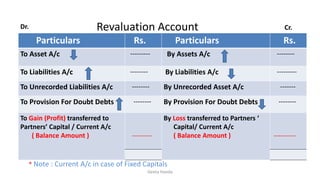

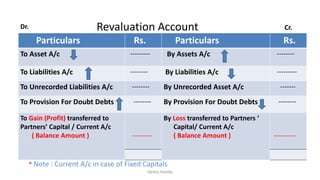

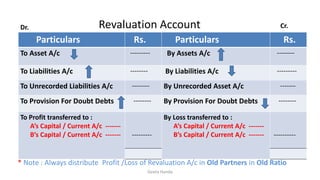

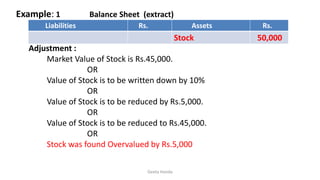

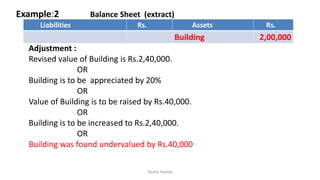

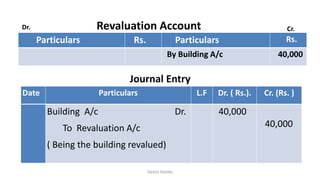

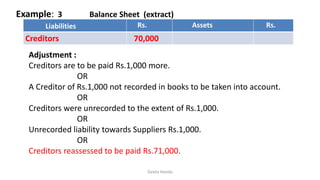

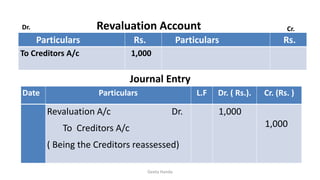

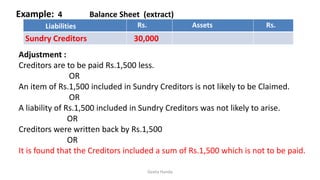

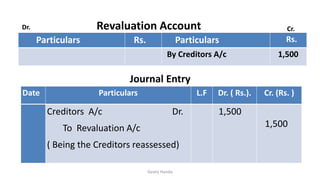

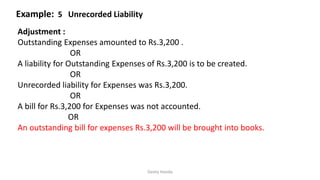

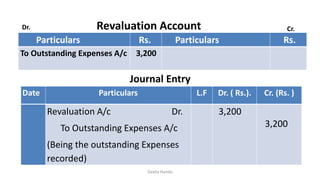

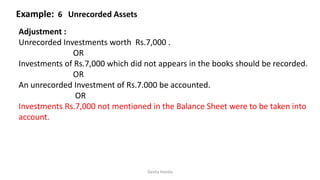

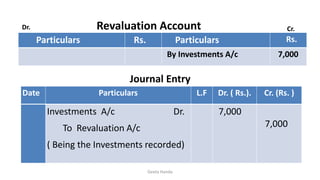

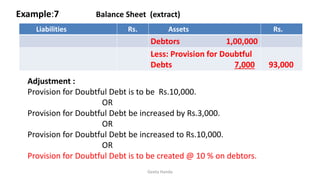

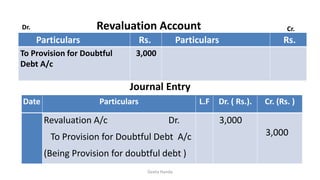

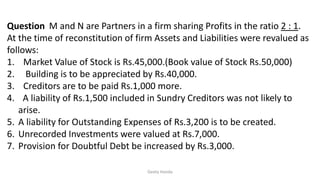

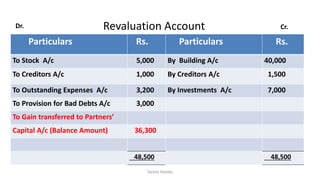

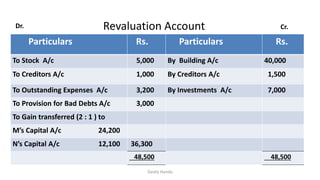

The document provides examples and explanations of revaluation accounts. A revaluation account is prepared when assets or liabilities are revalued at the time of business reorganization. The examples show journal entries to record adjustments such as an increase in the value of buildings, a decrease in stock valuation, unrecorded expenses, and changes to provisions. The final example summarizes all adjustments in a revaluation account, showing decreases to some accounts, increases to others, and the transfer of the net gain to partners' capital accounts in their old profit sharing ratios.