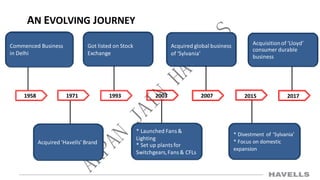

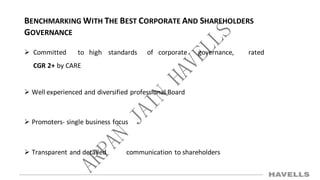

Havells India Limited is an electrical equipment company that has grown significantly since its founding in 1958. Some key points:

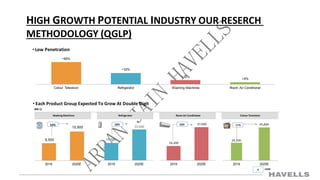

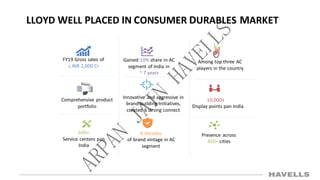

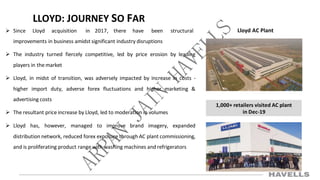

- Havells has expanded its product portfolio over the years from industrial to consumer products, and recently acquired Lloyd, entering the consumer durables market.

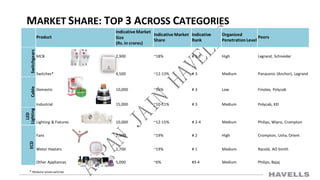

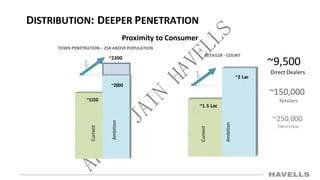

- It has a leading market share in switches, MCBs, lighting and wires in India through extensive distribution and manufacturing capabilities.

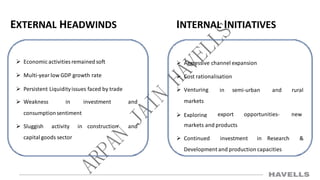

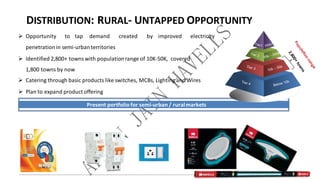

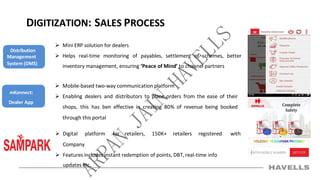

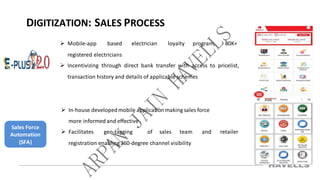

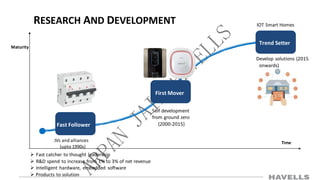

- The company is pursuing growth through expanding its reach in rural India, new product introductions, digitization initiatives, and research and development to develop smart home solutions.

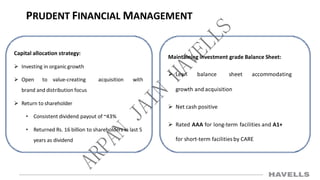

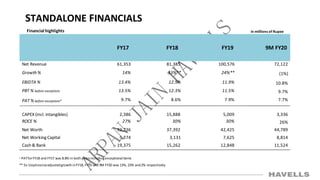

- Havells maintains strong financial performance with consistent revenue and profit growth as well as high returns on capital employed.