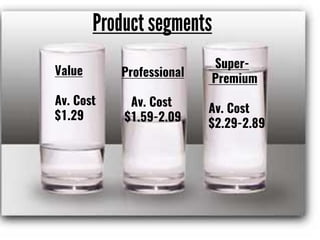

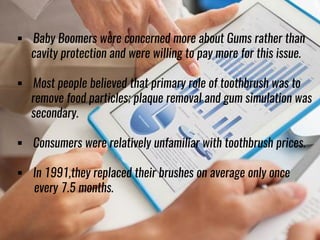

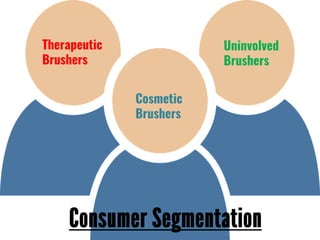

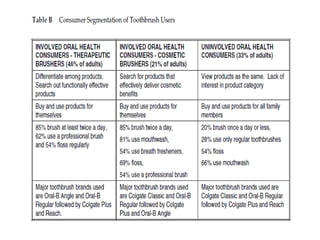

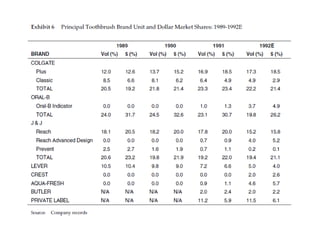

This document summarizes Colgate-Palmolive's (CP) business in 1991. It discusses that CP had $6.06 billion in sales and $2.76 billion in gross profits in 1991. CP held 43% of the global toothpaste market and 16% of the toothbrush market. $243 million was spent upgrading manufacturing plants and 275 new products were introduced. The US oral care market was $2.9 billion in 1991, with toothpaste accounting for 46% of sales. Toothbrush sales grew at an average of 9.3% annually but increased 21% in value and 18% in volume in 1992. The document discusses trends in toothbrush bristle firmness, price points, and consumer brush