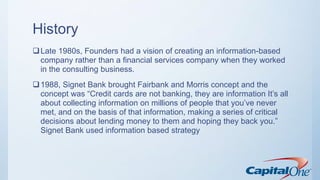

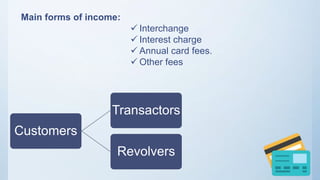

Capital One Financial Corporation is a bank holding company specializing in credit cards, home loans, auto loans, banking and savings products. It was founded in 1988 by Richard Fairbank and Nigel Morris with a vision of creating an information-based company. Capital One uses an information-based strategy to understand customers by collecting data and testing new products and segments. It has grown significantly since its founding and by 2001 had over $45 billion in loans and 43.8 million customers worldwide.