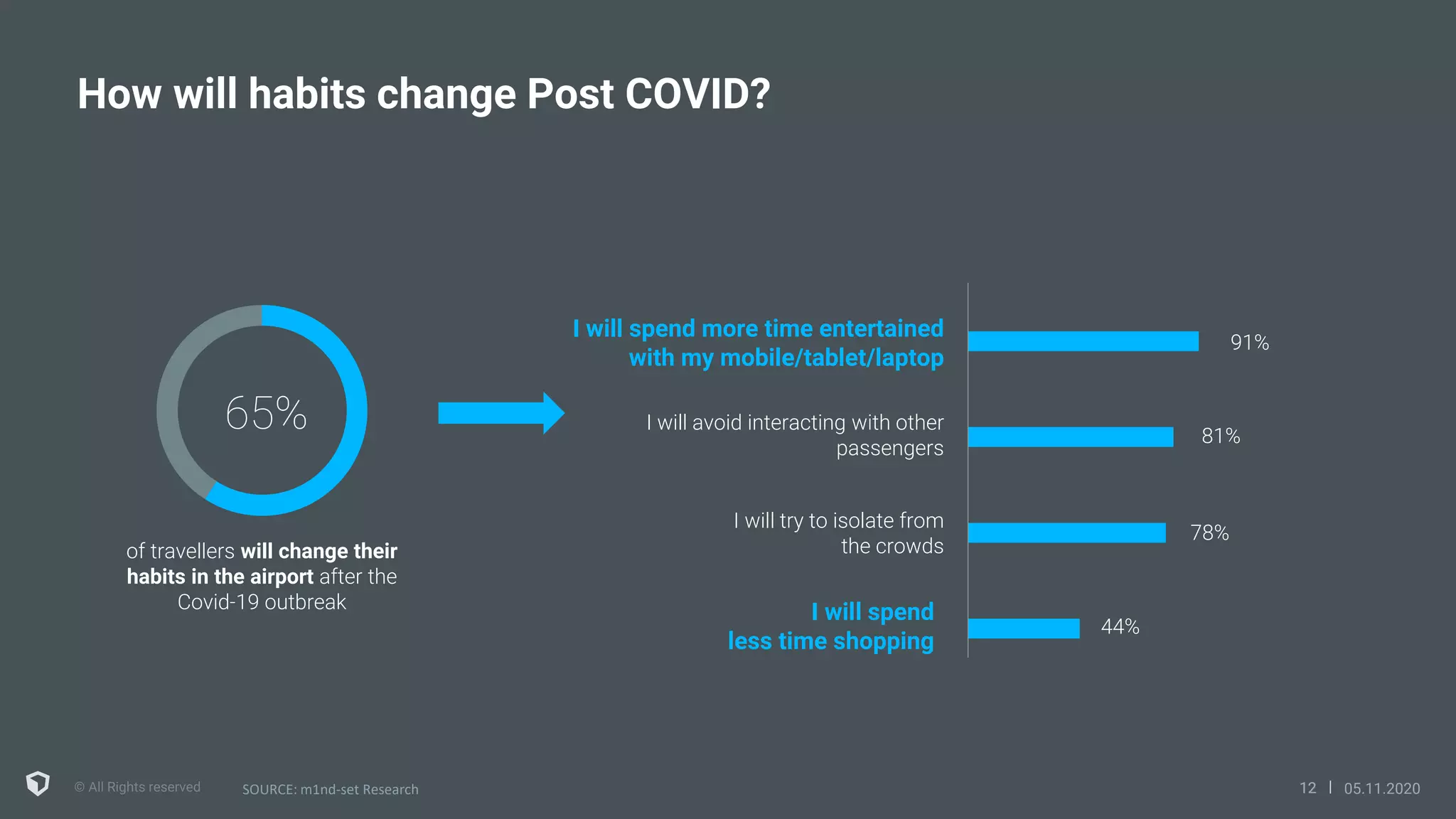

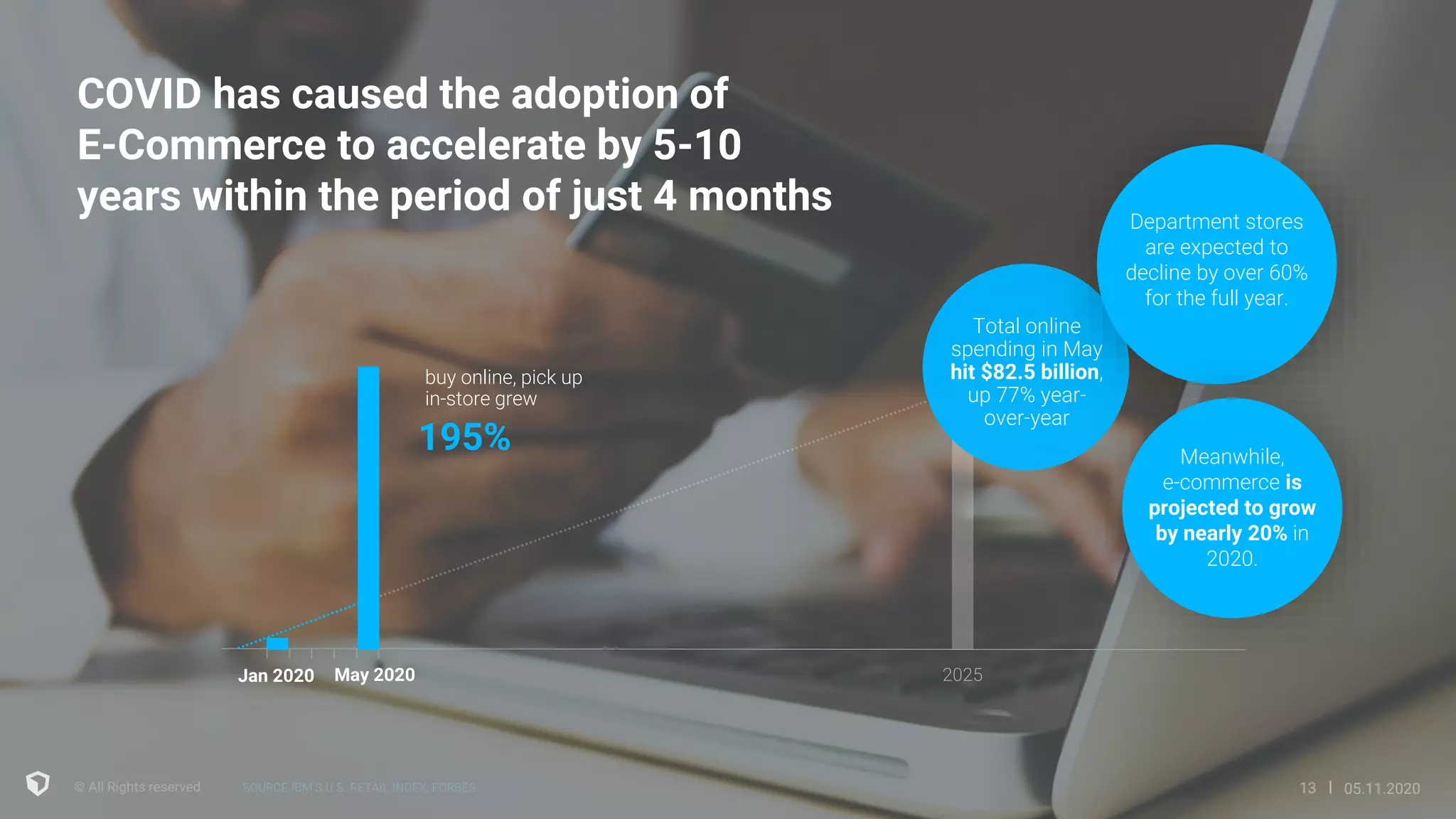

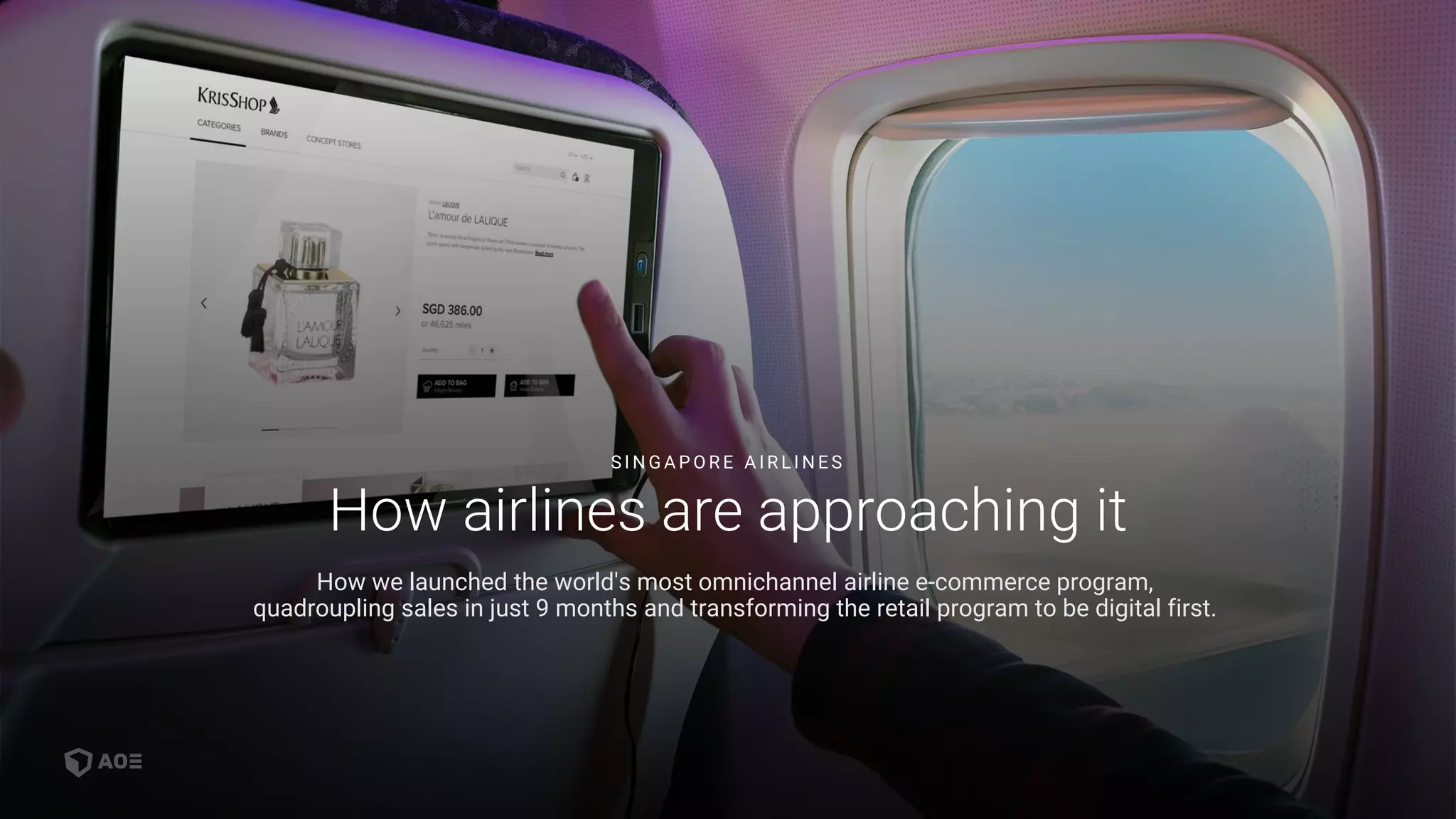

The document discusses the need for airports to reinvent their ancillary revenue generation strategies in the post-COVID era, highlighting the impact of the pandemic on passenger behavior and revenue streams. It emphasizes the shift towards digitalization and customer-centricity, urging airports to form partnerships, invest in digital infrastructure, and adopt an omnichannel approach to enhance customer experience. The document concludes with a call for collaboration and a unified digital strategy to adapt to the changing travel landscape.