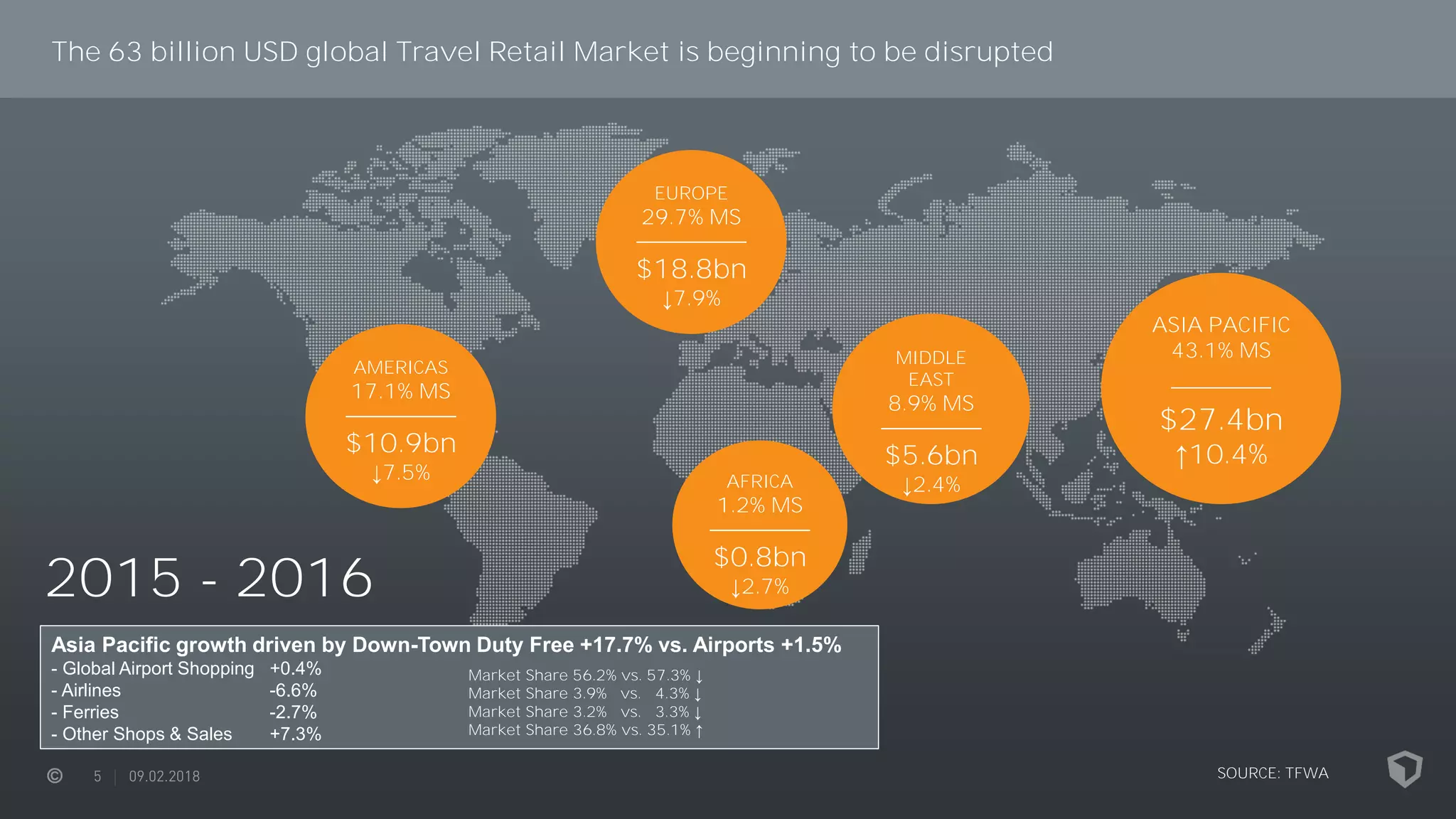

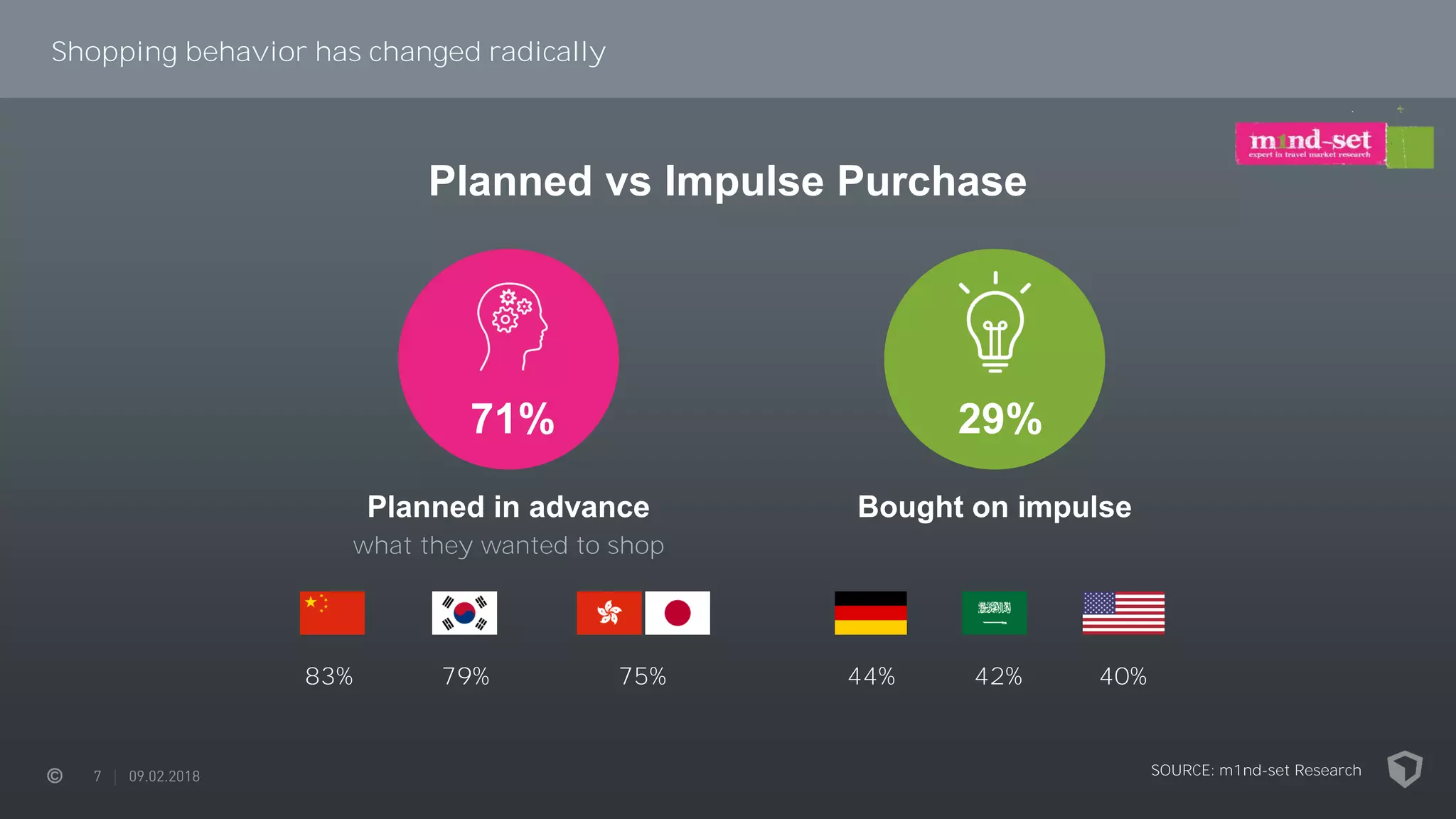

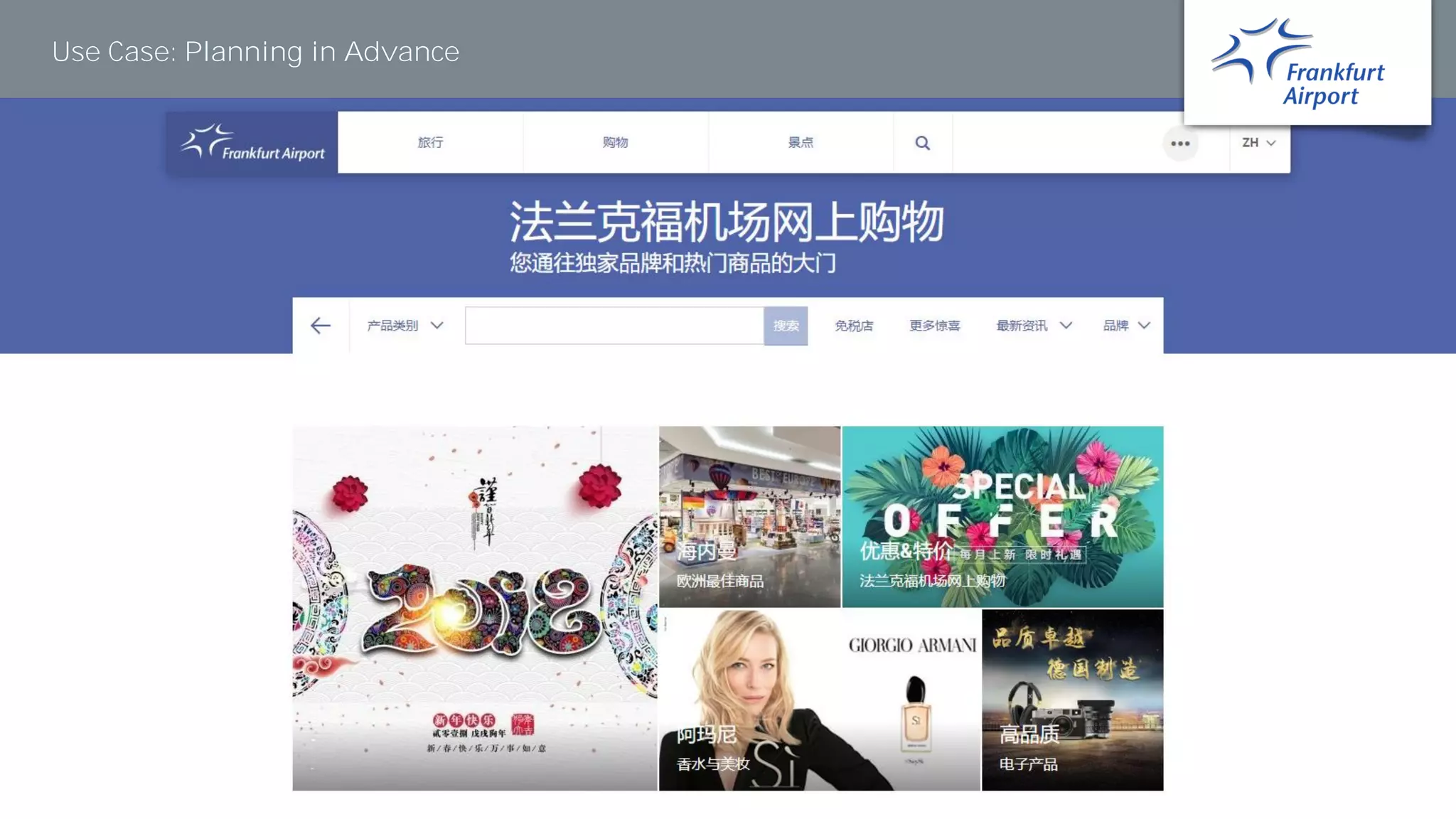

The global travel retail market, valued at $63 billion, is facing significant disruptions, with varying performance across regions. Key strategies for survival include enhancing the in-store experience, leveraging digital engagement, and integrating e-commerce at airports. Adapting to the changing consumer behavior and expectations will be crucial for the future of travel retail.