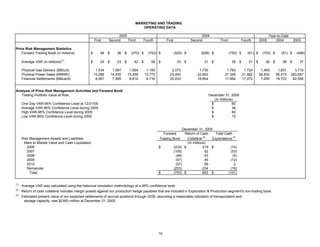

The document provides operating statistics and financial results for El Paso Corporation for the fourth quarter and full year of 2005. Some key details include: - For the fourth quarter of 2005, El Paso reported a net loss of $162 million and a loss from continuing operations of $283 million. - For the full year 2005, El Paso reported a net loss of $606 million and a loss from continuing operations of $702 million. - El Paso reported earnings before interest and taxes of -$106 million for the fourth quarter and $398 million for the full year from its various business segments including pipelines, exploration and production, marketing and trading, power and field services.