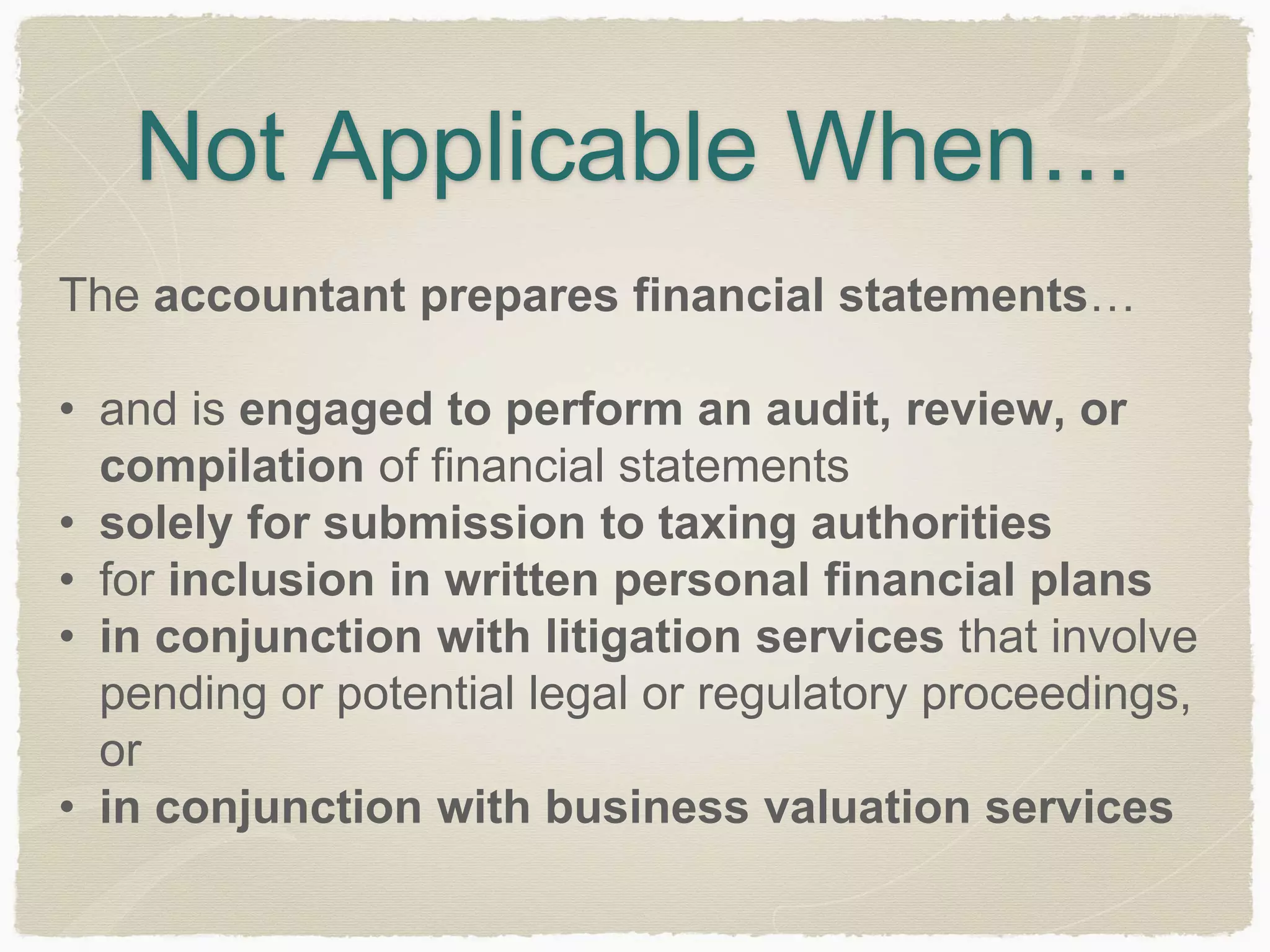

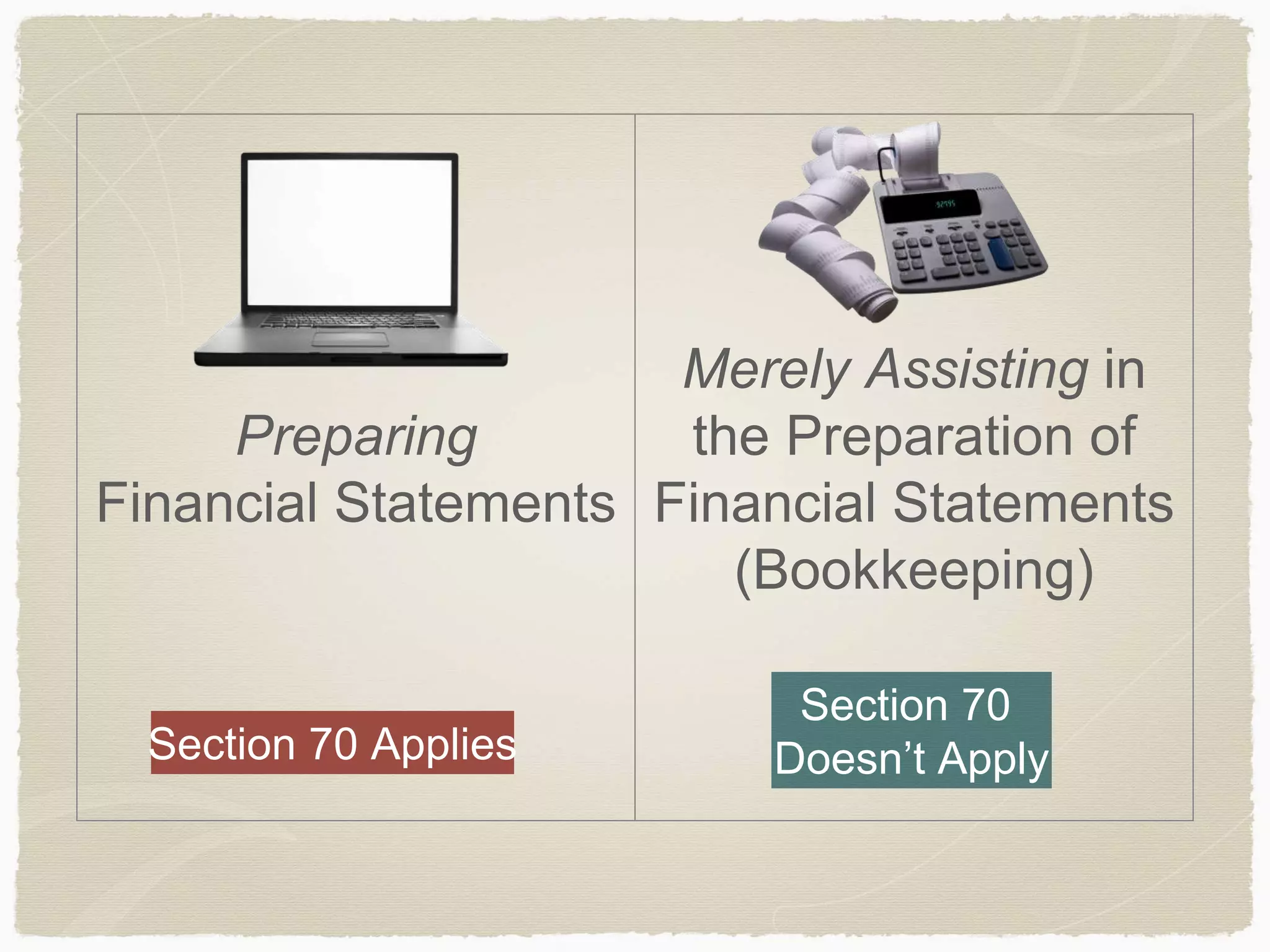

This document discusses the preparation of financial statements under Section 70 of SSARS 21, which allows the issuance of statements without a compilation report in certain circumstances. It details the situations where the accountant is engaged for preparation and emphasizes the required disclaimer wording. The document also outlines effective dates and the importance of an engagement letter for issuing financial statements.

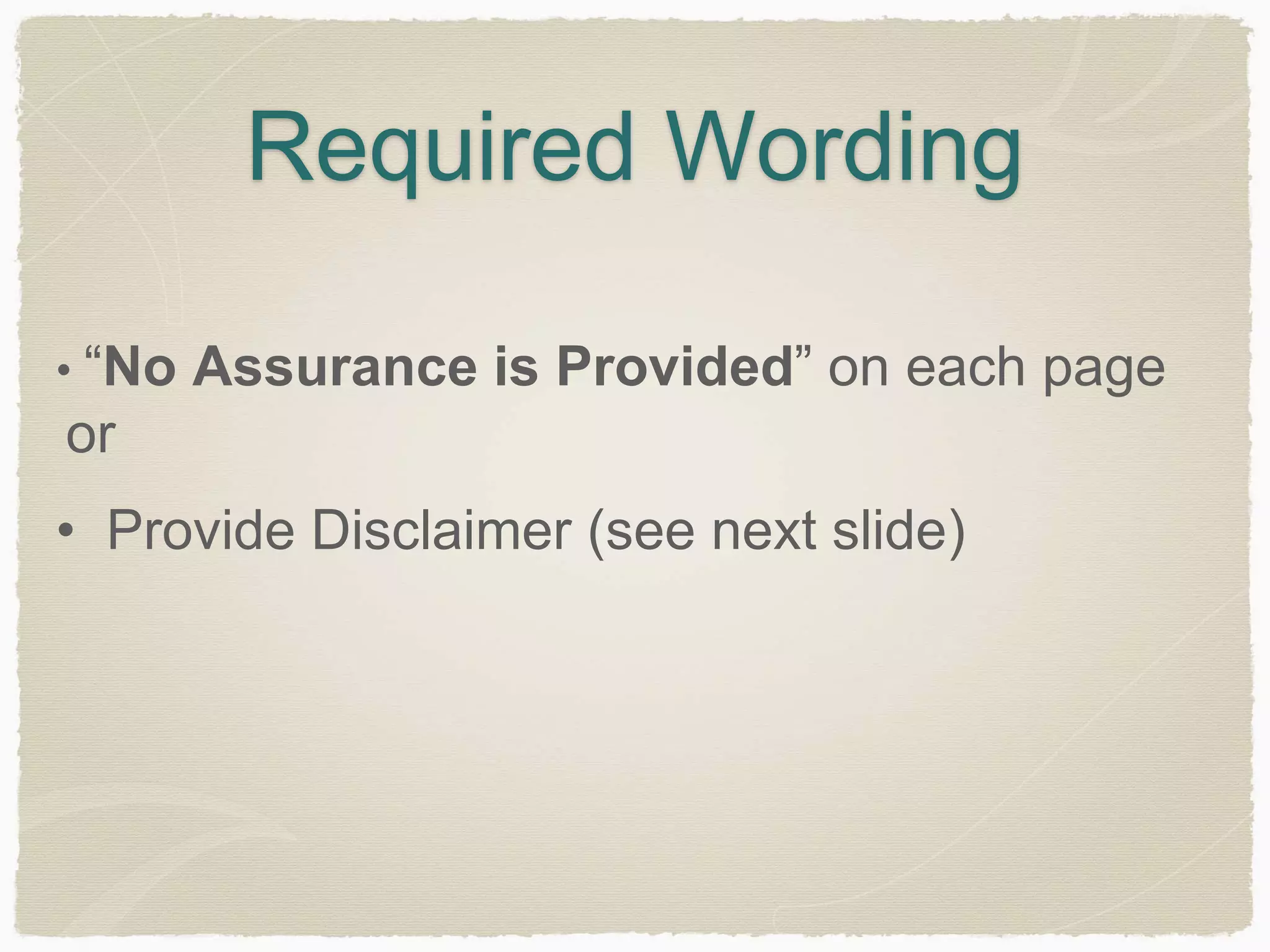

![Sample Disclaimer

The accompanying financial statements of XYZ Company as of

and for the year ended December 31, 20XX, were not subjected

to an audit, review, or compilation engagement by me (us) and,

accordingly, I (we) do not express an opinion, a conclusion, nor

provide any assurance on them.

[Signature of accounting firm or accountant, as appropriate]

[Accountant’s city and state]

[Date]](https://image.slidesharecdn.com/thenewpreparationoffinancialstatementstandardssars21-141206152245-conversion-gate01/75/The-New-Preparation-of-Financial-Statements-Standard-SSARS-21-9-2048.jpg)