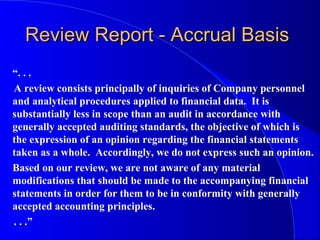

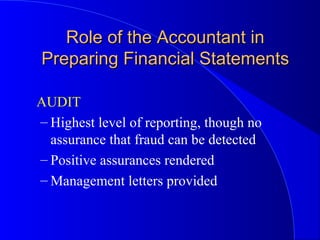

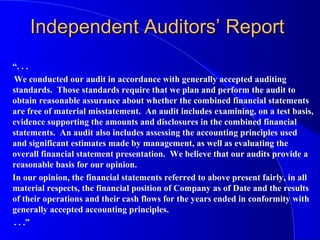

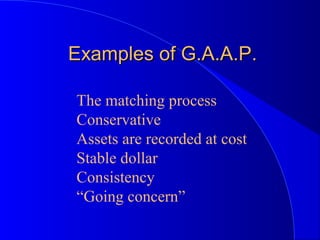

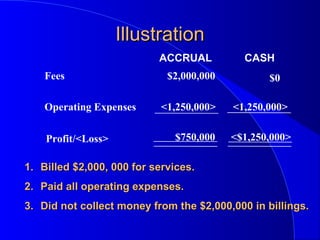

The document presented by Chaim Yudkowsky, CPA, discusses financial statements, their preparation, and the differences between cash and accrual accounting. It outlines the roles of accountants in compiling, reviewing, and auditing financial statements while adhering to Generally Accepted Accounting Principles (GAAP). The presentation emphasizes the importance of financial statements in revealing a company's assets, liabilities, and profitability.

![Compilation Report -Compilation Report -

Accrual BasisAccrual Basis

“. . .

A compilation is limited to presenting in the form of

financial statements information that is the representation of

management. We have not audited or reviewed the

accompanying financial statements [and supplementary

schedules] and, accordingly, do not express an opinion or

any other form of assurance on them.

. . .”](https://image.slidesharecdn.com/howtomakemoremoneycirca1997-130705161826-phpapp01/85/How-to-make-more-money-Part-2-circa-1997-13-320.jpg)