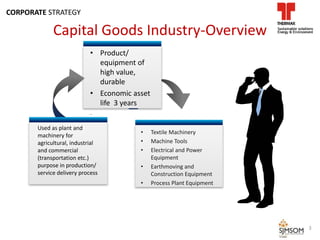

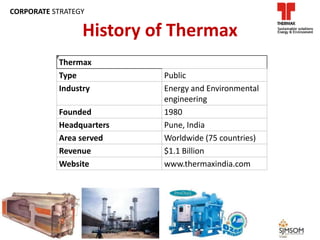

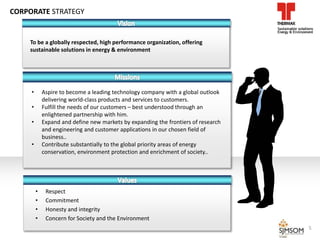

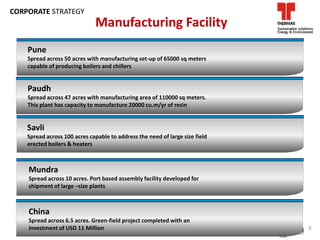

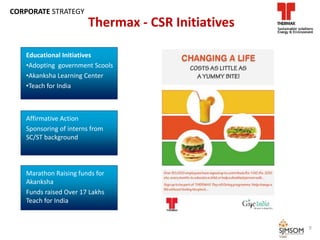

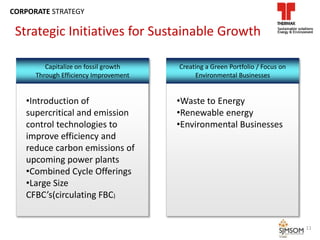

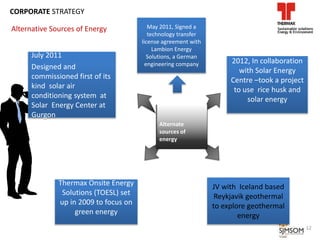

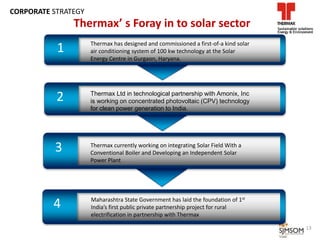

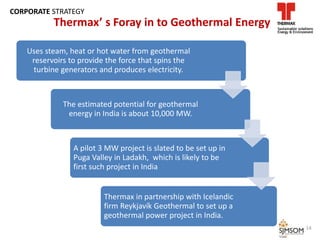

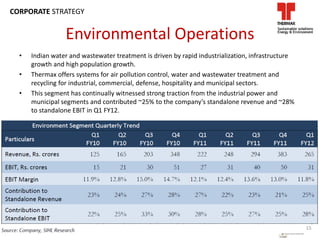

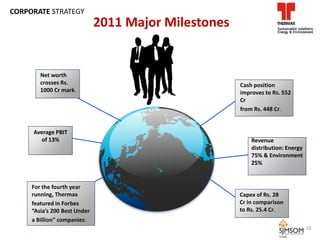

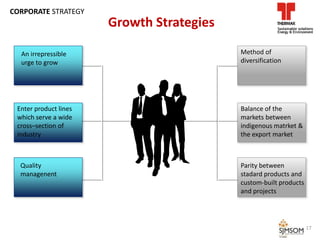

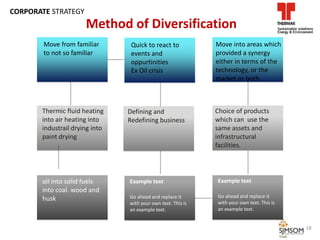

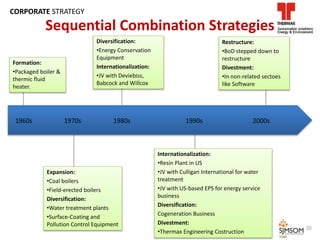

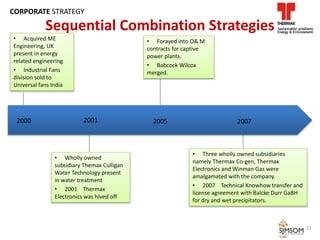

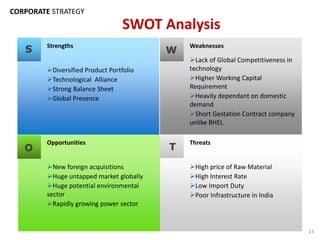

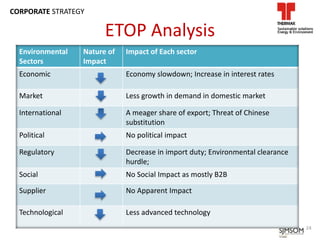

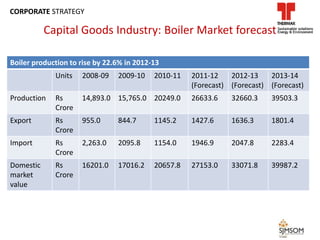

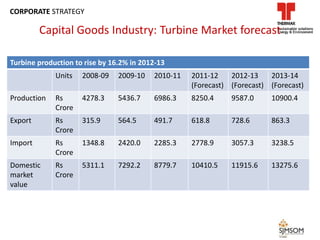

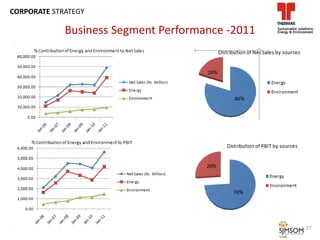

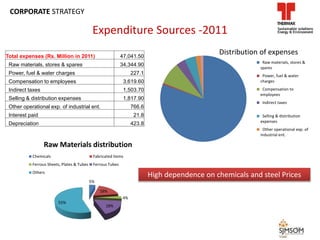

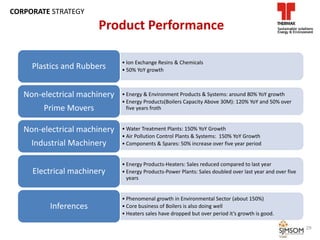

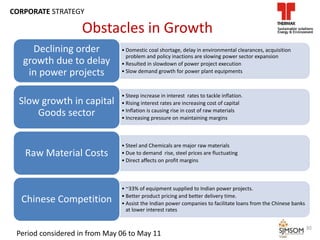

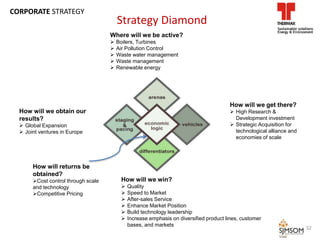

Thermax is an Indian energy and environment engineering company. The document discusses Thermax's history, products, facilities, CSR initiatives, strategies for sustainable growth including expanding into new markets like solar, geothermal and environmental operations. It analyzes Thermax's financial performance, markets, competitors and recommends developing technology infrastructure to improve competitiveness.