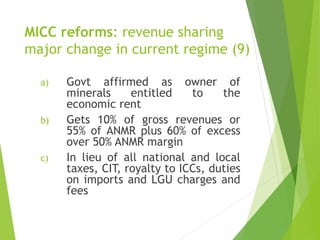

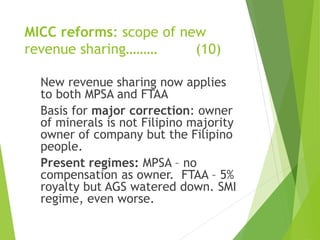

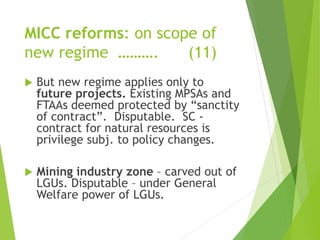

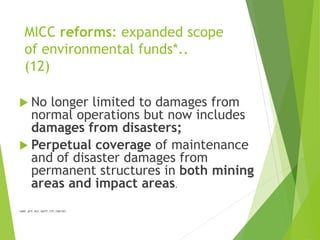

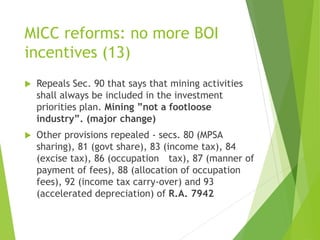

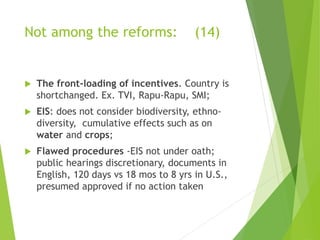

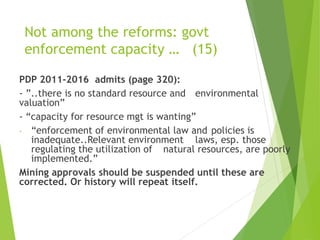

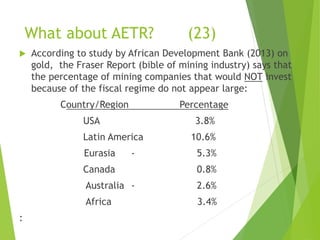

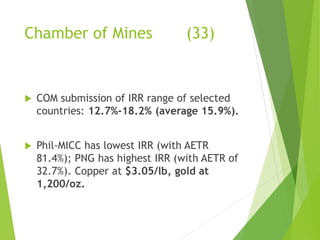

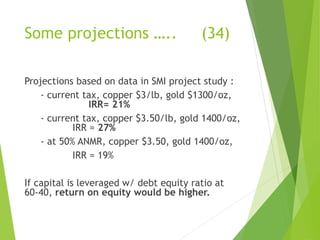

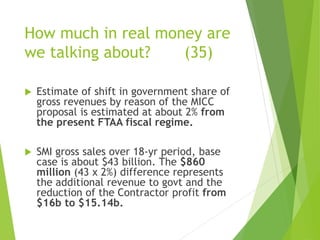

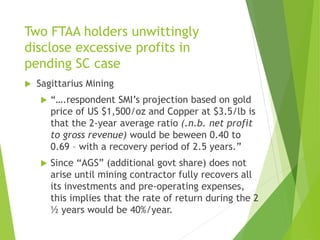

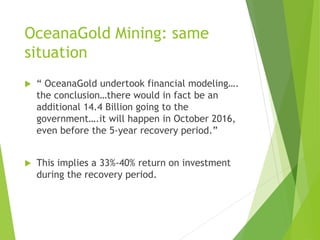

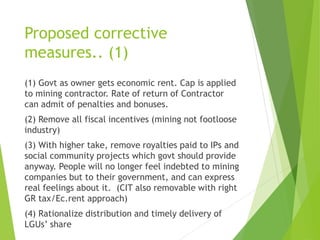

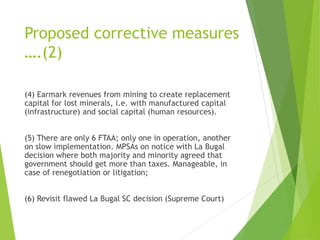

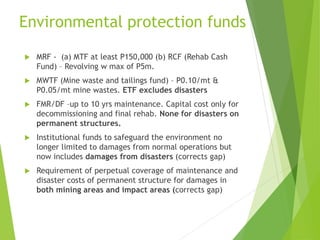

The document discusses the Philippine mining fiscal regime, highlighting its failure to promote equitable distribution of wealth and the need for reforms. It emphasizes that mining has not significantly contributed to economic development and often leads to social injustices, especially for marginalized communities affected by mining activities. Proposed reforms include equitable revenue sharing, improved environmental safeguards, and addressing the government's role as both owner and regulator of mineral resources.