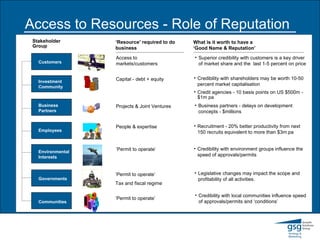

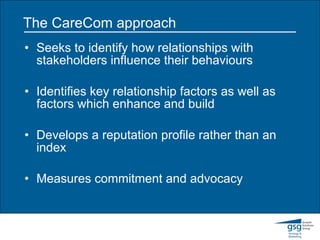

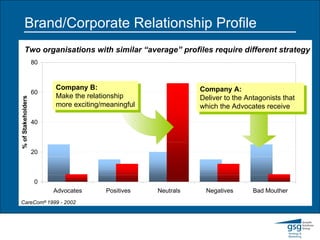

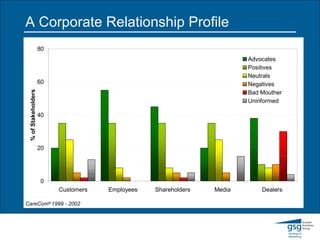

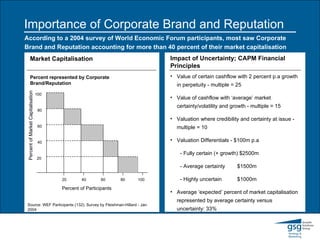

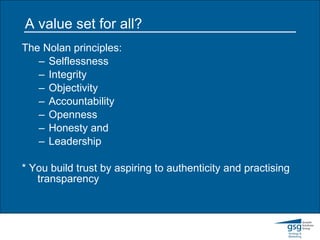

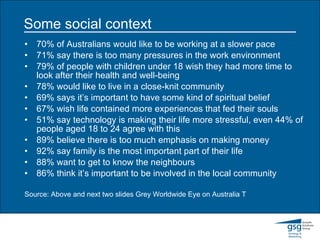

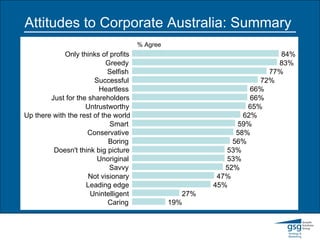

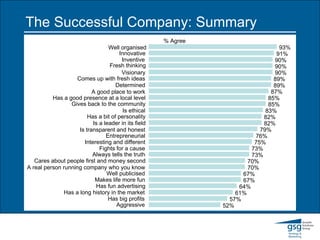

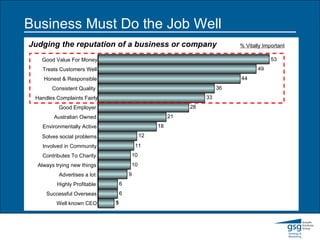

The document summarizes a presentation about understanding the current social and political climate and its implications. It discusses stakeholder relations, reputation management, and the importance of trust and authenticity. It notes that while CSR is important, it may not be enough to change attitudes on its own. Building trust through transparent relationships with key stakeholders is important for reputation and should be a priority.

![Corporate Brand & Reputation Building Blocks There are a set of conceptual building blocks for Corporate Reputation that incorporate the logic that a ‘good reputation’ is an asset that provides access to the sort of resources and support that is critical to an organisations success Reputation is an asset of value . [It’s synonymous with Corporate Brand ] Reputation largely exists in the heads of strategic stakeholders - and is primarily shaped by their experiences and interaction with the company. The benefits of a (good) reputation come from superior outcomes in gaining access to resources or support from strategic stakeholders . A reputation is enhanced by the organisation delivering on its value proposition to specific stakeholder groups (provided the value proposition is relevant and ‘valuable’). A reputation can be managed proactively or reactively , but is sometimes affected by events beyond the control of management.](https://image.slidesharecdn.com/thestakeholderclimate-100601015250-phpapp02/85/The-stakeholder-climate-31-320.jpg)