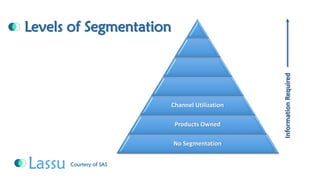

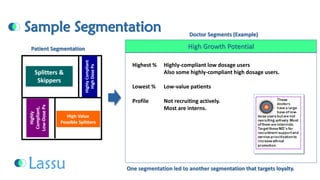

1. Segmentation plays a key role in loyalty marketing by dividing customers into groups based on common attributes and behaviors. This allows companies to better understand their customers and maximize relationships.

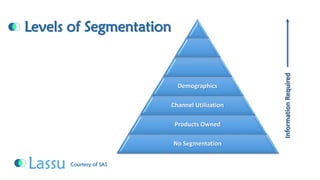

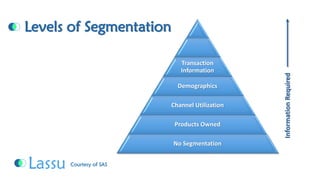

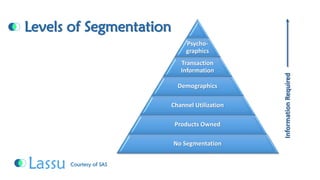

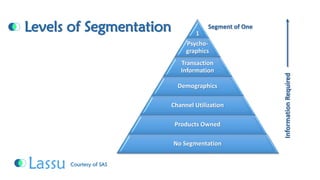

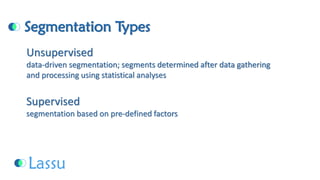

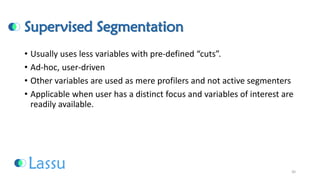

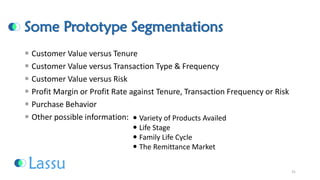

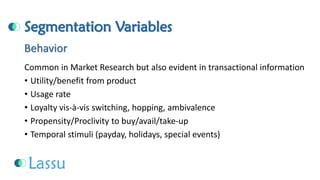

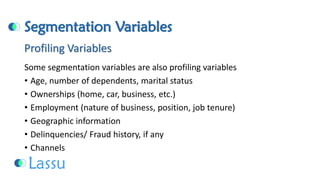

2. There are various levels of segmentation from basic demographics and purchases to more advanced psychographics and transaction data. Companies can use both supervised and unsupervised segmentation.

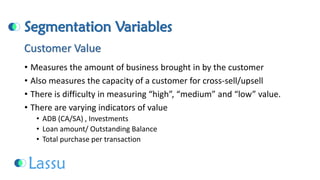

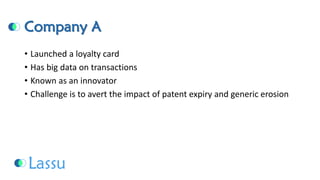

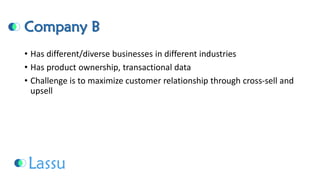

3. Effective segmentation identifies strategic business focuses, provides insights into customer needs, and helps companies focus communications and campaigns. It is a process that aims to create meaningful customer groups.