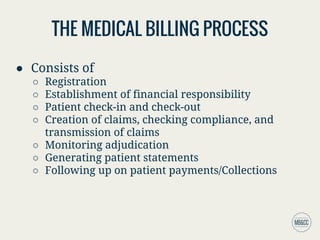

The medical billing process involves several key steps including patient registration, confirming financial responsibility, check-in and check-out, claims creation, compliance checking, and following up on payments. Claims are prepared using a superbill, and once submitted, they undergo adjudication by the payer, which can result in claims being accepted, rejected, or denied. Billers must generate patient statements that reflect the owed amounts and may involve collections if payments are not received promptly.