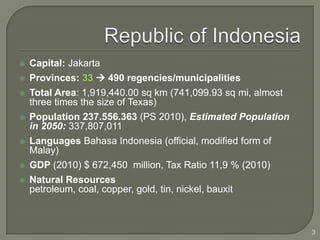

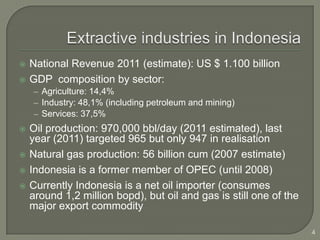

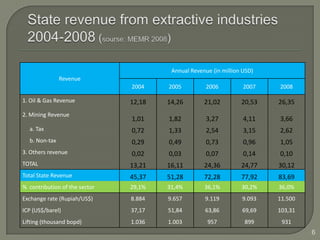

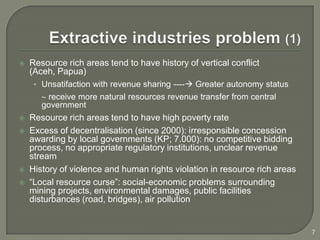

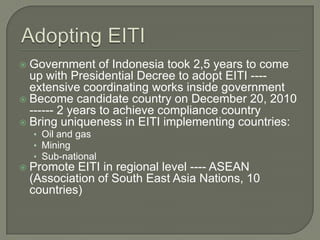

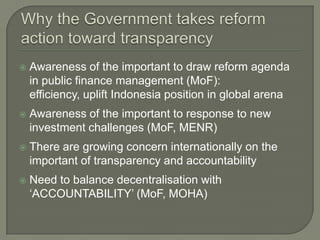

Indonesia is a resource-rich nation with a population of approximately 237.6 million and a GDP of $672.45 billion in 2010. The country faces challenges such as revenue sharing conflicts, high poverty rates in resource-rich areas, and issues related to transparency and accountability in public financial management. However, there have been recent reforms, including the adoption of the Extractive Industry Transparency Initiative (EITI) and improvements in environmental laws and public information access.