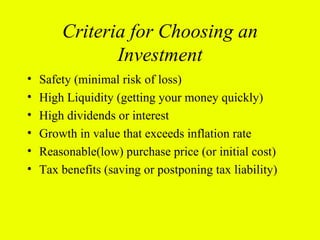

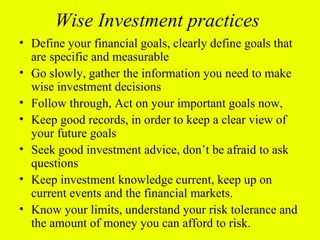

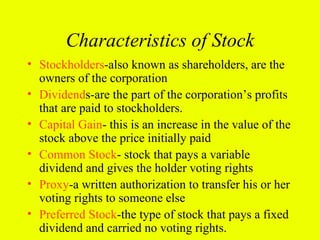

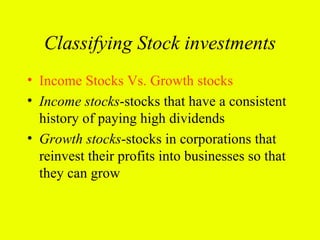

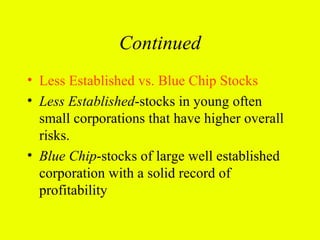

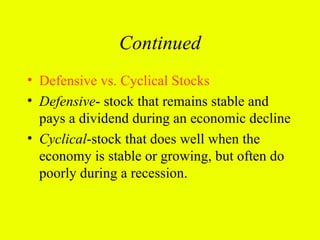

This document discusses different stages of investing including putting money in savings accounts, beginning investing in low-risk stocks, systematic monthly investing, strategic portfolio management, and speculative investing. It also covers reasons for investing such as beating inflation, increasing wealth, the fun and challenge of investing, and diversifying risk. Finally, it outlines characteristics of stocks, different types of stocks, factors that influence stock prices, and short-term and long-term investment techniques.