Asset Managers and ESG

•

2 likes•187 views

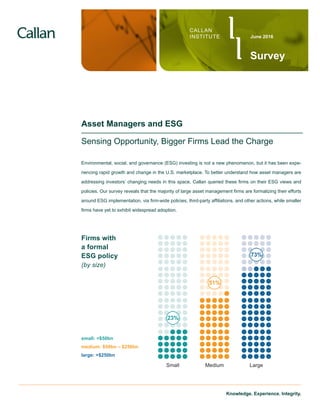

This document summarizes the results of a survey conducted by Callan Institute regarding asset managers' approaches to environmental, social, and governance (ESG) investing. The survey found that larger asset management firms are more likely to have formal ESG policies and sign the UN Principles for Responsible Investment. Over half of firms surveyed do not have an ESG policy, but interest is growing. Larger firms see greater opportunities in ESG strategies and expect increasing client demand from the US, Canada, and Europe.

Report

Share

Report

Share

Download to read offline

Recommended

Callan DC Survey Key Findings 2017

Highlights from our annual survey of defined contribution (DC) plan sponsors

Artifex guide to succesful esg investing

An introduction to ESG (Environmental, Social and Governance) Investing from Artifex Financial Group, a leader in ESG portfolio research and management.

Socially Responsible Investing - Keynote - "State of the Union"

In June 2010, Mark was asked to present a one-hour keynote on the state of research into socially responsible investing. This was presented in NYC to a large group organized by Steve Scheuth and his SRI in the Rockies / First Affirmative Financial organizations.

The “Buy Side” View on CEO Pay

By David F. Larcker, Brendan Sheehan, and Brian Tayan

September 1, 2016, Stanford Corporate Governance Initiative, and Stanford Rock Center for Corporate Governance

LFA ✩ Swiss wealth management for US clients ✩ ESG Investing - With a Sense o...

In addition to traditional investment strategies, LFA has a strong focus on ESG environmental, social and governance investing.

Recommended

Callan DC Survey Key Findings 2017

Highlights from our annual survey of defined contribution (DC) plan sponsors

Artifex guide to succesful esg investing

An introduction to ESG (Environmental, Social and Governance) Investing from Artifex Financial Group, a leader in ESG portfolio research and management.

Socially Responsible Investing - Keynote - "State of the Union"

In June 2010, Mark was asked to present a one-hour keynote on the state of research into socially responsible investing. This was presented in NYC to a large group organized by Steve Scheuth and his SRI in the Rockies / First Affirmative Financial organizations.

The “Buy Side” View on CEO Pay

By David F. Larcker, Brendan Sheehan, and Brian Tayan

September 1, 2016, Stanford Corporate Governance Initiative, and Stanford Rock Center for Corporate Governance

LFA ✩ Swiss wealth management for US clients ✩ ESG Investing - With a Sense o...

In addition to traditional investment strategies, LFA has a strong focus on ESG environmental, social and governance investing.

The ESG Ecosystem

This white paper was the culmination of a series of webinars and in-person conversations with corporate practitioners in the sustainability field. It provides the end user with an understanding of the ESG ratings and rankings field and helps prioritize engagement with the most influential organizations in the field.

The State of Corporate Reputation in 2020: Everything Matters Now

This new survey was conducted among executives from 22 markets worldwide and examines what drives a company’s reputation, why it is important to be highly regarded and the benefits that come with having a strong corporate reputation.

Evaluating an M&A strategy to expand impact and enhance outcomes

While organizational objectives can be achieved by establishing one-off partnerships and informal collaborations, some not-for-profits have elected

to expand impact by formalizing relationships via an M&A (Mergers & Acquisitions) strategy.

5 major opportunities awaiting manufacturers and their CFOs

It’s an exciting time to be in manufacturing. Revenues are on the rise, employment is up, and with potential for increased profits, today’s manufacturing CFOs understand that their role goes beyond the bottom line. A fall 2014 Grant Thornton LLP survey of 350 CFOs explored some of these burgeoning possibilities. This infographic identifies C-level insights about how to make the most of them.

Find out more about our survey at grantthornton.com/valueaddCFO.

A Practical Guide to ESG Integration for Equity Investing 2016

A Practical Guide to ESG Integration for Equity Investing 2016 from UNPRI

ESG Engagement Inisghts

ESG Engagement Insights, a presentation by Nawar Alsaadi of best engagement practices of 30 asset managers, owners, pension funds, and non-profits around the world. (The work is derived from BlackRock & Ceres’ paper entitled Engagement in the 21st Century).

For effective governance, boards must set a stronger tone

Boards are increasingly setting their own high standards and taking action to meet them.

ESG: The Need for Responsible Investment

These slides discusses on the environmental, social and governance (ESG) factors for responsible investment. It briefly covers the ongoing crisis our world economy is dealing with today, which adversely affects business owners and investors alike.

Navigating the World of ESG Investing

Environmental, Social and Governance (ESG) investing is bringing a new lens to the world of traditional investment management. ESG is increasingly becoming a key decision criterion within the institutional and retail channels as investors seek to ensure that their investments align with their values. In this webinar, we will provide a unique understanding of distribution trends driven by ESG criteria vital to product development and sales strategies for Asset Managers.

Broadridge has partnered with MSCI ESG Research to provide Asset Managers with access to ESG factors for funds. On this webinar, we will provide a detailed overview of ESG investment trends as well as present an overview of a unique set of data that provides ESG transparency on more than 27,000 funds.

Responsible investment: Aligning interests

Responsible investment is rapidly becoming a mainstream concern within the investment industry. The dramatic growth in the number of investors who have adopted the Principles for Responsible Investment (PRI) is only the latest indicator of the increased attention the sector is paying to the integration of environmental, social and governance (ESG) factors into investment management.

Etude PwC "Bridging the gap" sur les investisseurs institutionnels (mai 2015)

Selon la dernière étude du cabinet d’audit et de conseil PwC, intitulée « Bridging the gap », sept investisseurs institutionnels sur dix (70 %) – parmi les 60 qui ont été interrogés par PwC au plan mondial – affirment qu’ils refuseraient de participer à une levée de fonds de private equity ou à un co-investissement si ceux-ci présentaient un risque environnemental, social ou de gouvernance.

Méthodologie :

Pour réaliser cette étude, PwC a mené des entretiens individuels avec 60 commanditaires de 14 pays, totalisant quelque 500 milliards USD d’allocation aux gérants ou general partners (GP) de fonds de private equity. Les participants à l’enquête ont répondu sur la base du volontariat, d’où une surreprésentation probable des investisseurs relativement avancés dans leur approche de l’investissement responsable. Le panel était composé à 30 % de fonds de pension, à 20 % de gestionnaires d’actifs et à 7 % de fonds souverains ou publics. Parmi les répondants figuraient de grands fonds de pension du monde entier, comme le CalSTRS (caisse de retraite de l’enseignement public de Californie), l’USS (caisse de retraite de l’enseignement supérieur britannique), la caisse de retraite de BT, le West Midlands Pension Fund, le Wellcome Trust, un fonds de pension suédois et des fonds confessionnels aux États-Unis et en Finlande. Parmi les principaux gestionnaires d’actifs figuraient les sociétés Aberdeen, Hermes GPE, F&C et BlackRock. 7 investisseurs français ont aussi participé à cette étude comme par exemple BPI France, Ardian ou OFI Asset Management (devenu depuis SWEN Capital Partners).

What is socially responsible investment?

Socially Responsible Investments

Socially responsible investing is one of several similar approaches and concepts that impact how asset managers invest, in a socially responsible way. SRI's have been around for over 30 years in one form or another, and take the desire to make money and use it to create a better world. Companies which generate positive, measurable social and environmental change alongside a financial return. Keep in mind that it is a developing niche and therefore not without hiccups.

Does ESG Investing Work?

ESG investing leads to sustainability and ethical business practices but does ESG investing work when you want to make money? While this way to invest is a positive social force, does ESG investing work to increase your investment assets? Or is it a way to give to charitable causes while being disguised as a way to invest? Will you make money investing this way or would you do better simply giving your money to a cause that you support?

https://youtu.be/YXdOIB5uV_8

Chairman and CEO: The Controversy over Board Leadership Structure

Chairman and CEO: The Controversy over Board Leadership Structure Stanford GSB Corporate Governance Research Initiative

David F. Larcker and Brian Tayan

Stanford Closer Look Series

June 24, 2016

One of the most controversial issues in corporate governance is whether the CEO of a corporation should also serve as chairman of the board. In theory, an independent board chair improves the ability of the board to oversee management. However, an independent chairman is not unambiguously positive, and can lead to duplication of leadership, impair decision making, and create internal confusion—particularly when an effective dual chairman/CEO is already in place.

In this Closer Look, we examine in detail the leadership structure of publicly traded corporations and the circumstances under which they are changed. We ask:

• What factors should the board consider in deciding whether to combine or separate board leadership?

• How can the board weigh the tradeoffs between stability of leadership, efficient decision making, and decreased oversight?

• What structure should be the default setting for a corporation?

• Why do activists advocate that corporations strictly separate the roles when there is little research support for this position?

Stakeholders and Shareholders: Are Executives Really “Penny Wise and Pound Fo...

Stakeholders and Shareholders: Are Executives Really “Penny Wise and Pound Fo...Stanford GSB Corporate Governance Research Initiative

David F. Larcker, Brian Tayan, Vinay Trivedi, and Owen Wurzbacher, Stanford Closer Look Series, July 2, 2019

Currently, there is much debate about the role that non-investor stakeholder interests play in the governance of public companies. Critics argue that greater attention should be paid to the interest of stakeholders and that by investing in initiatives and programs to promote their interests, companies will create long-term value that is greater, more sustainable, and more equitably shared among investors and society. However, advocacy for a more stakeholder-centric governance model is based on assumptions about managerial behavior that are relatively untested. In this Closer Look, we examine survey data of the CEOs and CFOs of companies in the S&P 1500 Index to understand the extent to which they incorporate stakeholder needs into the business planning and long-term strategy, and their view of the costs and benefits of ESG-related programs.

We ask:

• What are the real costs and benefits of ESG?

• How do companies signal to constituents that they take ESG activities seriously?

• How accurate are the ratings of third-party providers that rate companies on ESG factors?

• Do boards understand the short- and long-term impact of ESG activities?

• Do boards believe this investment is beneficial for the company?

Let your Values Guide your Investing: Socially Responsible, ESG & Impact Inve...

Let your Values Guide your Investing: Socially Responsible, ESG & Impact Inve...Balanced Rock Investment Advisors

Balanced Rock Investment Advisors educational presentation on alternative investment strategies that reflect personal values.

Presented @ Brookline Library - 10.15.2015More Related Content

What's hot

The ESG Ecosystem

This white paper was the culmination of a series of webinars and in-person conversations with corporate practitioners in the sustainability field. It provides the end user with an understanding of the ESG ratings and rankings field and helps prioritize engagement with the most influential organizations in the field.

The State of Corporate Reputation in 2020: Everything Matters Now

This new survey was conducted among executives from 22 markets worldwide and examines what drives a company’s reputation, why it is important to be highly regarded and the benefits that come with having a strong corporate reputation.

Evaluating an M&A strategy to expand impact and enhance outcomes

While organizational objectives can be achieved by establishing one-off partnerships and informal collaborations, some not-for-profits have elected

to expand impact by formalizing relationships via an M&A (Mergers & Acquisitions) strategy.

5 major opportunities awaiting manufacturers and their CFOs

It’s an exciting time to be in manufacturing. Revenues are on the rise, employment is up, and with potential for increased profits, today’s manufacturing CFOs understand that their role goes beyond the bottom line. A fall 2014 Grant Thornton LLP survey of 350 CFOs explored some of these burgeoning possibilities. This infographic identifies C-level insights about how to make the most of them.

Find out more about our survey at grantthornton.com/valueaddCFO.

A Practical Guide to ESG Integration for Equity Investing 2016

A Practical Guide to ESG Integration for Equity Investing 2016 from UNPRI

ESG Engagement Inisghts

ESG Engagement Insights, a presentation by Nawar Alsaadi of best engagement practices of 30 asset managers, owners, pension funds, and non-profits around the world. (The work is derived from BlackRock & Ceres’ paper entitled Engagement in the 21st Century).

For effective governance, boards must set a stronger tone

Boards are increasingly setting their own high standards and taking action to meet them.

ESG: The Need for Responsible Investment

These slides discusses on the environmental, social and governance (ESG) factors for responsible investment. It briefly covers the ongoing crisis our world economy is dealing with today, which adversely affects business owners and investors alike.

Navigating the World of ESG Investing

Environmental, Social and Governance (ESG) investing is bringing a new lens to the world of traditional investment management. ESG is increasingly becoming a key decision criterion within the institutional and retail channels as investors seek to ensure that their investments align with their values. In this webinar, we will provide a unique understanding of distribution trends driven by ESG criteria vital to product development and sales strategies for Asset Managers.

Broadridge has partnered with MSCI ESG Research to provide Asset Managers with access to ESG factors for funds. On this webinar, we will provide a detailed overview of ESG investment trends as well as present an overview of a unique set of data that provides ESG transparency on more than 27,000 funds.

Responsible investment: Aligning interests

Responsible investment is rapidly becoming a mainstream concern within the investment industry. The dramatic growth in the number of investors who have adopted the Principles for Responsible Investment (PRI) is only the latest indicator of the increased attention the sector is paying to the integration of environmental, social and governance (ESG) factors into investment management.

Etude PwC "Bridging the gap" sur les investisseurs institutionnels (mai 2015)

Selon la dernière étude du cabinet d’audit et de conseil PwC, intitulée « Bridging the gap », sept investisseurs institutionnels sur dix (70 %) – parmi les 60 qui ont été interrogés par PwC au plan mondial – affirment qu’ils refuseraient de participer à une levée de fonds de private equity ou à un co-investissement si ceux-ci présentaient un risque environnemental, social ou de gouvernance.

Méthodologie :

Pour réaliser cette étude, PwC a mené des entretiens individuels avec 60 commanditaires de 14 pays, totalisant quelque 500 milliards USD d’allocation aux gérants ou general partners (GP) de fonds de private equity. Les participants à l’enquête ont répondu sur la base du volontariat, d’où une surreprésentation probable des investisseurs relativement avancés dans leur approche de l’investissement responsable. Le panel était composé à 30 % de fonds de pension, à 20 % de gestionnaires d’actifs et à 7 % de fonds souverains ou publics. Parmi les répondants figuraient de grands fonds de pension du monde entier, comme le CalSTRS (caisse de retraite de l’enseignement public de Californie), l’USS (caisse de retraite de l’enseignement supérieur britannique), la caisse de retraite de BT, le West Midlands Pension Fund, le Wellcome Trust, un fonds de pension suédois et des fonds confessionnels aux États-Unis et en Finlande. Parmi les principaux gestionnaires d’actifs figuraient les sociétés Aberdeen, Hermes GPE, F&C et BlackRock. 7 investisseurs français ont aussi participé à cette étude comme par exemple BPI France, Ardian ou OFI Asset Management (devenu depuis SWEN Capital Partners).

What is socially responsible investment?

Socially Responsible Investments

Socially responsible investing is one of several similar approaches and concepts that impact how asset managers invest, in a socially responsible way. SRI's have been around for over 30 years in one form or another, and take the desire to make money and use it to create a better world. Companies which generate positive, measurable social and environmental change alongside a financial return. Keep in mind that it is a developing niche and therefore not without hiccups.

Does ESG Investing Work?

ESG investing leads to sustainability and ethical business practices but does ESG investing work when you want to make money? While this way to invest is a positive social force, does ESG investing work to increase your investment assets? Or is it a way to give to charitable causes while being disguised as a way to invest? Will you make money investing this way or would you do better simply giving your money to a cause that you support?

https://youtu.be/YXdOIB5uV_8

Chairman and CEO: The Controversy over Board Leadership Structure

Chairman and CEO: The Controversy over Board Leadership Structure Stanford GSB Corporate Governance Research Initiative

David F. Larcker and Brian Tayan

Stanford Closer Look Series

June 24, 2016

One of the most controversial issues in corporate governance is whether the CEO of a corporation should also serve as chairman of the board. In theory, an independent board chair improves the ability of the board to oversee management. However, an independent chairman is not unambiguously positive, and can lead to duplication of leadership, impair decision making, and create internal confusion—particularly when an effective dual chairman/CEO is already in place.

In this Closer Look, we examine in detail the leadership structure of publicly traded corporations and the circumstances under which they are changed. We ask:

• What factors should the board consider in deciding whether to combine or separate board leadership?

• How can the board weigh the tradeoffs between stability of leadership, efficient decision making, and decreased oversight?

• What structure should be the default setting for a corporation?

• Why do activists advocate that corporations strictly separate the roles when there is little research support for this position?

Stakeholders and Shareholders: Are Executives Really “Penny Wise and Pound Fo...

Stakeholders and Shareholders: Are Executives Really “Penny Wise and Pound Fo...Stanford GSB Corporate Governance Research Initiative

David F. Larcker, Brian Tayan, Vinay Trivedi, and Owen Wurzbacher, Stanford Closer Look Series, July 2, 2019

Currently, there is much debate about the role that non-investor stakeholder interests play in the governance of public companies. Critics argue that greater attention should be paid to the interest of stakeholders and that by investing in initiatives and programs to promote their interests, companies will create long-term value that is greater, more sustainable, and more equitably shared among investors and society. However, advocacy for a more stakeholder-centric governance model is based on assumptions about managerial behavior that are relatively untested. In this Closer Look, we examine survey data of the CEOs and CFOs of companies in the S&P 1500 Index to understand the extent to which they incorporate stakeholder needs into the business planning and long-term strategy, and their view of the costs and benefits of ESG-related programs.

We ask:

• What are the real costs and benefits of ESG?

• How do companies signal to constituents that they take ESG activities seriously?

• How accurate are the ratings of third-party providers that rate companies on ESG factors?

• Do boards understand the short- and long-term impact of ESG activities?

• Do boards believe this investment is beneficial for the company?

Let your Values Guide your Investing: Socially Responsible, ESG & Impact Inve...

Let your Values Guide your Investing: Socially Responsible, ESG & Impact Inve...Balanced Rock Investment Advisors

Balanced Rock Investment Advisors educational presentation on alternative investment strategies that reflect personal values.

Presented @ Brookline Library - 10.15.2015What's hot (20)

The State of Corporate Reputation in 2020: Everything Matters Now

The State of Corporate Reputation in 2020: Everything Matters Now

Evaluating an M&A strategy to expand impact and enhance outcomes

Evaluating an M&A strategy to expand impact and enhance outcomes

5 major opportunities awaiting manufacturers and their CFOs

5 major opportunities awaiting manufacturers and their CFOs

A Practical Guide to ESG Integration for Equity Investing 2016

A Practical Guide to ESG Integration for Equity Investing 2016

For effective governance, boards must set a stronger tone

For effective governance, boards must set a stronger tone

Etude PwC "Bridging the gap" sur les investisseurs institutionnels (mai 2015)

Etude PwC "Bridging the gap" sur les investisseurs institutionnels (mai 2015)

Chairman and CEO: The Controversy over Board Leadership Structure

Chairman and CEO: The Controversy over Board Leadership Structure

cgri-stanford-survey-ceos-and-directors-ceo-pay-2016-final

cgri-stanford-survey-ceos-and-directors-ceo-pay-2016-final

Stakeholders and Shareholders: Are Executives Really “Penny Wise and Pound Fo...

Stakeholders and Shareholders: Are Executives Really “Penny Wise and Pound Fo...

Let your Values Guide your Investing: Socially Responsible, ESG & Impact Inve...

Let your Values Guide your Investing: Socially Responsible, ESG & Impact Inve...

Viewers also liked

Callan Periodic Table of Investment Returns 2017

Our annual illustration of the importance of diversification

Risky Business

Callan research that found investors over the last 20 years have had to take on three times as much risk to earn the same return electrified the institutional investing community. The Published Research Group interviewed Jay Kloepfer and Julia Moriarty about how the research was done and its implications.

Viewers also liked (6)

Similar to Asset Managers and ESG

Nonprofit Investing Survey Results

The results suggest that there is a real opportunity to improve the investment process so nonprofits can better protect the capital they’ve worked so hard to raise. I hope you find the results as interesting as I did. Please feel free to reach out to me directly if you have questions.

Stakeholders Take Center Stage: Director Views on Priorities and Society

Stakeholders Take Center Stage: Director Views on Priorities and SocietyStanford GSB Corporate Governance Research Initiative

By David F. Larcker, Brian Tayan, Dottie Schindlinger and Anne Kors, CGRI Survey Series. Corporate Governance Research Initiative, Stanford Rock Center for Corporate Governance and the Diligent Institute, November 2019

New research from the Rock Center for Corporate Governance at Stanford University and the Diligent Institute finds that corporate directors are not as shareholder-centric as commonly believed and that companies do not put the needs of shareholders significantly above the needs of their employees or society at large. Instead, directors pay considerable attention to important stakeholders—particularly their workforce—and take the interests of these groups into account as part of their long-term business planning.

• While directors are largely satisfied with their ESG-related efforts, they do not believe the outside world understands or appreciates the work they do.

• Directors recognize that tensions exist between shareholder and stakeholder interests. That said,

most believe their companies successfully balance this tension.

• In general, directors reject the view that their companies have a short-term investment horizon in

running their businesses.

In the summer of 2019, the Diligent Institute and the Rock Center for Corporate Governance at Stanford University surveyed nearly 200 directors of public and private corporations globally to better understand how they balance shareholder and stakeholder needs.

Corporate Social Responsibility (CSR) - The Fact's You Should Know 2013-14

Corporate Social Responsibility (CSR) and Sustainability - The facts you should know. A review of some of the ground breaking research conducted over the past couple of years. Looking at; public perceptions, business leaders views, consumer trends, investors opinions, employee engagement, graduates, risks and where's the value. www.4frontconsulting.com

Methodical Investment Management

Methodical presentation to the Senate Group. Intended for professional investors only.

How CFOs Are Helping Corporations Integrate ESG Into Their Business Strategie...

Many high executives have not yet incorporated ESG reporting in their annual

reports and businesses, while others have just started to do so. While many companies made

no commitments, they struggled to deliver perfect reporting in all their involvements. To redefine

your organization’s ESG goal and scrutiny purposes, engaging with the CFOs strategic plans

for flourishing business growth is essential.

Factors: Finding a place in institutional investors' arsenal

Institutional investors are always looking for better ways to increase returns, reduce risk and achieve specific investment goals. Particularly in the wake of the financial crisis, investors have been seeking more robust ways to diversify and reduce risk.

A Hands On Future for Endowment and Foundation Funds

Endowments and foundations funds are taking a new approach to risk as they seek to boost their investment funds.

2017 Edelman Trust Barometer Special Report: Investor Trust Executive Summary

The 2017 Edelman Trust Barometer Special Report: Institutional Investors, a survey of institutional investors who invest in global equities highlights emerging business risks and opportunities for companies, their boards, and management to build and maintain trust with the financial community.

The inaugural report reveals that roughly half of institutional investors think that most companies do not acknowledge the risks to their business from the current political climate, reflecting broader concerns raised in the Trust Barometer Global Report 2017.

Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...

Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...Canadian Business for Social Responsibility (CBSR)

The ES&G Accountability Forum (2013) provided participants and panelists with an opportunity to examine the question of how information (both financial and non-financial) can best be provided in a form that is useful to decision makers that are affected by, or have an affect on Canada’s companies.

This document captures key points made by panelists, their answers to questions posed, and the Forum’s participants’ table discussions. It is organized around each panel: investors, companies, evaluation organizations. We hope to encourage all groups to consider the advice and comments discussed at the Forum, and to take action on the outstanding questions and issues to improve the state of ES&G disclosure, analysis and investing that are highlighted on pages 9 & 10.

This year on September 23, 2014 in Calgary, many of these unanswered questions will be addressed at the ES&G Forum 2014: "Non-financial performance... A missed opportunity?"

Building on the last two years' discussions, participants will hear how investors and businesses are implementing innovative methods to manage investor demand for ES&G information. To learn more about & register for this year's ES&G Forum, please visit: http://bit.ly/esg-forum-2014How to Put a Value on your CSR Efforts

We discuss how to set up a measurement program for Corporate Social Responsibility Communications Efforts

The Shifting Sands of Social Responsibility IR Update May 2011

Communicating your company's environmental, social and governance priorities is no longer a practice to consider, its a practice to execute.

Similar to Asset Managers and ESG (20)

Stakeholders Take Center Stage: Director Views on Priorities and Society

Stakeholders Take Center Stage: Director Views on Priorities and Society

2014 state of global strategy and leadership survey report updated

2014 state of global strategy and leadership survey report updated

Corporate Social Responsibility (CSR) - The Fact's You Should Know 2013-14

Corporate Social Responsibility (CSR) - The Fact's You Should Know 2013-14

How CFOs Are Helping Corporations Integrate ESG Into Their Business Strategie...

How CFOs Are Helping Corporations Integrate ESG Into Their Business Strategie...

Factors: Finding a place in institutional investors' arsenal

Factors: Finding a place in institutional investors' arsenal

London 2015 Speaker Slide Template 16-9 FINAL copy

London 2015 Speaker Slide Template 16-9 FINAL copy

A Hands On Future for Endowment and Foundation Funds

A Hands On Future for Endowment and Foundation Funds

2017 Edelman Trust Barometer Special Report: Investor Trust Executive Summary

2017 Edelman Trust Barometer Special Report: Investor Trust Executive Summary

Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...

Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...

The Shifting Sands of Social Responsibility IR Update May 2011

The Shifting Sands of Social Responsibility IR Update May 2011

More from Callan

Momentum: The Trend Is Your Friend

Callan's director of Hedge Fund Research, Jim McKee, explores the advantages of momentum-based investing strategies, which profit from market trends in whichever direction. He discusses the rationale behind them, how they are defined and harnessed for different diversification needs, and whether they are appropriate for fund sponsors.

The Renaissance of Stable Value: Capital Preservation in Defined Contribution

*Stable value funds are low-risk investment options in participant directed plans that mix capital preservation with return generation. They invest in high-quality, short- and intermediate-duration fixed income securities, and utilize wrap contracts to insulate individual plan participants from market value fluctuations.

*Stable value funds serve as an alternative to more volatile or risky asset classes and are a direct substitute for a money market fund. They typically offer a more attractive yield than money market funds, except during periods when short-term rates are rising rapidly.

*This paper describes how the underlying mix of securities and issuer characteristics have evolved since the financial crisis, and why Callan sees stable value as a healthy and important part of the U.S. retirement plan marketplace.

Introduction

In this paper, we seek to answer questions defined contribution (DC) plan sponsors and their participants may have about stable value funds, including mechanics, instruments, liquidity, and implementation considerations. We also look at risk and performance, address benchmarking issues, cover recent trends, and provide key takeaways for DC plan sponsors.

Stable value funds are popular with DC plans and 529 college saving investors. According to Callan’s DC Index™, 65% of DC plans offer a stable value fund, and typically 14% of total plan assets are in such funds when offered.

We believe stable value can be an effective investment option for DC plan participants seeking capital preservation.

Grading the Pensions Protection Act, 10 Years Later

Do you remember the Pension Protection Act (PPA)? More than 900 pages of legislation touching seemingly every part of the retirement system. It presented challenges for defined benefits plans. Defined contribution (DC) plans instead saw beneficial provisions, including the permanence of certain provisions of the 2001 Economic Growth Tax Relief Reconciliation Act (EGTRRA) and the creation of safe harbors for using target date funds as defaults and for implementing automatic enrollment.

The PPA heralded a new era for DC plans with the potential to greatly increase workers’ access to retirement income security. But looking at the PPA’s report card, we do not see “straight As” over the last decade.

Many of the provisions took years to enact, and plan sponsors still seem to struggle with them. As the PPA celebrates 10 years, we ask: Was it successful? Did it transform DC plans in the way the industry had hoped? How can we do better?

Callan gives a grade to the performance of nine key PPA provisions over the past decade. We start with the least effective.

2016 Defined Contribution Trends Survey

What’s on the minds of larger defined contribution (DC) plan sponsors? According to a recently released Callan Associates study conducted in late 2015 with almost 150 employers, fees, investments and compliance top the list. With more resources devoted to running this DC plan, what happens in the larger market usually trickles down market.

Though the number one action taken to reduce fiduciary liability was updating or reviewing their investment policy statement, followed by reviewing fees, the number one priority in 2016 will be compliance.

Other key findings from the Callan DC study include:

*61% use auto-enrollment with 1 in 5 employing re-enrollment for current employees

*88% of plans offer financial advice to employees

*75% benchmark their fees as part of fee calculation and 53% rebate revenue sharing

*86% use TDFs (target date funds) as their default option of QDIA – usage of the proprietary funds of the record keeper as their QDIA is down to 32% from 70% in 2011

*15% of plans increased the number of funds while 11% decreased the number

The DOL’s 2012 fee disclosure regs and the 2006 Pension Protection Act (PPA) were cited as the most important events affecting DC plans showing that fees and auto features paved by the PPA are keys drivers for lawmakers and plan sponsors.

Though there is a lot of noise about the pending DOL conflict of interest rule aimed at increasing oversight of DC plans as well as IRAs, most affected will be advisors, especially those selling proprietary products, and broker dealers that will have to impose greater scrutiny over their advisors that manage DC plans and IRAs.

The DOL rule could limit plan participants access to advisors and advice as well as education especially when they separate from employment but will have little impact on employers running their plan.

Target Date Funds - Finding the Right Vehicle for the Road to Retirement

There seems to be no stopping target date fund (TDF) strategies, which are growing both in use within defined contribution (DC) plans and in products available. Each TDF manager differs in their underlying philosophy, which shapes construction and implementation.

The wide variety of options represents both a benefit and a challenge. As plan sponsors examine and monitor TDF options they must be aware of the differences and how these differences can ultimately affect participant outcomes.

This paper draws on Callan’s comprehensive data on TDFs and DC plans, which is gathered and analyzed annually.

We present key findings and highlight questions plan sponsors may want to consider when evaluating their TDF options.

***

Just as people rely on cars to get them where they need to go, Americans increasingly depend on TDFs to help them achieve their retirement goals. For the first time since the inception of the Callan DC Index™ in 2006, TDFs (25%) recently beat out U.S. large cap equity (24%) as the largest portfolio allocation in DC plans.

As part of Callan’s annual DC Trends Survey, more than 140 DC plan sponsors were asked about their use of TDFs. Callan also annually collects qualitative and quantitative data from target date managers representing both mutual funds and collective trusts. This paper leverages this combined data to examine the current state of the TDF universe and the differentiating characteristics that help drive outcomes.

Defined Contribution Plans and Fee Lawsuits: Stuck in the Mud or the Road to ...

The message is clear for defined contribution (DC) plan sponsors: follow best practices established for plan fees or risk getting stuck in a costly and time-consuming lawsuit.

Nearly 40 401(k) fee lawsuits have been filed since 2006. The first generation of lawsuits focused on revenue-sharing violations, failure to understand specific costs, and use of retail mutual funds in 401(k) lineups. Over time these lawsuits have expanded in scope, covering everything from the prudence of offering certain stable value funds to adherence to investment policy statements.

In addition to monetary payments, settlements have typically included

requirements to:

• Competitively bid plan recordkeeping services

• Engage an outside consultant

• Utilize institutional or retirement-share classes where possible

• Add passively managed funds to the lineup

• Comply with the Department of Labor’s participant disclosure regulation

In this infographic, Callan describes select DC fee lawsuits. We suggest best practices to help plan sponsors keep their plan on the path to success.

Active Share and Product Pairs Analysis

Strategies with high active share have garnered much attention from institutional investors following the release of Martijn Cremers and Antti Petajisto’s research paper that introduced the concept.

In this paper we isolate the impact of active share on performance by focusing on “product pairs,” which are two portfolios that share many characteristics (same management team, basic philosophy, research platform, etc.) but have different degrees of concentration (concentrated vs. diversified), which translates fairly directly to a difference in active share.

We ran several analyses using product pairs identified in Callan’s database in order to better understand— and quantify—the performance differences between concentrated and diversified products managed by the same team. Our analysis reveals the inherent difficulty of identifying reliable predictors of excess return across strategies and over time. High active share may be worthy of consideration as a screening variable, but it is clearly only one of potentially dozens of factors that might influence the magnitude and direction of the excess return for any given strategy over time.

Author Gregory C. Allen is Callan’s President and Director of Research. He oversees Callan’s Fund Sponsor Consulting, Trust Advisory, and multiple other firm-wide research groups.

Greg is a member of Callan’s Management, Alternatives Review, and Client Policy Review Committees. He is also a member of the Investment Committee, which has oversight responsibility for all of Callan’s discretionary multi-manager solutions.

Emerging Managers: Small Firms with Big Ideas

Everybody has to start somewhere, including investment managers. Even the largest firms with broad name recognition and substantial assets were once emerging firms.

Emerging managers generally include smaller and newer investment managers, potentially

with atypical ownership structures. While smaller asset pools can work against them in some cases, it can also work in their favor, enabling them to access opportunities that larger, more established investment managers cannot.

Many U.S. institutional investors have long track records of dedicated investments with emerging managers while others are just starting to examine the space.

Emerging manager programs are becoming more commonplace, particularly at public pension funds, as investors recognize the potential portfolio gains that can be achieved through investing with the diverse and entrepreneurial investment managers that make up the emerging manager space.

Callan has long recognized the value that diversity of professionals and firm size can bring to investment outcomes. Our founder Ed Callan was instrumental in launching Progress Investment Management more than two decades ago. In 2010, we launched Callan Connects to expand our universe of emerging manager and minority, women, and disabled owned firms.

In this interview, Uvan Tseng talks with Lauren Mathias, who oversees Callan Connects, about trends and issues in the emerging manager arena.

Managing Defined Contribution Plan Investments: A Fiduciary Handbook

Employee Retirement Income Security Act (ERISA) fiduciaries face a challenging task: They must familiarize themselves with ERISA's complicated rules of fiduciary conduct. They must understand and evaluate the performance of plan investments, and in doing so, they are subject to ERISA's prudent expert and exclusive purpose standards. In this handbook we focus on defined contribution (DC) plan investment fiduciaries and some of the key issues they face.

What do Money Market Reforms Mean for Investors? A Roundtable Discussion with...

Money market funds are an important source of liquidity and are critical to our financial markets.

Following the financial crisis of 2008, some money market funds “broke the buck,” with net asset values (NAVs) falling below $1 per share. The chaotic scene that ensued surprised investors, and regulators have responded by updating laws to prevent a repeat of that difficult time.

On July 23, 2014, the Securities and Exchange Commission adopted amendments to the rules that govern

money market mutual funds. The amendments address the risks of an investor run on money market funds,

while seeking to preserve the benefits of these funds. The new rules—the second wave of reforms since 2008—are effective October 14, 2014, but have a long compliance period (two years or more) to ease the transition.

New requirements include:

Institutional prime money market funds will have a floating NAV.

Portfolios must value securities according to their current market value and redeem shares based on the floating NAV.

Non-government money market fund boards will now be able to impose liquidity fees and redemption gates to address investor runs.

The 2014 changes further tighten disclosure requirements (e.g., the requirement to disclose a fund’s level

of daily and weekly liquid assets, net flows, and market-based NAV on a website) and define enhanced

diversification requirements and stress testing.

The ruling impacts many institutional investors, including sponsors of defined benefit and defined contribution plans. We assembled a group of Callan experts to highlight key provisions and their potential impacts on investors. Jim Callahan, CFA, manager of Callan’s Fund Sponsor Consulting group, sat down with his colleagues to discuss the latest money market reforms.

Roundtable participants included Bo Abesamis, Steve Center, CFA, and Jimmy Veneruso, CFA, CAIA, from Callan’s Trust and Custody, Fund Sponsor, and Defined Contribution groups.

2014 Callan Investment Manager Fee Survey

Callan’s 2014 Investment Management Fee Survey provides a current report on institutional investment management fee payment practices and trends. To collect this information, Callan sent an electronic questionnaire to a broad sample of U.S.-based institutional fund sponsors and investment management organizations. Respondents provided fee information for calendar year 2013 (specific dates varied by organization, but the majority were as of December 31, 2013), and perspective on fee practices and perspectives for 2014. We supplemented this data with information from Callan’s proprietary databases to establish the trends observed in this report.

Callan conducted similar surveys in 2004, 2006, 2009, and 2011. We offer commentary regarding differences, where relevant, between historical survey results and the 2014 findings, along with observations reflecting both long- and short-term trends.

Seventy-two fund sponsors representing $859 billion in assets, and 211 investment management organizations with $15 trillion in assets under management, provided detailed fee practices and data on 15 asset classes. Results were supplemented by actual and published fee information sourced from Callan’s fund sponsor and investment manager databases, as well as other industry sources.

Key Findings:

*Investment management fees represent 46 basis points (bps), on average, of fund sponsors’ total assets, up from 37 bps in

2009. The difference between the median and average has climbed over this time period. Other data in Callan’s fee survey also reveals a divergence between the funds that pay the most and those that pay the least in investment management fees.

*The range between funds that paid the most (10th percentile) and those that paid the least (90th percentile) increased dramatically:

from 56 bps in 2009 to 73 bps in 2013. Differences in investment policy, and notably asset allocation, can lead to

substantial disparity in fees. While some funds are increasingly looking to low-cost, public market index strategies, others are

investing a greater portion of their portfolio in high-cost alternative assets. Other key survey findings include:

Alternatives, which are consistently the most expensive asset class, are facing fee compression: the median total asset class fee declined from 134 bps in 2009 to 99 bps in 2013, and the 90th percentile fell from 174 bps to 152 bps. Large allocations to alternatives can greatly increase overall investment management fees.

Correlations between percentage of total portfolio allocated to alternatives and fees paid (in bps) were strong in 2013 (+0.70).

Total U.S. and non-U.S. equity fees paid increased marginally from 2009 to 2011, but declined from 2011 to 2013. Median U.S. equity fees run about 60% of their non-U.S. counterparts. Non-U.S. fees are typically higher in part due to research expenses. Fixed income median expenses were flat from 2009 to 2013.

Are Defined Contribution Plans Ready for Alternative Investments?

Amid the growing popularity of the defined contribution (DC) model, the DC industry continues to look for ways to optimize performance.

The outperformance of defined benefit (DB) plans, and the increasing cross-pollination of DB and DC investment staff, has led some DC plans to take a closer look at alternative investments.

We examine three broad areas of alternative investments in relation to the DC market: real estate, hedge funds, and private equity.

Authors: Sally Haskins, Gary Robertson, Jimmy Veneruso

2013 Callan Cost of Doing Business Survey: U.S. Funds and Trusts

Monitoring and controlling costs is a primary fiduciary responsibility for all funds and trusts. In this survey, Callan compares the costs of administering and operating funds and trusts across all types of tax-exempt and tax-qualified organizations in the U.S.

We identify practices and trends to help institutional investors manage expenses.

We fielded this survey in April and May of 2013. The results incorporate responses from 49 fund sponsors representing $219 billion in assets. In this report, we include comparisons with four similar surveys Callan conducted over the past 15 years to identify enduring, long-term trends in fund/trust management and expenses.

Major long-term trends identified include rising external investment management fees and non-investment management external advisor fees, alongside falling custody costs. Allocations have steadily shifted out of U.S. equity and into non-U.S. and global equities, real estate, hedge funds, and private equity since 1998. Other key findings include:

• In 2012, funds spent an average of 54 basis points of total assets to operate their funds. Average total fund expenses have climbed more than 50% since 1998, when Callan first collected this data.

• External investment management fees represent the lion’s share of total fund expenses at 90%. This figure has grown steadily over time, from 83% in 1998. The increase can largely be attributed to growing allocations to more expensive alternative

asset classes, namely hedge funds and private equity.

• More assets flowed to hedge funds and private equity, as the percentage of funds invested in and the average allocations to these asset classes grew. Hedge fund and private equity fees saw modest declines at the median over the last four years, while averages were fairly static. Real estate fees saw little change and the average allocation remained around 6%.

• Not surprisingly, smaller funds—defined as those with less than $1 billion in total assets—pay a premium (65 basis points, on average) to administer their funds relative to mid-sized and larger funds. Conversely, there is little difference between total expenses for the medium (47 basis points) and large funds (48.5 basis points) that responded to our survey. This can

be attributed to differences in asset allocation, as large funds tend to invest in more expensive strategies.

• External investment management fees are the primary driver of total fund expenses. These fees have risen 55% over 15 years. Non-investment management external advisor fees,1 which are the second largest average expense for U.S.

funds, have increased 115% since 1998. However, at 5% of total fund expenses, changes in this area have a more modest impact than external investment management fees.

The Outsourced Chief Investment Officer Model: One Size Does Not Fit All

As investors reach for returns in a sometimes bruising market, they are adding private equity, hedge funds,

and other alternatives, leading to increasingly sophisticated—and complicated—portfolio monitoring and

management. Heightened regulatory and compliance requirements have further increased the time and

resources required to meet fiduciary responsibilities. This has led some investors to consider delegating

investment oversight, monitoring, and management duties.

The industry press regularly reports on a large and rapidly growing outsourced chief investment officer

(OCIO) market, and some fund sponsors wonder if this model would serve them better than the traditional consulting model. Funds managed through an OCIO are beholden to the same challenging market environment and regulatory atmosphere, but the burden of balancing these challenges can be largely shifted from the investment committee to the OCIO provider. Some funds find this solution meets their needs.

In the outsourced chief investment officer (OCIO) model (also known as “implemented consulting,”

“discretionary consulting,” or “delegated consulting”), an institution shifts discretionary authority to an

advisory firm to manage some or all of the investment functions typically performed by the investment committee. The precise definition of this model varies as much as the name, making the size and scope of the marketplace difficult to pin down.

The increasing popularity of this model is in part a response to the frustration investment committees

have felt amid a shifting environment in which portfolio management requires more resources. While an OCIO offers an elegant solution, it is not a panacea for all the issues facing institutional investors, and relinquishing all fiduciary oversight is not an option.

In this paper we describe the OCIO market and Callan’s approach, which acknowledges that each investor faces unique challenges that require custom solutions. We offer two case studies and a series of questions that might assist fund sponsors in weighing the appropriateness of the OCIO model for their fund.

2013 Callan Risk Management Survey

According to results of Callan Associates’ 2013 Risk Management Survey, more than half of fund sponsors (55%) say their risk management tools are effective at mitigating investment risk, but 14% see them as simply a means to improve risk identification and monitoring. One-third of respondents indicated they do not know yet the effectiveness of their risk management tools because they are new and untested in a true market crisis.

The survey found formal risk management processes are most prevalent at large funds. Half of the medium and small funds have adopted a risk management process or are doing so in 2013. Forty-two percent of respondents employ proprietary and/or third-party risk measurement tools, such as software or data services. Usage of third-party tools is most prevalent at public funds, while endowments and foundations more often use in-house (proprietary) tools.

Corporate and public funds are embracing policy-level approaches to risk management more so than endowments and foundations. Public funds have implemented economic regime asset allocations, risk parity, and risk factor-based asset allocations, while corporate funds favor liability-driven investing and funded status-based glide path de-risking.

Strategy-level approaches to mitigate risk are easier to implement than those that alter the fund’s overall investment policy, and Callan observed higher levels of adoption of strategy changes across fund types. Public funds and foundations and endowments are most heavily implementing or considering real assets, opportunistic fixed income, absolute return and long/short equity. Corporate funds are also embracing absolute return, but long duration is the most favored strategy-level approach used to address risk.

Many fund sponsors wrestle with whether or not to tactically manage plan risk. Only 30% of sponsors have made rebalancing decisions based on risk management findings. Of those that have not done so, 82% do not plan to in the future.Public (31%) and large (25%) funds are the most likely to use tactical implementations going forward.

According to the survey, most funds (94%) do not have a formal risk budget, but explicitly address risk management in their plan governance via asset allocation, investment objectives and disciplined rebalancing.

The investment committee is the body most regularly tasked with deciding when to take action based on the findings of risk management tools. The most common actions taken were asset allocation changes (64% of respondents), manager due diligence/search (56%) and increased manager monitoring (52%). Twenty percent of respondents had not yet taken any actions based on risk management findings.

The survey was conducted in November 2012 and includes responses from 53 fund sponsors representing $576 billion in assets.

Risk Factors as Building Blocks for Portfolio Diversification

Author: Eugene Podkaminer

Asset classes can be broken down into building blocks, or factors, that explain the majority of the assets’ risk and return characteristics. A factor-based investment approach enables the investor theoretically to remix the factors into portfolios that are better diversified and more efficient than traditional portfolios.

Seemingly diverse asset classes can have unexpectedly high correlations—a result of the significant overlap in their underlying common risk factor exposures. These high correlations caused many portfolios to exhibit poor diversification in the recent market downturn, and investors can use risk factors to view their portfolios and assess risk.

Although constructing ex ante optimized portfolios using risk factor inputs is possible, there are significant challenges to overcome, including the need for active, frequent rebalancing; creation of forward-looking assumptions; and the use of derivatives and short positions. However, key elements of factor-based methodologies can be integrated in multiple ways into traditional asset allocation structures to enhance portfolio construction, illuminate sources of risk, and inform manager structure.

Going Global: U.S. Domestic Bias vs. The World

How does the average U.S. pension plan’s domestic bias stack up against that of other developed countries? Taking a look at how investments really break out may surprise you. Flip the page to see more detailed discussions of the evolution in global equity markets and emerging markets as well as global population trends. We also highlight seven key aspects of non-U.S. investing that you may want to consider when assessing your asset allocation strategy.

More from Callan (17)

The Renaissance of Stable Value: Capital Preservation in Defined Contribution

The Renaissance of Stable Value: Capital Preservation in Defined Contribution

Grading the Pensions Protection Act, 10 Years Later

Grading the Pensions Protection Act, 10 Years Later

Target Date Funds - Finding the Right Vehicle for the Road to Retirement

Target Date Funds - Finding the Right Vehicle for the Road to Retirement

Defined Contribution Plans and Fee Lawsuits: Stuck in the Mud or the Road to ...

Defined Contribution Plans and Fee Lawsuits: Stuck in the Mud or the Road to ...

Managing Defined Contribution Plan Investments: A Fiduciary Handbook

Managing Defined Contribution Plan Investments: A Fiduciary Handbook

What do Money Market Reforms Mean for Investors? A Roundtable Discussion with...

What do Money Market Reforms Mean for Investors? A Roundtable Discussion with...

Are Defined Contribution Plans Ready for Alternative Investments?

Are Defined Contribution Plans Ready for Alternative Investments?

2013 Callan Cost of Doing Business Survey: U.S. Funds and Trusts

2013 Callan Cost of Doing Business Survey: U.S. Funds and Trusts

The Outsourced Chief Investment Officer Model: One Size Does Not Fit All

The Outsourced Chief Investment Officer Model: One Size Does Not Fit All

Risk Factors as Building Blocks for Portfolio Diversification

Risk Factors as Building Blocks for Portfolio Diversification

Recently uploaded

how can I sell/buy bulk pi coins securely

Even tho Pi network is not listed on any exchange yet.

Buying/Selling or investing in pi network coins is highly possible through the help of vendors. You can buy from vendors[ buy directly from the pi network miners and resell it]. I will leave the telegram contact of my personal vendor.

@Pi_vendor_247

Which Crypto to Buy Today for Short-Term in May-June 2024.pdf

The world of bitcoin is constantly changing, with new opportunities and hazards surfacing practically daily.

what is the best method to sell pi coins in 2024

The best way to sell your pi coins safely is trading with an exchange..but since pi is not launched in any exchange, and second option is through a VERIFIED pi merchant.

Who is a pi merchant?

A pi merchant is someone who buys pi coins from miners and pioneers and resell them to Investors looking forward to hold massive amounts before mainnet launch in 2026.

I will leave the telegram contact of my personal pi merchant to trade pi coins with.

@Pi_vendor_247

how can i use my minded pi coins I need some funds.

If you are interested in selling your pi coins, i have a verified pi merchant, who buys pi coins and resell them to exchanges looking forward to hold till mainnet launch.

Because the core team has announced that pi network will not be doing any pre-sale. The only way exchanges like huobi, bitmart and hotbit can get pi is by buying from miners.

Now a merchant stands in between these exchanges and the miners. As a link to make transactions smooth. Because right now in the enclosed mainnet you can't sell pi coins your self. You need the help of a merchant,

i will leave the telegram contact of my personal pi merchant below. 👇 I and my friends has traded more than 3000pi coins with him successfully.

@Pi_vendor_247

how to sell pi coins effectively (from 50 - 100k pi)

Anywhere in the world, including Africa, America, and Europe, you can sell Pi Network Coins online and receive cash through online payment options.

Pi has not yet been launched on any exchange because we are currently using the confined Mainnet. The planned launch date for Pi is June 28, 2026.

Reselling to investors who want to hold until the mainnet launch in 2026 is currently the sole way to sell.

Consequently, right now. All you need to do is select the right pi network provider.

Who is a pi merchant?

An individual who buys coins from miners on the pi network and resells them to investors hoping to hang onto them until the mainnet is launched is known as a pi merchant.

debuts.

I'll provide you the Telegram username

@Pi_vendor_247

The Evolution of Non-Banking Financial Companies (NBFCs) in India: Challenges...

Role in Financial System

NBFCs are critical in bridging the financial inclusion gap.

They provide specialized financial services that cater to segments often neglected by traditional banks.

Economic Impact

NBFCs contribute significantly to India's GDP.

They support sectors like micro, small, and medium enterprises (MSMEs), housing finance, and personal loans.

Introduction to Indian Financial System ()

The financial system of a country is an important tool for economic development of the country, as it helps in creation of wealth by linking savings with investments.

It facilitates the flow of funds form the households (savers) to business firms (investors) to aid in wealth creation and development of both the parties

where can I find a legit pi merchant online

Yes. This is very easy what you need is a recommendation from someone who has successfully traded pi coins before with a merchant.

Who is a pi merchant?

A pi merchant is someone who buys pi network coins and resell them to Investors looking forward to hold thousands of pi coins before the open mainnet.

I will leave the telegram contact of my personal pi merchant to trade with

@Pi_vendor_247

This assessment plan proposal is to outline a structured approach to evaluati...

This assessment plan proposal is to outline a structured approach to evaluati...lamluanvan.net Viết thuê luận văn

Luận Văn Group hỗ trợ viết luận văn thạc sĩ,chuyên đề,khóa luận tốt nghiệp, báo cáo thực tập, Assignment, Essay

Zalo/Sdt 0967 538 624/ 0886 091 915 Website:lamluanvan.net

Tham gia nhóm hỗ trợ viết bài fb: https://www.facebook.com/groups/285625754522599?locale=vi_VNhow to sell pi coins in all Africa Countries.

Yes. You can sell your pi network for other cryptocurrencies like Bitcoin, usdt , Ethereum and other currencies And this is done easily with the help from a pi merchant.

What is a pi merchant ?

Since pi is not launched yet in any exchange. The only way you can sell right now is through merchants.

A verified Pi merchant is someone who buys pi network coins from miners and resell them to investors looking forward to hold massive quantities of pi coins before mainnet launch in 2026.

I will leave the telegram contact of my personal pi merchant to trade with.

@Pi_vendor_247

when will pi network coin be available on crypto exchange.

There is no set date for when Pi coins will enter the market.

However, the developers are working hard to get them released as soon as possible.

Once they are available, users will be able to exchange other cryptocurrencies for Pi coins on designated exchanges.

But for now the only way to sell your pi coins is through verified pi vendor.

Here is the telegram contact of my personal pi vendor

@Pi_vendor_247

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...Falcon Invoice Discounting

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.US Economic Outlook - Being Decided - M Capital Group August 2021.pdf

The U.S. economy is continuing its impressive recovery from the COVID-19 pandemic and not slowing down despite re-occurring bumps. The U.S. savings rate reached its highest ever recorded level at 34% in April 2020 and Americans seem ready to spend. The sectors that had been hurt the most by the pandemic specifically reduced consumer spending, like retail, leisure, hospitality, and travel, are now experiencing massive growth in revenue and job openings.

Could this growth lead to a “Roaring Twenties”? As quickly as the U.S. economy contracted, experiencing a 9.1% drop in economic output relative to the business cycle in Q2 2020, the largest in recorded history, it has rebounded beyond expectations. This surprising growth seems to be fueled by the U.S. government’s aggressive fiscal and monetary policies, and an increase in consumer spending as mobility restrictions are lifted. Unemployment rates between June 2020 and June 2021 decreased by 5.2%, while the demand for labor is increasing, coupled with increasing wages to incentivize Americans to rejoin the labor force. Schools and businesses are expected to fully reopen soon. In parallel, vaccination rates across the country and the world continue to rise, with full vaccination rates of 50% and 14.8% respectively.

However, it is not completely smooth sailing from here. According to M Capital Group, the main risks that threaten the continued growth of the U.S. economy are inflation, unsettled trade relations, and another wave of Covid-19 mutations that could shut down the world again. Have we learned from the past year of COVID-19 and adapted our economy accordingly?

“In order for the U.S. economy to continue growing, whether there is another wave or not, the U.S. needs to focus on diversifying supply chains, supporting business investment, and maintaining consumer spending,” says Grace Feeley, a research analyst at M Capital Group.

While the economic indicators are positive, the risks are coming closer to manifesting and threatening such growth. The new variants spreading throughout the world, Delta, Lambda, and Gamma, are vaccine-resistant and muddy the predictions made about the economy and health of the country. These variants bring back the feeling of uncertainty that has wreaked havoc not only on the stock market but the mindset of people around the world. MCG provides unique insight on how to mitigate these risks to possibly ensure a bright economic future.

Empowering the Unbanked: The Vital Role of NBFCs in Promoting Financial Inclu...

In India, financial inclusion remains a critical challenge, with a significant portion of the population still unbanked. Non-Banking Financial Companies (NBFCs) have emerged as key players in bridging this gap by providing financial services to those often overlooked by traditional banking institutions. This article delves into how NBFCs are fostering financial inclusion and empowering the unbanked.

The secret way to sell pi coins effortlessly.

Well as we all know pi isn't launched yet. But you can still sell your pi coins effortlessly because some whales in China are interested in holding massive pi coins. And they are willing to pay good money for it. If you are interested in selling I will leave a contact for you. Just telegram this number below. I sold about 3000 pi coins to him and he paid me immediately.

Telegram: @Pi_vendor_247

Recently uploaded (20)

Which Crypto to Buy Today for Short-Term in May-June 2024.pdf

Which Crypto to Buy Today for Short-Term in May-June 2024.pdf

how can i use my minded pi coins I need some funds.

how can i use my minded pi coins I need some funds.

how to sell pi coins effectively (from 50 - 100k pi)

how to sell pi coins effectively (from 50 - 100k pi)

The Evolution of Non-Banking Financial Companies (NBFCs) in India: Challenges...

The Evolution of Non-Banking Financial Companies (NBFCs) in India: Challenges...

This assessment plan proposal is to outline a structured approach to evaluati...

This assessment plan proposal is to outline a structured approach to evaluati...

when will pi network coin be available on crypto exchange.

when will pi network coin be available on crypto exchange.

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...

US Economic Outlook - Being Decided - M Capital Group August 2021.pdf

US Economic Outlook - Being Decided - M Capital Group August 2021.pdf

Empowering the Unbanked: The Vital Role of NBFCs in Promoting Financial Inclu...

Empowering the Unbanked: The Vital Role of NBFCs in Promoting Financial Inclu...

655264371-checkpoint-science-past-papers-april-2023.pdf

655264371-checkpoint-science-past-papers-april-2023.pdf

Asset Managers and ESG

- 1. Knowledge. Experience. Integrity. CALLAN INSTITUTE Survey June 2016 Asset Managers and ESG Sensing Opportunity, Bigger Firms Lead the Charge Environmental, social, and governance (ESG) investing is not a new phenomenon, but it has been expe- riencing rapid growth and change in the U.S. marketplace. To better understand how asset managers are addressing investors’ changing needs in this space, Callan queried these firms on their ESG views and policies. Our survey reveals that the majority of large asset management firms are formalizing their efforts around ESG implementation, via firm-wide policies, third-party affiliations, and other actions, while smaller firms have yet to exhibit widespread adoption. Small 23% Medium 51% Large 73% Firms with a formal ESG policy (by size) small: <$50bn medium: $50bn – $250bn large: >$250bn

- 2. 2 Part of being a sound fiduciary was another popular reason for adopting ESG with 56% 26% of those not adopting ESG feel ESG factors are already accounted for in their current investment process 41%of all respondents have a formal ESG policy Has your firm signed the Principles for Responsible Investment (PRI)? 40% Yes 53% No 7% Not Sure Results reflect responses from 180 asset management firms representing more than $42 trillion in assets under management (AUM). While more than half of asset management firms (56%) do not have a formal ESG policy, and a similar percentage (53%) have not signed on to the United Nations Principles for Responsible Investment (PRI), the firms that have pursued these initiatives cite growing client demand as the primary motivation. For this survey we examined managers by size groups: small (less than $50 billion), medium ($50 - $250 billion), and large (greater than $250 billion). A greater proportion of large firms (73%) versus small firms (23%) have a formal ESG policy at the firm level (as opposed to on a strategy level). The same trend is true for PRI signatories: 82% of large firms versus 20% of small firms. Further, larger firms tend to be more established in the space: more than one-quarter (27%) of large firms created their ESG policy more than a decade ago, compared to 21% of medium firms and 16% of small firms. 59% cite client demand as their reason for adopting ESG 16% Small 62% 22% 27% Large 36% 21% Medium 42% 37% 37% When was your firm’s ESG policy established? Within past 2 years 3–10 years ago > 10 years ago 35% of firms with no ESG policy have considered adopting one within the last year Note: Multiple responses allowed.

- 3. 3Knowledge. Experience. Integrity. What research process is utilized at your firm? Managers with an ESG Policy by Research Process Quantitative, factor/model driven approach Combination of fundamental & quantitative Fundamental, bottom-up research* * this includes basic screening 10% 31% 59% QuantitativeComboFundamental 53% 51% 33% How is research organized within your firm? Multiple boutique model Central research platform Team-based approach Managers with an ESG Policy by Research Organization 11% 60% Multiple boutique Central Team-based59% 45% 36% 29% We also posed questions around research processes and discovered that firms with fundamental, bottom-up research are less likely to have a formal ESG policy (33%) than those with a quantitative approach (53%) or that use a combination of research processes. Research organization also mattered. Asset management firms that implement a multiple boutique model are more likely to have a formal ESG policy (59%) than those with centrally organized research (45%) or team- based approaches (36%). Respondent Perspective “We believe that responsible investing is a core component of traditional investing. Governed, sustainable businesses have the potential to generate strong results over time.”

- 4. 4 41% of respondents say ESG strategies present a market opportunity going forward Looking forward, all sizes of asset management firms expect client interest in ESG investing will grow. However, just 41% of the respondents see this marketplace shift as an opportunity. Again, larger firms tend to be more optimistic about future growth, with nearly 100% sensing slight or significant increases in client interest. Asset managers that project growth in client interest expect to see that interest coming from the U.S. and Canada (72%) and Europe (57%). This reflects the survey respondent population, who are primarily based in the U.S. and Europe, but may also reflect the notion that European investors are further along in integrating ESG into investment decision making than their North American counterparts. Over the next 3-5 years, how do you expect client interest in ESG to change? Where is this increased interest likely to come from?* Increase Slightly Increase Significantly Small Medium Large U.S. and Canada Europe Asia Emerging Australia 72% 57% 16% 5% 4% 100% 88% 76% * Multiple responses allowed. Around one-third of managers with a formal ESG policy expect it will help them achieve higher risk-adjusted returns and improved risk profiles over the long term Respondent Perspective “We believe that environmental, social and governance (“ESG”) issues play an important role in the global economy, both from a business and investment perspective.” “Incorporating ESG factors into the research process is part of ensuring all risks and opportunities that could influence the growth potential of the company in question have been considered.”

- 5. 5Knowledge. Experience. Integrity. Size matters larger asset management firms are taking more actions on ESG 96% of respondents are active managers Respondents by Size How many unique strategies does your firm manage? We provide further detail on the demographics of respondent firms for reference. Rough- ly half of the 180 asset management firms that responded to our survey are small (less than $50 billion in assets), and around a quarter are either medium ($50 – $250 billion) or large (greater than $250 billion). Respondent firms had a median of $56 billion and an average of $232 billion in AUM. The vast majority of respondent firms actively manage their strategies (96%). As one would expect, the smaller respondent firms manage fewer unique strategies. Key Takeaways For asset management firms, it’s clear that size matters when it comes to ESG in- tegration. Large firms are more likely than smaller firms to have formal, firm-wide ESG policies, be PRI signatories, and have significant expectations of growing client interest in the space. Small <$50bn 53% Medium $50bn – $250bn 25% Large >$250bn 22% 0 - 5 6 - 10 11 - 25 Over 25 Small Medium Large 100% 65% 30% 8% 37% 29% 26% 5%