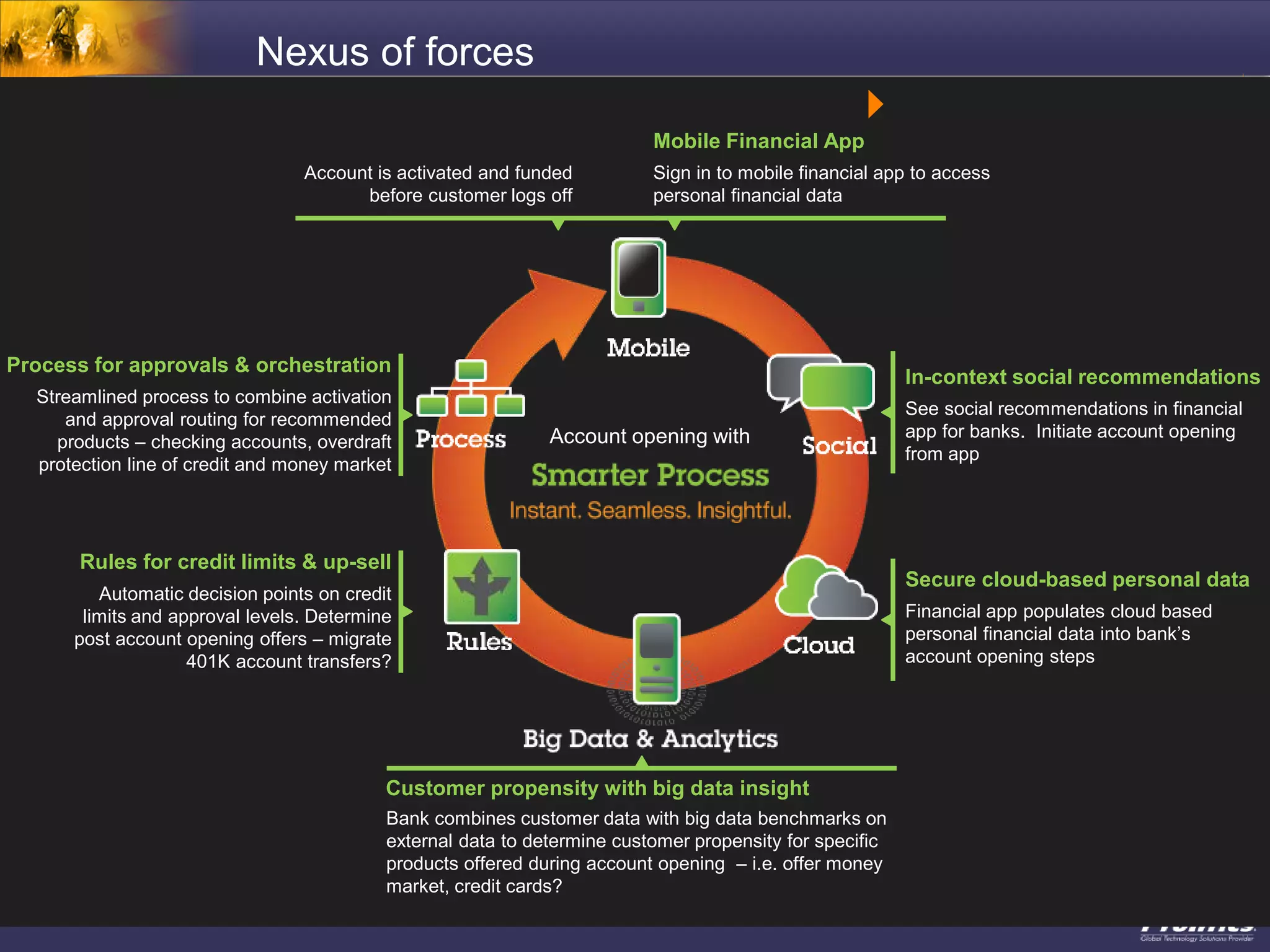

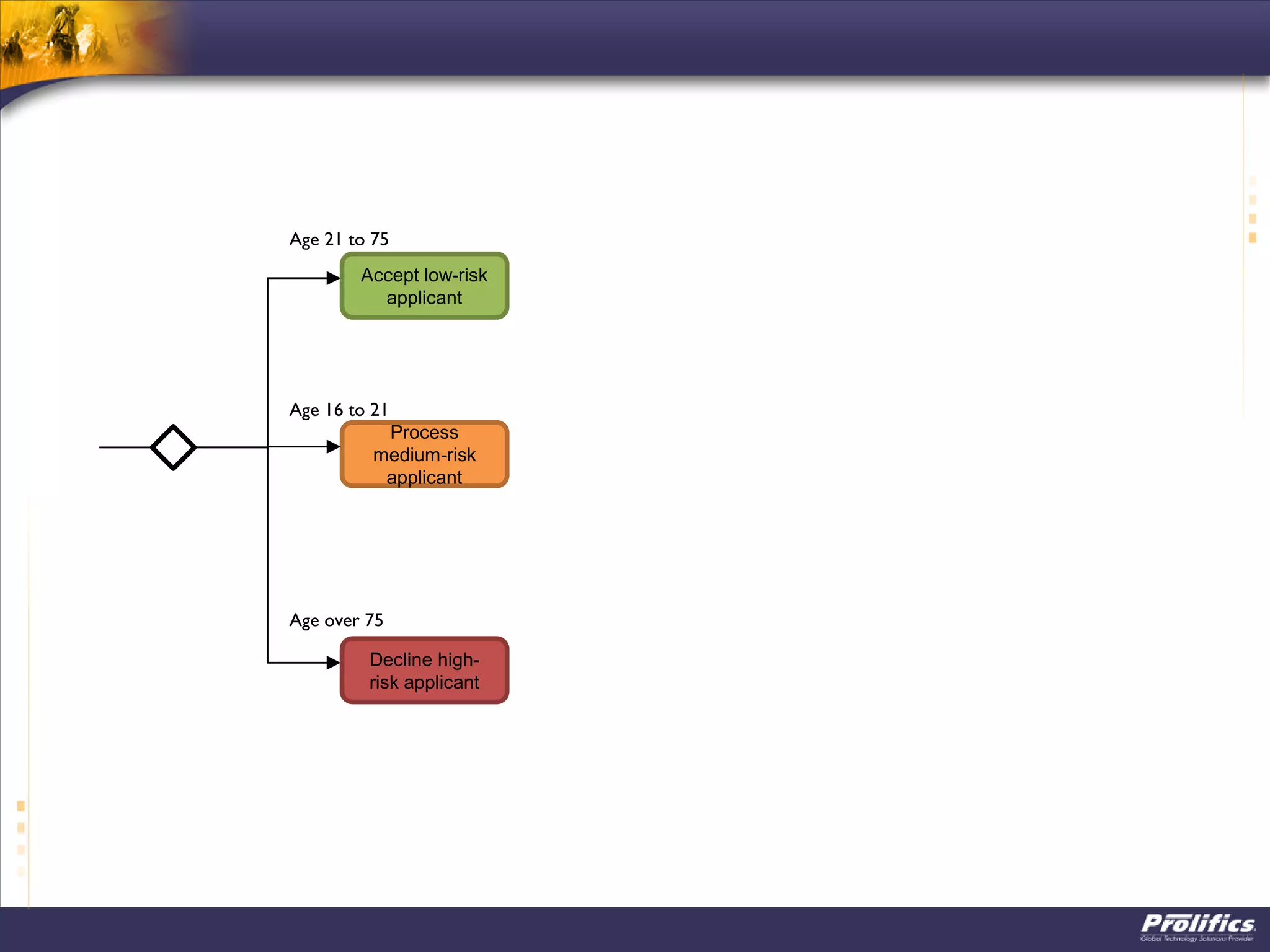

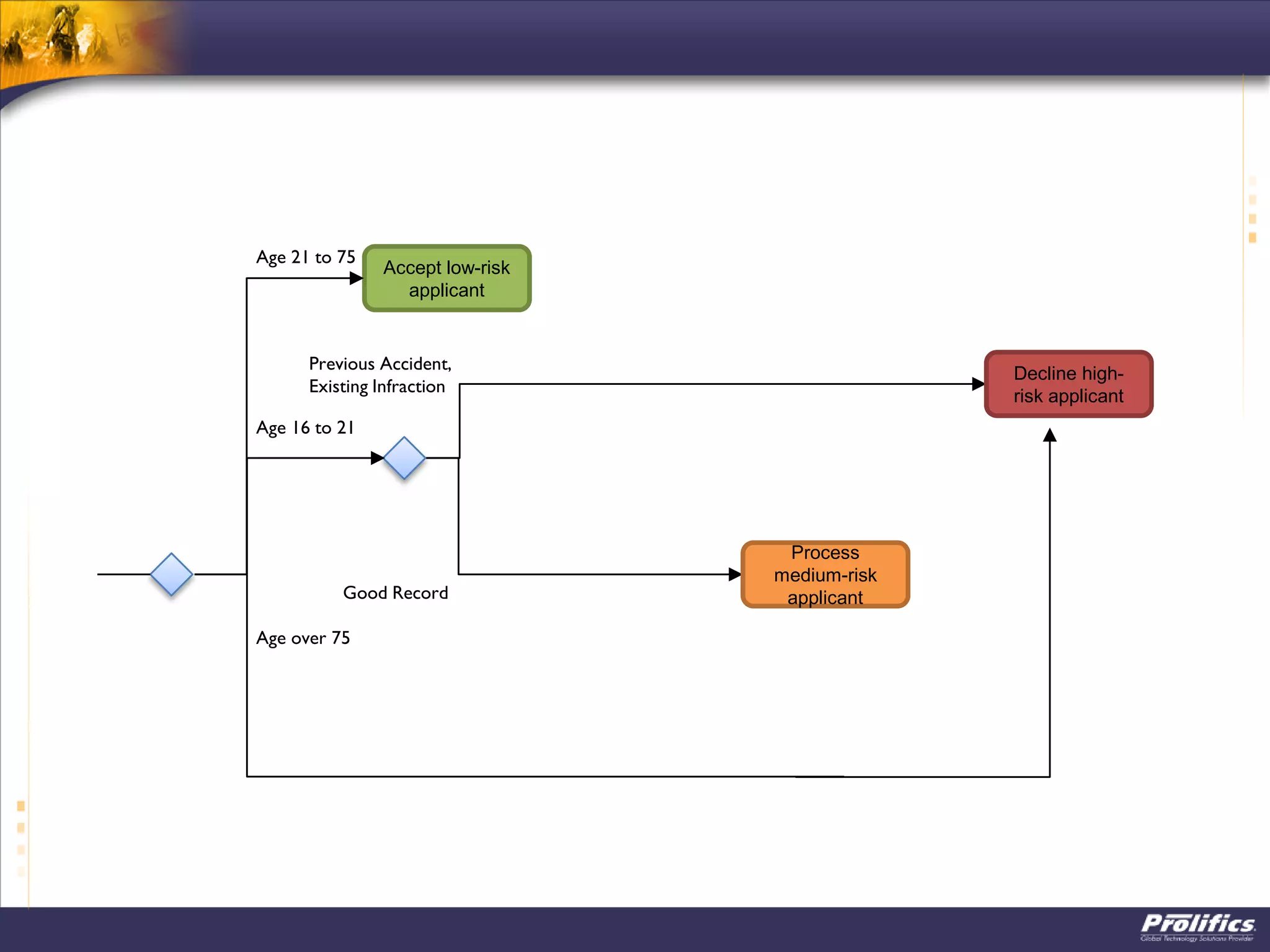

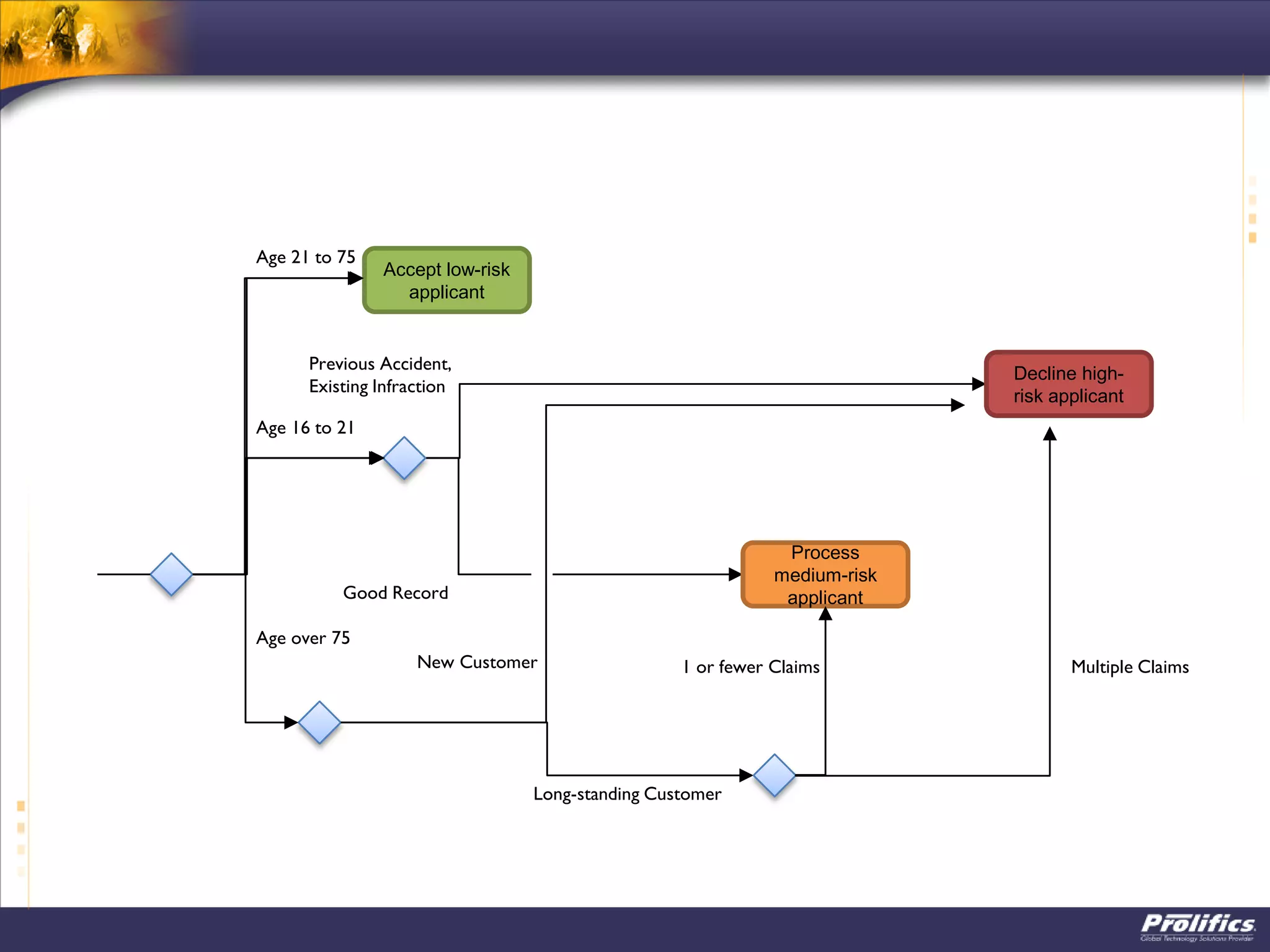

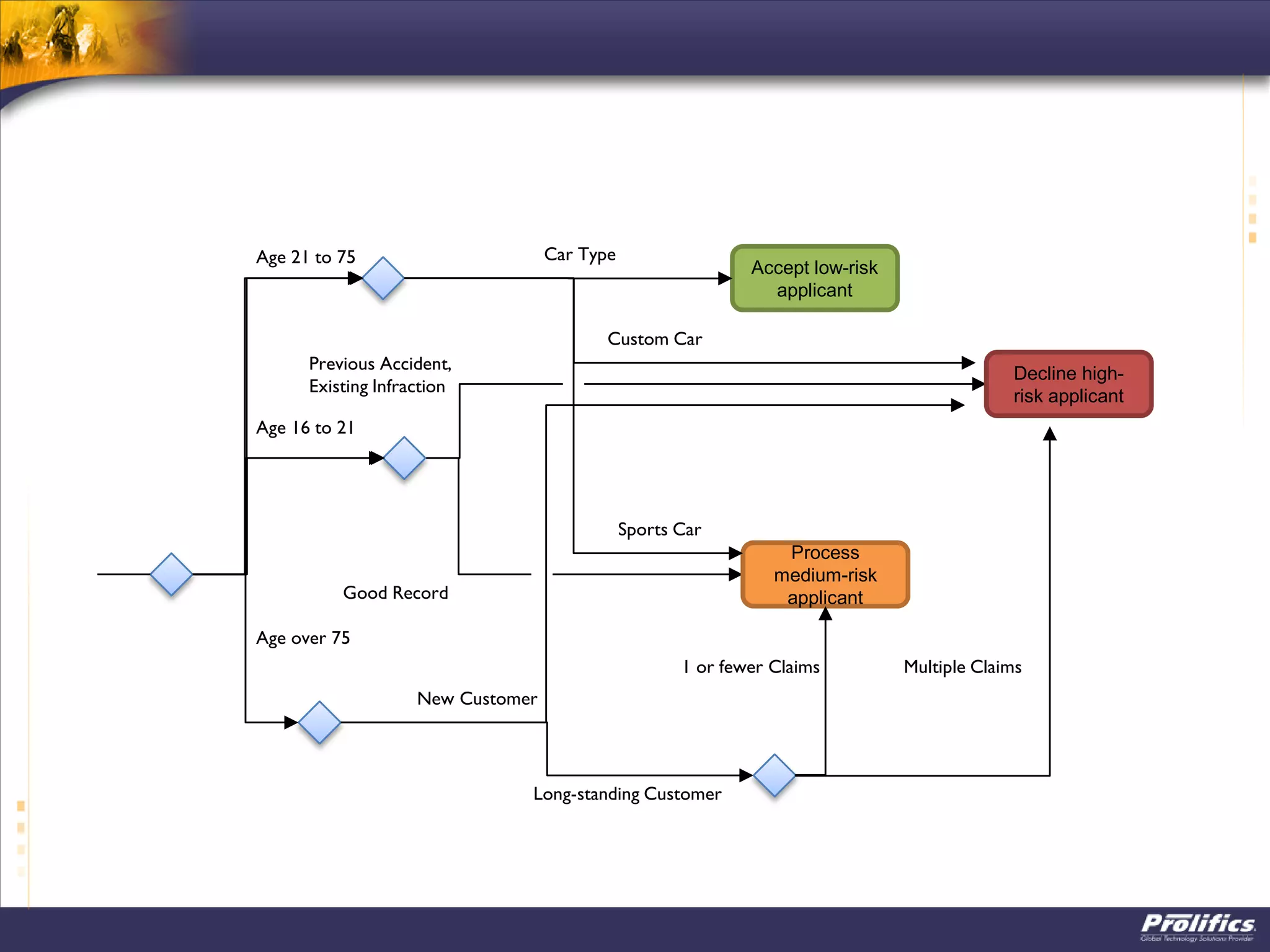

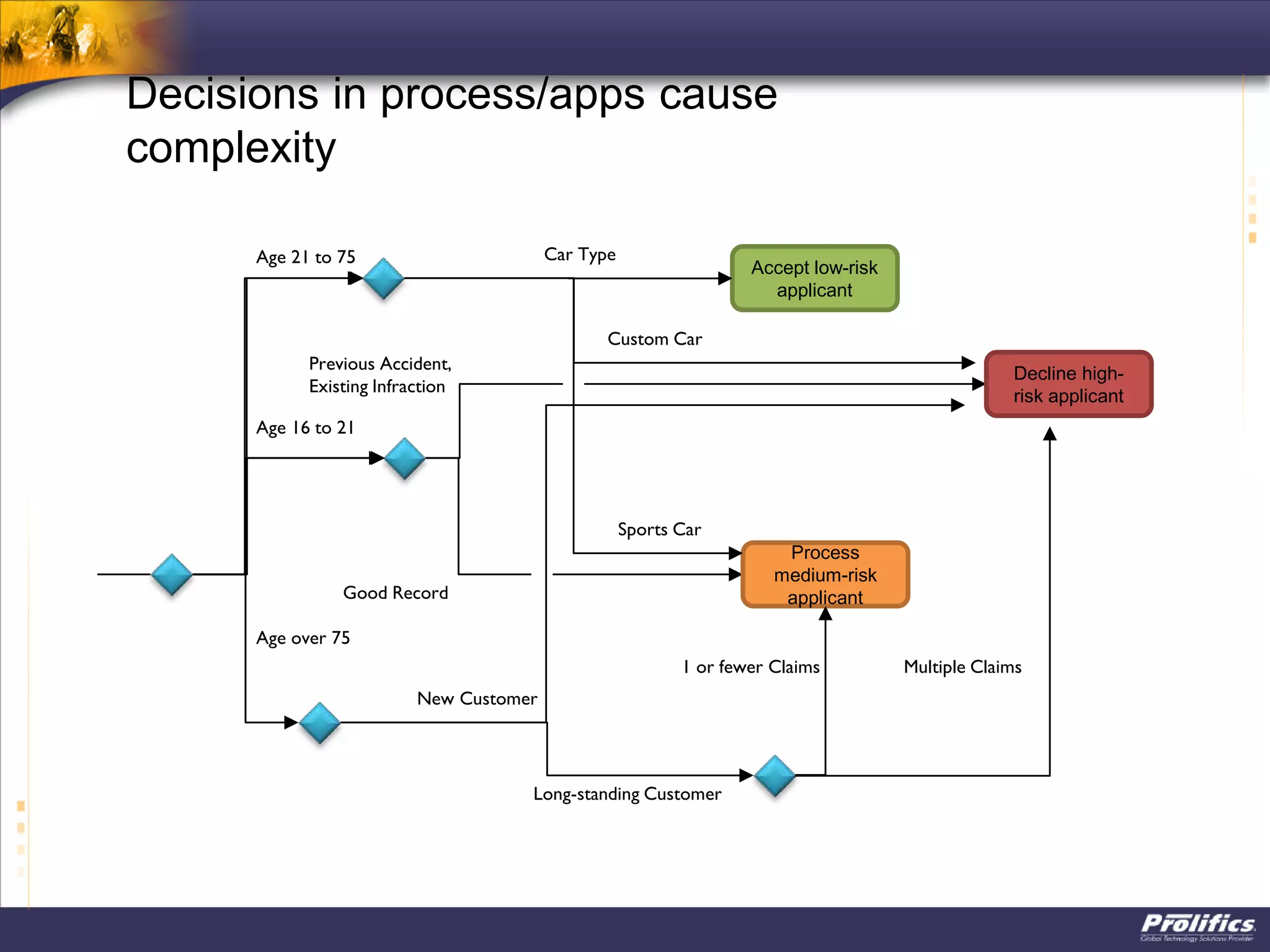

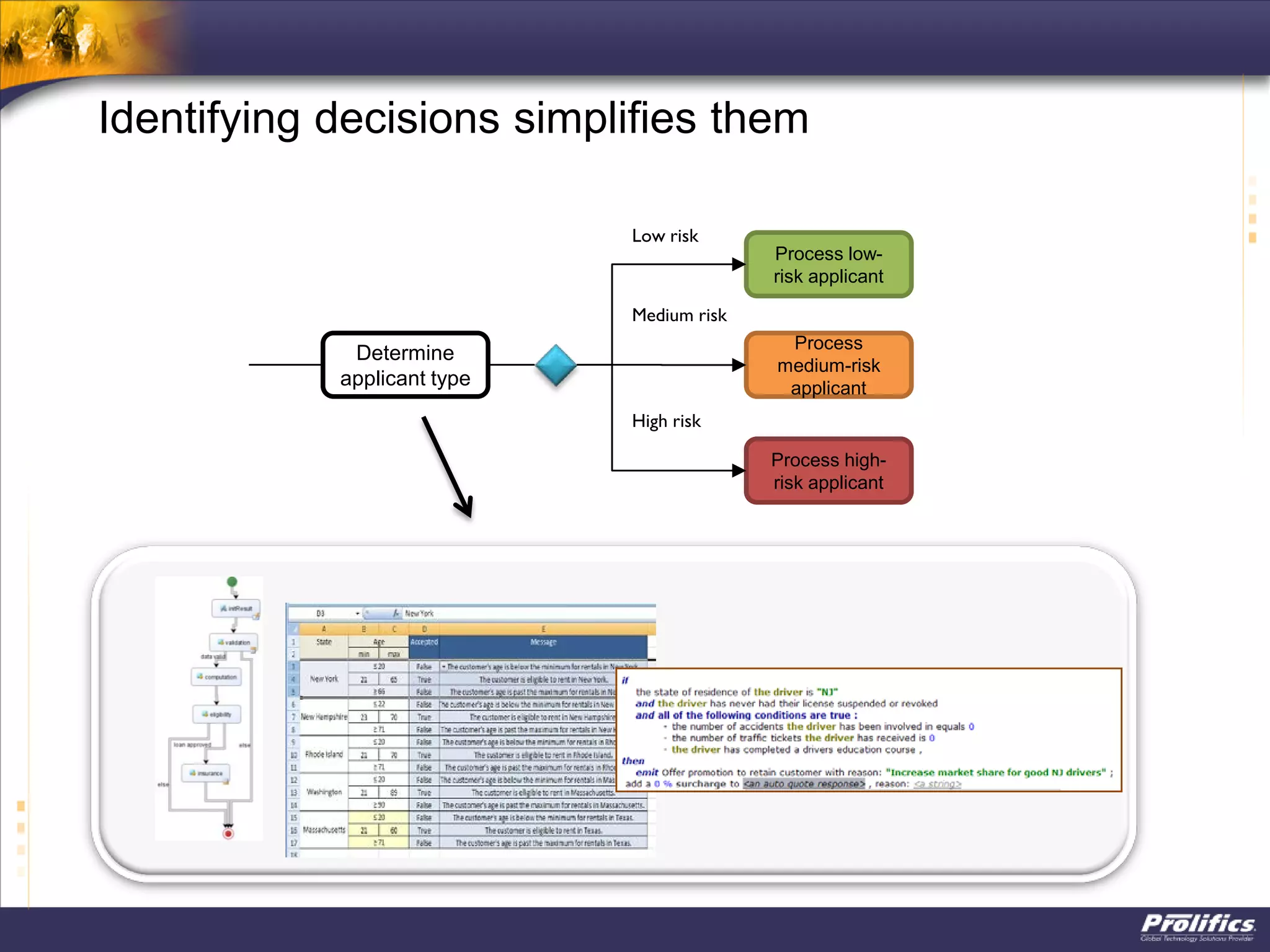

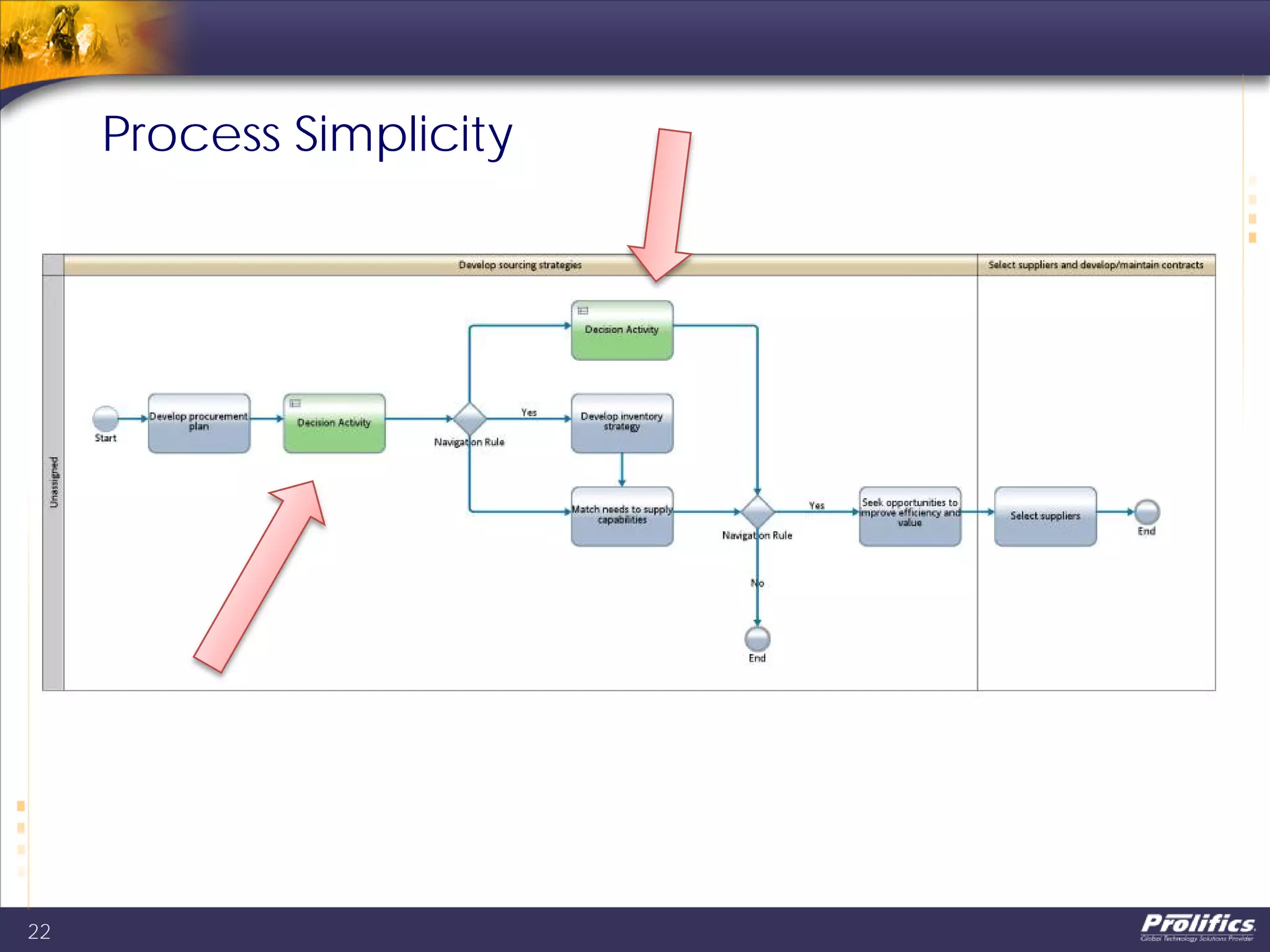

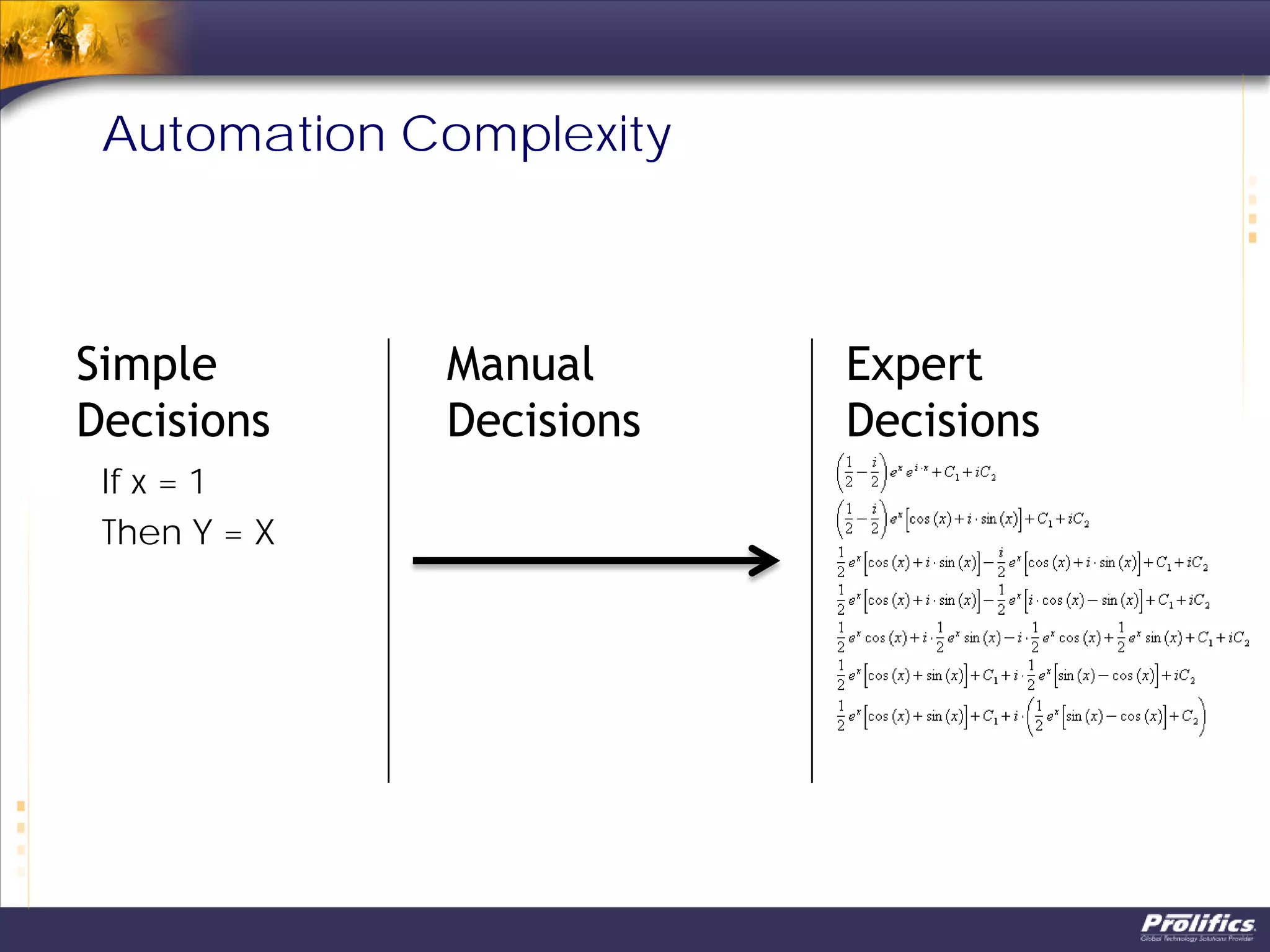

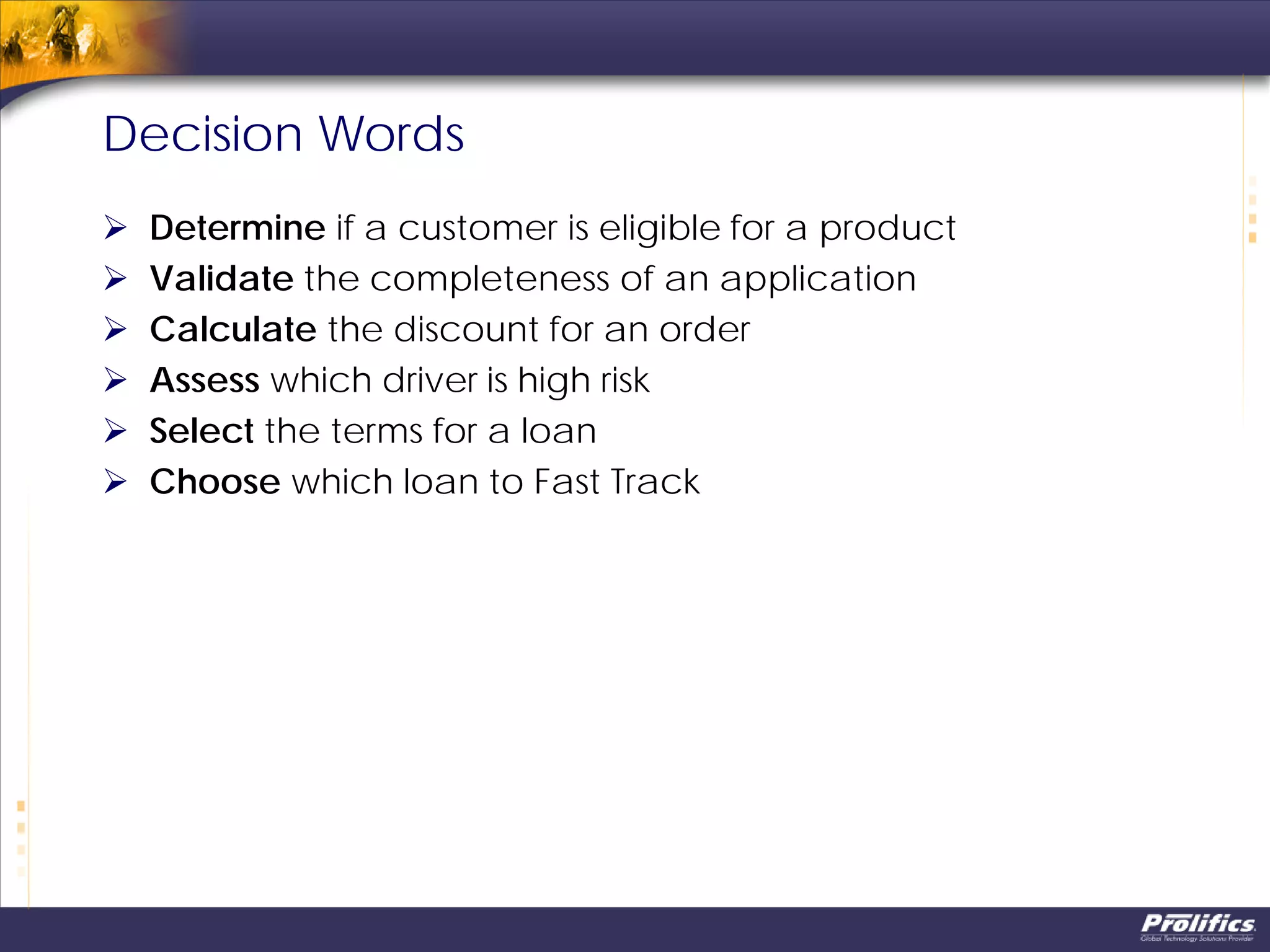

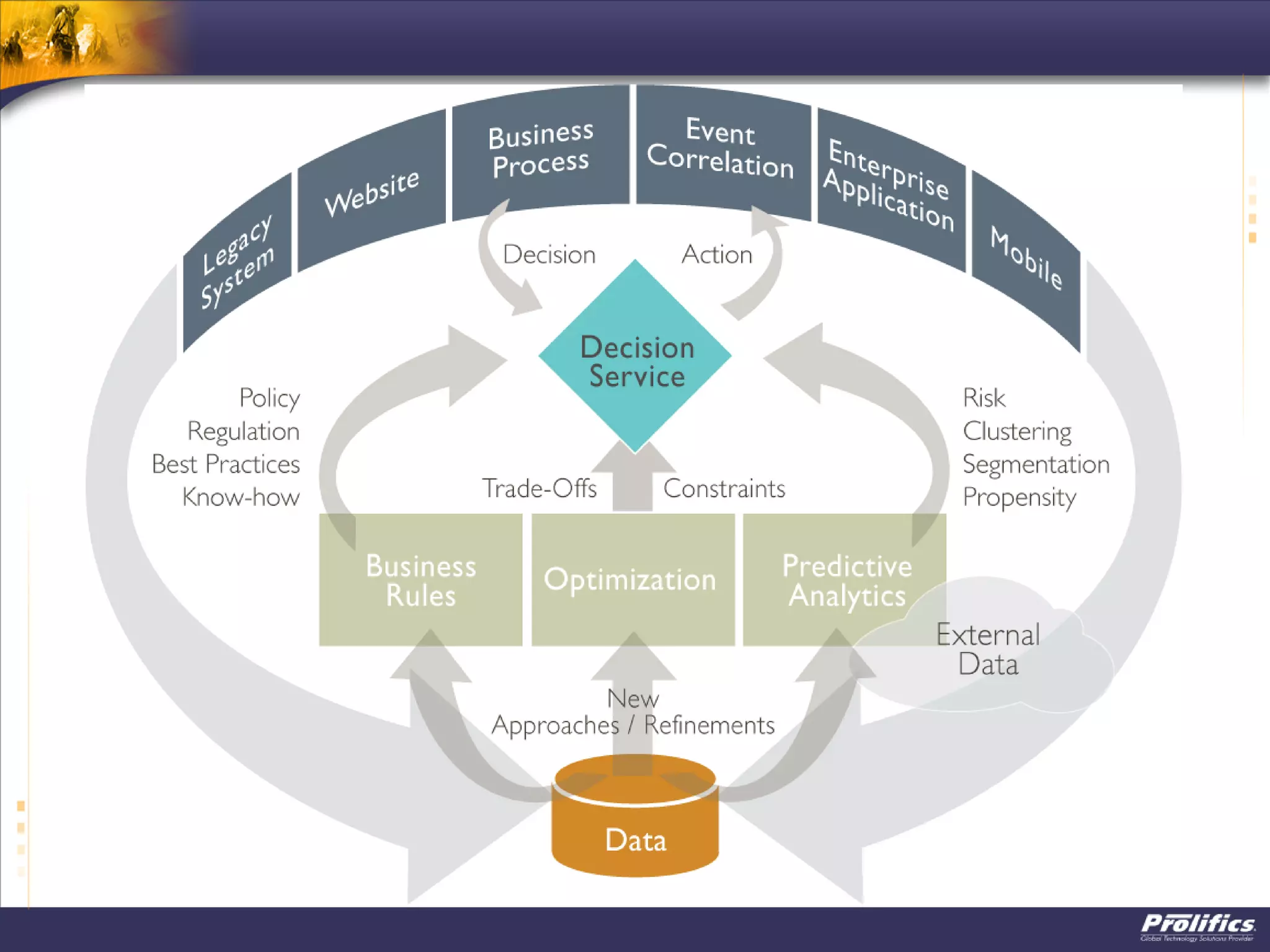

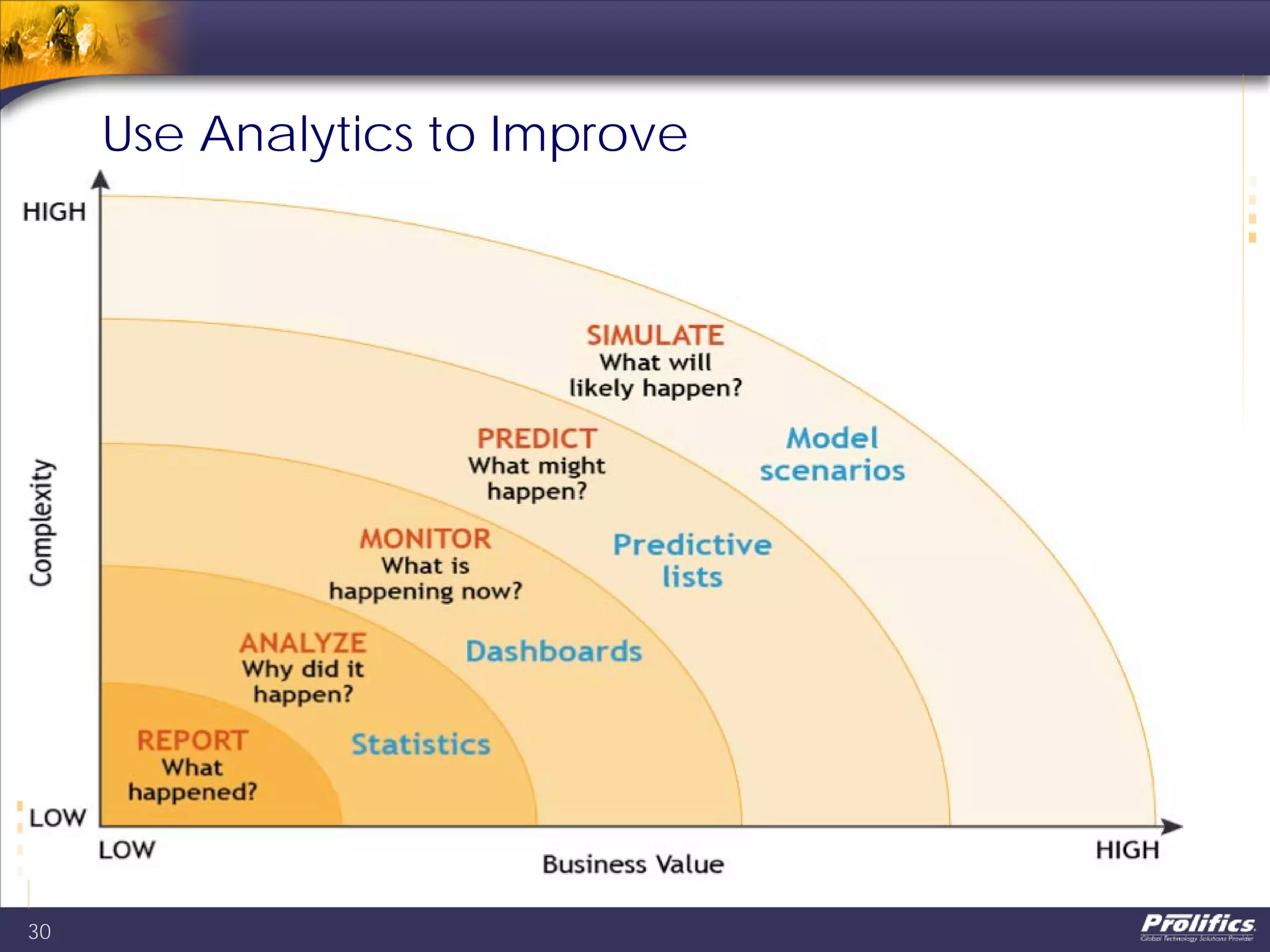

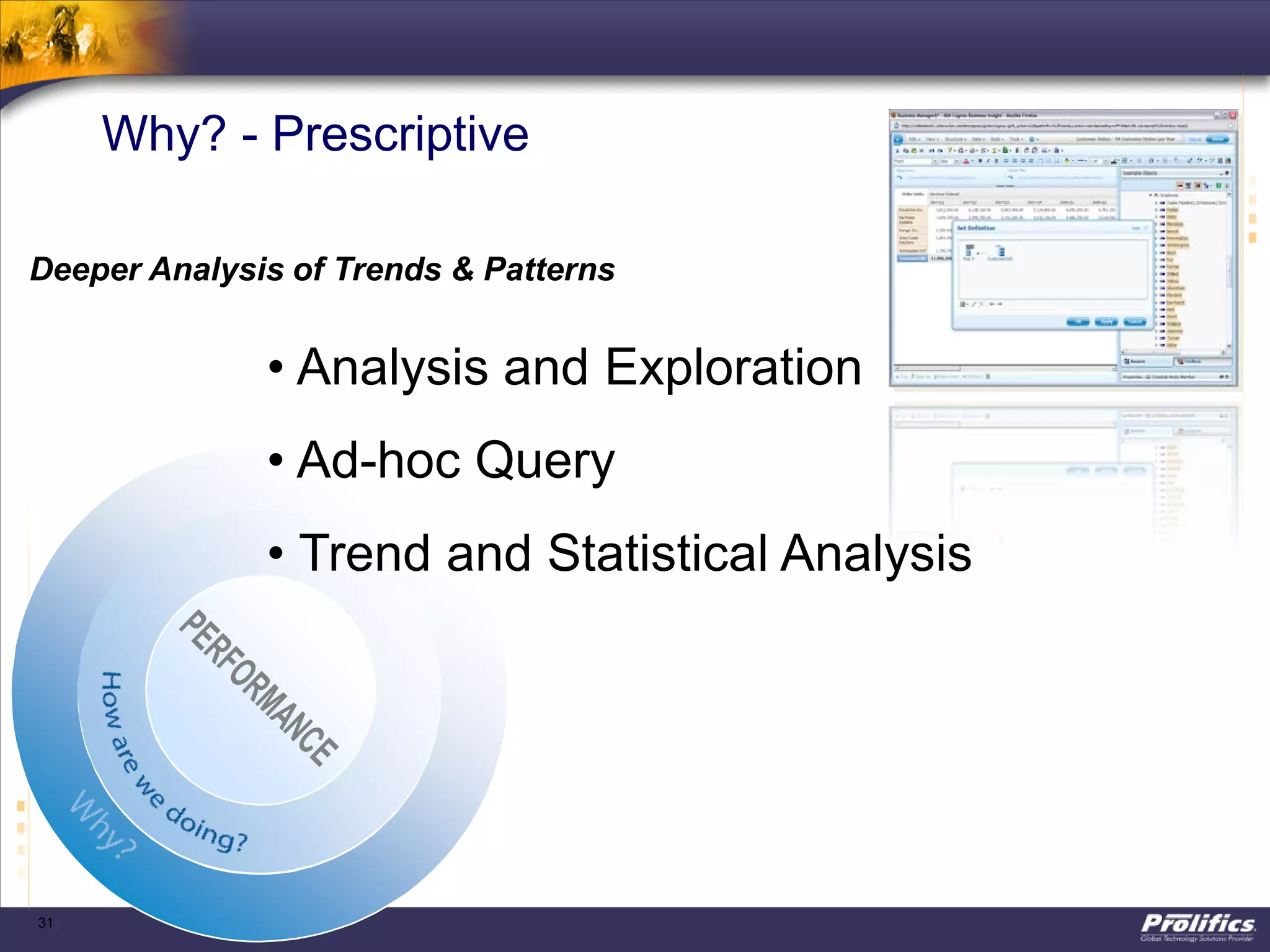

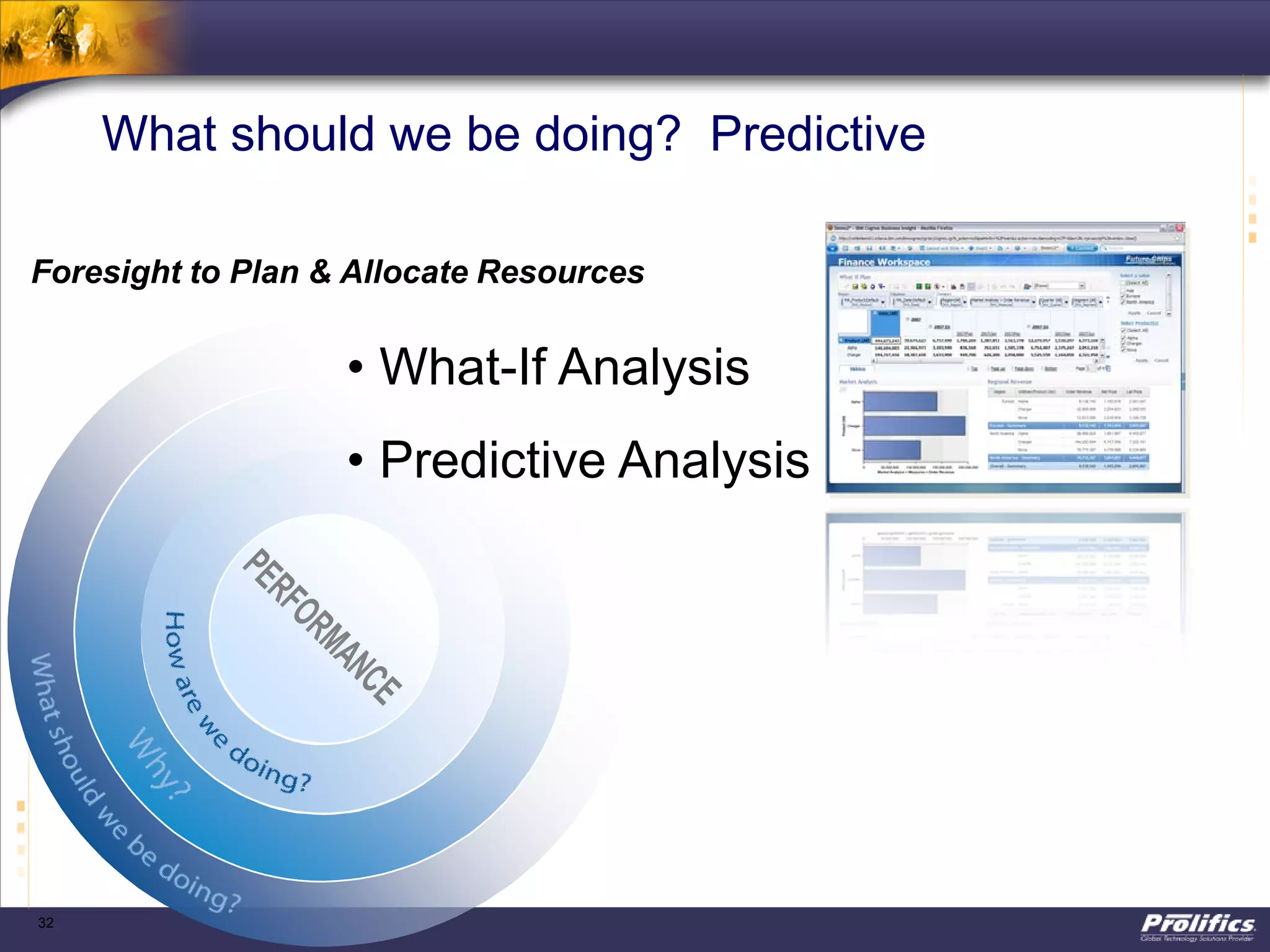

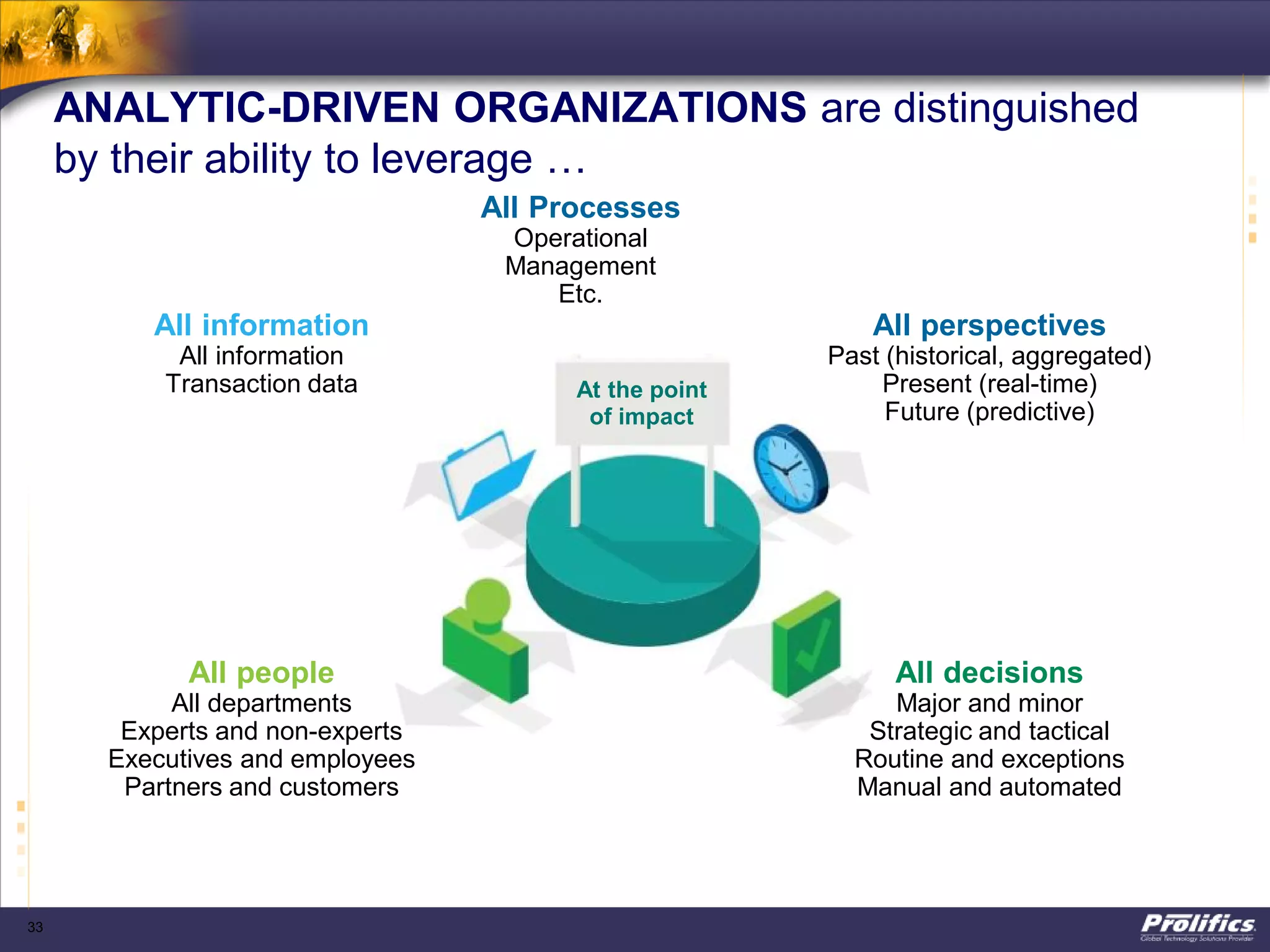

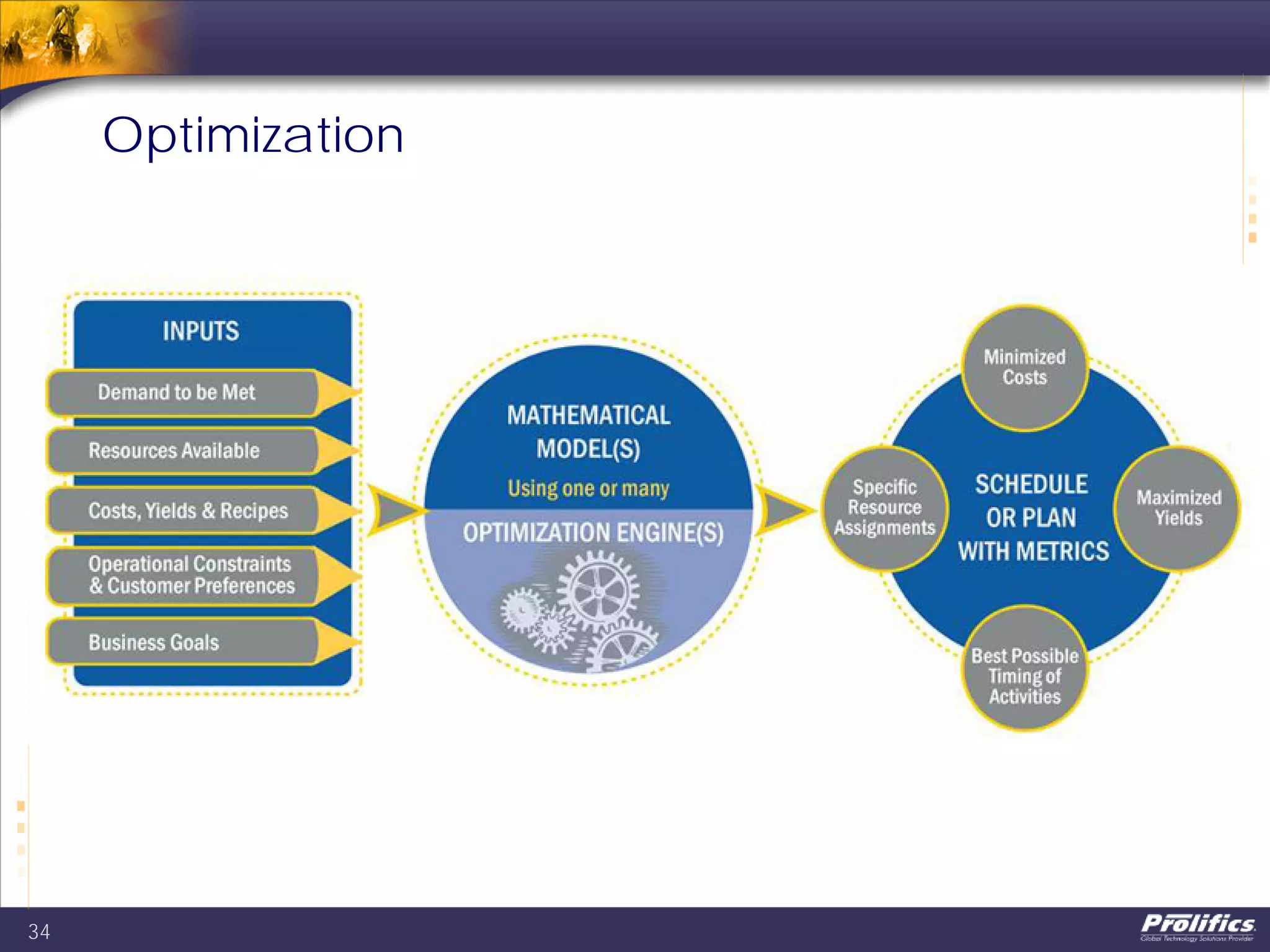

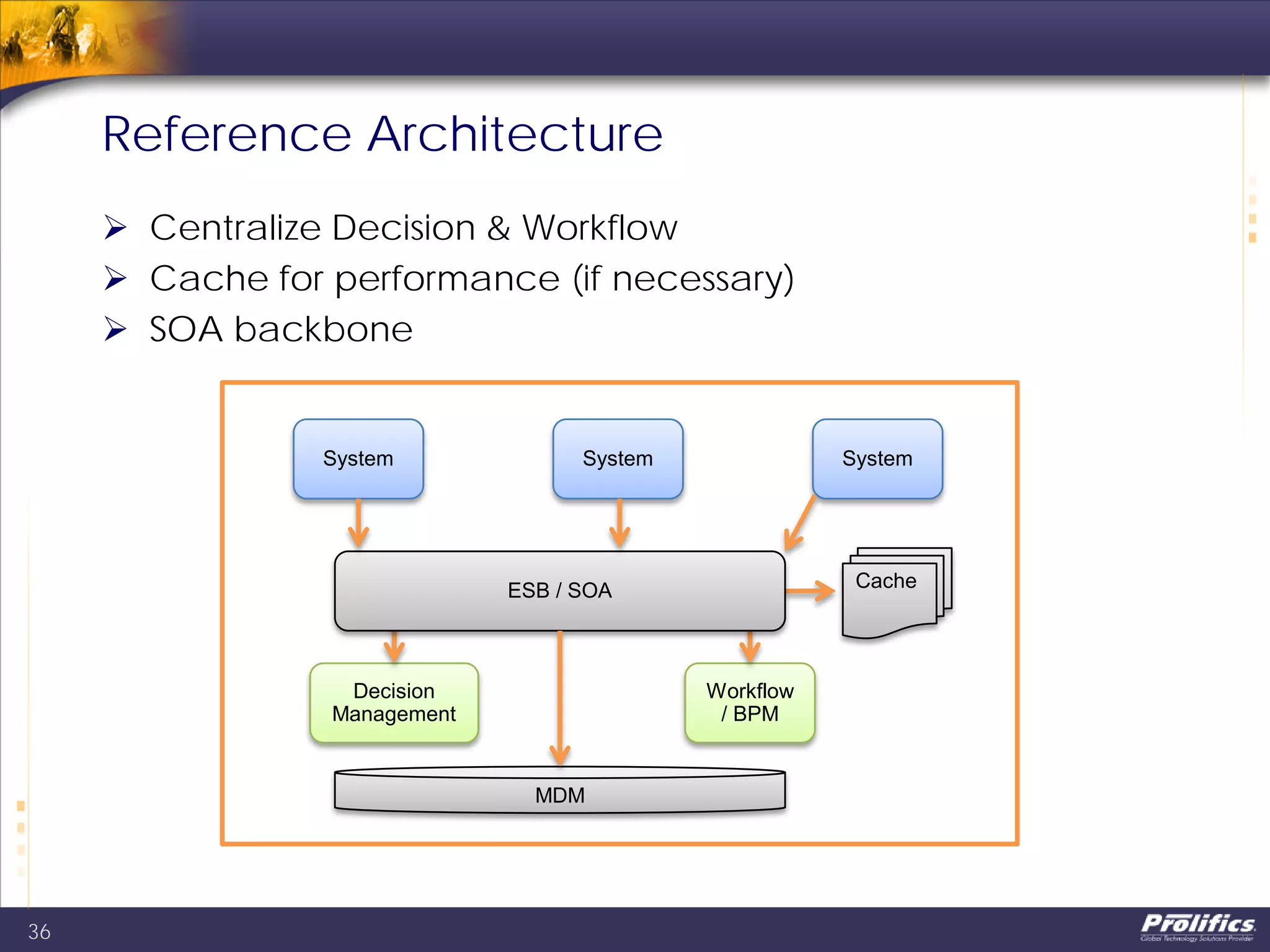

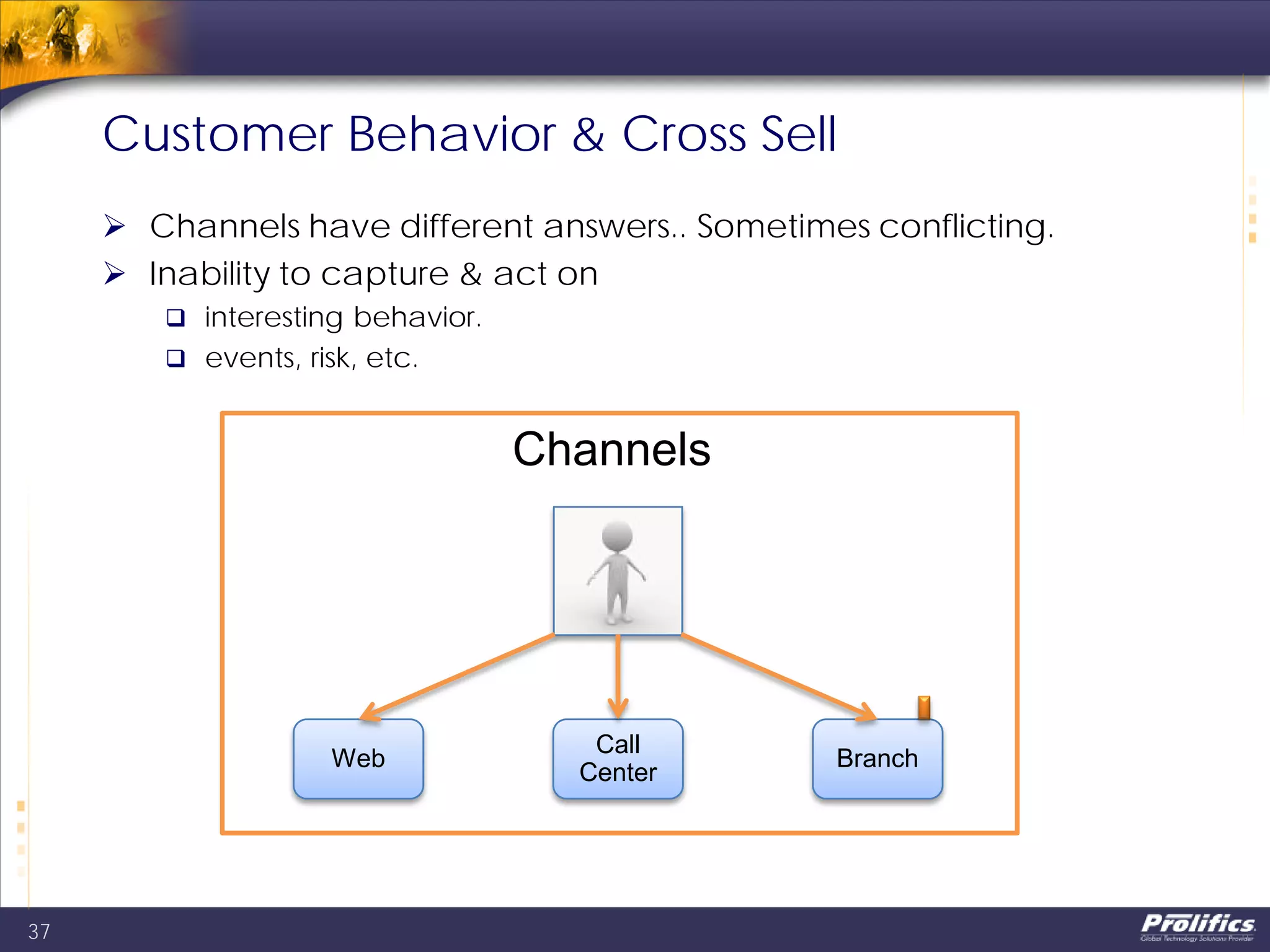

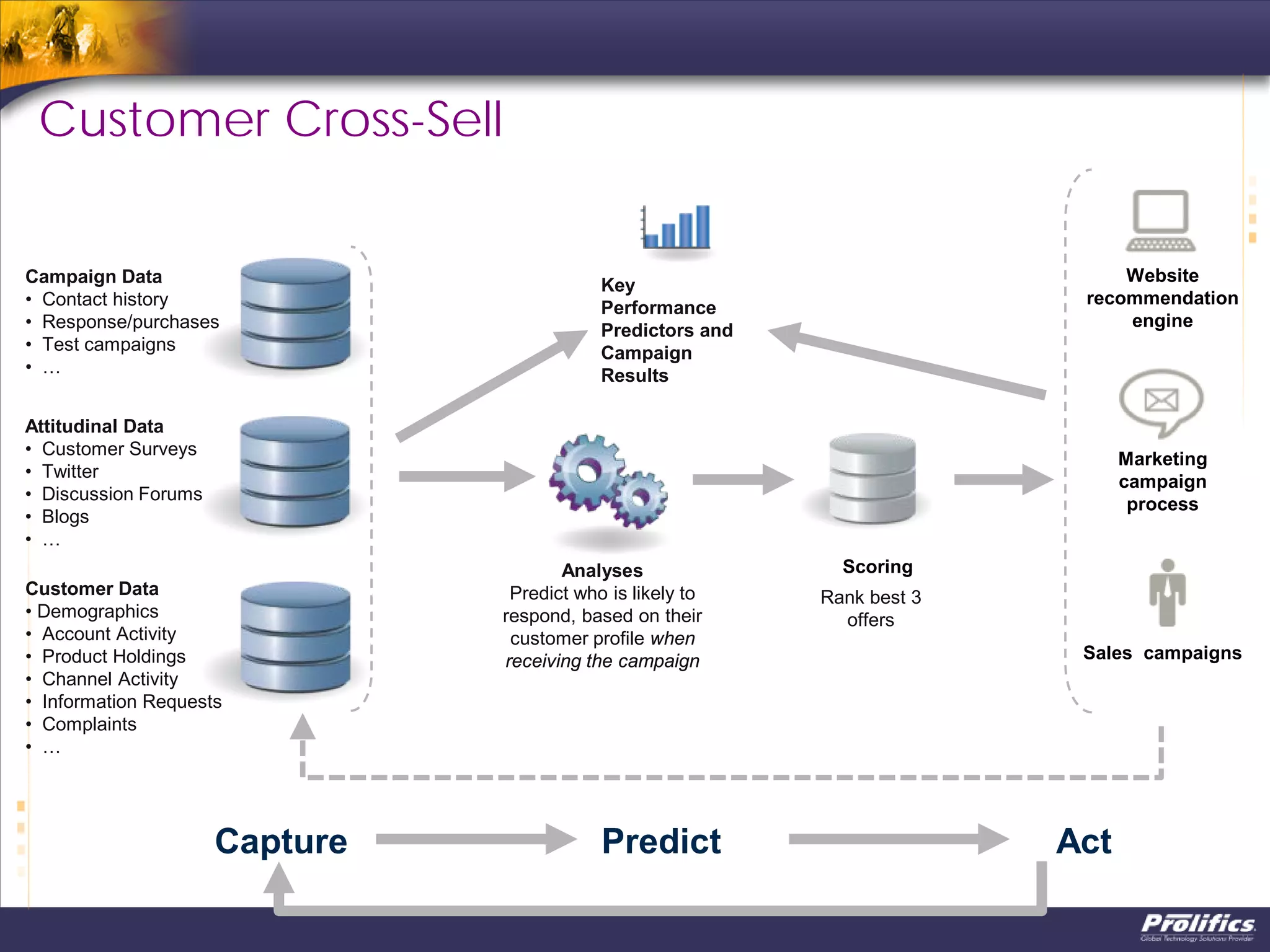

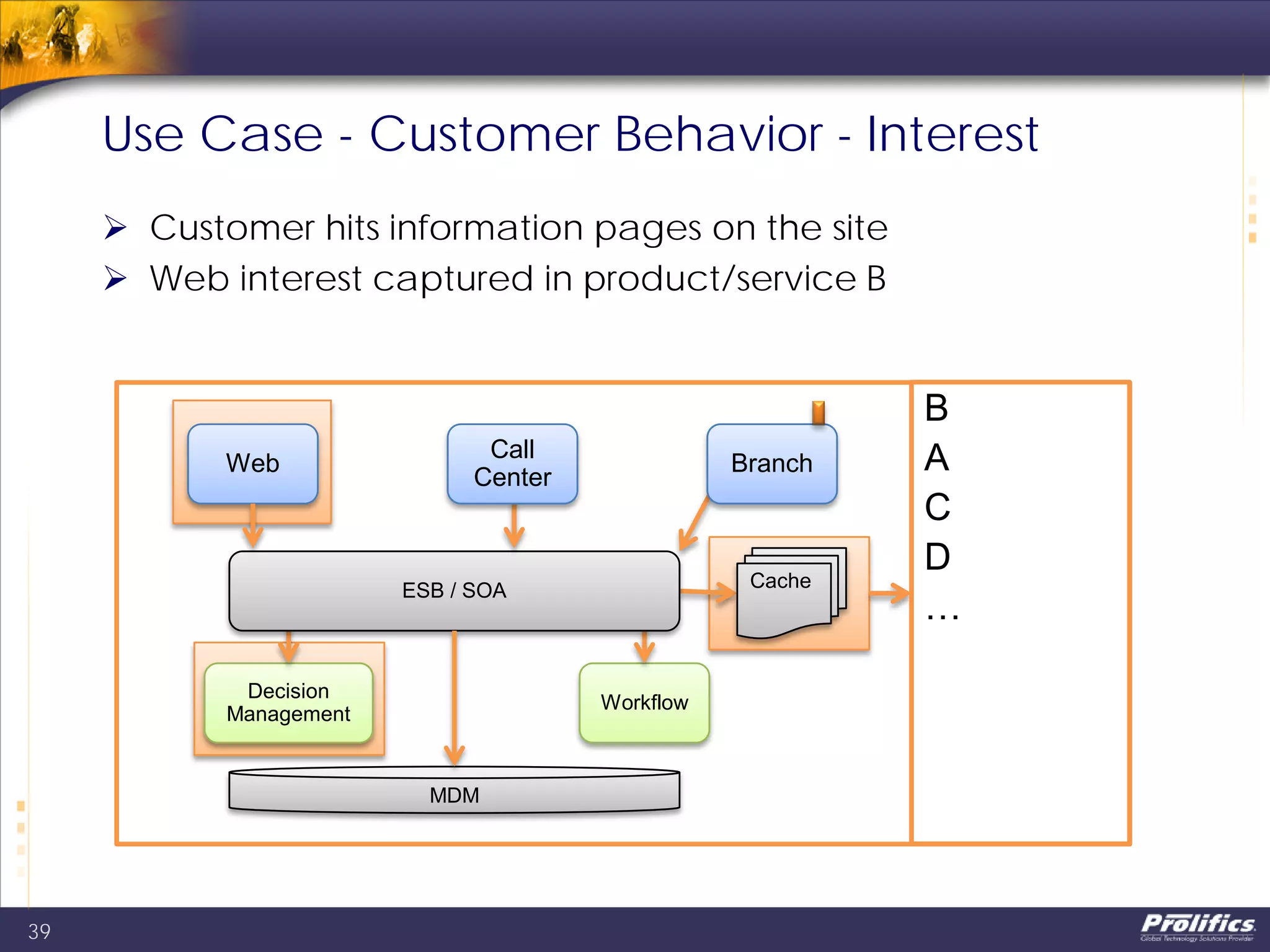

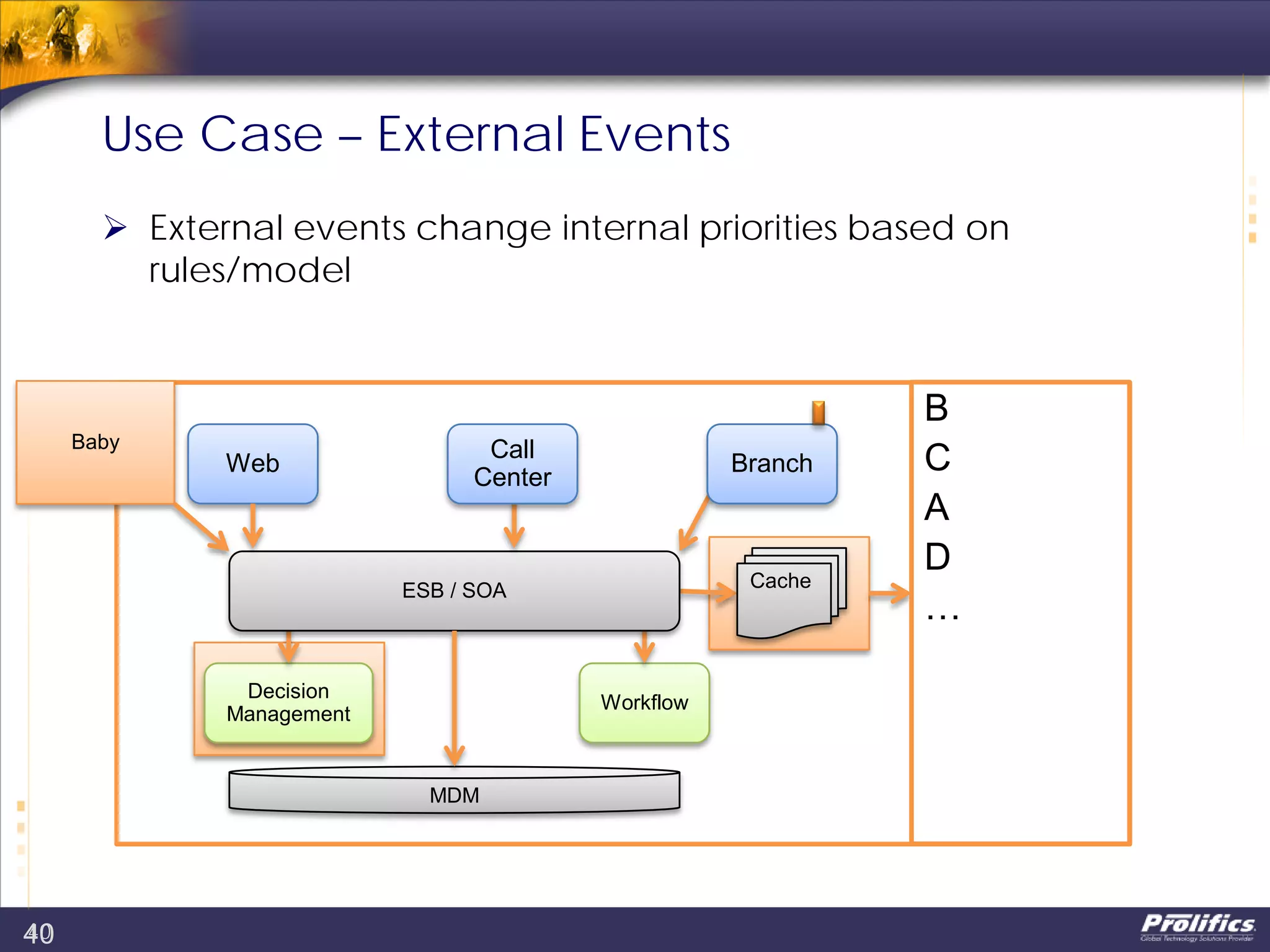

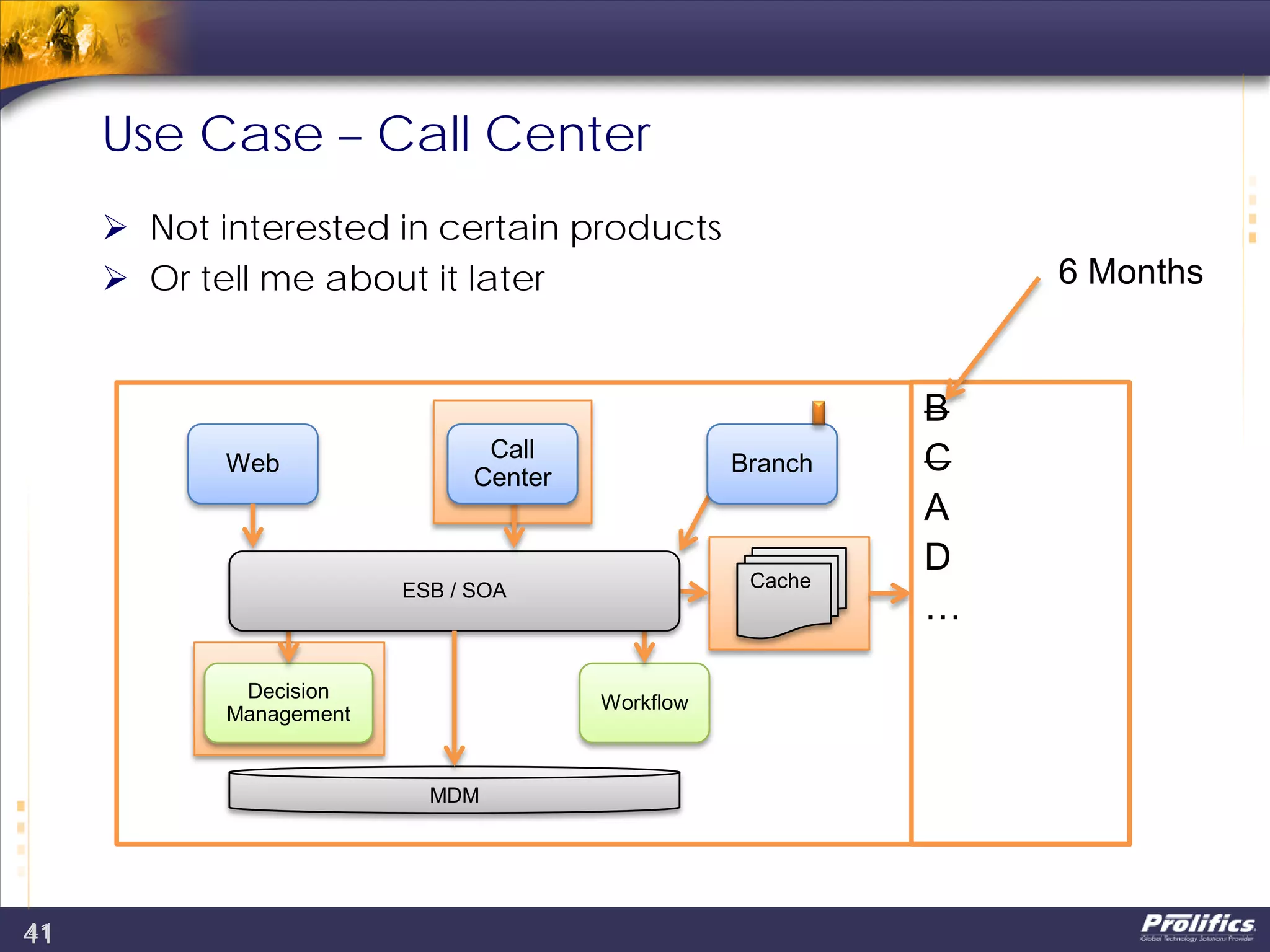

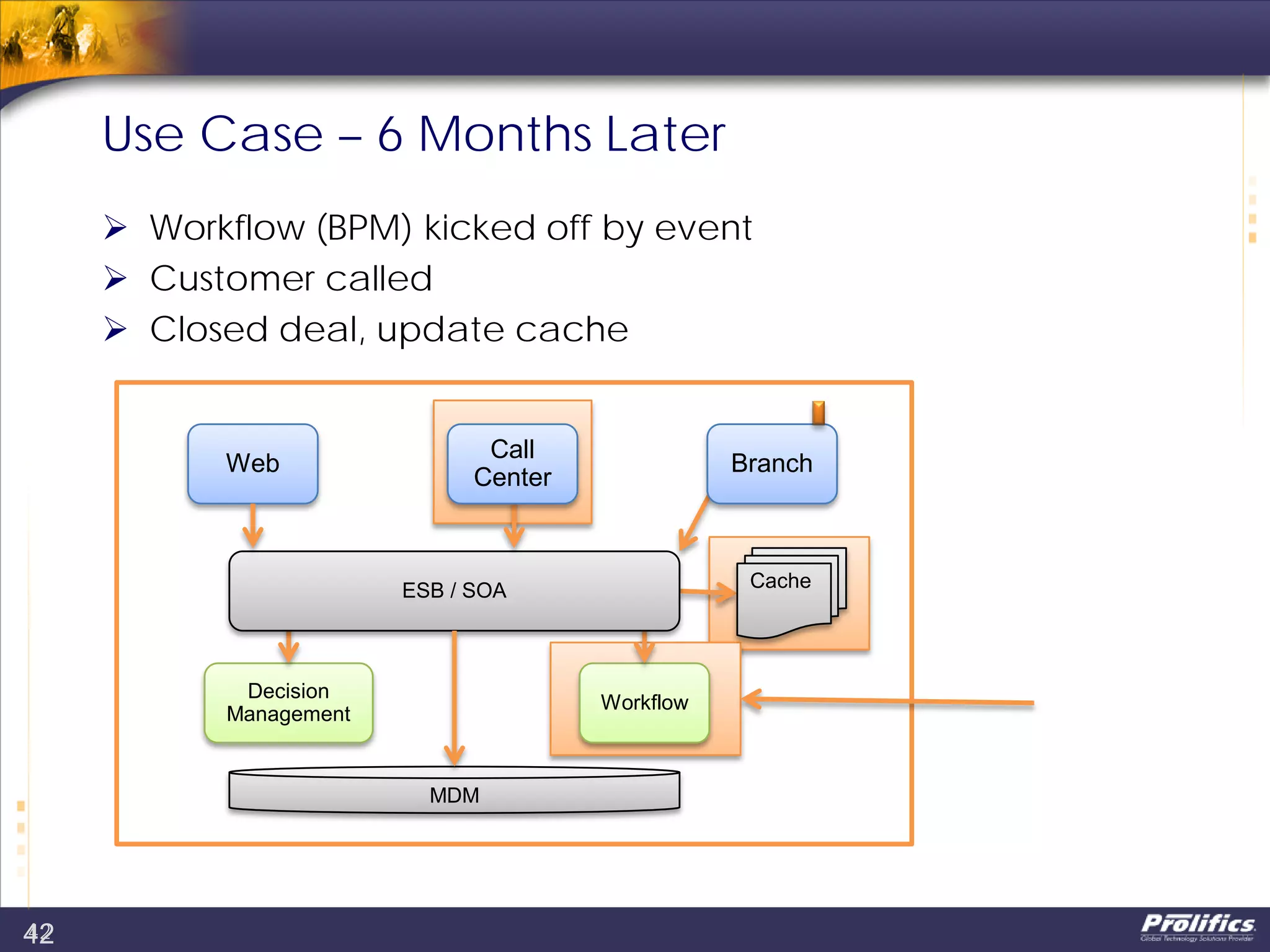

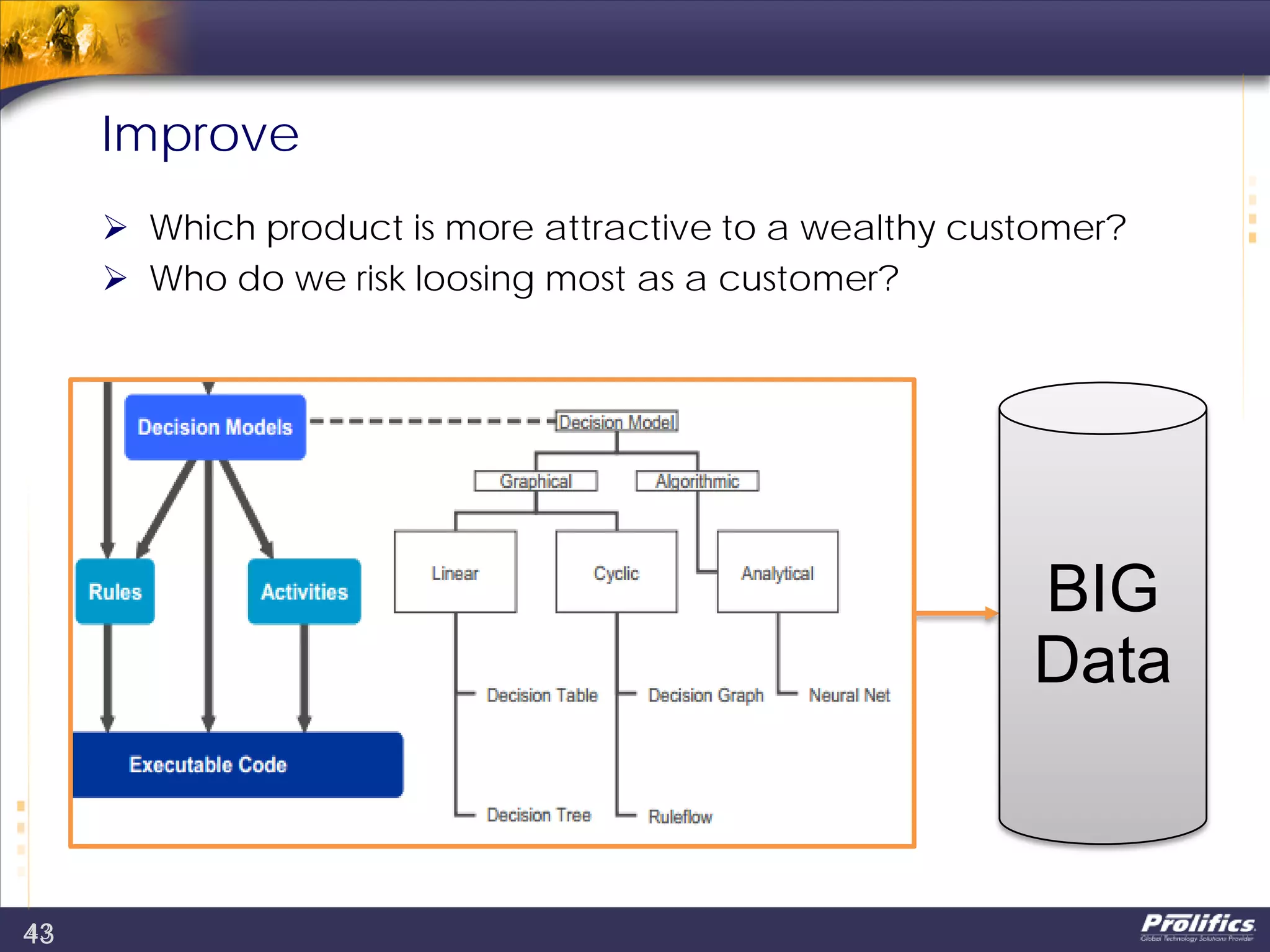

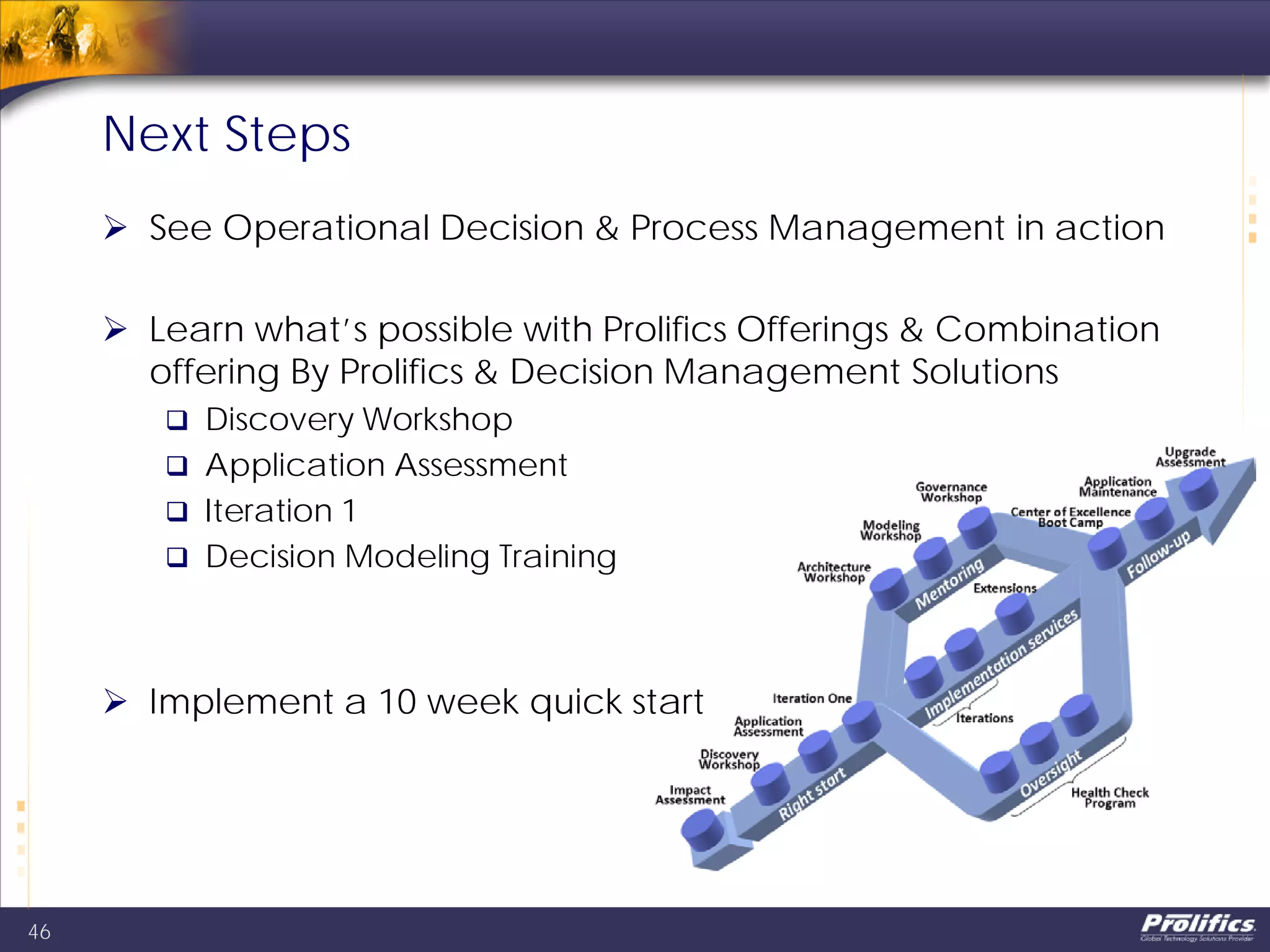

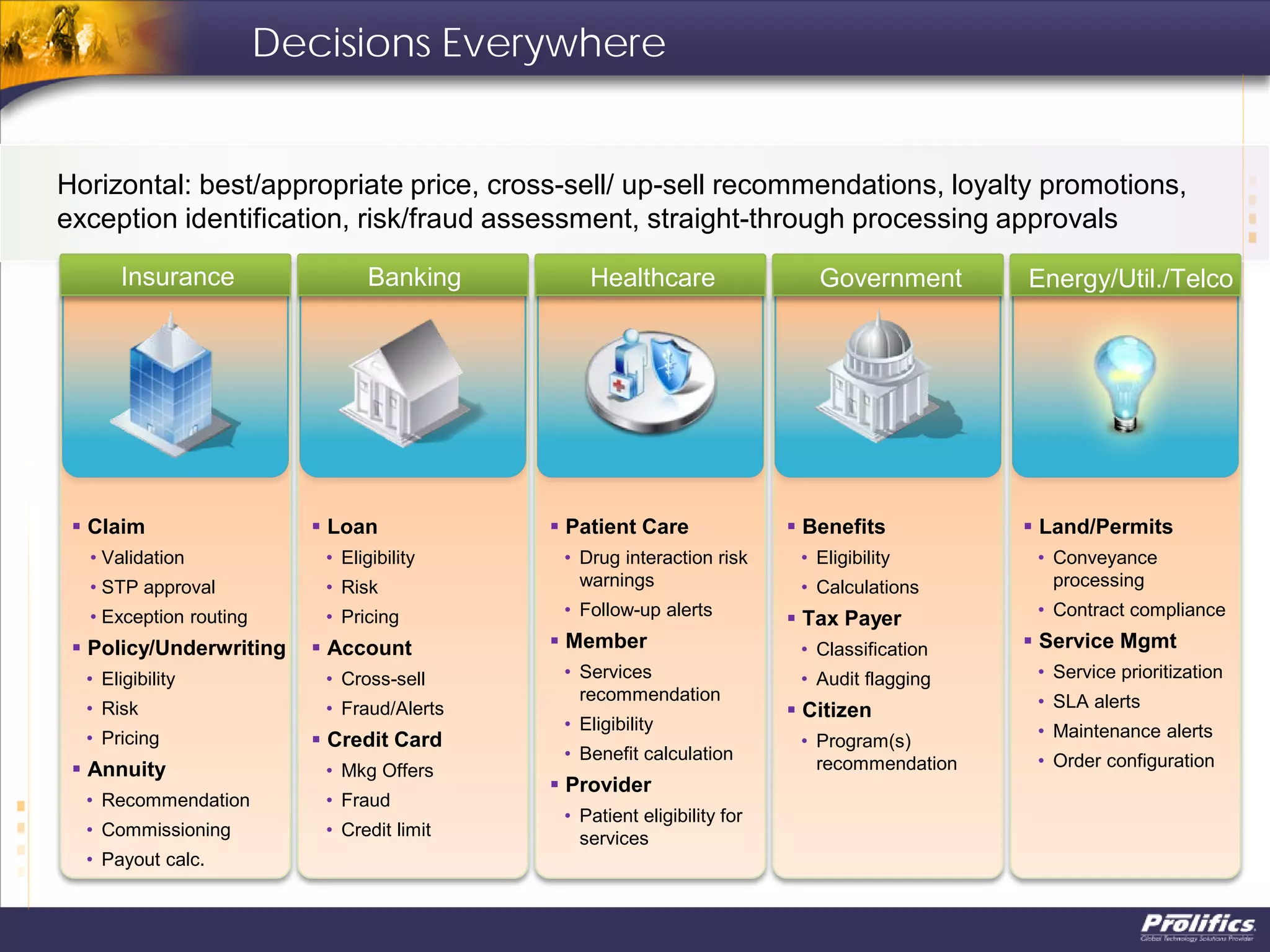

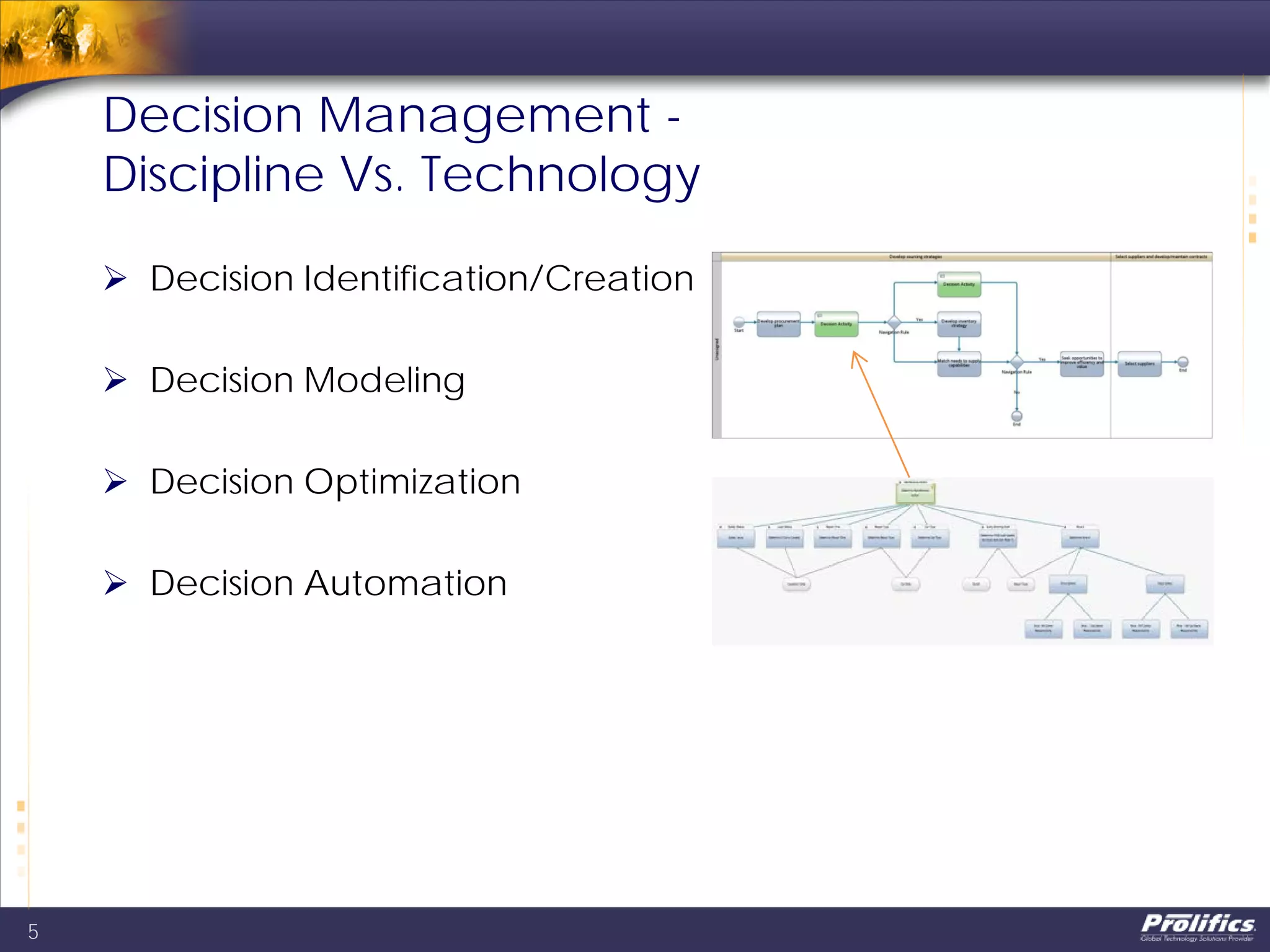

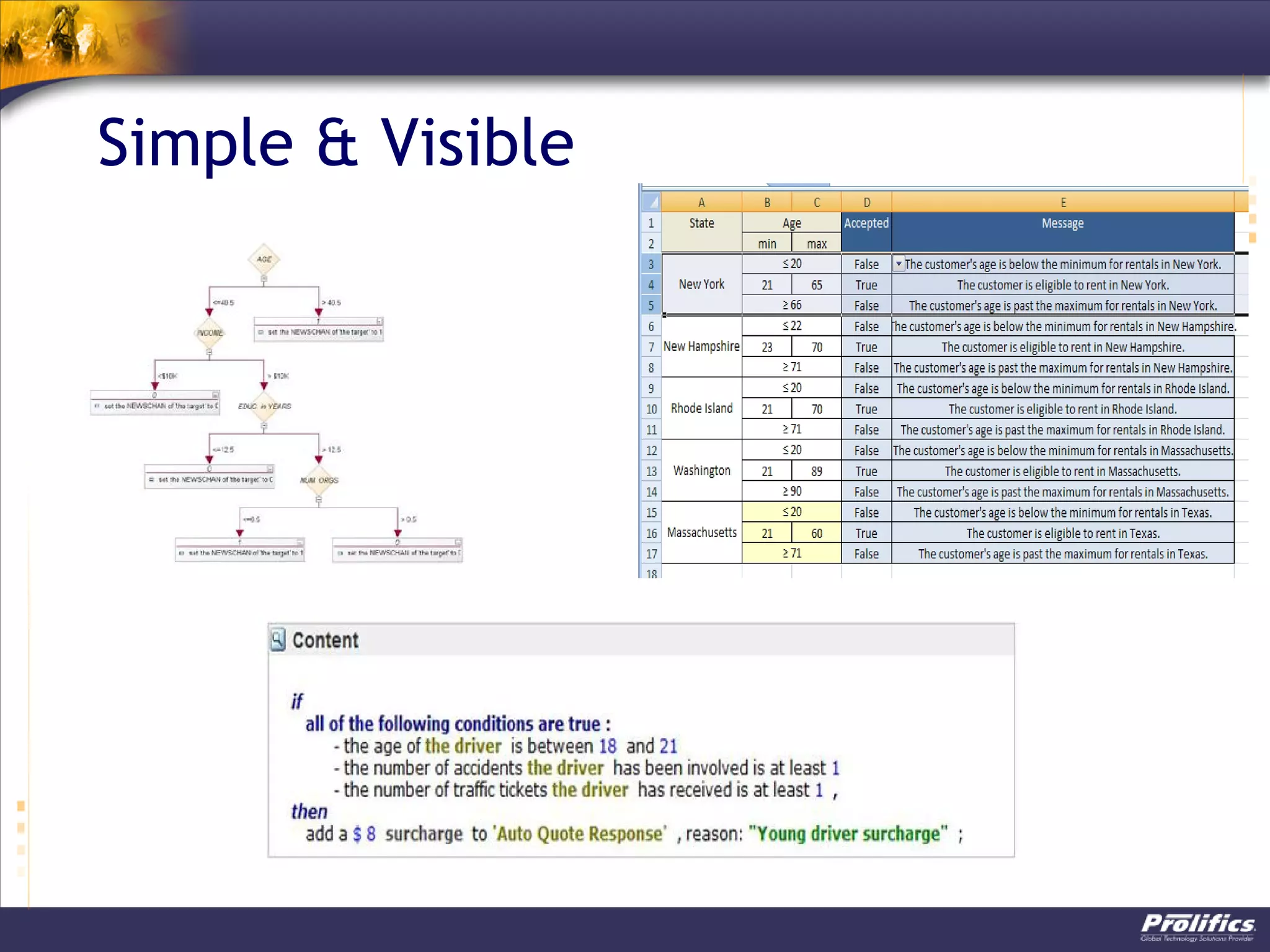

The document discusses operational decision management (ODM) and best practices for increasing agility and visibility with decision automation. It describes how decisions are found throughout business processes in areas like insurance, banking, healthcare, and more. Automating decisions can simplify processes by extracting business rules and encapsulating them in decision models. This allows for centralized management of decisions independent of processes. The document advocates using analytics to continuously improve decisions and processes over time through predictive analysis and optimization. It provides an example reference architecture and use cases for automating customer-related decisions to improve cross-selling based on behaviors and external events.

![Difficult to manage!

public class Application {

private Customer customers[];

private Customer goldCustomers[];

...

public void checkOrder() {

for (int i = 0; i < numCustomers; i++) {

Customer aCustomer = customers[i];

if (aCustomer.checkIfGold()) {

numGoldCustomers++;

goldCustomers[numGoldCustomers] = aCustomer;

if (aCustomer.getCurrentOrder().getAmount() > 100000)

aCustomer.setSpecialDiscount (0.05);

}

}

}](https://image.slidesharecdn.com/themindsetofdecisionmakingryantrollip-140519144515-phpapp02/75/The-Mindset-of-Decision-Making-Best-Practices-to-Increase-Agility-and-Visibility-with-Operational-Decision-Management-ODM-7-2048.jpg)

![Centralize

9

public class Application {

private Customer customers[];

private Customer

goldCustomers[];

...

public void checkOrder() {

for (int i = 0; i <

numCustomers; i++) {

Customer aCustomer =

customers[i];

if (aCustomer.checkIfGold())

{

numGoldCustomers++;

goldCustomers[numGoldCustomers]

= aCustomer;

if

(aCustomer.getCurrentOrder().ge

tAmount() > 100000)

aCustomer.setSpecialDiscount

(0.05);

}

}

}](https://image.slidesharecdn.com/themindsetofdecisionmakingryantrollip-140519144515-phpapp02/75/The-Mindset-of-Decision-Making-Best-Practices-to-Increase-Agility-and-Visibility-with-Operational-Decision-Management-ODM-9-2048.jpg)