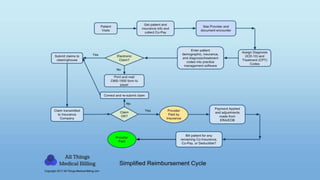

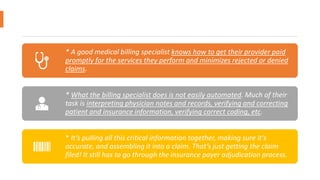

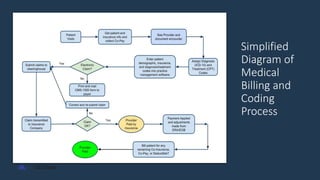

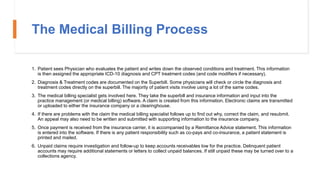

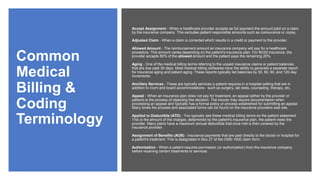

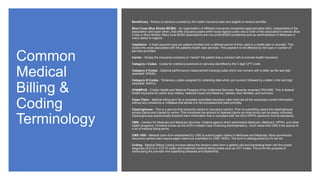

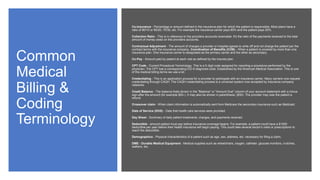

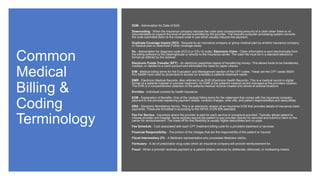

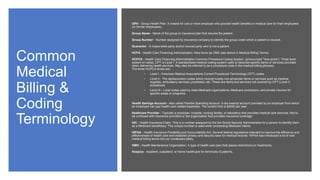

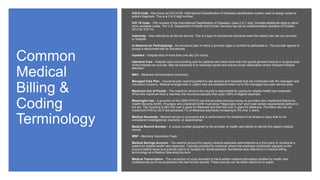

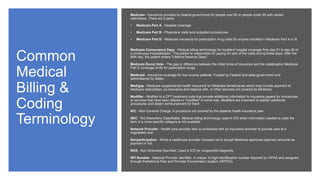

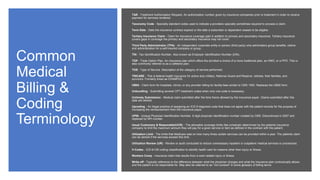

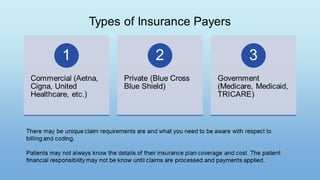

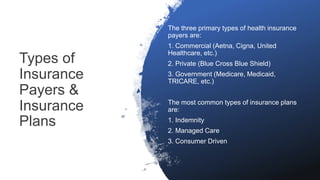

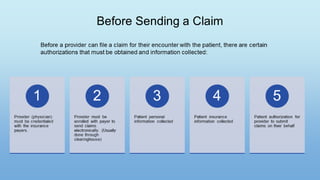

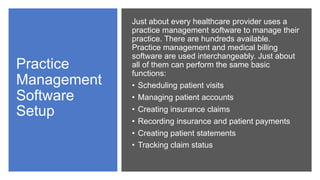

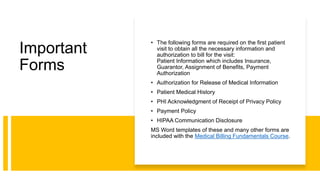

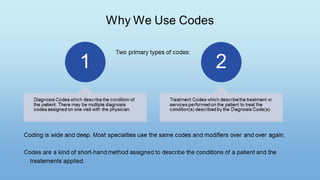

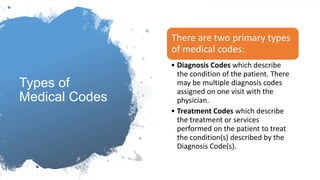

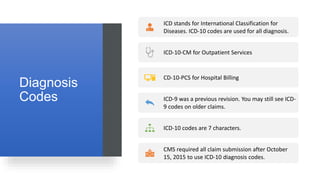

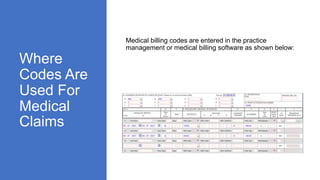

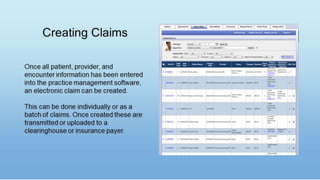

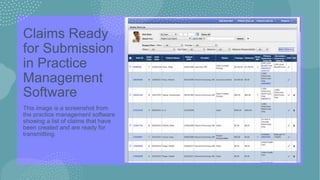

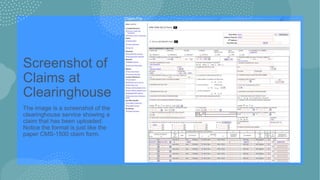

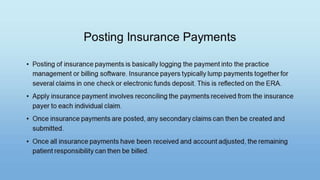

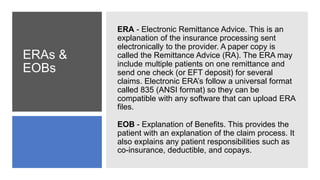

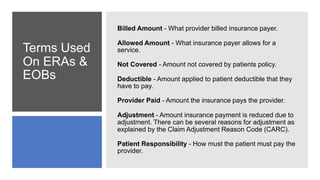

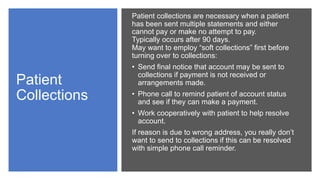

The document provides an overview of medical billing and coding concepts and processes. It covers key topics such as the importance of medical billing, the billing process, common terminology and acronyms, and a simplified diagram of the billing and coding process. Key aspects of the billing process include coding patient diagnoses and treatments, submitting claims to insurance companies, following up on rejected or denied claims, and collecting payments from insurance providers and patients.