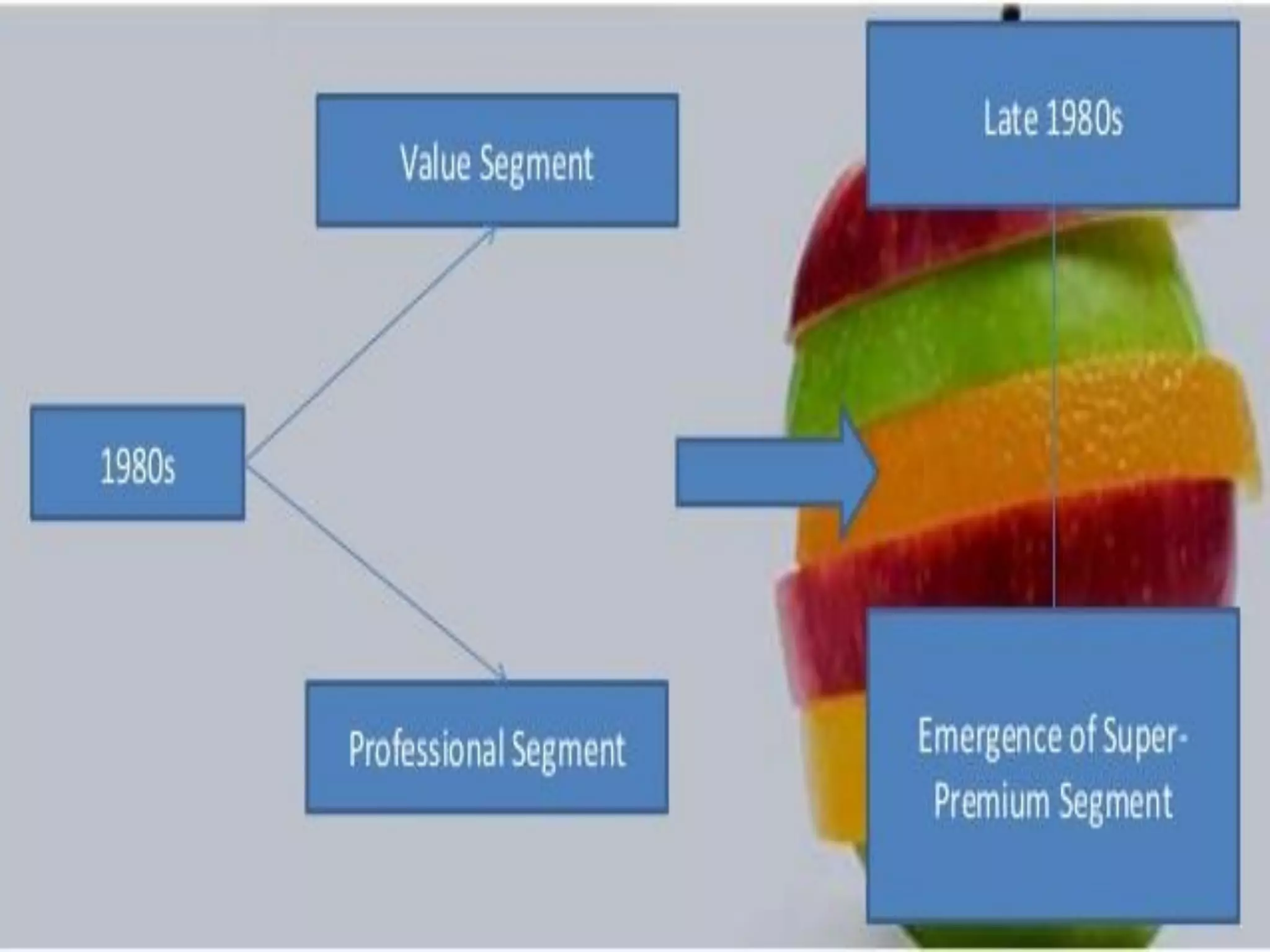

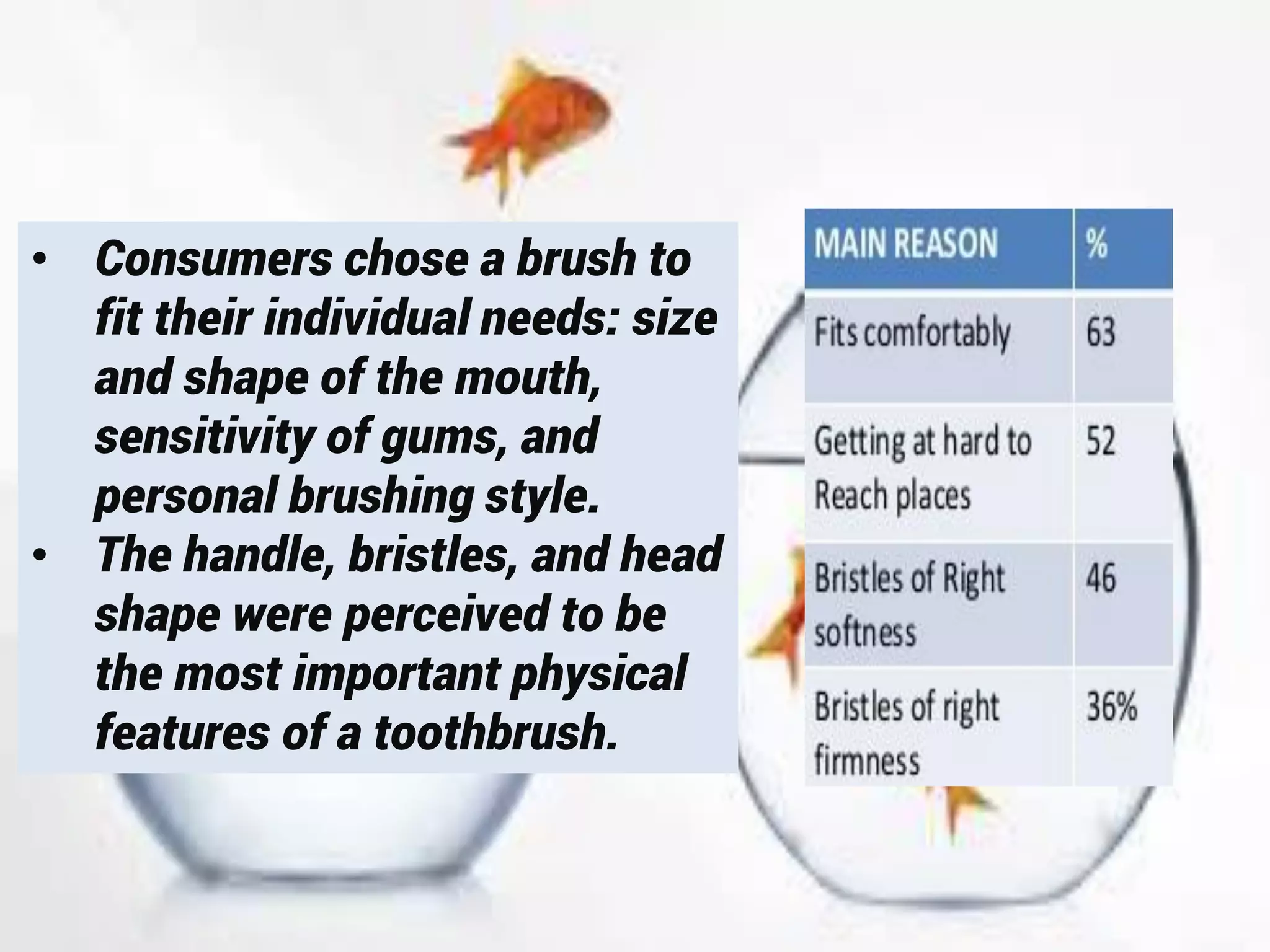

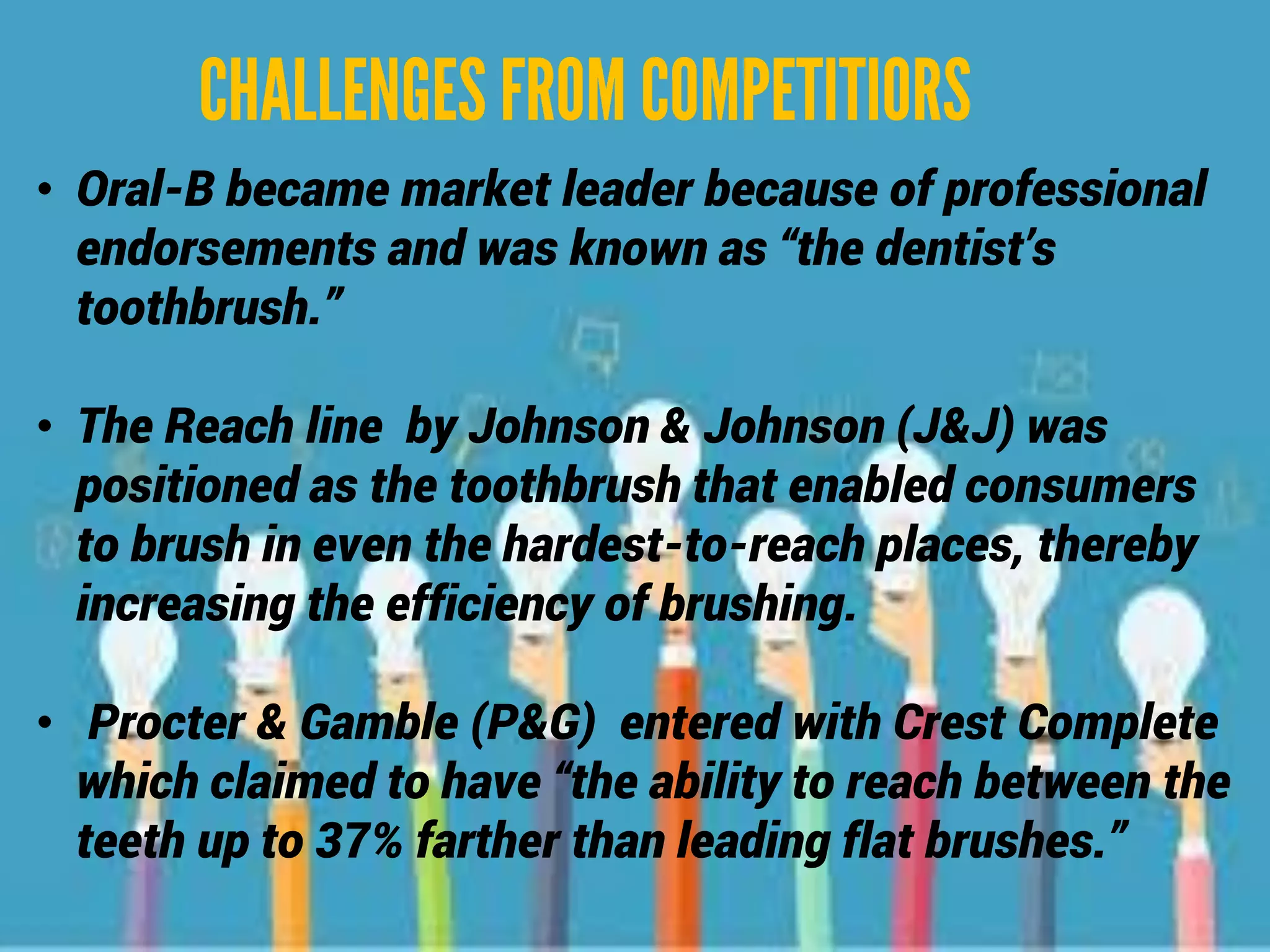

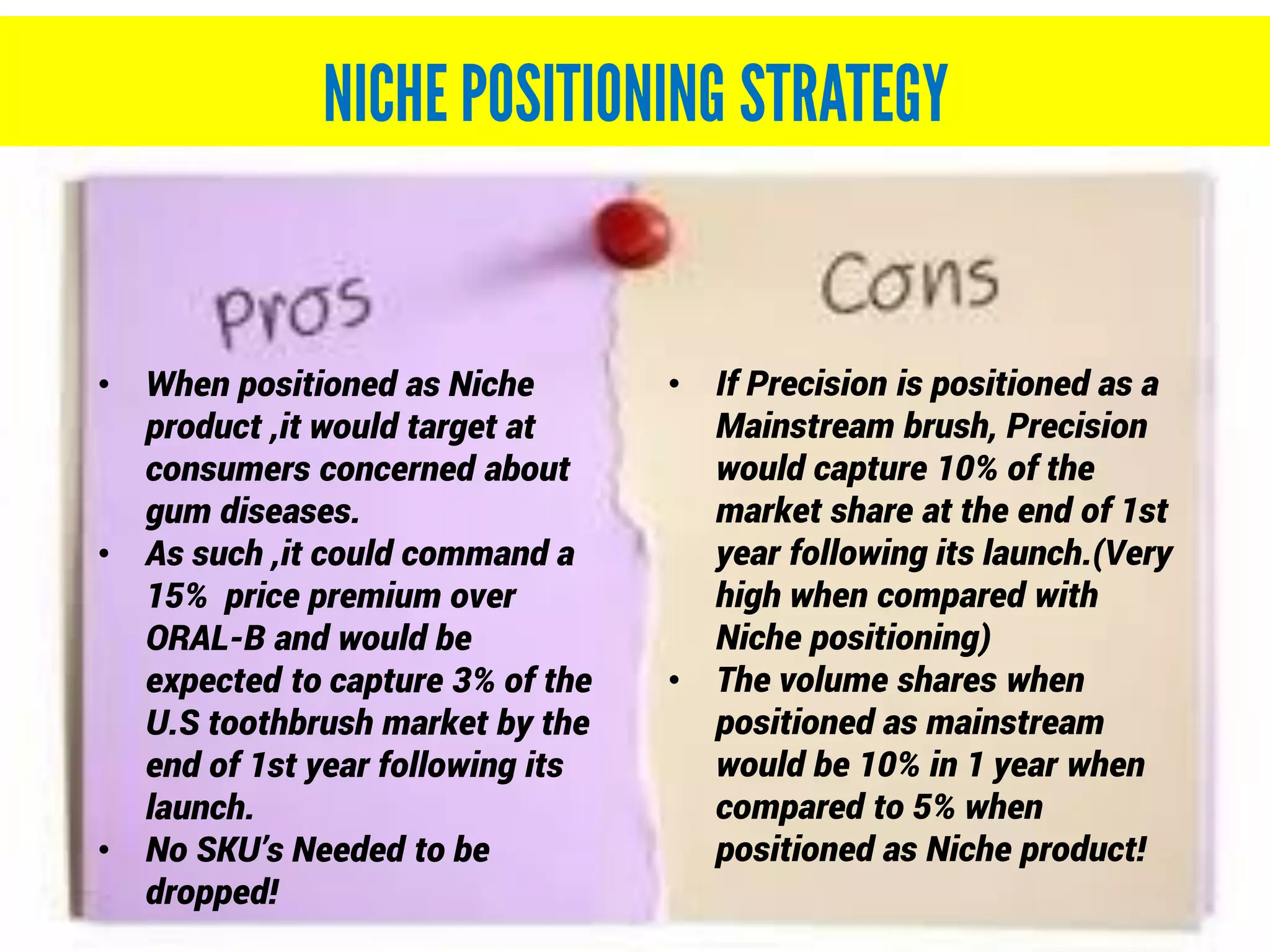

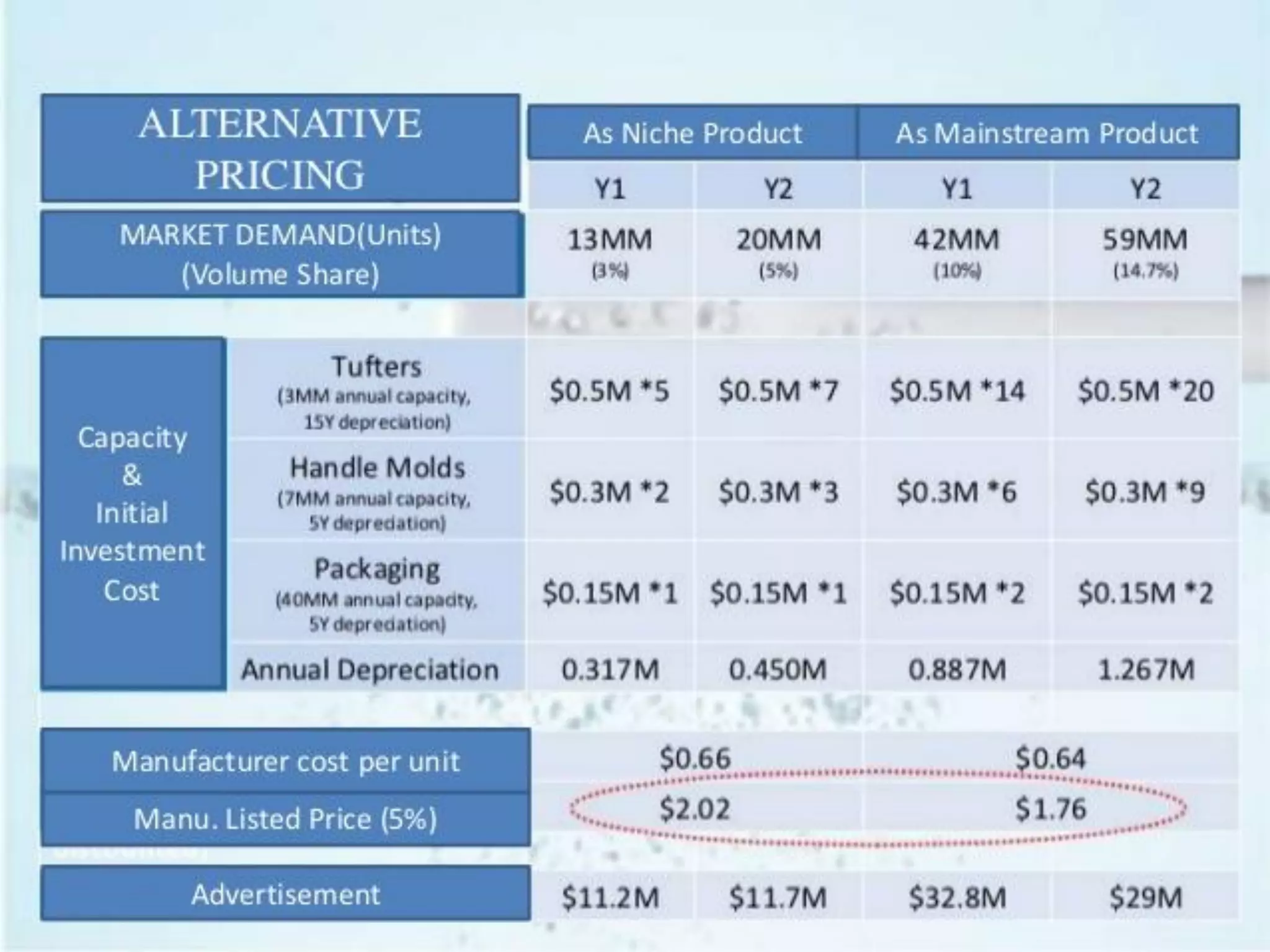

The document discusses marketing strategies for Colgate-Palmolive's new Precision toothbrush. It analyzes the US toothbrush market and competitors. Precision is a technologically superior brush that removes 35% more plaque. The document considers whether to position it as a niche product targeting gum disease or mainstream. Mainstream is more appealing as it could capture 10% market share in the first year, generating higher profits than niche positioning. However, it may cannibalize existing Colgate brush sales and exceed production capacity. The document recommends mainstream positioning if production can be increased and the Precision brand is emphasized to limit cannibalization.