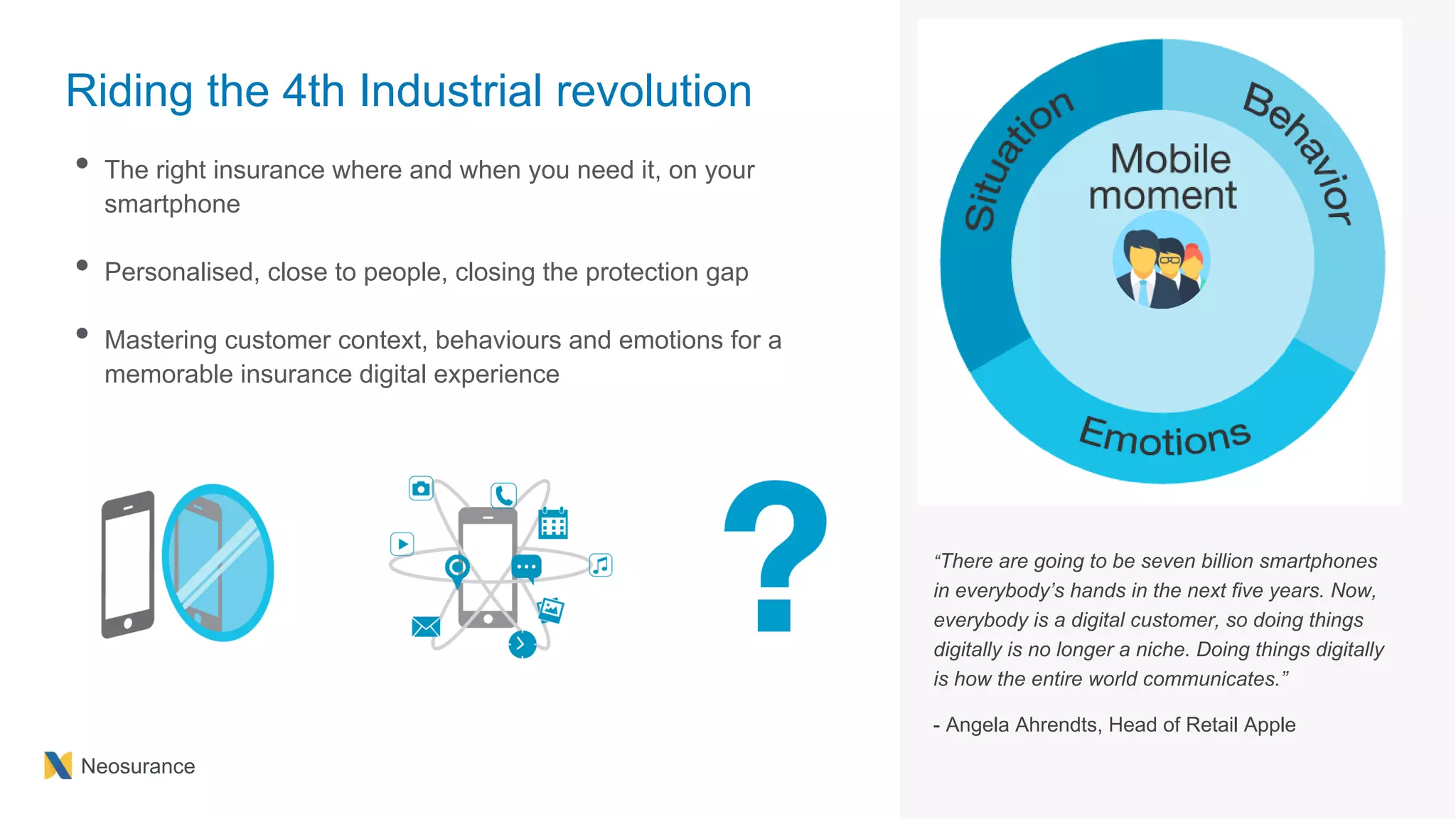

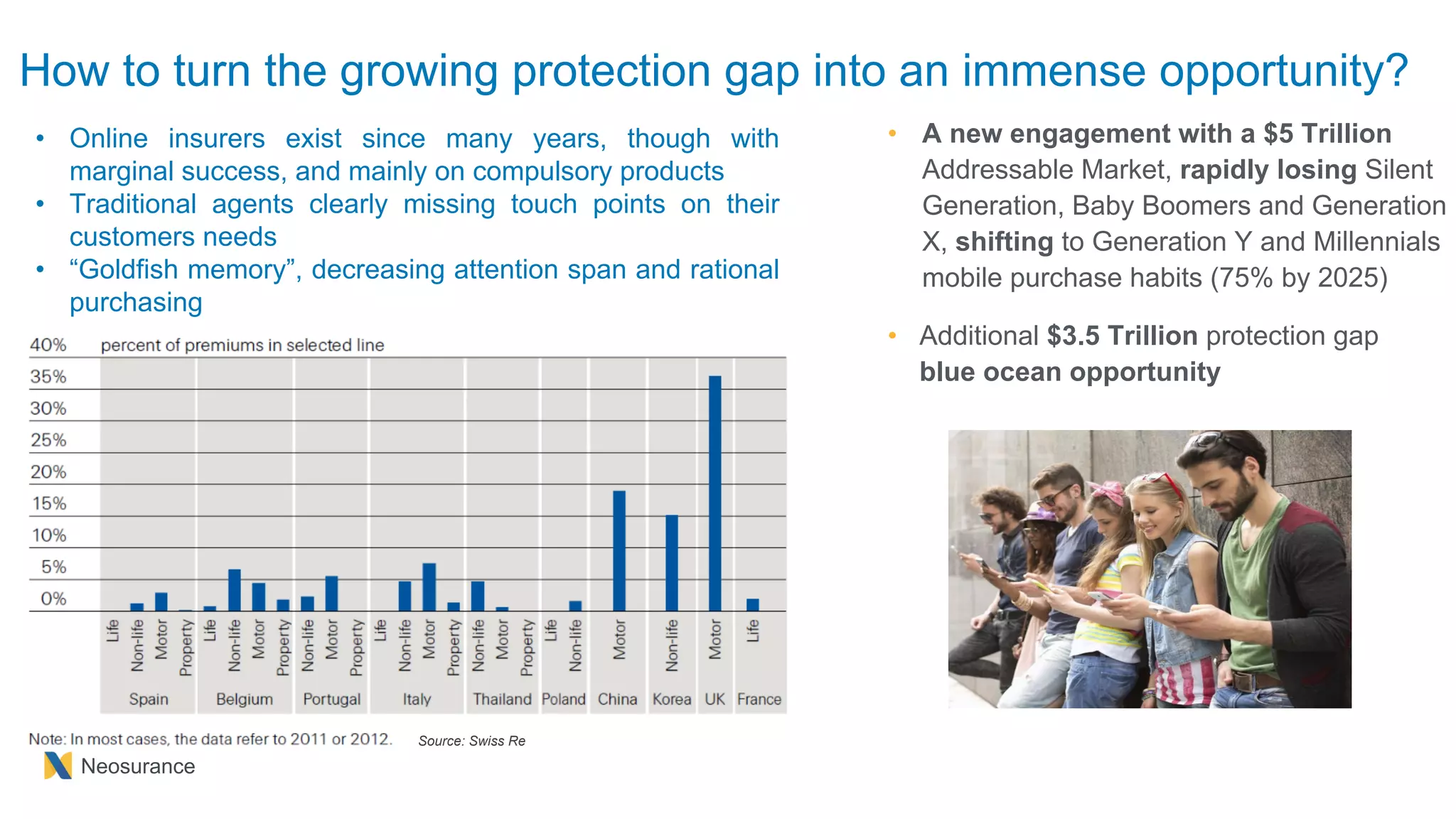

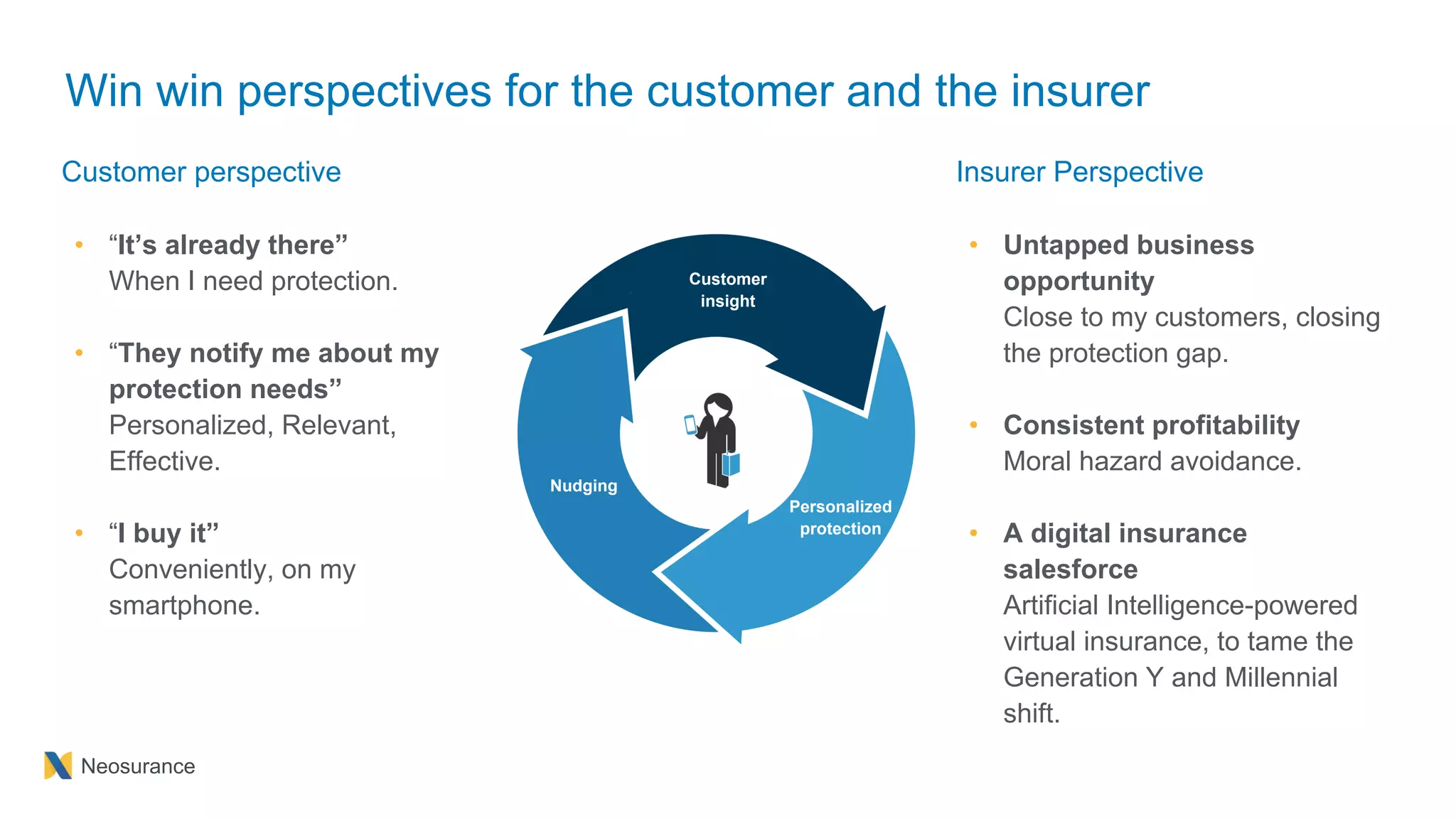

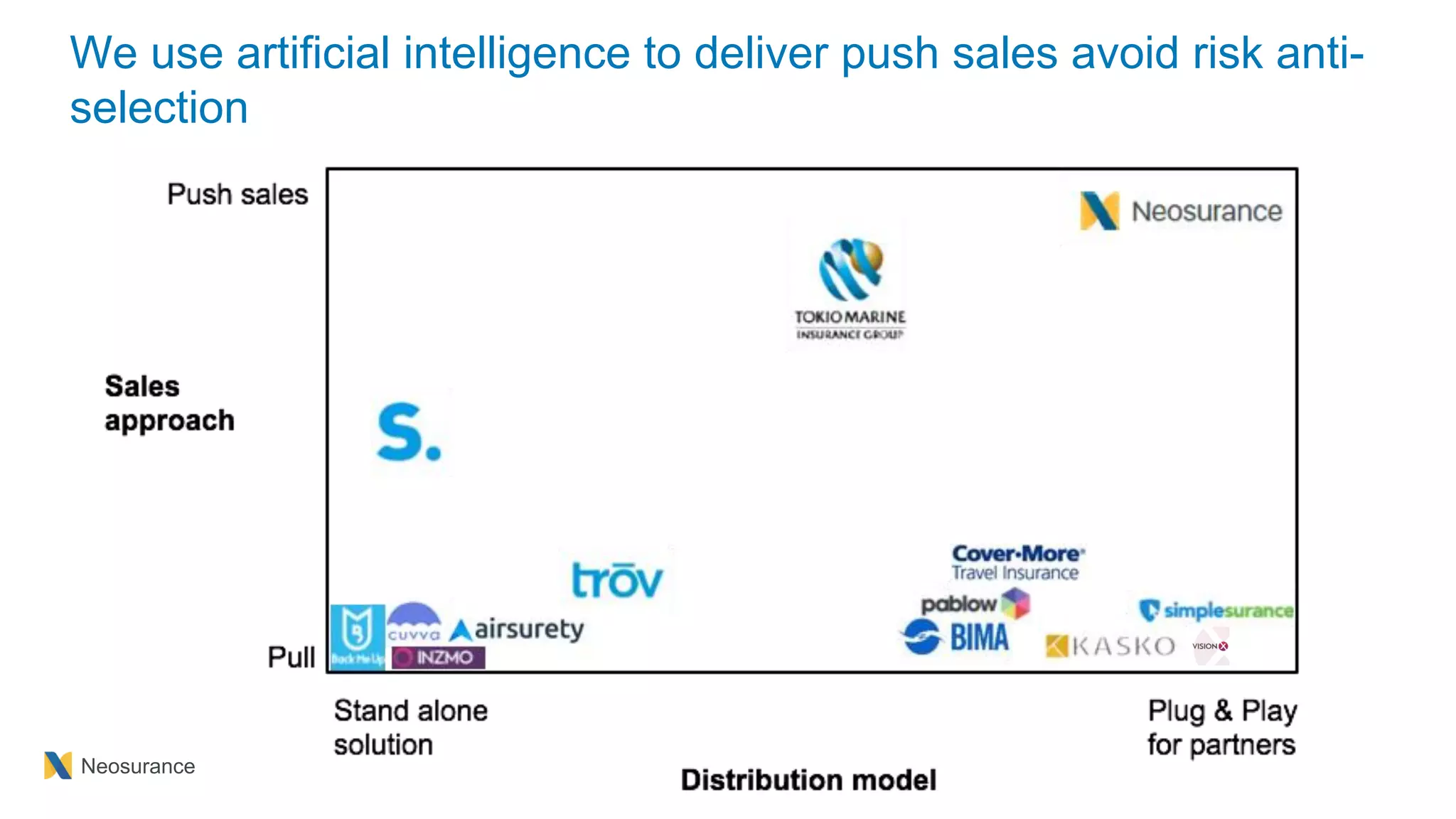

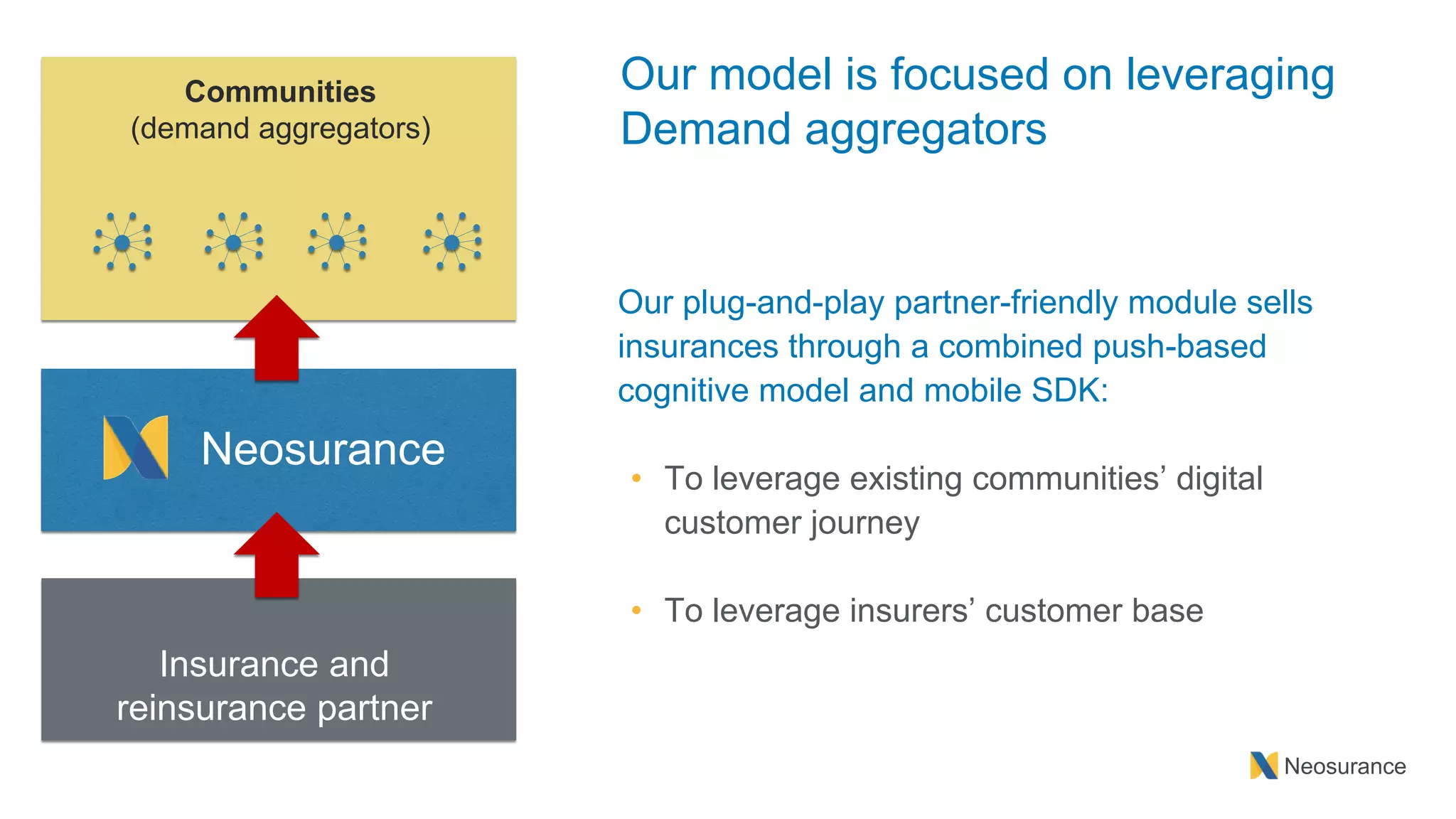

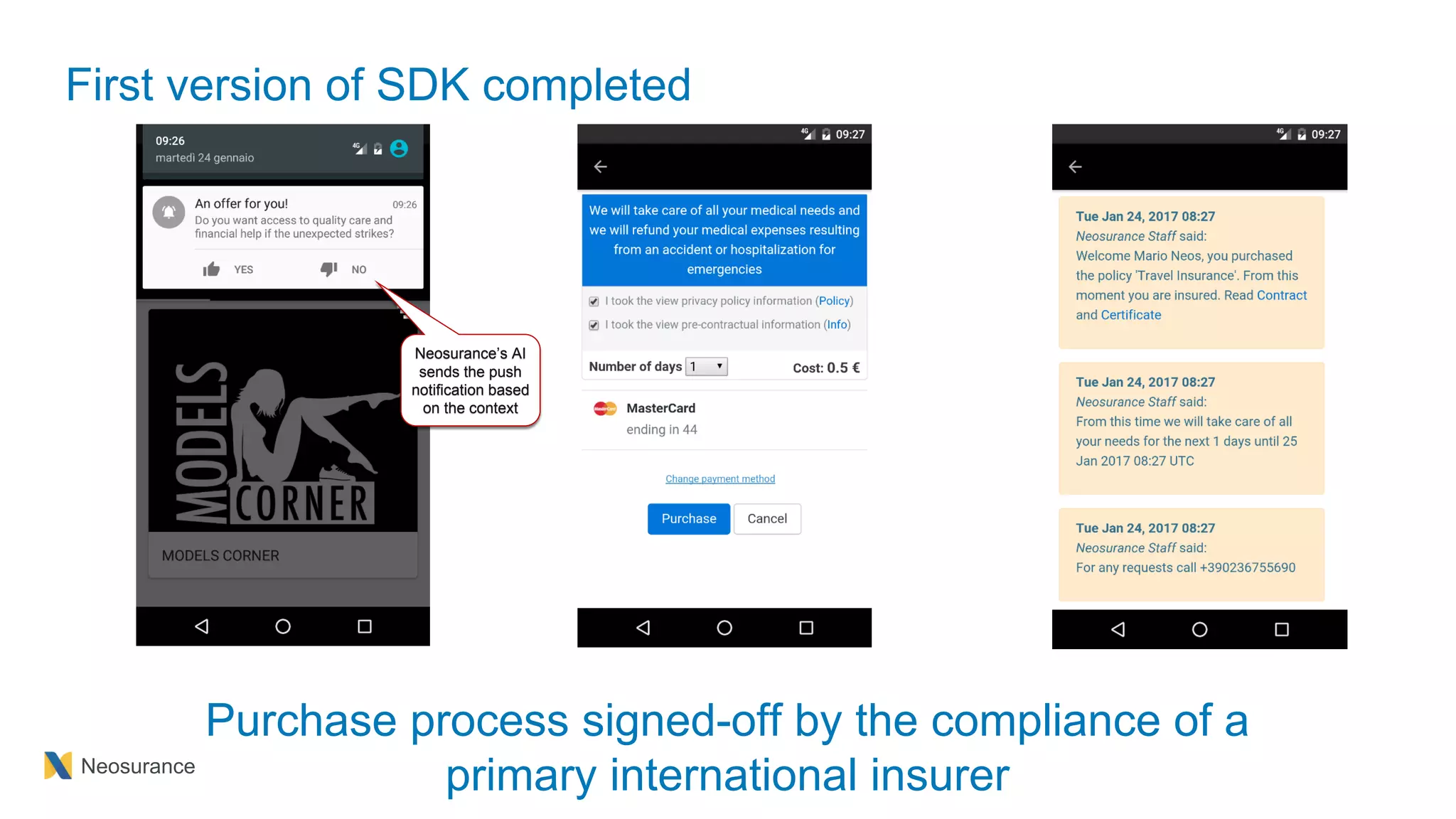

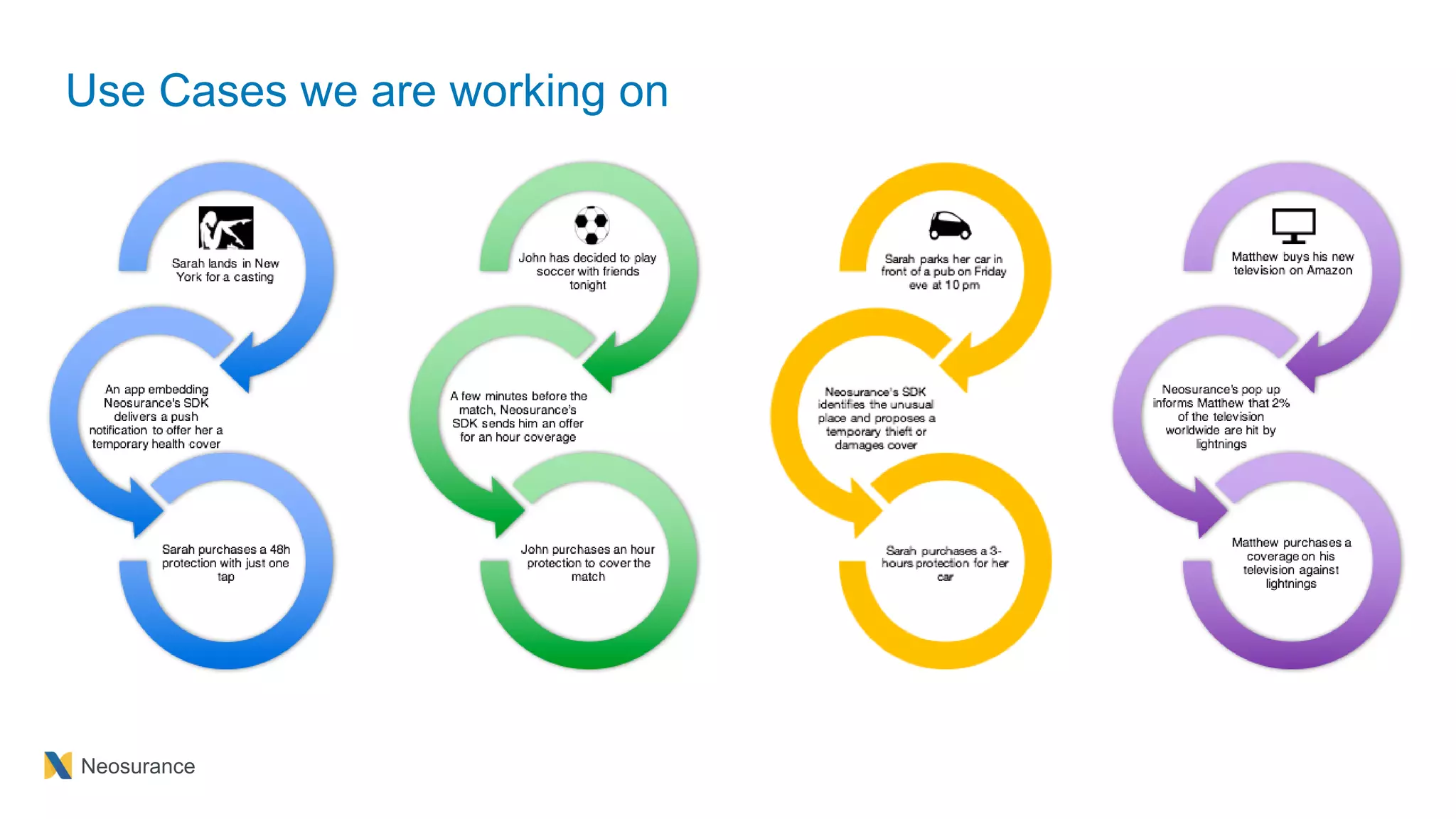

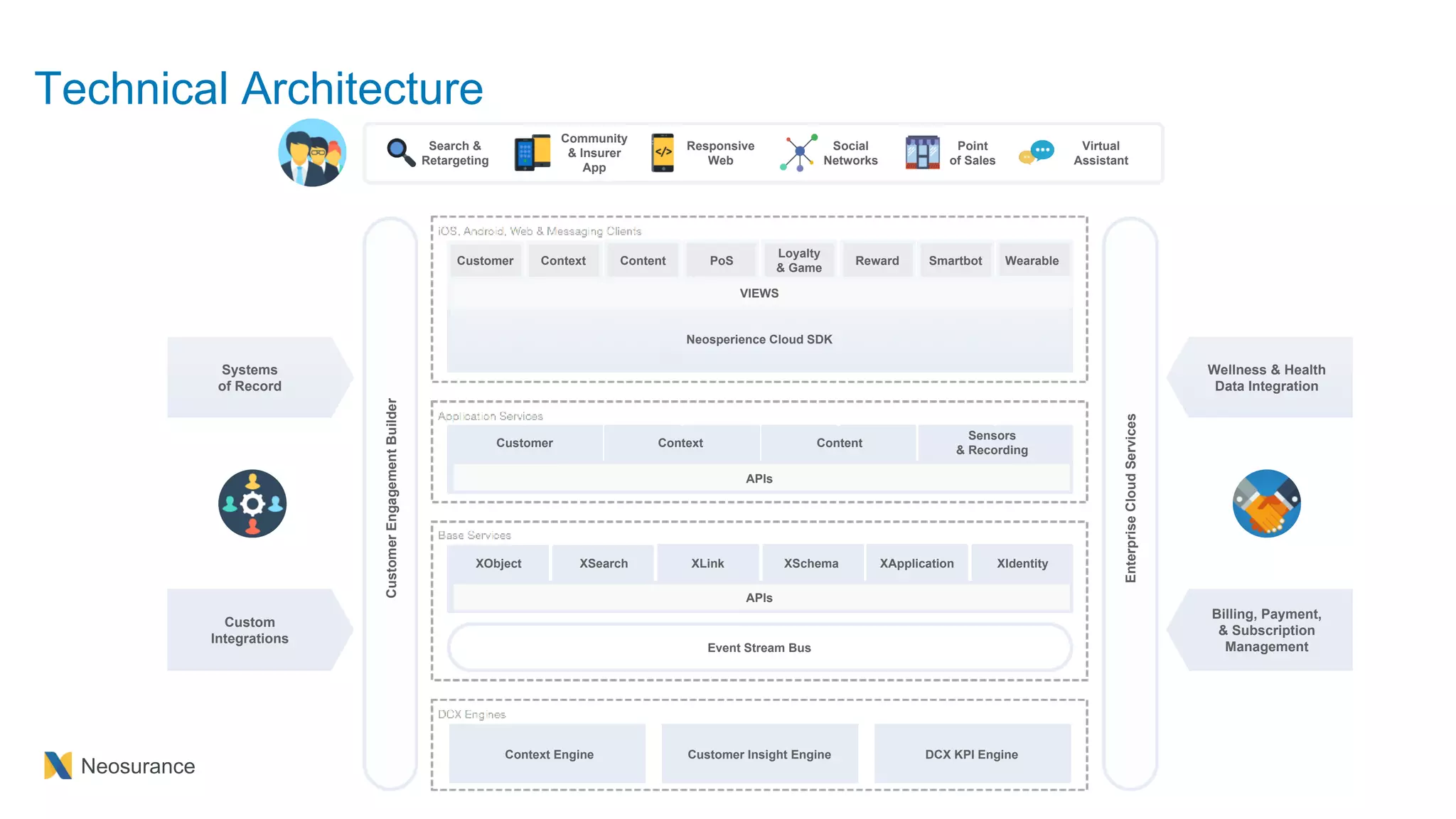

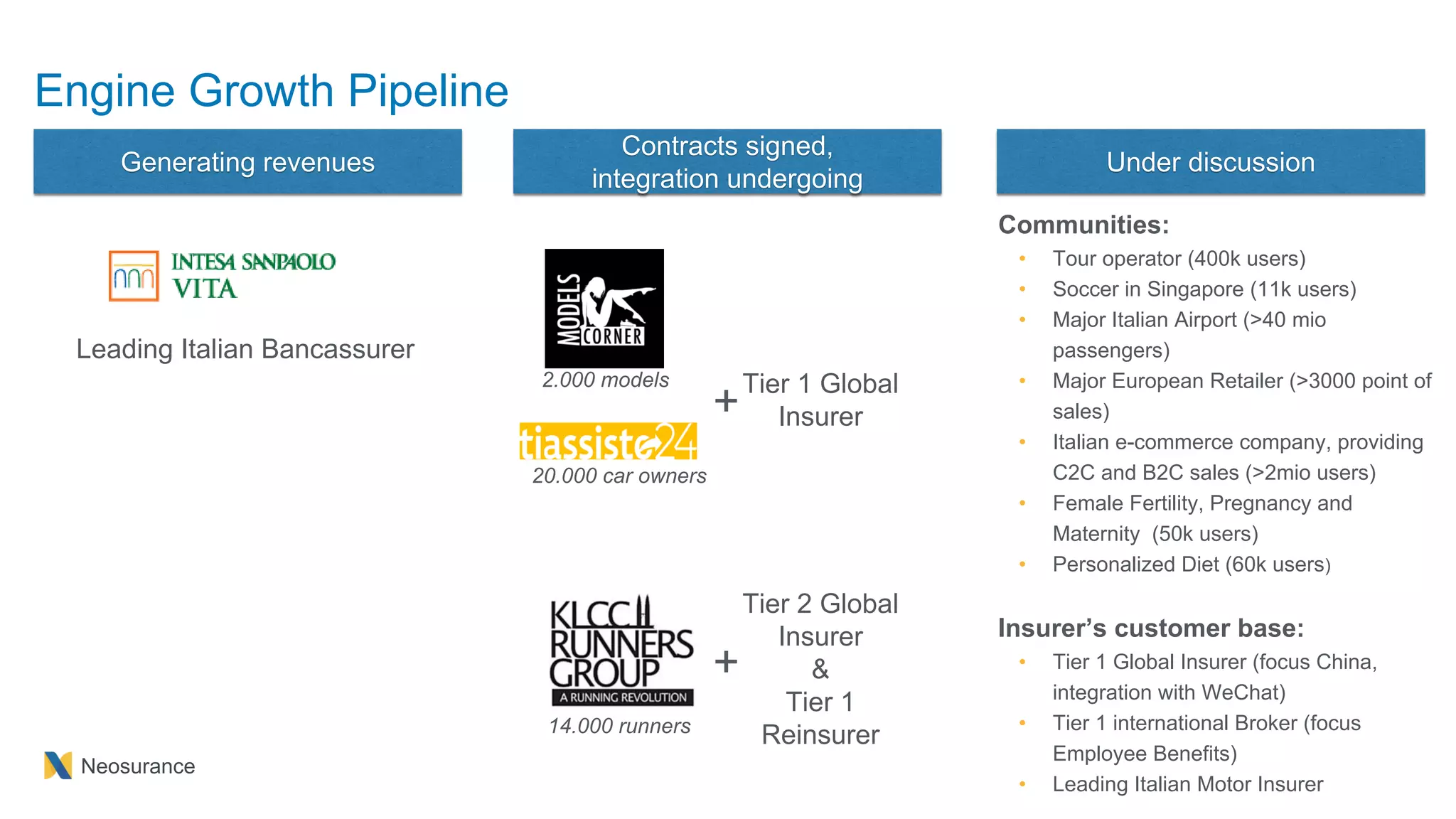

Neosurance is an AI-driven mobile insurance platform aimed at improving customer engagement and addressing the insurance protection gap by providing personalized coverage via smartphones. It focuses on leveraging existing digital communities and customer behaviors to deliver timely insurance notifications and sales opportunities. The company has received multiple awards and funding, indicating strong recognition in the insurtech space as it prepares for growth with a diverse team and strategic partnerships.