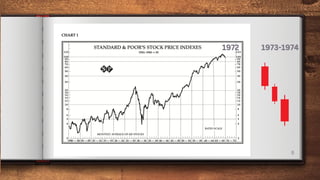

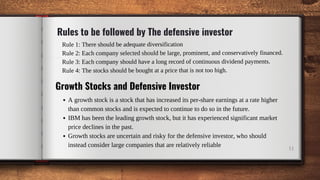

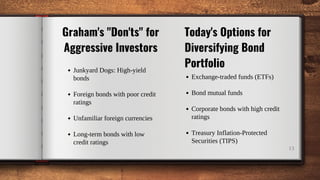

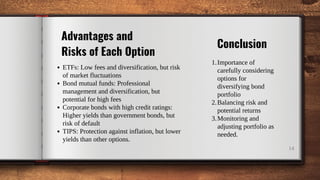

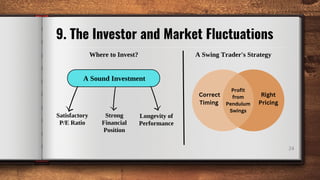

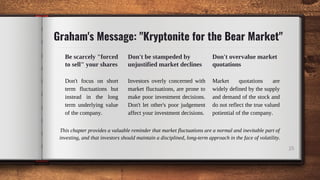

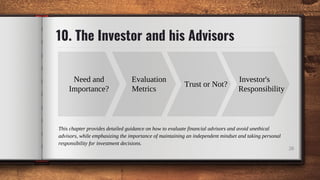

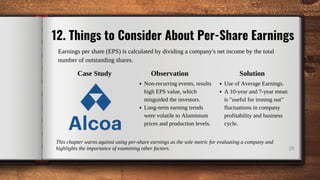

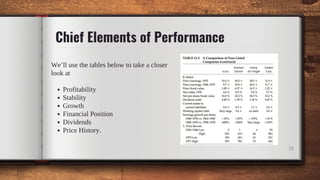

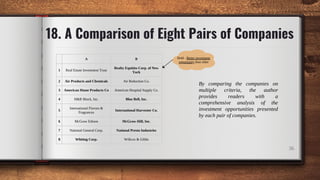

The document outlines key principles from 'The Intelligent Investor' by Benjamin Graham, emphasizing the importance of thorough research, emotional discipline, and long-term perspective in investing. It distinguishes between defensive and aggressive investors while highlighting the risks of inflation and market fluctuations, along with strategies for portfolio management. Graham advocates for a margin of safety in investments, urging investors to focus on fundamental analysis over speculative trends.